ICYMI: Top 10 Fintech Blueprint Articles Last Month

Hi Fintech Futurists —

We introduce a new format today to share our top 10 articles, podcasts, and analyses from the last month.

For more, check out our subscription options below.

(1) Ethereum difficulty bomb delayed to September; MakerDAO governance drama; Voyager down 98% YTD; Solend won't liquidate (link here)

Ethereum’s ‘difficulty bomb’ has been programmed since 2015, and executes once a specific block has been mined. It makes transaction validation more complex and significantly increases block time. This will lower the profits between block rewards and energy costs, and is aimed to prevent proof of work (“PoW”) mining and incentivise migration to the new proof of stake (“PoS”) system. The Gray Glacier update will push back the difficulty bomb by 700,000 blocks, or mid-September.

Miners and node operators that do not upgrade will sync to a pre-fork chain where they will be unable to send ETH or operate on the new PoS chain. The difficulty bomb has been delayed multiple times to align with the date of the Merge, so that the current network does not grind to a halt…

(2) BlockFi and FTX structure a $240MM acquisition; Klarna's $6.5B 85% down round; $200MM into BNB exchange Unizen (link here)

FTX and BlockFi got to a deal last week — the exchange will acquire the distressed lender for up to $240MM, including a $400MM revolving line of credit. Whether BlockFi goes for the full $240MM will depend on whether it hits performance triggers. Rumours are circulating that the acquisition will lead to further BlockFi layoffs, but both BlockFi CEO, Zac Prince, and FTX CEO, Sam Bankman-Fried (SBF), have denied these claims.

The sale could potentially go for considerably cheaper, with the lower end pegged at $25MM, as reported by CNBC. As we’ve covered in detail in our Long Take, BlockFi has been hit hard by the recent market volatility of the crypto markets. They experienced around ~$80MM in losses due to overcollateralised loan exposure to 3AC, who recently filed bankruptcy. But also, leverage is down in the market and leverage is BlockFi’s whole business model…

(3) Should Robinhood, Voyager, and BlockFi sell to FTX -- a view on the industrial logic (link here)

This week we look at how FTX and Alameda are spending their balance sheet, supporting crypto broker Voyager with a $500MM revolver and crypto lender BlockFi with a $250MM loan. We examine potential strategic rationales for this loans in the context of FTX strategy, as well as the underlying cause of distress for those companies, such as the Terra and 3AC fallout. We also think about Robinhood, and what it would add to the FTX equation…

