Digital Wealth: Social investing app Shares raises $40MM, charges 79 bps

When buying or selling stocks on the Shares app, users can use captions and GIFs to share their views on their investment. The activity feed lets members react to their friends' investments

Hi Fintech Futurists —

Before we jump into today’s Digital Wealth issue, let us remind you of something special. On Tuesday, we released the latest issue of the Greatest Hits Report focusing on DAOs.

There are over 4,800 DAOs, with over 3 million members managing more than $10B in assets. Given their importance for the future of Web3, it is important to properly highlight what a DAO is, and explain their architecture.

With this in mind, in the Greatest Hits Report on DAOs we covered:

DAO 101: an introduction to DAOs and their history

The opportunities in the Web3/DAO CFO tech stack, compared to its Fintech counterparts

Lessons from Elon Musk, Warren Buffett, Galaxy Digital, and the emerging DAOs for building a Fintech empire

Creating, Transacting, and Storing Value in the Financial Metaverse of NFTs, DAOs, and DeFi

And so much more…

The report is exclusive to premium subscribers. If you want immediate access, then subscribe below 👇👇👇

North America News

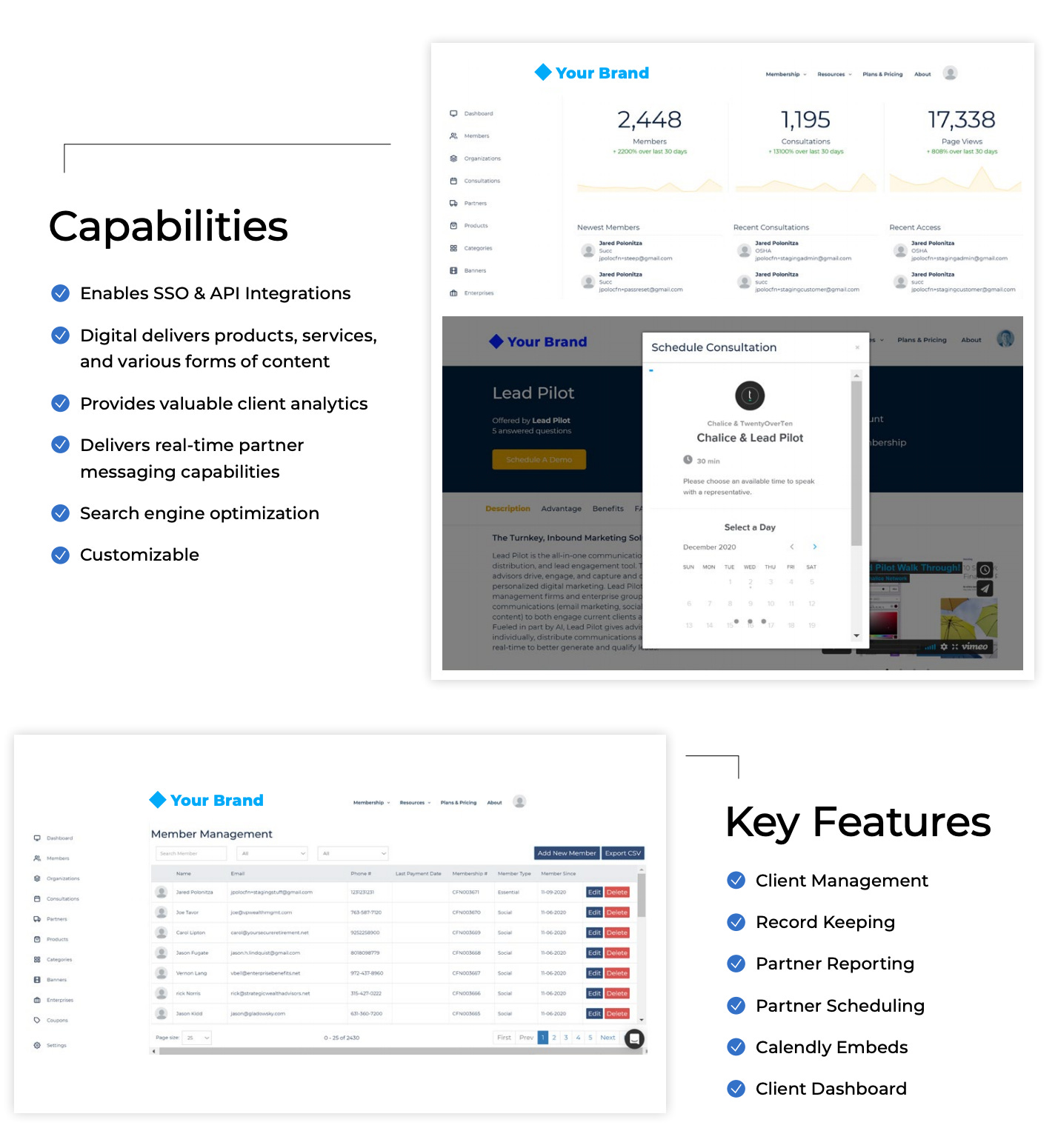

⭐🇺🇸 TIFIN Wealth Announces Strategic Partnership With Chalice Network And Their Community Of 60,000+ Advisors - PR Newswire, July 26, Colorado

