Digital Wealth: BlackRock partners with neobroker Bux for European ETF growth

BlackRock offers 1,300+ iShares ETFs to 35MM users globally, 3MM+ of which are European, a 22% increase since 2021

Hi Fintech Futurists —

Due to a mailing glitch, we are doubling up with the Podcast and Digital Wealth email today. Here we highlight the following news —

NORTH AMERICA: BlackRock Partners With Digital Platform To Launch ETF Savings Plans Across Europe

EMEA: M&G Launches D2C Platform One Year After MoneyFarm Deal

ASIA PACIFIC: Zorion Selects WealthOS To Support International Expansion

REPORTS: M&A In Wealth And Asset Management: How Deals Will Shake Up the Industry

Thanks as always for your time and attention. To dive deeper into our covered topics, check out the premium options below.

North America News

⭐🇺🇸 BlackRock Partners With Digital Platform To Launch ETF Savings Plans Across Europe - ETF Stream, January 31, New York

BlackRock has partnered with digital wealth platform Bux, which has 700,000+ users, to launch ETF savings plans across the Netherlands, Belgium, Germany, Italy, France, Spain, Austria and Ireland. The company is a new name to us, but has been around since 2013 and clears via ABN AMRO.

Bux's investment brokerage platform will help investors build individual portfolios with BlackRock's iShares ETFs, offering asset allocation into bonds, stocks, themes, sectors, factors and sustainable ETFs with a minimum investment of €10 a month and a €1.5 commission fee per trade.

Alongside savings and thematic investing, Bux lets investors purchase fractional shares in stocks and ETFs on BUX Zero. BUX Zero also enables investors to trade with 30 cryptocurrencies, whereby users can avoid fees on crypto trading altogether by holding at least 1000 $BUX, Bux's native token. This is similar to Bitpanda's BEST (Bitpanda Ecosystem Token).

The platform's fee structure is interesting — (1) zero orders, which are executed between 16:00 CET and market close (€0 fee), we assume done in batches; (2) market orders, which are are executed immediately (€1.5 fee); and (3) limit orders, which are executed once the asset reaches the price you set.

Given number of digital wealth platforms that use iShares ETFs as part of their model portfolios, one can recognize BlackRock's distribution strategy into European retail investors. The company offers 1,300+ iShares ETFs to 35MM users, 3MM+ of which are European, a 22% increase since 2021. BlackRock predicts that ETF investments on European digital wealth platforms will hit €500B by 2026.

Bux is just yet another digital broker to sell the default vehicle for market exposure. That said, we commend it to integrating all the key attributes of digital investing in the last decade — free trades, roboadvice, crypto assets, and fractional shares. Cash account should be next!

⭐🇺🇸 Yield App Acquires Structured Product Provider Trofi Group - Crowdfund Insider, January 31, California

⭐🇺🇸 Schwab Buys Wealth Management Platform Focused On Ultra-Wealthy - Financial Advisor, January 26, Texas

🇺🇸 Orion Champions Effort To Connect 10,000 Advisors To Families Facing Financial Hardships - Businesswire, January 30, Nebraska

🇺🇸 Pontera Announces Integration With Envestnet, Incorporating Its 401(k) Management Capabilities Into Envestnet’s Ecosystem - Businesswire, February 1, New York

🇺🇸 FLX Networks Taps Broadridge To Offer Distribution Platform To Asset Managers - Private Banker International, January 27, New Jersey

EMEA News

⭐🇬🇧 M&G Launches D2C Platform One Year After MoneyFarm Deal - FT Adviser, January 31, London

Moneyfarm, the UK digital investing app, has 90,000 customers and £2B+ on its platform. It raised £44MM in a Series D led by asset manager M&G Wealth, which manages £350B in AUM. Since its inception in 2012, Moneyfarm has raised £139MM, and is now valued between £300-350MM (surely the floundering Wealthfront sale to UBS didn’t help comps). The silver lining is that the asset managers — M&G, Allianz Asset Management, Poste Italiane and UniCredit — have partnered with MoneyFarm for its digital wealth tech.

