Digital Wealth: Betterment, via Gemini, and DBS Bank both launch crypto offerings to clients

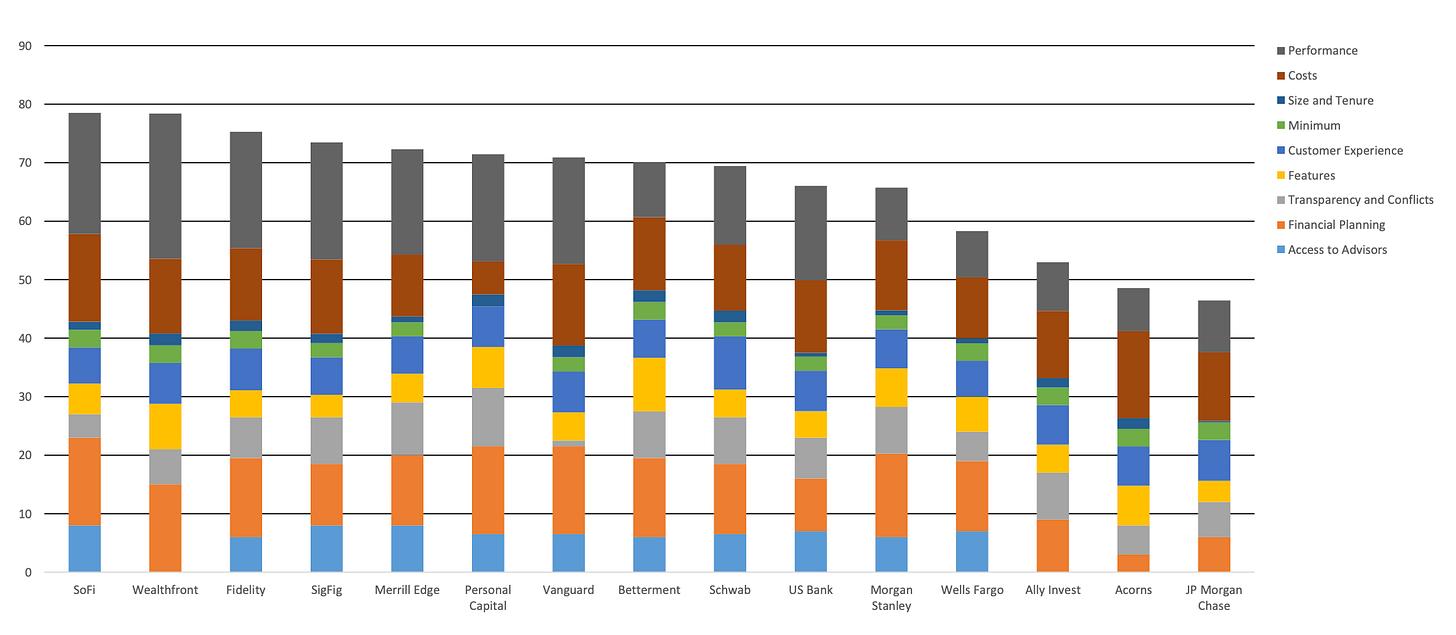

In the 2022 Q2 Robo Ranking Report, Betterment won the "Best Robo for First-Time Investors'' category

Hi Fintech Futurists —

Welcome back to Digital Wealth, the weekly news aggregator for digital investing, asset management, and wealthtech. Today we highlight the following:

NORTH AMERICA: Robo-Advisor Betterment Partners With Crypto Exchange Gemini To Offer Customized Crypto Portfolios

EMEA: Ghanaian Fintech SecondSTAX Allows Investors To Access Capital Markets Outside Their Countries, Raises $1.6MM

ASIA PACIFIC: DBS Opens Crypto Exchange To Wealthy Clients

For deeper dives, including Long Take analyses of wealthtech, subscribe below:

North America News

⭐🇺🇸 Robo-Advisor Betterment Partners With Crypto Exchange Gemini To Offer Customized Crypto Portfolios - CoinDesk, September 27, New York

Betterment has partnered with crypto exchange Gemini to launch crypto portfolios for its 730,000 users. In the 2022 Q2 Robo Ranking Report, Betterment won the "Best Robo for First-Time Investors'' category for its intuitive interface. The company has had good judgment in the past to not rush into new categories before they are proven out (unlike Wealthront’s risk parity for example), so we take this as a positive sign overall of de-risking digital assets within asset allocations.

Gemini has grown this year by acquiring crypto custodian BITRIA and trading tech platform Omniex in January. Besides the $200MM in Custody Insurance Coverage and its multi-layered security features, Gemini's custody offering lets users trade directly on Gemini Exchange with assets held in offline storage, such that the hardware security modules, storing private keys, are disconnected from the internet.