TIFIN, a wealthtech to connect retail investors, intermediaries, and investment managers, announced its acquisition of Chalice Network, a community of over 60,000 financial advisors. The network provides education, networking, and a marketplace of services to help independent financial professionals (e.g., RIAs, real estate agent, insurance brokers) grow their business. The marketplace includes discounts on services such as Intuit’s QuickBooks, an accounting software for SMBs, LegalShields, an affordable legal protection platform, and more. See here for the full list.

TIFIN is joining the 50 partners that Chalice already has (e.g. Orion, Timber Point Capital Management, Concorde) and will get preferred market access, lead generation, networking and conferences, and thought leadership exposure. Chalice advisors will also get preferred pricing in exchange for promotion of TIFIN’s digital product offering. We cover this after last week’s news of TIFIN partnering with SharingAlpha, a community of 15,000 fund investors, last week (see here).

We think about this type of move through the perspective of finding novel distribution footprints and getting cheap attention. Would be curious to see go-to-market move from more traditional lead gen in marketplaces and towards embedded finance.

🇺🇸 Nada Raises $8.1MM In Funding To Unlock Real Estate Wealth For Everyone - Businesswire, July 27

Cool stuff.

🇺🇸 LevelField Financial Selects AlgoTrader's pOEMS For Digital Asset Trading And Orchestration - Businesswire, July 27, Texas

🇺🇸 Orion Announces Updates To Texas LoneStar 529® Plan For Fee-Based Advisors - Businesswire, July 21, Nebraska

🇺🇸 UBS U.S. Wealth Leans On Lending As Client Assets Fall - AdvisorHub, July 26, New York

🇺🇸 M1, A Personal Finance Management Company, Will Soon Offer Crypto Portfolios To Its Investors - ZDNet, July 27, Illinois

EMEA News

⭐🇬🇧 Social Investing App Shares Raises $40MM For European Expansion - Finextra, July 25, London

London-based investing app Shares raised $40MM in its Series B funding round, led by Valar Ventures, and is now looking at European expansion and a move into crypto. Sounds like a need to print revenue! This brings the firm’s total funding to $90MM — $40MM in its Series A funding round in March, and $10MM in its Seed funding round last August. The hefty numbers are surprising considering the macro environment and the slashed valuations for Fintech companies, but Shares has had a solid start in the UK so far.

The app has 150,000 users within the UK, where they can trade 1,500 stocks with just £1 and fees around 80 bps per trade. Also, when buying or selling stocks, users can use captions and GIFs to share their views on their investment. It’s like a Robinhood and Instagram Frankenchild. The activity feed lets members react to their friends’ investments, making the experience more social, like Venmo.Shares says that its features make it easier for people to talk about investing, rather than relying on outside platforms such as Reddit and WhatsApp. The reason Reddit is so popular for investing, and almost broke the stock market, is because of the size and engagement within the investing communities (e.g. WallStreetBets has 12MM+ members). As an aside, Coinbase made a comparable social-media-but-also-finance attempt with their NFT platform and it was a disappointment — only about $2.9MM in trading volume since launching in April 20, compared to OpenSea’s $5.9B in trading volume over the same period.

But selling NFTs and putting emojis on your friends’ investment ideas perhaps are quite different levels of financial commitment.

🇦🇪 Moonfare Launches Digital Private Markets Investing Platform In The United Arab Emirates - Businesswire, July 27, United Arab Emirates

🇳🇱 InvestCloud Supports Rabobank To Bring Digital Financial Planning To All Levels Of Wealth - Businesswire, July 21, Amsterdam

🇫🇷 BNP Paribas Guns For Growth In Wealth Management And Sustainable Investments - The Business Times, July 25, Paris

🇪🇸 GVC Gaesco Partners With FNZ To Develop Digital Solutions For Investment Services - IBS Intelligence, July 21, Barcelona

🇬🇧 Novia Renews GBST Partnership For Composer Platform - Finance Feeds, July 25, London

🇮🇱 Claritus For Advisors Provides New Investment Service For Managers And Fintechs - Sociable, July 27, Tel Aviv