A year after the partnership announcement, M&G has unveiled its new digital investing platform, &me. The incredibly named effor (who is your SEO expert!?) leverages MoneyFarm's platform and helps clients to invest in &me classic or targeted portfolios, starting from £500.

Classic portfolios comprise ETFs and the targeted portfolios invest in a blend of active and passive funds (equities, bonds and alternatives) from First Sentier, iShares, M&G, Manulife, Pictet, PIMCO, Robeco and Wellington. Each portfolio is also ranked 1-6 (1 = least risky; 6 = most risky), and there is a maximum of 35% of the active funds that any one firm can manage. &me also offers free personal consulting services for portfolio construction.

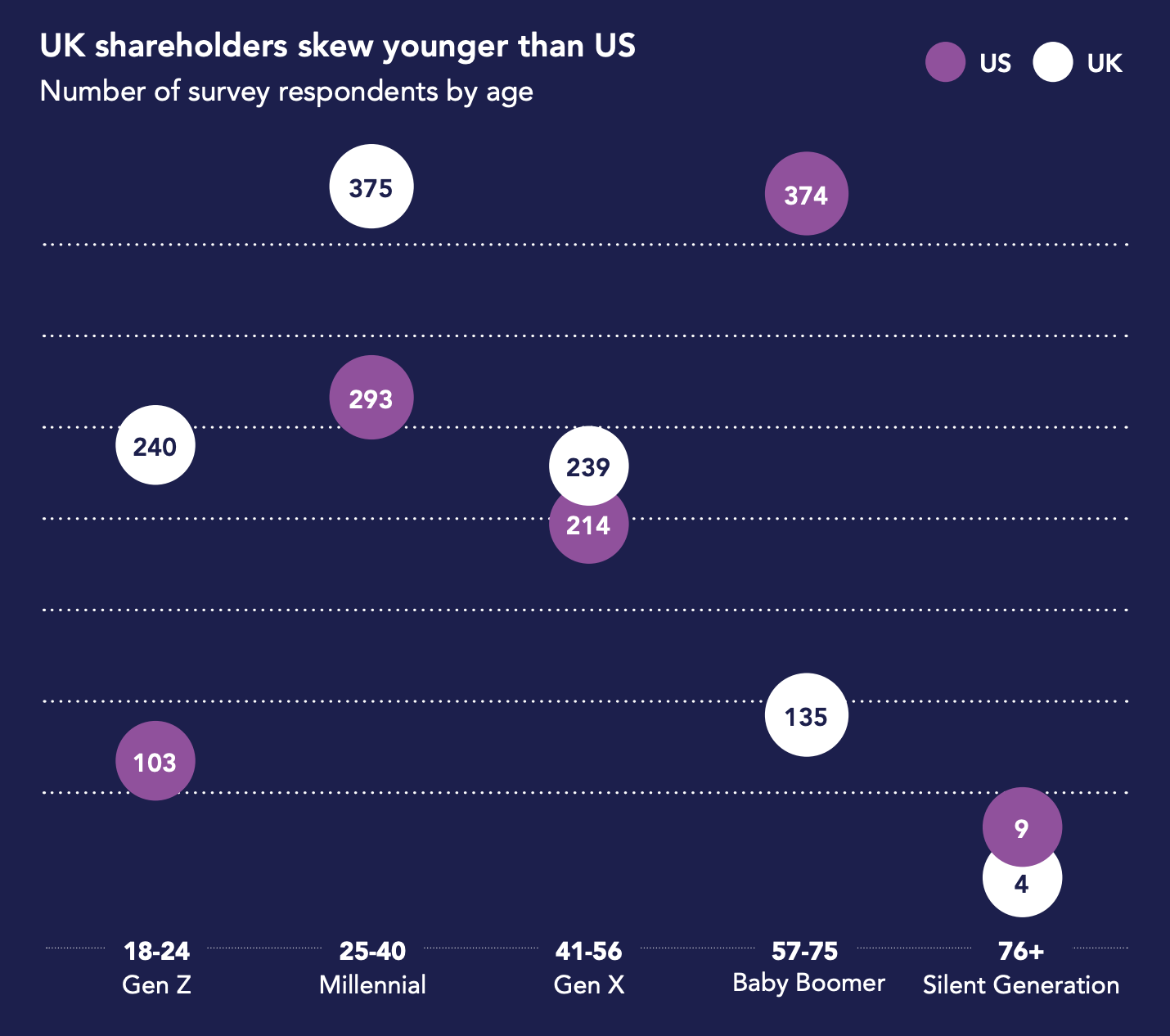

Hargreaves Lansdown, Interactive Investor and Fidelity have a 62% market share in the UK direct investment sector, which reached £351B by the end of June 2021. But the demand for digital investment services has accelerated, accounting for 19% of all UK direct customers, with M&G Wealth going full force to capture a more significant market share of Gen Z and Millennial investors from companies like MoneyBox, Shares.io, Wealthsimple, and Wealthify. Nutmeg was bought by JPM.

Since late 2021, M&G Wealth initiatives include launching ''MAP your future," which is a hybrid financial advisor; acquiring financial advisor business Sandringham Partners; partnering with MoneyFarm; acquiring TCF Investments to provide model portfolio services (MPS); adding six ESG-focused model portfolios; and taking an initial 49.9% stake in National IFA Continuum Financial. Asset managers are hungry for distribution, and digital is the main storefront.

👑Related Coverage👑

🇫🇷 Credit Agricole Subsidiary Buys 70% Stake In Global Wealthtech Firm - International Adviser, January 26, France

🇦🇪 Globaleye Launches New Wealth Management Platform In The UAE - IBS Intelligence, January 31, Dubai

🇬🇧 Wealthtech Start-up Nucoro Reshapes Its Business - Fintech Futures, January 26, London

🇩🇪 Wealthtech Startup Beatvest Closes €1.3MM Round - Fintech Global, January 30, Munich

Asia Pacific News

⭐🇸🇬 Zorion Selects WealthOS To Support International Expansion - Finextra, January 31, Singapore