In February, Betterment also acquired crypto roboadvisor Makara, which uses an algorithmic trading software developed by Strix Leviathan. Strix, launched in 2018, spun out of Makara, registered with the SEC as an automated roboadvisor, and opened the platform to retail investors. Makara offers automated crypto baskets, ranging from single-coin investments, such as the “Ethereum” basket, to thematic baskets, such as the “Universe,” which contains 43 cryptocurrencies. The best performing basket, according to returns, has an all-time return of -40%. Yep, you read that right — it’s all about the time period.

Makara uses Gemini to custody assets for a 0.35% fee per transaction, so the Betterment partnership has a precedent. That said, we are a bit confused as to the product packaging here — whether thematic baskets are different from the Gemini assets integrated into Betterment portfolios. Our guess would be that Makara gets deprecated once the simpler Betterment offering is done.

🇺🇸 Fidelity Will Merge Its Robo-Advisor Offerings - Barron’s, September 23, Massachusetts

Hmm.

🇺🇸 Investment Platform Delphia Launches Digital Asset Ecosystem - PR Newswire, September 28, New York

🇺🇸 Morgan Stanley’s Wealth Management Arm Hit With $35MM Data Protection Fine - Fintech Futures, September 26, New York

🇺🇸 Secfi Launches ‘Secfi Wealth’ — A Fully Independent RIA — To Provide Startup Founders And Employees With Financial Planning And Investment Management - Businesswire, September 27, California

🇨🇦 Purpose Advisor Solutions Partners With Origin Wealth To Help Improve The Client Experience For Financial Advisors - GlobeNewswire, September 27, Vancouver

🇺🇸 OneDigital Expands Wealth Management Offering With Addition Of KB Financial Companies, LLC - PR Newswire, September 27, Georgia

Fundraising?

Are you building in Fintech or Web3? We are investing in great teams at the pre-seed and seed stage. Do you have an awesome idea — click below to let us know!

EMEA News

⭐🇬🇭 Ghanaian Fintech SecondSTAX Allows Investors To Access Capital Markets Outside Their Countries, Raises $1.6MM - TechCrunch, September 21, Accra

