Digital Wealth: Charles Schwab's $187MM settlement to roboadvisor clients for cash sweep

Schwab profited by moving cash to an affiliate bank, loaning the money, and keeping the difference between the loan interest it received and the cash interest it paid to robo-adviser clients

Dear readers — thanks always for your time and attention! Your essential news in digital wealth is here. For actionable insights on growing your digital strategy or investing in fintech companies, explore our subscription options.

North America News

⭐🇺🇸 Charles Schwab To Pay $187MM Settlement To Robo-Adviser Clients - Financial Times, June 13, Texas

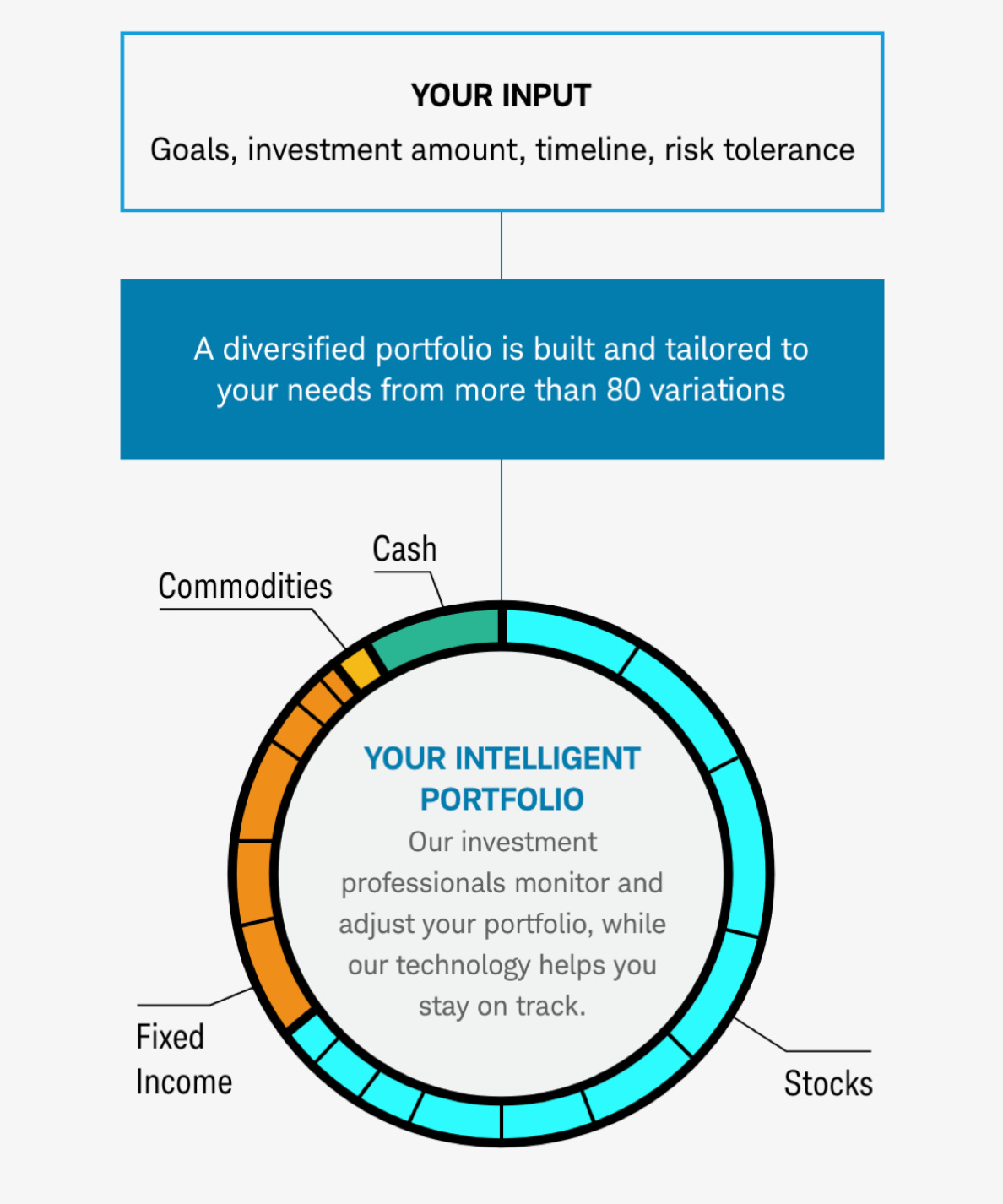

Three Schwab subsidiaries — Charles Schwab & Co., Charles Schwab Investment Advisory and Schwab Wealth Investment Advisory — agreed to pay $187MM to settle a SEC investigation into alleged hidden fees charged by the firm’s robo-advisor, Schwab Intelligent Portfolios.

Between March 2015 and November 2018, the firm didn’t disclose to clients that its robo-advisor allocated funds “in a manner that their own internal analyses showed would be less profitable for their clients under most market conditions.” Schwab profited by sweeping cash to an affiliate bank, loaning the money, and keeping the difference between the loan interest it received and the cash interest it paid to robo-advisor clients.

This is a big deal. Schwab’s cash sweep profit center was well known at the time, and the fact that it has been punished with nearly $200MM in fees is … astounding. Interest spread is one of the things that makes the cheap roboadvisor model sustainable by generating higher fees. It also makes it, you know, not really advice.

⭐ 🇺🇸 Insigneo Financial Group, Fast-Growing Independent Wealth Platform, To Receive $100MM Investment Led By Bain Capital Credit And J.C. Flowers - Businesswire, June 13, Florida

Bain Capital Credit and private investment firm J.C. Flowers invested $100MM into wealth management platform Insigneo. Insigneo’s platform has over $13B in client assets and offers access to account opening services with BNY Mellon’s Pershing and Charles Shwab. Earlier this year, Insigneo completed its acquisition of Citi’s offshore wealth management business in Uruguay as it accelerates its accelerates Latin American expansion. It also offers services in Argentina and Chile.

