Digital Wealth: $130B alts fintech iCapital acquires SIMON Markets, a Goldman spin-out

SIMON Markets raised $100MM in its Series B funding round last July, valuing the firm at $800MM. iCapital itself raised a total of $490MM last year, valuing the firm at $6B+

Dear Fintech Futurists,

Welcome to our Digital Wealth issue, the weekly news aggregator for digital investing, asset management, and wealthtech. For deep, comprehensive, and insightful analysis on the Fintech and Web3 world, upgrade your subscription below.

North America News

⭐🇺🇸 iCapital® Completes Acquisition Of SIMON Markets - Businesswire, August 2, New York

iCapital, a B2B fintech for alternative investing with $130B+ in assets across 1,000+ funds, announced it has completed the acquisition of SIMON Markets, a technology platform facilitating structured investments and annuity products, with $5T+ in assets under administration. We covered this briefly when the deal was announced on the 25th May.

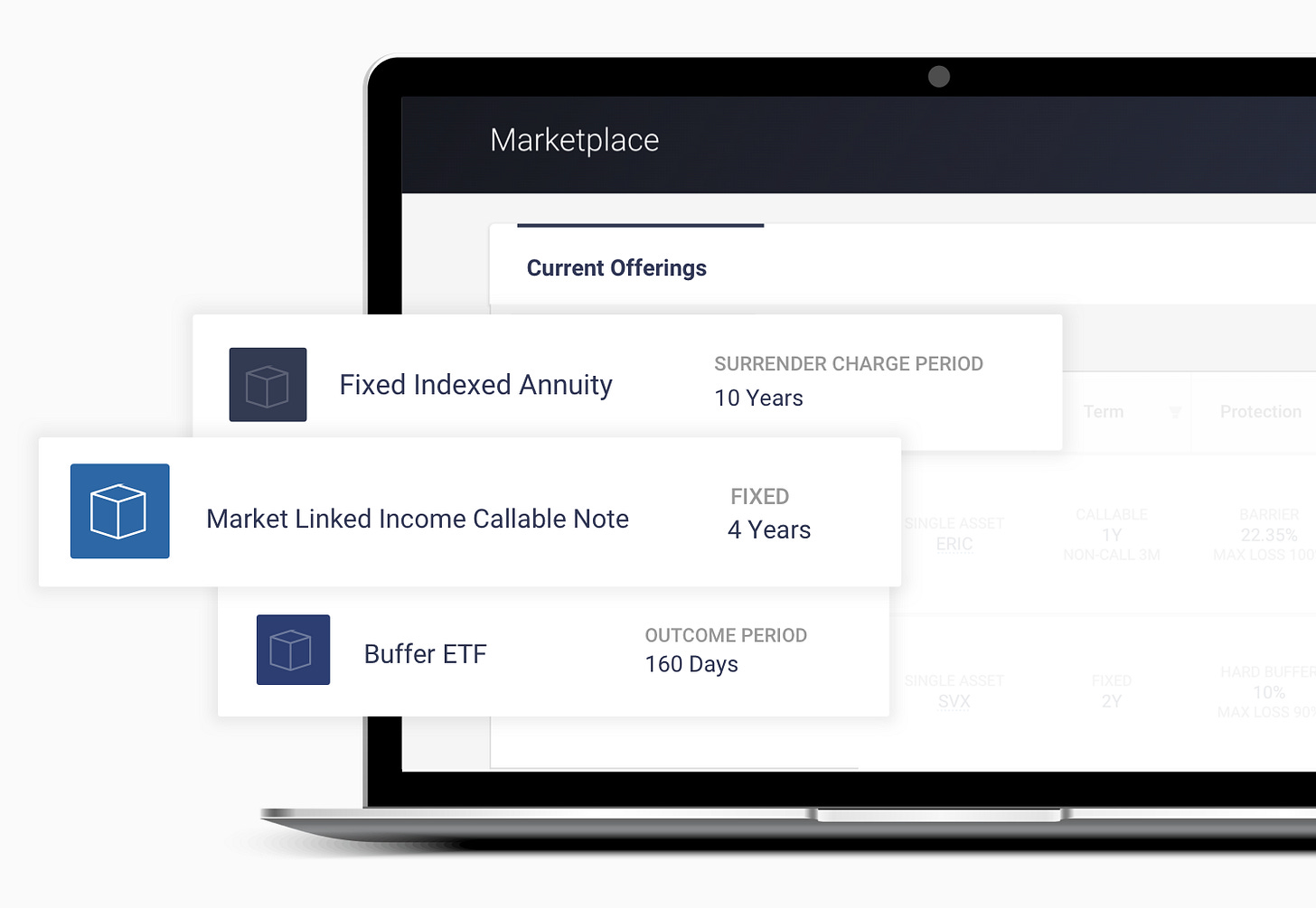

For context, SIMON Markets spun out of Goldman Sachs in 2018, as part of a bank-owned consortium, and raised $100MM in its Series B funding round last July, valuing the firm at $800MM. iCapital itself raised a lot of cash last year — $440MM last July, valuing the firm at $4B, and then $50MM more in December, bringing its valuation to over $6B. SIMON’s flagship product is its investment platform, which offers 1) product marketplaces, which has structured investment, annuity, alternative, and digital asset (i.e., crypto) solutions, 2) lifecycle management, which offers analytics for 90,000+ past offerings and secondary values, and 3) analysis tools such as: historical performance analysis, an income calculator, and a product builder to customise hypothetical investments with illustrative pricing and backtesting.

The two companies also have a focus on education and research, including research and portfolio analytics to support advisors in understanding alts and incorporating them into their practices via AltsEdge, AI Insight, iCapital Portfolio Intelligence, alongside a library of articles. This continues iCapital’s consolidation of the alternative investments tech space.

