Digital Wealth: Masttro gets $43MM for UHNW data from FTV & Citi

Using machine learning to improve analysis and aggregation

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Masttro Secures $43MM Growth Equity Investment Led By FTV Capital

EMEA: Connectd Raises £2.2MM To Match Startups With Investors

APAC: Yangzijiang Financial To Work With ADDX On Distribution Of Capital Markets Products

GEOGRAPHIC NEWS CURATION

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Shout Outs!

Thanks to everyone that helped us with the survey last month. Your feedback has been invaluable. Here are a few of the cool projects that our premium subscribers are working on — check them out!

Scrypt, a regulated Swiss institutional crypto services business, provides a trusted access point to digital assets for institutions 👉 Learn more here

WealthObjects is an award-winning digital wealth management technology and adviser software modular solutions company.👉Visit the website

Digital Wealth Short Takes

⭐🇺🇸 Masttro Secures $43MM Growth Equity Investment Led By FTV Capital - Businesswire, March 9, New York

Wealthtech platform Masttro, founded in 2010, serves single-family offices and wealth managers with an integrated platform. The company received a $43MM growth equity investment from FTV Capital and Citi Ventures. FTV and Citi are more conservative investors, than let’s say Sequoia or a16z. Putting a check of this size into the company suggests cashflow and reasonable traction with target clients.

Masttro's SaaS platform extracts data about investments, processing and analyzing it using machine learning. The data is segregated by region, currency, custodian, asset class, and estate structure, with multiple reporting templates and timeframes. The platform offers customizable visualizations, portfolio performance, risk, and exposure analysis. Additionally, the platform integrates Know-Your-Customer (KYC), Anti-Money Laundering (AML) validations, documentation, and regulatory reporting requirements.

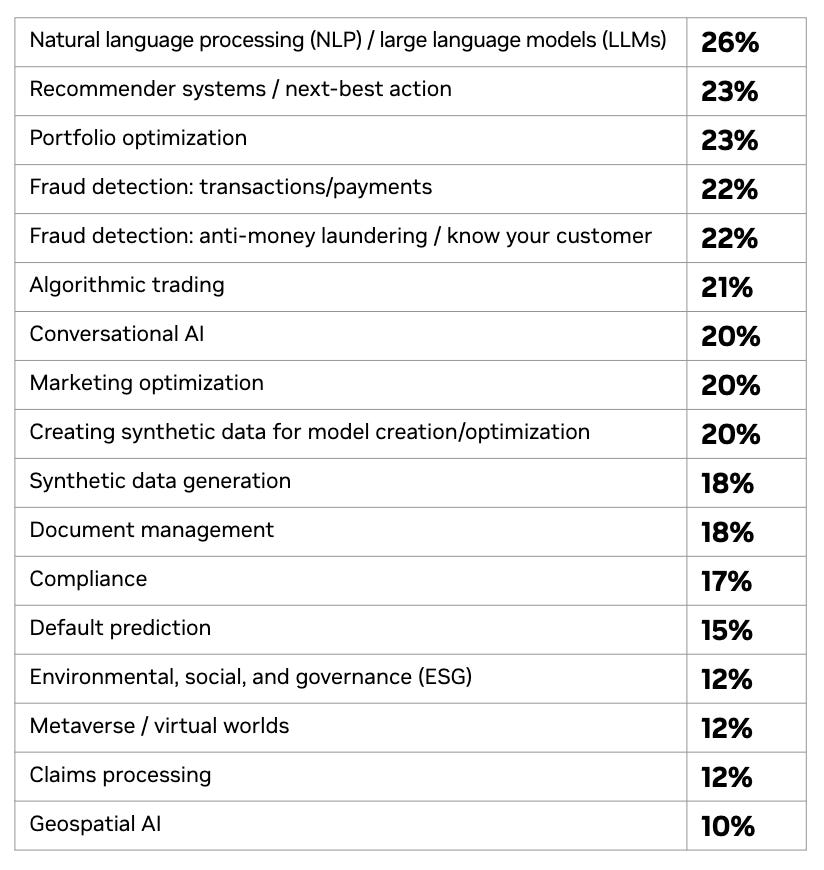

Numerous wealthtechs, including Adeppar, Eton Solutions, Allfunds, and Canoe Intelligence, are targeting the intersection of UHNW clients and alternative investments. Given that this target client segment manages some of the most complex portfolios — alternatives and illiquid assets, administration of estate structures, differing compliance — financial data companies are racing to leverage AI technologies to assess risk more accurately and generate operational efficiencies.

For example, this week Stripe integrated OpenAI's GPT-4 into its digital payment processing. Klarity did the same to help automate document-centric workflows. Morgan Stanley Wealth Management uses GPT-4 to access and process insights into companies, sectors, asset classes, capital markets.