The Latin America Wealth Management Market is becoming highly competitive, with players like Credit Suisse and Morgan Stanley leading the way. The big opportunities for wealth management service still lay with the big 3 economics - Mexico, Argentina and Chile - who account for 87.5% of AUM in Latin America.

🇺🇸 Lido Advisors Announces Acquisition Of Enterprise Trust & Investment Company To Further Expand Its Wealth Management Platform - Businesswire, June 14, Los Angeles

🇺🇸 BridgeFT And StratiFi Announce Partnership And Integration To Provide Advisors With A Holistic View Into Client Wealth And Total Risk - PR Newswire, June 14, Illinois

🇨🇦 CapIntel Raises $11MM Series A To Expand Wealth Management Sales Platform, Launching In US Market - Yahoo Finance, June 14, Toronto

🇺🇸 Sanctuary Wealth Launches Customized Alternative Investment Platform For Hybrid RIAs - Yahoo Finance, June 14, Indiana

🇺🇸 Zoe Announces Partnership With Virginia-Based Wealth Planning RIA, Craftwork Capital LLC - GlobeNewswire, June 15, New York

🇺🇸 BNY Mellon's Pershing Delivers Next-Gen Technology And Integration Capabilities For Smarter, More Personalized, Highly Efficient Experiences - PR Newswire, June 15, Texas

🇨🇦 RBC And Envestnet Data And Analytics Announce Agreement To Provide Clients With Greater Control Over Their Financial Data - Yahoo Finance, June 14, Toronto

EMEA News

⭐🇪🇸 AllianceBernstein And Allfunds Blockchain Enter Collaboration - PR Newswire, June 15, Madrid

AllianceBernstein, an asset management firm with $687 billion in AUM, and Allfunds Blockchain, Allfunds’ blockchain arm, announced a collaboration to bring AllianceBernstein's asset services activities to the blockchain.

One of the ways Allfunds uses blockchain technology is via the issuance and custody of tokenized investment fund shares. A token is a digital representation of what could be any asset class, from traditional equities and fixed income, to private equity, real estate, and specialty finance. Asset managers and primary issuers are using tokenization to streamline asset and stakeholder management and reduce the costs of data reconciliation. This is compelling industry infrastructure use caes, and Allfunds is a key player within investment management.