Zorion, a Singapore-based early-stage investment app with $500K in funding, has partnered with WealthOS, a SaaS platform improving the technology and infrastructure for digital investing and wealth management.

Zorion enters a digital wealth arena in Singapore that includes established firms such as Syfe, Bambu, Kristal.AI, and StashAway. It offers (1) fractional shares with investing as little as RM 5 (~ $1 equivalent); (2) analytics that measure investment risk-profile; (3) thematic portfolios; and (4) Shariah-compliant and ESG-risk rated stocks for those with a socially-driven investing approach.

In an Investor Pulse 2022 survey, over 66% of Singaporeans stated that they are "unlikely to meet their investment goals within the timeframe they planned," while 56% stated that "they require more support, education and insights to direct their investment decisions." — highlighting the need for increased financial education. And yet, traditional online brokerages remains the preferred type of digital investing platform in Singapore. For the long term, investment outcomes suffer in transactional business models, and succeed in advisory or asset allocation business models.

That said, Singapore is friendly and developed market for wealth management where, according to a report from KPMG, strong internet penetration and a wave of tech-savvy consumers are embracing digital investing solutions. WealthOS can save B2C footprints time and money in standing up the back and middle office, and the game is a race to acquire customers.

🇭🇰 Hong Kong’s Livi bank Forays Into Wealth Management Space - Private Banker International, February 1, Hong Kong

🇮🇳 Indian Wealth Manager Wealthapp Enters Family Office Business - Private Banker International, January 30, Bengaluru

Blogs, Webinars, Podcasts

🇺🇸 Advisors Must Evolve To Survive In The AI Era - Investment News, February 1, California

🇺🇸 How Model Portfolios Work in the Real World: Advisors' Advice - ThinkAdvisor, February 1, New York

🇺🇸 The WealthStack Podcast: 2023 WealthTech Outlook with Davis Janowski - WealthManagement.com, February 1, New York

Events & Reports

⭐🇺🇸 M&A In Wealth And Asset Management: How Deals Will Shake Up the Industry - Bain & Company, January 31, Massachusetts

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇬🇧 Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

🇬🇧Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.

💸💸💸😁