Digital Wealth: Bain projects digital-human hybrid firms winning wealth mgmt with private and crypto assets, growing revenue pool to $500B in 2030

The Bain & Company report projects a $90 trillion increase in assets from all investors globally by 2030, with changes in business models

Dear Fintech Futurists,

Welcome to another Digital Wealth issue, the weekly aggregator for digital investing, asset management, and wealthtech.

Before we jump to today’s issue, we want to bring your attention to our monthly recap, containing the top 10 write-ups on the latest Fintech & DeFi developments.

Here’s what you may have missed this month:

Should Robinhood, Voyager, and BlockFi sell to FTX?

Longer term strategy for crypto wallets, with launches from Zerion and GameStop

Ethereum difficulty bomb delayed to September; MakerDAO governance drama; Voyager down 98% YTD; Solend won't liquidate

Were we wrong about neobanks and B2C fintech?

and 6 more key ideas in the industry that you can read in the recap

At the Fintech Blueprint, we go down the rabbit hole in Fintech & DeFi to help you make better investment decisions, innovate, and compete in the industry.

These top 10 articles cover the most pressing issues in Fintech and Web3 space along with our expert curation. Additionally, we provide deep, comprehensive analysis without shilling or marketing narratives.

North America News

⭐🇺🇸 Eton Solutions Raises $38MM Series C Funding - Eton Solutions, July 12, North Carolin

Eton Solutions, a SaaS platform geared towards the asset management of ultra-high net worth clients, raised $38MM in a Series C funding round led by Navis Capital Partners. Globally, the number of family offices increased from about 1,000 in 2008 to 10,000 in 2019, with over 400 family offices established in Singapore in the past five years. The $38MM capital injection will be used to establish an Eton Solutions international headquarters in Singapore.

Eton Solutions developed the AtlasFive platform, which has $425B in assets under administration and over 4.3MM annual transactions. The all-in-one tech platform offers services such as data aggregation, consolidation, and normalisation, fund accounting, and tax support services for both single and multi-family offices. More specifically, AtlasFive has a transaction processing workflow that initiates all family office operations and records these transactions on the investment ledger, general ledger and tax ledger; keeping them in sync.

Family offices waste 20-40% of working hours on manual processes because of generic software — many use a combination of spreadsheets, accounting software packages, and tax systems. Further, an EY report highlights that 74% of single-family offices have experienced some form of cyber security breach. It’s also a tough market to crack for software providers given that clients are price sensitive, and often comfortable with a legacy approach. However, there is a straight line from Addepar to more digital UHNW software, and we think Eton is a contender.

🇺🇸 Dynamic Announces Strategic Partnership With CAIS - Businesswire, July 12, Arizona

🇺🇸 First Trust Capital Partners, LLC To Acquire Direct Indexing Firm Veriti Management LLC - Businesswire, July 6, Illinois

🇺🇸 Tenjin AI Capital Advisors Announces Launch Of Tenjin AI - A Digital Platform That Democratizes Access To Managed Hedged Investment Strategies - PR Newswire, July 12, New York

🇺🇸 Practifi Expands Consulting Network With Red Rock Strategic Partners - Businesswire, July 12, Illinois

EMEA News

⭐🇫🇷 AXA IM Alts Partners With iCapital® As It Pursues Strategic Growth Of Private Wealth Offering - iCapital, July 12, Paris

AXA IM Alts, an alternative investment firm with $200B in assets under management (AUM), partnered with iCapital, a B2B fintech for alternative investing with over $130B in AUM. The partnership will start with AXA IM Alts’ $500MM Global Health Private Equity strategy, which is focused on medical devices, biopharmaceuticals, vaccines, and diagnostics.

Going forward, iCapital’s solutions for financial advisors, wealth management firms, and fund managers will be available to AXA IM Alts’ network of wealth managers and their high-net-worth clients. For advisors and wealth management firms, iCapital’s Flagship Platform (used by over 1,300 investment advisors and 300 family offices and wealth management firms), offers funds with investment minimums starting at $25K, due diligence and performance reporting, custodian integration and compliance and tax reporting.

AXA IM Alts’ strategic expansion into the private wealth sector makes sense according to recent industry trends. As mentioned in the Eton Solutions analysis, the number of family offices grew 10x from 2008-2009, but also, from 2015 to the end of 2021, AUM across all alternative asset classes increased from $7T to $13T, with forecasted AUM of $23T in 2026.

We do wonder whether value creation in the private markets will sustain in the current macro environment, but structurally deeper integration of alternatives manufacturing into advisor distribution will continue regardless. iCapital is the fintech company in a prime position to benefit as a result.