👉 Listen to our podcast with Ruben Nieto, Managing Director at Allfunds Blockchain about how this work.

🇬🇧 NatWest Eyes Digital Wealth Acquisitions Amid Sector Slowdown - Altfi, June 13, London

🇨🇭 AAZZUR Integrates Additiv Into Embedded Finance Ecosystem - Private Banker International, June 13, Zurich

🇬🇧 Mortgage Tech Firm Twenty7Tec Takes Over Bluecoat Software - Fintech Futures, June 14, London

🇧🇭 Make Better And Smarter Investments With Bahrain’s New Platform, Twazn! - Startup MGZN, June 9, Manama

🇰🇪 Sauti Sol’s New Deal To Help Fans Achieve Financial Freedom - Nairobi Wire, June 15, Nairobi

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇮🇳 Walmart-Backed PhonePe Prepping For IPO; Seeks Valuation Of $8-10B - Mint, June 15, Bengaluru

Digital payments company PhonePe is aiming to raise funds through an IPO as soon as the firm becomes profitable, which it hopes to achieve by next year.

PhonePe raised a total of $1.7 billion in funding over 13 rounds, with the largest one being a $700 million round led by Flipkart and Walmart at a valuation of $5.5 billion in 2020. The firm will be looking for a valuation of $8-10 billion, and plans to double its workforce by the end of the year.

In terms of its core businesses, PhonePe is a leader in the Unified Payments Interface (UPI) space with a 47% market share in monthly transactions and will be adding stocks and exchange traded funds to its list of wealth management products. One of PhonePe’s rivals, digital payments platform Paytm, had an IPO that valued the firm at $20 billion last November; the biggest IPO in India’s history. Paytm’s valuation is now around $10 billion after the stock plunged in price post-IPO.

🇸🇬 Digital Wealth Management Platform StashAway Marks Significant Breakthrough In Bridging The Gender Investment Gap - Zawya, June 13, Singapore

🇦🇺 Blu Horseshoe Ventures Launches A Full Digital Capital Raising Platform Using Skyhook DAWN™ - EIN Newswires, June 16, Sydney

🇭🇰 CITIC CLSA Goes Extramile; Collaboration Leads To A New Level Of Greater Bay Area Fintech Collaboration - Yahoo Finance, June 15, Hong Kong

Blogs, Webinars, Podcasts

🇸🇬 Women Opt For Lower-Risk Digital Wealth Portfolios Compared To Men, Study - ITP, June 13, Singapore

🇭🇰 AQUMON – Redefining Digital Wealth Management And Empowering Investors - Hubbis, June 15, Hong Kong

🇸🇬 Institutional Investors Remain Interested In Crypto After Recent Rout - The Straits Times, June 15, Singapore

🇬🇧 Online Platforms Seen As Main Driver Of ETF Demand In The Next Three Years - Wealth Professional, June 14, London

🇬🇧 Institutional Investors ‘To Replace Retail Investors As Major Holders Of Digital Assets’ - ETF Express, June 15, London

Events & Reports

⭐🇺🇸 Global Wealth 2022: Standing Still Is Not An Option - Boston Consulting Group, June 9, Massachusetts