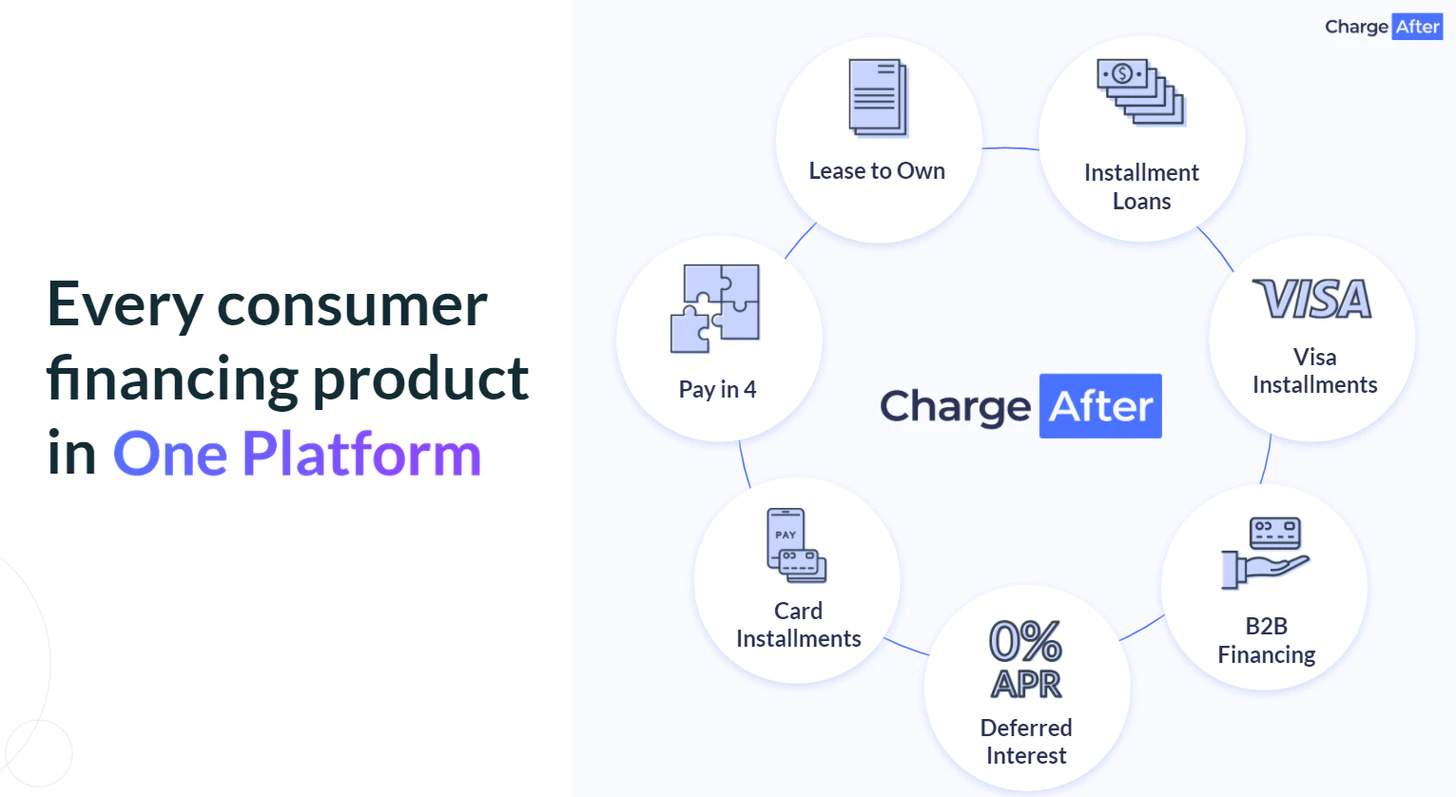

(4) Powering a BNPL platform with a global lender network, with ChargeAfter CEO Meidad Sharon (link here)

In this conversation, we chat with Meidad Sharon, the CEO and founder of the award-winning retail finance SaaS network platform ChargeAfter, the first global network to provide a complete solution to Point-of-Sale financing from multiple lenders.

Meidad is a long-time high-tech industry veteran, with over 15 years of experience scaling global payments and SaaS businesses with a people and customer-first approach. As well as, demonstrating how simple payment processing and fraud prevention solutions can meet complex needs, and lead to maximum profitability and a seamless end-user experience.

(5) Kids go neobanking with GoHenry acquiring Pixpay; Flutterwave fraud allegations in Kenya; Aave's multichain stablecoin proposal (link here)

GoHenry, a UK-based provider of prepaid debit cards and financial education for children has acquired Pixpay, their French counterpart. Launched in 2012 to allow parents to allocate and control their children’s bank accounts, with saving insights in-app, GoHenry expanded into the US in 2018 and grew to 2MM+ users and $42MM in revenue between the two markets. Pixpay focuses on kids from ten to eighteen and has 200,000 users across France and Spain, with plans to move into Italy and Germany.

Consumer fintech for kids is still quite … a young sector in Europe, even though in the US teen-banking fintech Step raised $100MM in funding. GoHenry raised $40MM in December 2020, and has been looking for a way to expand into Europe. The acquisition of Pixpay, for an undisclosed amount, takes them there. At this time, the two companies will not be integrated, with Pixpay retaining its branding, leadership and HQ…