🇩🇪 Ride Capital Raises €3MM To Rid Investors Of The Wrath Of The Taxman - Tech EU, July 14, Berlin

🇧🇪 Deutsche Bank Partners Abbove For Wealth Management Services In Belgium - Fintech Futures, July 14, Brussels

🇬🇧 Banco Sabadell Extends Partnership With Wealth Dynamix For A Further 5 Years - Hubbis, July 13, London

🇮🇹 Allfunds Blockchain Launches FAST In Italy: The First Blockchain Platform To Make Fund Transfers More Efficient In The Italian Market - Allfunds, July 12, Milan

🇱🇺 New European Wealthtech Moniflo Launches In Beta - Fintech Futures, July 13, Luxembourg

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇸🇬 Amber Group Becomes The Official Global And Main Partner Of Atlético De Madrid - PR Newswire, July 11, Singapore

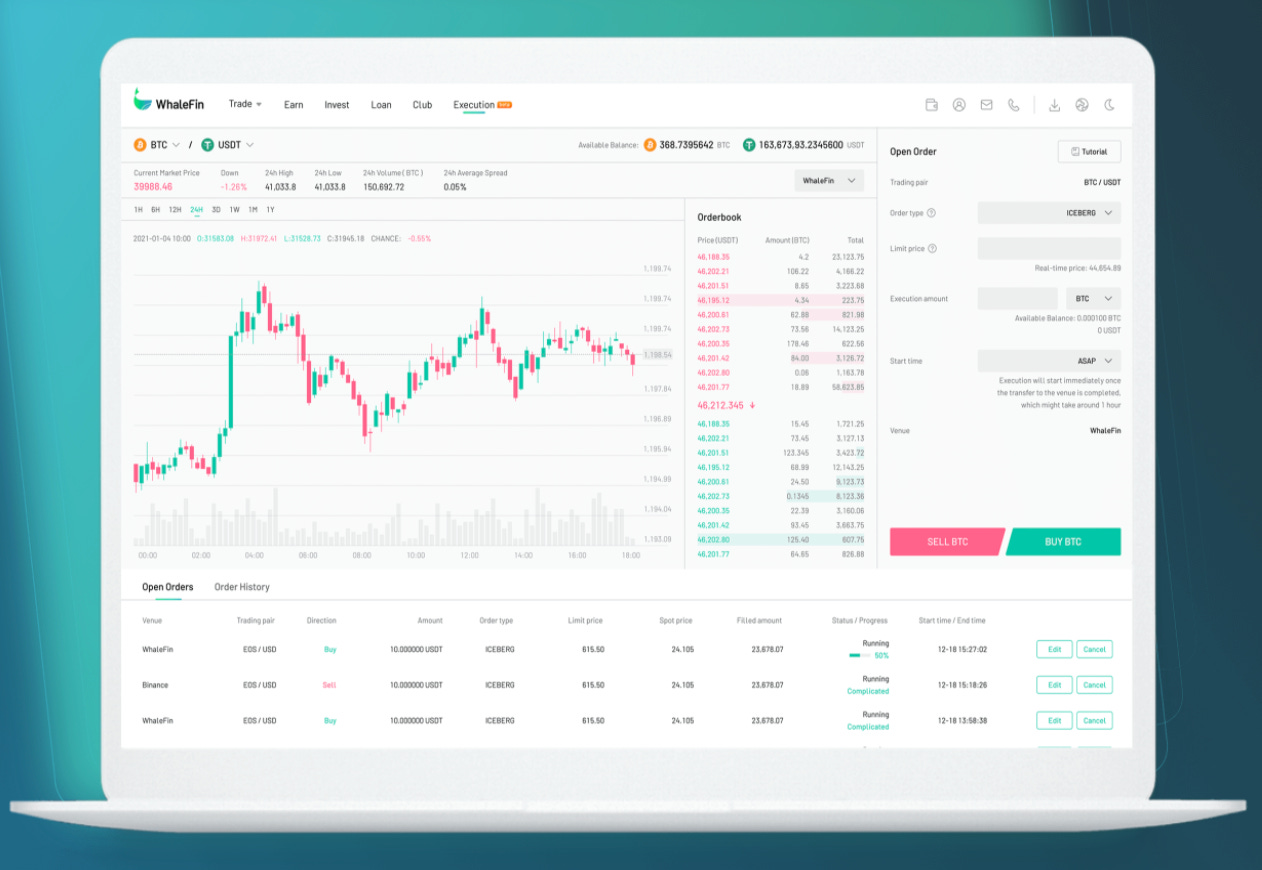

Digital asset firm Amber Group announced that it will be the official Global and Digital Wealth Partner of Atlético Madrid. WhaleFin, Amber Group's digital asset platform, will appear on the front of the team's game kits and will serve as the digital asset solution for Atlético de Madrid's fans.

WhaleFin’s offering consists of (1) trading, supporting 100+ assets and offering flexible leverage terms (95% liquidation loan-to-value); (2) earnings, where investors can commit to deposit to earn up to 7.5% APR, and (3) lending, where clients can borrow against the major digital assets at lower rates than the market average (e.g., 11.50% APR for USDT loans). We wonder how stable these rates are going to be given the collapse in demand for leverage.