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

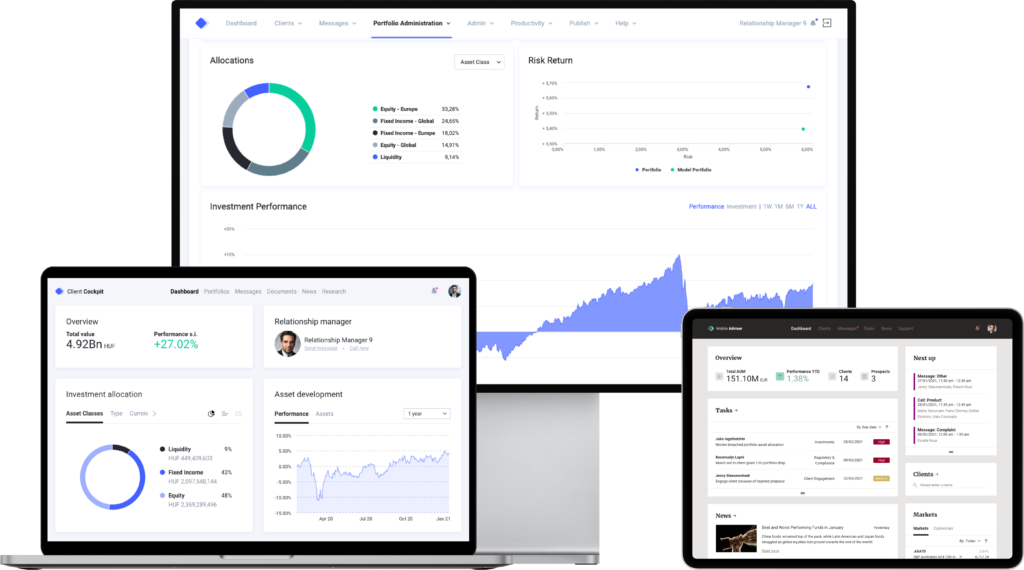

⭐🇵🇭 ATRAM Partners With Additive To Launch Wealth Management Platform - IBS Intelligence, July 25, Manila

Philippines-based wealth manager, ATRAM Trust Corporation (ATRAM), announced a strategic partnership with wealthtech platform Additiv. ATRAM manages $3B in client assets within its 18 feeder funds, and has two main businesses — (1) wealth management, (minimums of $90K), and (2) fund investing, a range of equity, fixed-income, and multi-asset mutual funds. It is the biggest wealth manager in the country, as the capital markets still have a lot of room to grow. Wealth management clients in the Philippines primarily trust traditional banks to manage their wealth, and 45% of clients assets are tied to fixed income securities.

The ATRAM Alpha Opportunity Fund invests mainly in equity securities, with a focus on hyper-growth companies that are not included in the Philippine Stock Exchange Composite Index. The fund is down 22% YTD. One of ATRAM’s fixed-income funds, the Total Return Dollar Bond Fund invests in a diversified portfolio of long-term and short-term debt securities, and is down 9% YTD. However, this is the experience across the overall market, per BlackRock’s 2022 midyear outlook.

Additiv’s platform consists of various components — its DFS Platform, Embedded Wealth, BaaS, Marketplace, and API catalogue — that power a hybrid wealth manager, a roboadvisor, a risk analytics dashboard, and a credit engine. ATRAM is planning to use Additiv’s Digital Finance Suite, which enables financial service providers like ATRAM to launch personalised wealth and investment services.

We see this integration as the natural spread of digital investing across the world. As an aside, the Phillipines was also a geography with the highest engagement in the crypto game, Axie Infinity, which has now crashed out.

🇸🇬 SG Fintech SuperAtom Raises $22MM In Series C Round Led By Neu3 Capital - Deal Street Asia, July 27, Singapore

🇯🇵 Alternative Digital Platform LUCA Closed Angel Round, Reaching The Total Capital Of $1.8MM - EIN News, July 26, Tokyo

🇸🇬 MAS-Regulated Digital Asset Exchange SDAX Has Officially Launched - Fintech News Singapore, July 26, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Data Management And AI Are The Top Wealth Tech Investments - Wealth Professional, July 26, Massachusetts

🇬🇧 Four Information Management Barriers Wealth Management Professionals Face - Wealth Management, July 26, London

🇺🇸 Demystifying WealthTech Consulting - Advisor Perspectives, July 25, Massachusetts

🇸🇬 DBS Technology & Transformation Expert On The Holistic Approach To Digitisation In Wealth Management - Hubbis, July 26, Singapore

🇭🇰 Generation Z Are More Conservative Investors Than You May Think - Hubbis, July 28, Hong Kong

Events & Reports

🇬🇧 The Future Of FinTech - Coltech Global, July 28, Virtual

🇺🇸 VenCent Fintech Summit - The Venture Center, August 15-18, Virtual

🇲🇽 Fintech Summit LATAM - MobiFin, August 24-25, Atlatlahucan

🇺🇸 Fintech_Devcon 22 - Fintech_Devcon, August 23-25, Colorado

🇺🇸 Fintech Growth Summit - MGA, August 25-26, Florida

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.