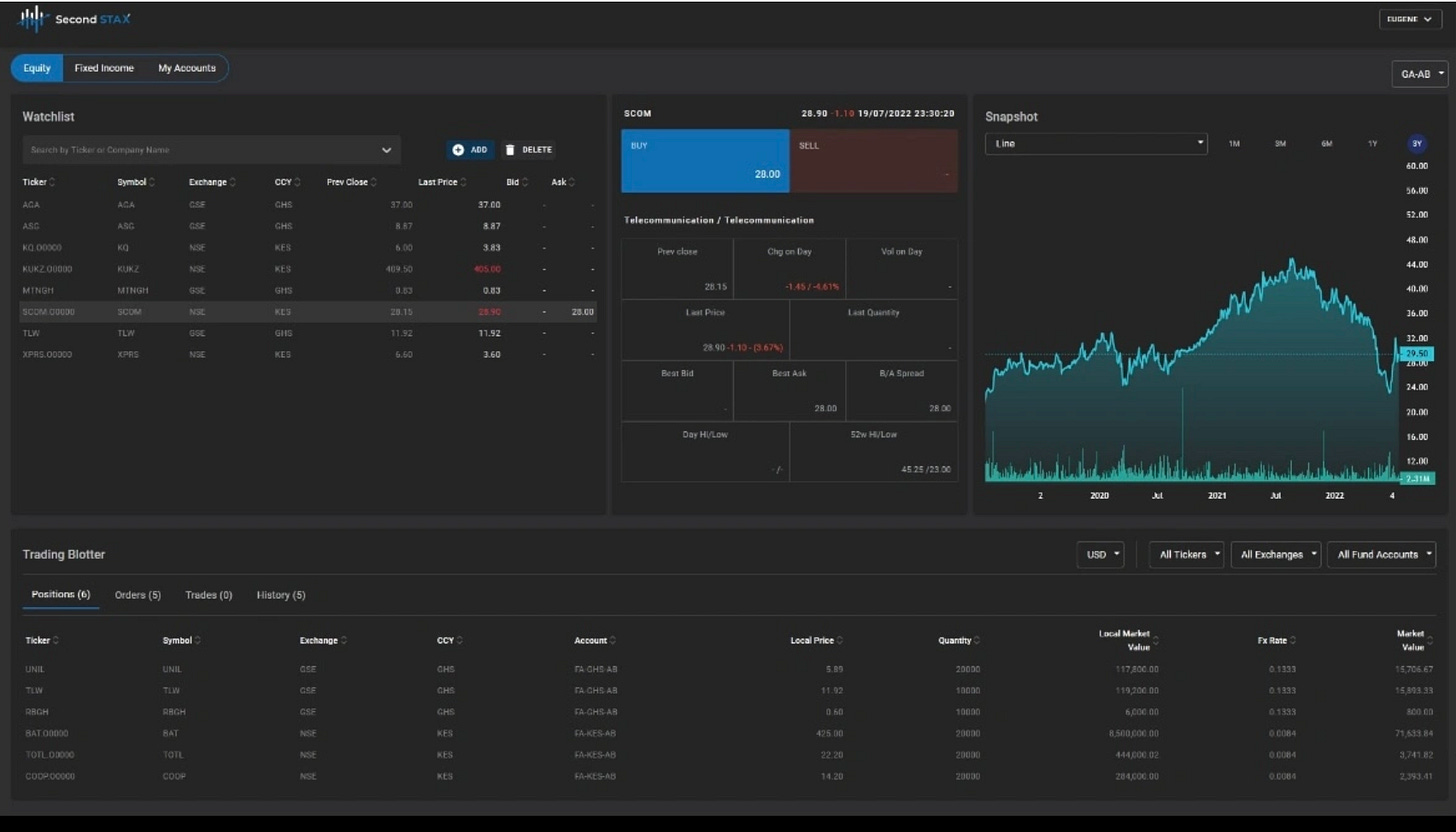

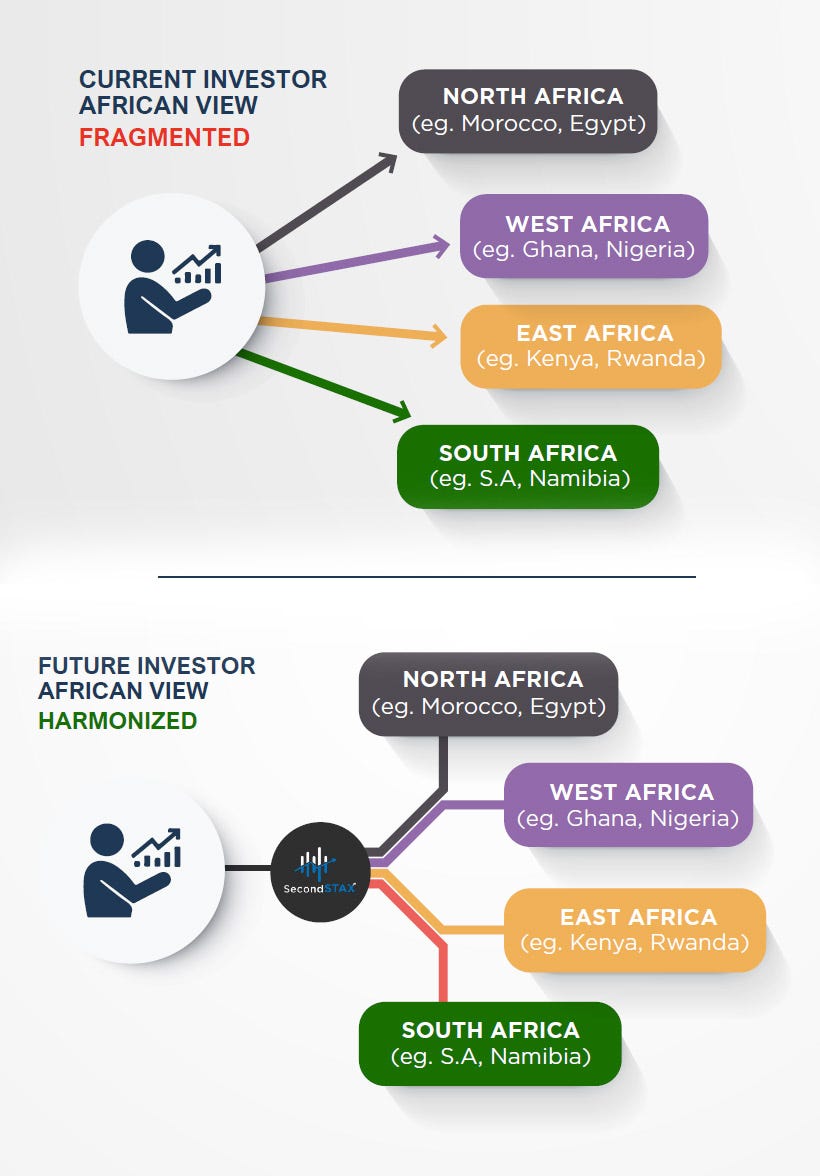

This is an interesting story as it relates to market structure and investment fund product across the African continent, and the challenges of moving securities between different countries. Ghanaian B2B capital markets infrastructure platform SecondSTAX (Secondary Securities Trading and Aggregation eXchange) has raised $1.6MM in pre-seed funding from private investors and LoftyInc Capital, Orbit54, and STEMeIn.