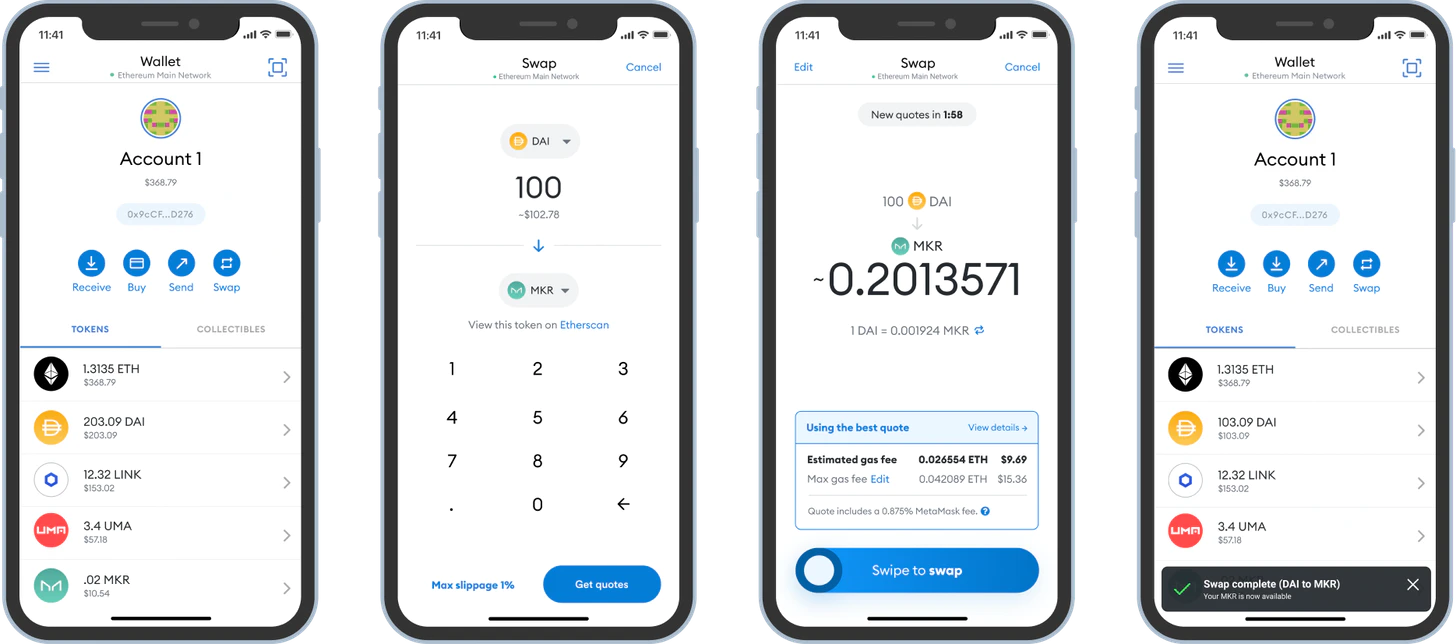

(6) Longer term strategy for crypto wallets, with launches from Zerion and GameStop (link here)

Today we look into the Zerion and GameStop launch of their crypto wallets, and articulate a number of core threads. First, we define the differentiation and value added from crypto wallets, separating them from paytech, neobanks, and digital investing apps.

Second, we touch on fintech integration of the crypto asset class, and then look at the path of data aggregators and performance reporting apps into vertically integrated solutions. Finally, we take a quick look at NFT avatars and their connection into Metaverse identity.

(7) Cleo, the 4MM user personal finance AI chatbot, valued at $500MM (link here)

Cleo, an AI-based financial assistant platform, raised $80MM in venture funding at a $500MM valuation. Cleo integrates with client bank accounts and uses AI to analyse spending habits to help users with budgeting, saving, borrowing and improving credit rating.

The platform has 4 million users, largely in the Gen Z demographic, who’ve been enticed by novelty features like “roast mode” that roasts you for spending money. Other features include: (1) budgeting, which includes an AI assistant to help users stay on track, monthly targets based on spending, breakdowns by category, and bill management; (2) saving, which includes goal setting, round ups and cashback on everyday buys; (3) borrowing, which allows borrowing up to $100; and (4) building out a credit history. We think this stuff should be integrated into all wealthtech as well…

(8) Were we wrong about neobanks and B2C fintech? With 2x digital bank founder Will Beeson (link here)

In this conversation, we chat with Will Beeson, Co-Founder & Chief Product Officer at digital bank BELLA. Previously, Will was a Principal at Rebank, a fintech advisory firm, as well as he co-founded Allica, a digital bank for businesses in the UK. After starting his career at Citigroup in New York, Will spent nearly a decade in Europe working with and managing financial services companies prior to launching Allica. Will holds a BA from Amherst College (USA) and is a Chartered Financial Analyst (CFA) Charterholder.