🇺🇸 VRGL And BridgeFT Partner To Streamline Portfolio Analysis For Wealth Managers - Businesswire, August 2, Illinois

🇺🇸 HilltopSecurities Partners With CAIS To Expand Advisor Access To Alternative Investments - Businesswire, August 2, New York

🇺🇸 Stackwell Successfully Closes $3.5MM Seed Funding Round Backed By Lead Investors Michael Gordon, Jeremy Sclar And The Kraft Group - PR Newswire, August 3, Massachusetts

🇺🇸 Aquinas Wealth Advisors℠ Launches Technology To Better Align Investors With Their Values - PR Newswire, August 3, Pennsylvania

🇺🇸 Ovenue Launches Real-World Asset Management, Tokenization, And Financing Platform Powered By Artificial Intelligence And Blockchain Technology - GlobeNewswire, August 3, California

EMEA News

⭐🇬🇧 TrueLayer Targets Wealth Sector Via Partnership With WealthOS - Finextra, August 2, London

Open banking platform TrueLayer integrated WealthOS, a SaaS platform to accelerate digital wealth management. The partnership will allow instant bank payments to be used for account funding. High value transactions with card payments are often an ineffective method as they get flagged by banks, resulting in delays, rejected payments, and customer dissatisfaction. Online bank transfers offer another method to fund accounts, but require customers to leave an investing app, sign in to their banking platform, and carry out the transfer — an inefficient old-school process.

WealthOS clients can embed TrueLayer’s account-to-account payments within its digital wealth experience, and incorporate instant pay-ins, withdrawals and refunds using the phone’s biometric authentication (i.e., fingerprint or face ID) — no need to enter card details. Users select the ‘Instant bank transfer’ option at the top of the payment screen and authenticate to confirm the payment. The account-to-account payment system also implies no interchange or processing fees along the way, and a real-time confirmation.For more context on biometric payments, read our take on MasterCard's biometric payments, Web3 soulbound NFTs, and the construction of digital identity. It’s nice to see open banking starting to help with a positive user experience.