The platform, launched this week, allows asset managers and institutional investors to access securities markets across various African geographies. Western capital markets participants tend to assume quite a bit about common custody, settlement, fund management, and trading infrastructure — but those rails have to be built to create an advanced investment management industry.

SecondSTAX provides access to debt and equity securities across African bonds and stock exchanges, and assists investment firms that want to invest in the continent, supporting various currencies. Tawiah, CEO of SecondSTAX, mentioned, “you have exchanges where the securities are traded in each country. Nigeria is a silo, same with Ghana, Kenya and South Africa, etc. SecondSTAX is effectively the aggregation of these exchanges across the continent."

African countries are evolving at different paces, and the uneven infrastructure and fragmented financial regulatory framework can make operating difficult for African fintechs. For example, Nigeria-based fractionalized investing app Bamboo, which raised $15MM, does not offer stocks and bonds across different geographies.

👉If interested in similar topics, check out our conversation with Allfunds on how to build a $1.4T investment product aggregation machine.

🇬🇧 Moneyfarm Launches Fixed Allocation Portfolios - Altfi, September 26, London

🇬🇧 Citi To Wind Down UK Retail Banking Ops To Focus On Wealth Management - Fintech Futures, September 26, London

🇳🇬 Nigerian Startup ComiBlock Raises Funding To Scale Its Crypto Investing Services - Blockbuild, September 27, Lagos

Asia Pacific News

⭐🇸🇬 DBS Opens Crypto Exchange To Wealthy Clients - Finextra, September 26, Singapore

DBS bank has rolled out self-directed crypto trading via DBS Digibank, enabling accredited investors to trade Bitcoin, Bitcoin Cash, Ethereum, and XRP on DDEx, a bank-backed digital exchange. Previously, crypto trading on DDEx was limited to institutional investors, family offices, and clients of DBS Private Bank. The target market is about 100,000 accredited investors in Singapore.

We have seen asset managers pursuing growth in digital assets (e.g., Abrdn buying a stake in Archax), but offering crypto investing is still rare across traditional banks. DBS allows clients to see their equities, bonds, forex, and crypto investments in one place rather than switching between various investment apps; DBS bank accounts and DDEx custody accounts link via DBS digibank. There are no transfer fees, conversions, or third-party processing.

Unfortunately, crypto-friendly banks all seem to charge 1%+ trading fees for the convenience of dealing within a licensed regulatory perimeter (e.g., Vast bank, LevelField Financial yet to be priced). DBS joins the pack with a 1% trading fee, a 0.1% exchange fee, and a 0.5% custodian fee per annum. We look at these economics as an attempt to charge high for early adopter features, with pricing pressure eventually driving the numbers down as everyone else pulls DeFi into the Fintech B2C bundle.

🇮🇳 Wealthtech Startup Savart Raises $1.5MM Funding Led By 9Unicorns, Venture Catalysts’ Angel Fund - CXOtoday, September 21, Hyderabad

🇮🇳 Moonfare Expands Foothold To India Opening Digital Private Market Investing Platform To Eligible Investors - PR Newswire, September 28, New Delhi

🇰🇷 Fintech Startup Quantit Signs Mou With Nice & Prive For Asset Management In Korea - KoreaTechDesk, September 27, Seongnam

🇹🇼 Taiwan’s SinoPac Selects Temenos For Seamless Digital Banking - IBS Intelligence, September 28, Taipei

Blogs, Webinars, Podcasts

🇨🇦 5-Star Wealth Technology Providers 2022 - Wealth Professional, September 26, Ontario

🇭🇰 Advice Tops Execution For SE Asia Mass Affluent - The Asset, September 27, Hong Kong

🇺🇸 Robo-Advisor Performance Is Only One Piece Of The Puzzle - Nerdwallet, September 22, California

🇸🇬 Money Mind: Wealth Management - S1: Could Digital Wealth Tools Bridge Investing Gap? - Channel News Asia, September 26, Singapore

Events & Reports

🇺🇸 Boston Fintech Week - Boston Fintech Week, September 27-29, Massachusetts

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

🇬🇧 Global WealthTech Summit - Fintech Global, November 2, London

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.

M1 Finance also just launched their crypto product last week.