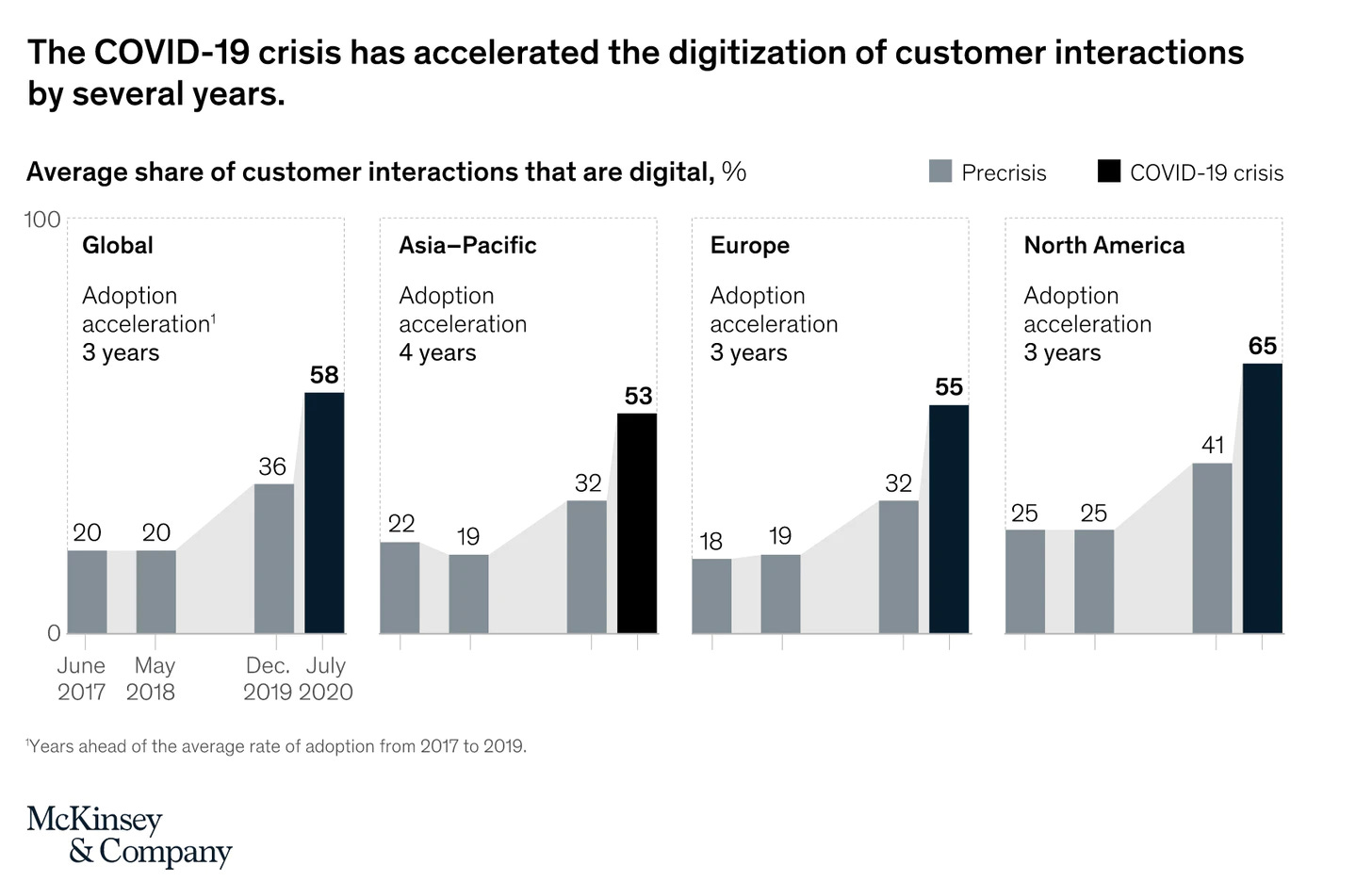

More specifically, we touch on frameworks for navigating down markets, valuations, multiples, why some fintechs have to disclose themselves as tech companies than banks, covid-19 implications, buy now pay later developments, and so so much more!

(9) Gemini 10% staff cut; Kroo neobank raises $26MM; Utopia Labs gets $23MM for DAO payroll and finance (link here)

The Winklevoss owned crypto exchange, Gemini, laid off 10% of the workforce following the downturn in the crypto markets, which the firm expects will last for a meaningful amount of time. Employees that were laid off will receive healthcare benefits and a severance package. Physical offices have also been closed — perhaps to preserve privacy of those laid off, perhaps as part of remote work, or perhaps to save cash in the bear market.

This symptom is part of a wider trend in risky assets markets, although it is having an outsized impact on crypto exchanges. Coinbase has been rescinding job offers and Bitso cut 80 employees last week as well. Why exchanges? The short answer is that brokerage is cyclical twice — in users and in market value…

(10) Algo-advisor Delphia closes $60MM round led by Multicoin Capital (link here)