🇬🇧 Acquisition-Hungry Kingswood Inks Another Deal; Eyes More M&A - WealthBriefing, August 2, London

🇬🇧 UK-Based Legal Tech Consultancy Firm Livesilver Unveils Robo Advisor Service To Provide AI Financial And Legal Guidance - Newsfile, August 3, London

🇪🇸 Allfunds Buys London-Headquartered ESG Platform - International Adviser, August 2, Madrid

🇬🇧 M&G Acquires IFA Firm - International Adviser, August 3, London

🇬🇧 Tellimer Launches Insights Platform Scriber For Investors - Fintech Global, August 1, London

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇮🇳 Wealth management Startup Dezerv Raises $20MM In Series A Funding Led Accel Partner - Startup Story, August 3, Mumbai

Invite-only wealthtech Dezerv raised $20.7MM in a Series A round, led by Accel Partners. The startup previously raised $7MM in a seed round, bringing total funding to $28MM since launch last year. Dezerv provides advisory and investment services — particularly targeting senior working professionals and high net-worth individuals — across assets such as large cap index funds, fixed income securities (e.g. high yield bonds), and alternatives (e.g. private equity). The minimum investment size is $630 and the average investment is in the range of $6,300 - $8,810, and a total of $75MM+ of transacted assets. The platform’s 5-year investment option targets a 16% return per year, which we feel … quite uncertain about.

Within the app, portfolio managers create a personalised mutual fund recommendation for the client using the Integrated Portfolio Approach™ (IPA), supposedly a “scientifically designed multi-asset, multi-instrument, and multi-geography portfolio” that deliver superior returns with controlled downside. According to Dezerv, the IPA blends Markowitz’s Modern Portfolio Theory, the Black-Litterman Model, and aspects of behavioural finance. The company competes with the investment arms of private sector banks, alongside independent financial advisories and tech platforms such as Groww, Upstox, and Scripbox.

There seems to be a rising trend of new B2C roboadvisors launching across the world, likely helped by the recent market collapse and the disfavor of more active trading, brokerage, and the Robinhood model. Thus, more conservative approaches are having another shot at asset gathering.

🇸🇬 SG Fintech Firm UNOAsia, Owner Of Digital Bank In The Philippines, Raises $11MM Funding - Asia Tech Daily, August 1, Singapore

🇮🇳 LC Nueva, Capital A, Others Invest $10MM In Fintech Startup Credit Fair - VC Circle, August 3, Mumbai

🇸🇬 OrBit Raises $4.6MM From Matrixport, Brevan Howard Digital To Develop Exotic Options And Structured Products In Digital Assets - Businesswire, July 31, Singapore

🇮🇳 Meet Kunji, A Startup Simplifying Crypto Investments Via Digital Asset Managers - The Decrypting Story, August 3, Mumbai

Blogs, Webinars, Podcasts

🇺🇸 The Blurring Lines Between Fintech And Financial Advisors - Global Banking & Finance Review, August 3, California

🇺🇸 Fidelity Says That Advisors Want Help With Efficiency, Growth, And Building A Sustainable Business - RIA Intel, August 3, Massachusetts

🇺🇸 Betterment Changed The Game For Investors, But Wall Street Banks Have Caught Up And The Disruptor Has Been Disrupted - Business Insider, August 1, New York

Events & Reports

🇬🇧 The Future Of FinTech - Coltech Global, July 28, Virtual

🇺🇸 VenCent Fintech Summit - The Venture Center, August 15-18, Virtual

🇲🇽 Fintech Summit LATAM - MobiFin, August 24-25, Atlatlahucan

🇺🇸 Fintech_Devcon 22 - Fintech_Devcon, August 23-25, Colorado

🇺🇸 Fintech Growth Summit - MGA, August 25-26, Florida

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.