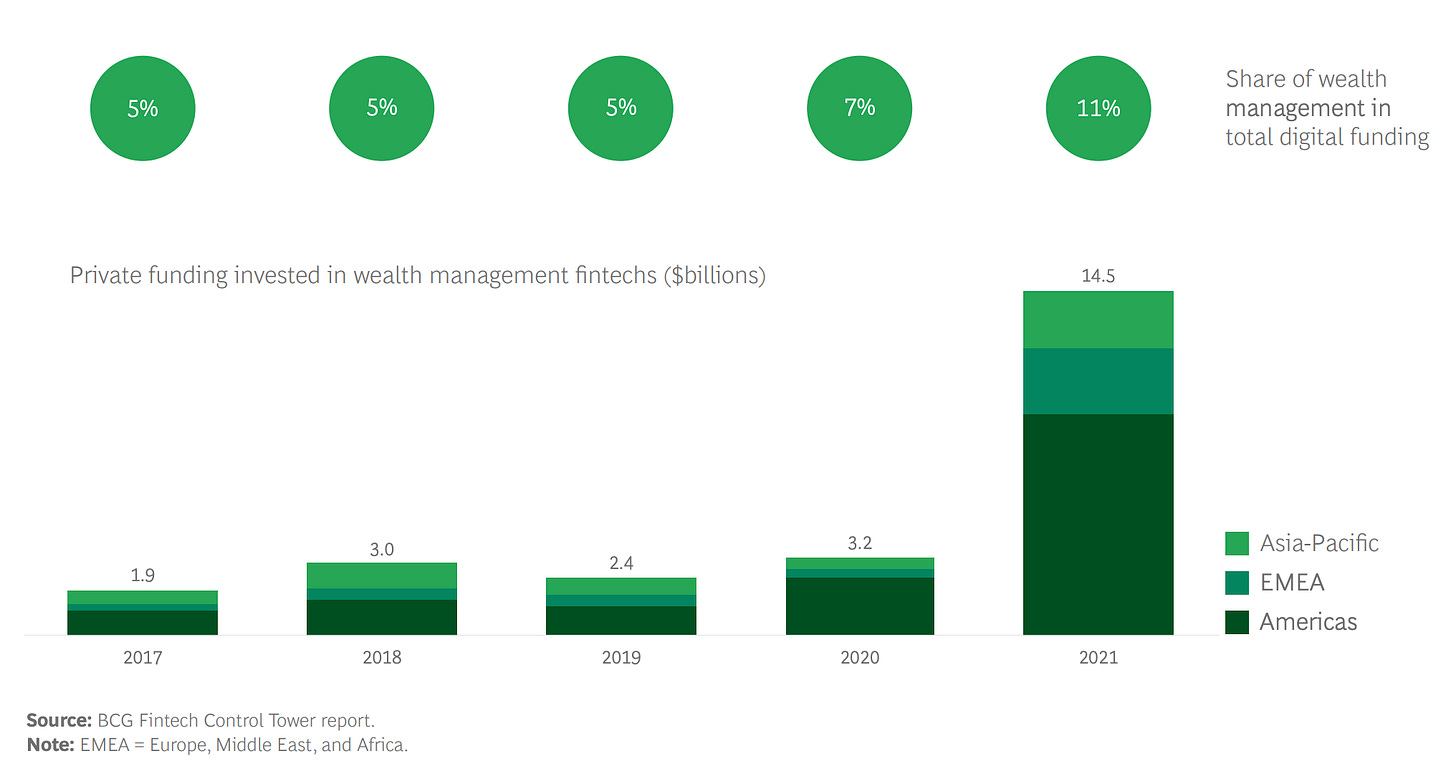

Boston Consulting Group (BCG) released their 22nd annual Global Wealth Report. The report dives into topics like net-zero, crypto, personalisation, and digitisation - key areas that pose an opportunity for wealth managers to drive better customer experience and product execution.

Digital wealth firms, often seen as competitors to legacy wealth management firms, have been gaining traction over recent years. Wealth management now makes up 11% of all digital funding, with private funding rising to $14.5B in 2021, up from $3.2B the previous year. Their success largely boils down to cheaper cost structures, customisable discretionary mandates, access to a wider array of investment opportunities and hybrid models that bring the best of digital and human advice. Always worth checking this out.

🇮🇳 IIFL Wealth In Association With VCCEDGE Launches Its Second Edition Of India Invests Report For FY2022 - Businesswire India, June 14, Mumbai

🇬🇧 Cloud In FinTech & Banking Summit - TechForge Media, June 30, Virtual

🇰🇪 The Africa Fintech Summit - Dx5group, June 22, Virtual

🇩🇪 Germany Summit 2022: Fintech Europe - Plug And Play Fintech Europe, June 29, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts