Digital Wealth: Farther gets $15MM to compete with roboadvisors, TAMPs, and wirehouses; Abrdn invests in Archax exchange

Fartherhas also quadrupled its AUM to more than $250MM this year.

Dear Fintech Futurists,

Welcome to our Digital Wealth issue, the weekly news aggregator for digital investing, asset management, and wealthtech.

Is there something in the investing world you would like us to cover in more detail? Share your ideas below:

North America News

⭐🇺🇸 Farther, A Wealth Tech Firm, Banks $15MM Series A As Valuation Hits $50MM - TechCrunch, August 11, New York

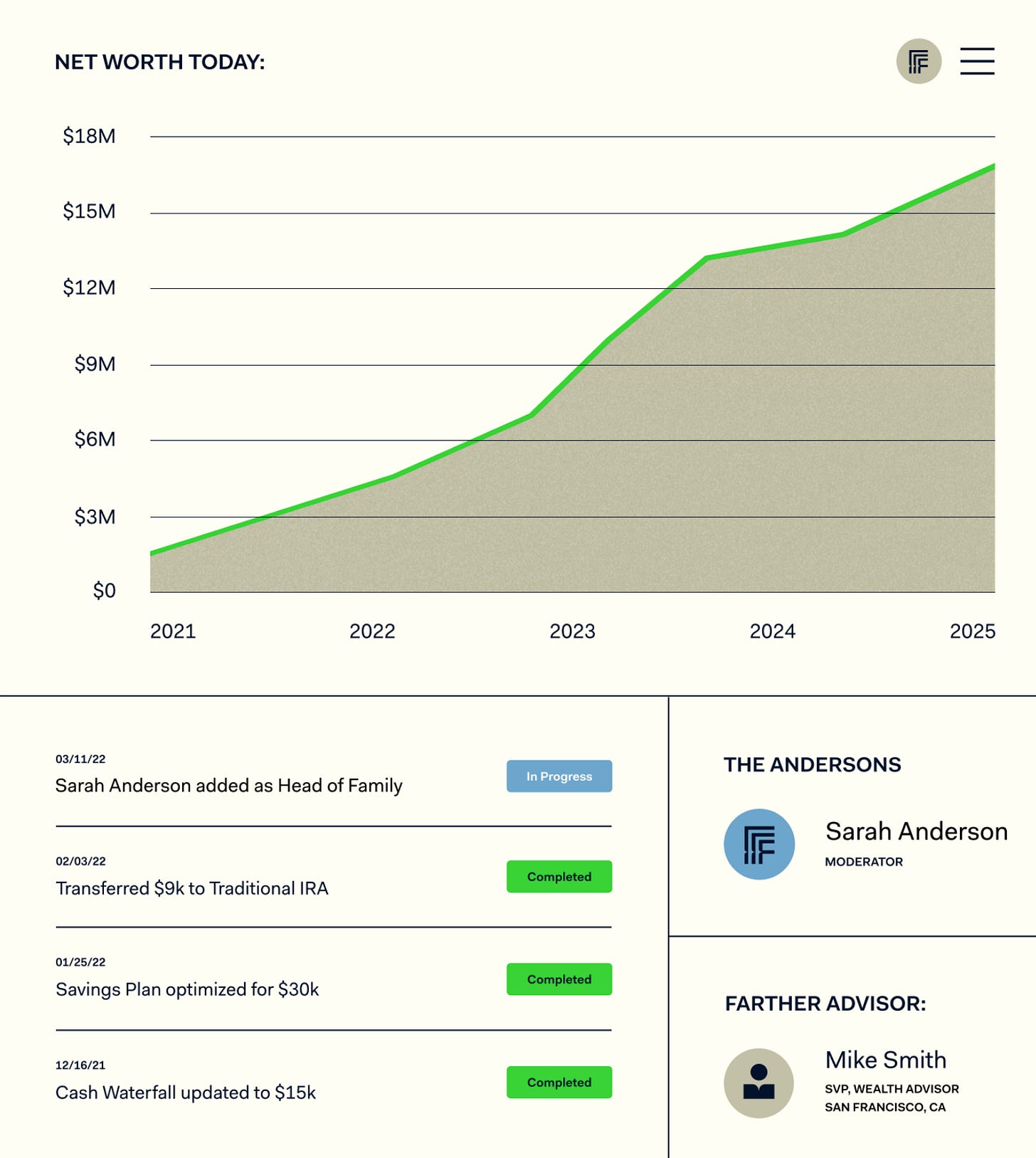

Farther raised $15MM in its Series A round, led by Bessemer Venture Partners. The firm raised a total of $22MM since 2019, now with a valuation of $50MM. Assets under management have increased 4x to more than $250MM this year.

Farther is a play on taking the traditional advisor desktop, combining it with a roboadvisor TAMP, and hiring in-house advisors while paying them out up to 75 % of revenue. For end-clients, the wealth management platform has investment products, like (1) ESG custom portfolios that track existing ESG benchmarks, and (2) alternative investments in PE and hedge funds with account minimums as low as $25K, and (3) crypto, because YOLO, via access to funds that offer single or multi-coin exposure. There’s an automated “cash waterfall” feature that detects excess cash and routes it into new assets.

Many wealthtech raises in the past months were B2C roboadvisors (e.g. Dezerv’s $20MM raise, Bibit’s $80MM raise), in part due to the recent market collapse and the resulting distaste for more active trading / brokerage, i.,e., the Robinhood model. Farther’s model is closer to B2C financial planning, which is less viral and sometimes harder for consumers to understand, but does have niche traction (e.g. PINA’s $3MM raise). The $15MM raise is a signal that perhaps TAMPs can be challenged by a tech-enabled RIA going after the high-net-worth demographic.

⭐ 🇺🇸 J.P. Morgan Completes Acquisition Of Global Shares - J.P. Morgan, August 11, New York

Eat your heart out, Carta!

🇺🇸 Ezra Group Announces WealthTech Integration Score - PR Newswire, August 16, New York

🇺🇸 Orion Partners With Apex To Launch Fast, Fully Digital Account Opening For Independent Advisors - Fintech Futures, August 16, Nebraska

🇺🇸 Creative Planning Ends 2022 M&A Spree With 'Bold' $5B Buy - Wealth Management, August 17, Kansas

🇺🇸 Fidelis Capital Launched By Private Banking Executives Formerly With Wells Fargo And Bank Of America - PR Newswire, August 15, Florida

🇺🇸 Signature Estate & Investment Advisors Announces Strategic Investment From Reverence Capital Partners, Announces Plan To Work With Newly Formed Broker-Dealer - PR Newswire, August 17, California

🇻🇬 Acquire.Fi: Where Investing And Web3 Intersect - Be In Crypto, August 17, Tortola

Want to go deeper?

If you haven’t yet, upgrade your subscription to get access to our analytical Long Takes below. Here is a preview around roboadvisors and digital investing.

EMEA News

⭐🏴 Abrdn Buys Stake In Digital Exchange Archax - CoinDesk, August 12, Edinburgh

Investment company Abrdn has become the biggest external stakeholder in Archax, a London-based digital asset exchange, brokerage, and custodian. Archax is the first and only digital asset exchange that is regulated by the UK's Financial Conduct Authority. They are the real deal, sweating out the licenses while the rest of crypto trades around levered NFTs.

Archax provides institutional investors a platform to trade digital assets, acting as a bridge to traditional finance. Institutions can apply to become a member of the Archax exchange. If they pass due diligence and the application is approved, institutions can buy and sell digital assets globally. The platform also provides a segregated digital asset custody service in partnership with METACO and IBM. The solution protects the cryptographic keys through the IBM product Hex Trust.

Asset management in a down-market is tough.

Abrdn's AUM dropped by 17% since H1 FY2022, from £464B to £386B, and the firm will be merging or closing 100 ‘non-core, subscale, or duplicative’ funds to deliver £75M in savings for its investment business. Within this context, the Archax deal showcases that asset managers have to pursue growth in digital assets. This news comes shortly after BlackRock partnered with crypto exchange Coinbase and unveiled a spot bitcoin private trust for institutional investors.