Targeting sports fans is becoming a common trend in crypto. Whether it be the Staples Centre changing to Crypto.com Arena or crypto ads taking over the SuperBowl. We understand the logic of trying to bring these services to more mainstream audiences, but it’s not yet really working, with superbowl ads unable to boost transaction volumes on crypto exchanges as risk appetite melts down.

🇸🇬 Fintech Startup Hugosave Raises $4MM In Pre-Series A Funding Round - The Business Times, July 13, Singapore

🇰🇷 IntelliQuant Provides Investors With An Algorithmic Investment Platform For Smart Investing - KoreaTechDesk, July 14, Seoul

🇭🇰 WeLab Officially Launches Its Digital Wealth Advisory Solution - Fintech News Hong Kong, July 8, Hong Kong

🇸🇬 StashAway Launches Industry-First Flexible Portfolios - Zawya, July 12, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Wealth Management Booms As The Rich Get Richer But Markets Get Choppy - Financial Times, July 11, New York

🇨🇭 UBS Promotes Khan To Steer Wealth Management - Reuters, July 13, Zurich

🇱🇺 Women Miss Out On €10K Investment Returns Annually - Delano, July 12, Luxembourg

🇺🇸 Crypto's Place In Credit Unions: What Should Credit Unions Do Post-Bitcoin Crash? - Credit Union Times, July 13, New York

Events & Reports

⭐🇺🇸 In A New World: Time For Wealth Management Firms To Shift Course - Bain & Company, July 11, Massachusetts

Bain & Company predicts that customer demand for wealth management will continue to surge, and by 2030, the industry’s revenues will grow by $254B, doubling 2021 revenue pools.

The report also highlights that for the top three wealth management firms, average annual growth in AUM from 2016-2020 was $262B; for the top 10 firms — excluding the top three — the figure was $99B. Scale is increasingly important and the top players are pulling ahead of the rest, which underpins the continuous M&A activity in recent years. To read about some the top digital wealth management deals (e.g., UBS acquiring Wealthfront for $1.4B), see here.

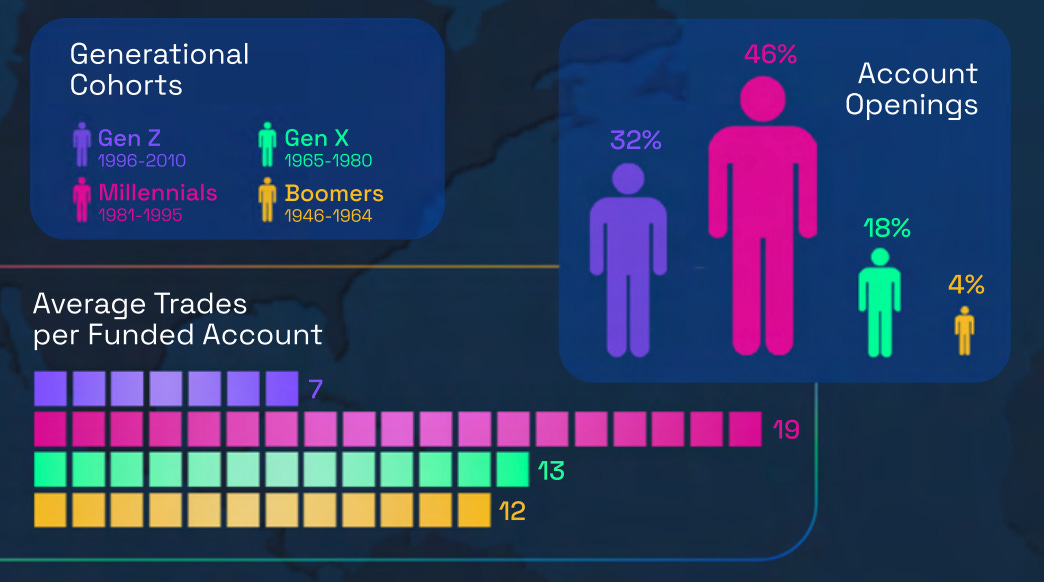

Bain suggests that from a user experience point of view, a combination of digital and human services will win, rather than models that offer human support or roboadvisors alone. Net promoter scores on such they hybrid approach have increased from 51 to 64 in the last two years. Further, the report expects private markets and crypto assets to become a more meaningful part of global asset allocations by 2030, which you can see in the graphs above.

🇺🇸 The Year Of The Millennial Trader: Trading Remained Trendy Despite Market Uncertainty - DriveWealth, July 13, New Jersey

🇺🇸 VenCent Fintech Summit - The Venture Center, August 15-18, Virtual

🇺🇸 Fintech Growth Summit - MGA, August 25-26, Florida

🇺🇸 Fintech_Devcon 22 - Fintech_Devcon, August 23-25, Colorado

🇮🇳 FinTech Festival India - Fintech Festival India, July 20-22, New Delhi

🇫🇷 Women In Fintech & Digital Payments - Women In Tech - Global Movement, July 21, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinons of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.