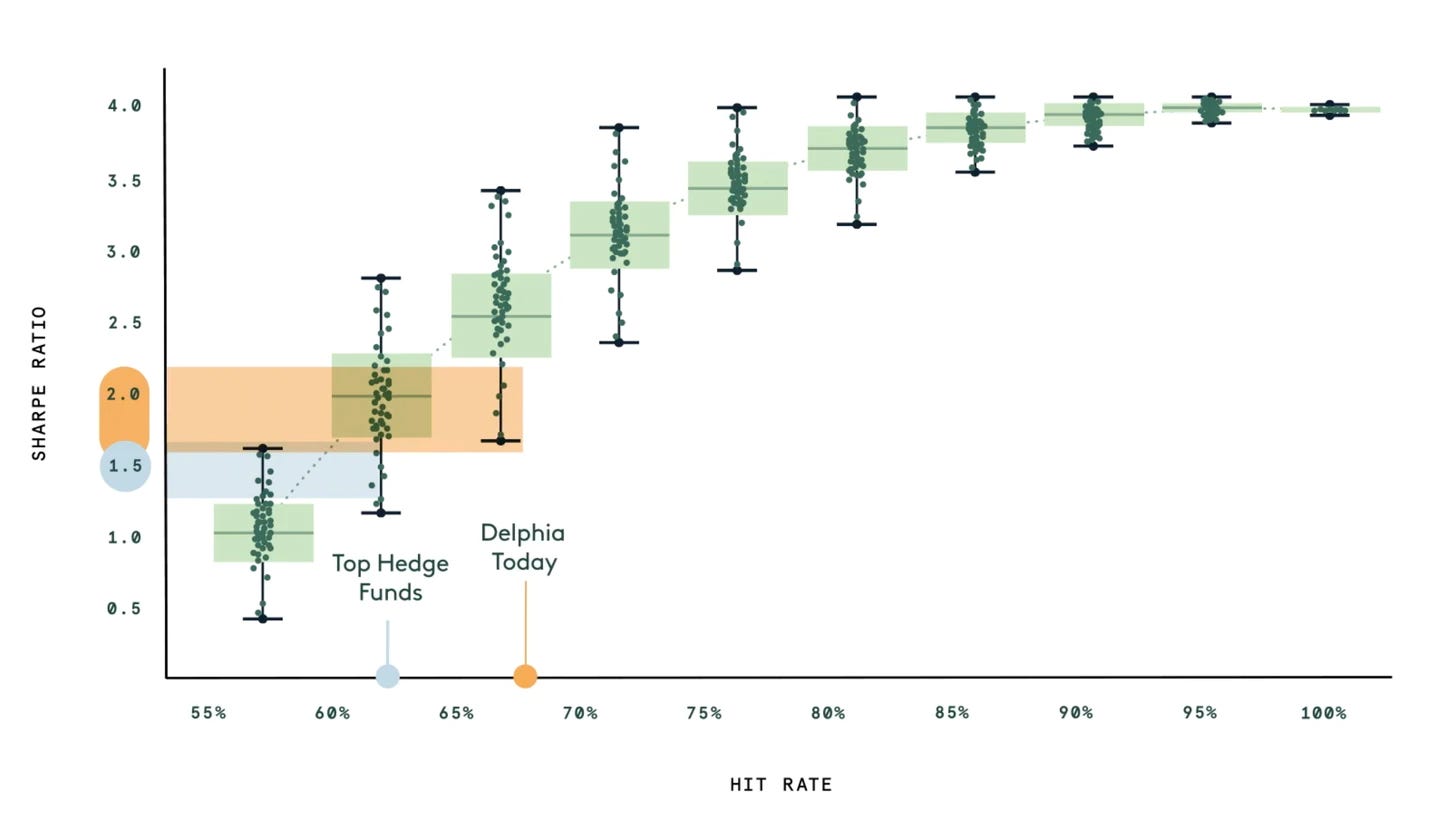

Delphia, an algorithmic stock-picking platform, announced a $60MM Series A round, bringing total funds raised to $80MM. There is an interesting play here implementing machine learning models for stock selection. However! You need large data sets to implement useful machine learning models, and Delphia solves this by having retail users share *data from their phone* with the Delphia app, and in exchange for rewards — such as their Amazon purchase history, LinkedIn, or Venmo accounts. Using consumer spending insights, employment patterns and public opinions, Delphia can try to create algorithmic models that were previously only for hedge funds.

Marketing spiel aside, building out a new giant data set is the interesting bit. Also interesting is that the venture investor set here is largely from the crypto crowd, which shows the shift into trying to own fintech distribution. Also also, we like that there is a thing called an “algo-advisor”.

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth newsletter issue, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to the Podcasts with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive convering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Exclusive monthly ‘Greatest Hits’ reports with an overview of various Fintech and Web3 topics to give you a well rounded perspective on a particular issue

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinons of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here any time.