🇩🇪 Scalable Capital Hits €10B Of Assets As ETFs Find Favour With Gen Z - Altfi, August 16, Munich

🇬🇧 Robinhood Re-Negotiates Ziglu Acquisition Deal, Leaving Some Crowdfunding Investors At A Loss - Altfi, August 17, London

🇳🇴 Axo Announces Acquisition Of Defero, A Leading Digital Credit-Scoring And Financial Management Platform - Altfi, August 16, Oslo

🇦🇪 HSBC Expands Global Securities Services In ADGM - Zawya, August 15, Abu Dhabi

🇨🇭 North International Bank Partners With Temenos To Launch A BaaS Platform - IBS Intelligence, August 16, London

🇬🇧 Bank Islam Taps Kestrl To Offer Financial Management Tools In Be U App - Fintech Futures, August 16, London

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇭🇰 Virtual Firm ZA Bank Launches Investment Fund Service - Private Banker International, August 10, Hong Kong

ZA Bank, a Hong Kong-based neobank with 500,000+ customers, is launching a range of investment funds from global asset management companies, such as the Franklin Technology Fund, AB American Growth Fund, and Amundi Balanced Fund.

One of the top-selling funds is Hong Kong-dollar fund by Franklin Templeton Investments (Asia), which invests in tech companies, such as Microsoft, Apple, and Amazon. The fund has an annual charge of 1.50%. We note the fund’s performance at the end of June was -35% YTD. Similarly, Philippines-based ATRAM, which manages $3B in client assets, has reported poor fund performance across its 18 feeder funds. One of ATRAM’s top-selling funds, the Alpha Opportunity Fund is down 13% YTD.

WeLab, another Hong Kong-based virtual bank, also expanded its wealth offerings by launching GoWealth, a platform that uses investment expertise by asset manager Allianz Global Investors to offer personalised advisory services to customers.

A survey of 1,000 Hong Kong-based respondents, aged 20-59, highlighted that 65% of respondents were unaware of their investment portfolio composition and its performance. ZA Bank can potentially acquire a large market share with its new venture, as the number of virtual bank users in Hong Kong is poised to rise to 25% by 2025. The dividing line between neobanks and roboadvisors is what again?

🇦🇺 AZ Sestante Rolls Out Digital Investing Tool For Wealth Management Industry - Private Banker International, August 16, Sydney

🇭🇰 WRISE Launches WRISE Wealth Management And TREX To Target Next-Gen Wealth Management - WealthBriefing Asia, August 17, Hong Kong

🇭🇰 BitMonsters Move Towards Launching A Full-Fledged Ecosystem, Targets Highest Passive Revenue And Referral Rewards For Users - Yahoo Finance, August 12, Hong Kong

🇮🇳 Fintech App Dinero Encourages Young Indians To Build Wealth; Launches Its Beta App On Google Play Store - CXOtoday , August 11, Mumbai

Blogs, Webinars, Podcasts

🇸🇬 Tackling The Retirement Adequacy Problem: A Conversation With Endowus’s Samuel Rhee - McKinsey Digital, August 12, Singapore

🇺🇸 Fintechs Use Investing APIs To Help Millennials, Gen Zs Build Wealth - PYMNTS, August 12, Massachusetts

🇨🇳 Digitalization Of Wealth Management Is Imperative For Banks - PR Newswire, August 15, Beijing

🇺🇸 Q&A: How Linqto Is Helping Democratise The Private Investment Space - Fintech Futures, August 12, California

🇬🇧 5 Notable Wealth Management Companies Across The Americas - IBS Intelligence, August 11, London

Events & Reports

⭐🇺🇸 The Robo Report | Second Quarter 2022 - The Robo Report, August 15, New Jersey

We always recommend this report. Reminder that from an operating perspective, all those features and ease of use matter. The takeaway is that there’s no sticky winner-take-all feature set, it can all be copied. From a financial perspective, only returns matter. Things looking pretty dire YTD.

🇮🇳 Financially Independent Millennial Report 2022: Highlights - Dalal Street Investment Journal, August 16, Mumbai

🇲🇽 Fintech Summit LATAM - MobiFin, August 24-25, Mexico

🇺🇸 Fintech_Devcon 22 - Fintech_Devcon, August 23-25, Colorado

🇺🇸 Fintech Growth Summit - MGA, August 25-26, Florida

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.