⭐🇬🇧 Connectd Raises £2.2MM To Match Startups With Investors - UK Tech, March 13, London

Connectd, a platform to manage relationships between startups and investors, has raised £2.2MM from LiFE Ventures, Blue Lake, Mail Venture Partners, Arch Law, Syndicate Room, and a host of angels, bringing total funding to £4.7MM. For founders, Connectd provides a way to meet with a community of active angel investors, family offices, and VC funds.

The company has three subscription offerings: a membership at £375 annually, a helping hand subscription at £2,000 annually, and a venture builder subscription at £5,000 annually. The most expensive option offers access to the investor network platform, three pro-bono advisors, "smart matching technology" that pairs founders with investors, portfolio reporting tools, investor-ready pitch day, monthly strategic consultations, four masterclass sessions, pitch deck development, financial modelling and company valuation.

Connectd combines ideas from three places: (1) equity crowdfunding platforms, like Seedrs and Crowdcube, and (2) incubators and accelerators, like YC or Startupbootcamp, and (3) private equity data rooms.

If you look at something like AngelList, the main product isn’t technology or the legal wrapper — it’s the underlying network connecting founders to capital, and capital to good founders. It is notoriously difficult to bootstrap such an ecosystem. The UK seems a bit more optimistic about algorithmic funding than the US experience proves out, in our view. We’re also a bit skeptical about charging people who are raising money recurring subscriptions.

⭐🇸🇬 Yangzijiang Financial To Work With ADDX On Distribution Of Capital Markets Products - The Tokenizer, Singapore, March 9

ADDX, a digital capital markets exchange known for using blockchain to tokenize and fractionalize security products, has signed a Memorandum of Understanding (MoU) with Singapore-based asset manager Yangzijiang Financial. The partnership intends to use ADDX’s distribution channel to broaden Yangzijiang Financial’s investor reach and increase its AUM as it completes a newly established $600MM maritime-focused fund.

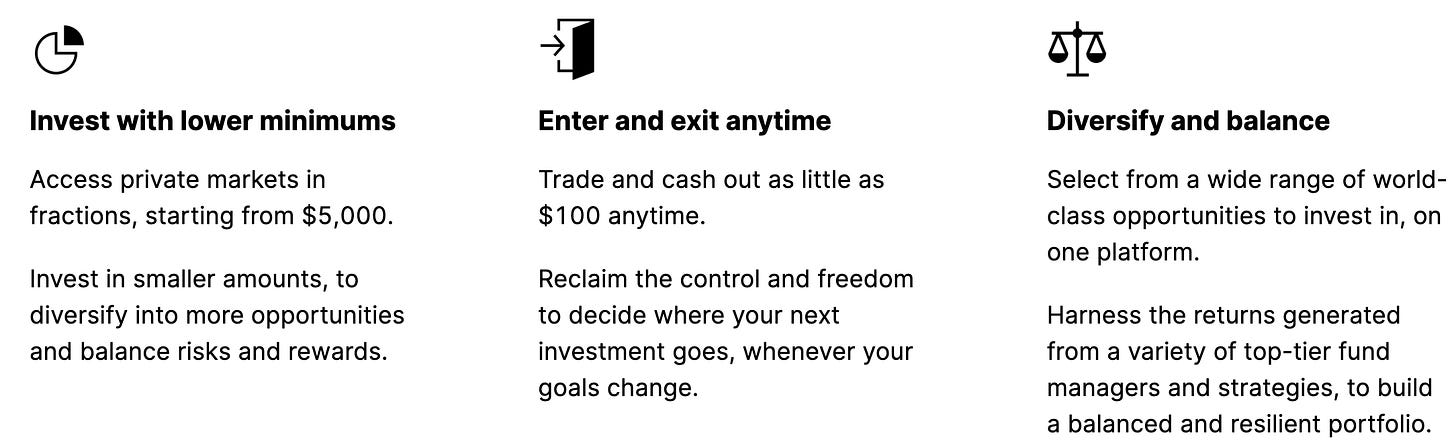

ADDX raised $140MM in funding since 2017. The platform allows the “everyday” person to invest with a minimum investment threshold of $5,000 while offering access to 50+ investments across its customer base that spans most geographies except the US. Customers select from 3 investment strategies— Income, Balanced, Growth — and invest in various asset classes such as Private Credit, Private Equity, Venture Capital, Luxury, and Hedge Funds. Operating under a B2B2C model is also ADDX Advantage, which helps wealth managers introduce products to end-clients.

ADDX reminds us of other emerging alts platforms like Moonfare (private-equity specific) and DBS Bank’s DBS Digital Exchange (more crypto-focused), among many others.

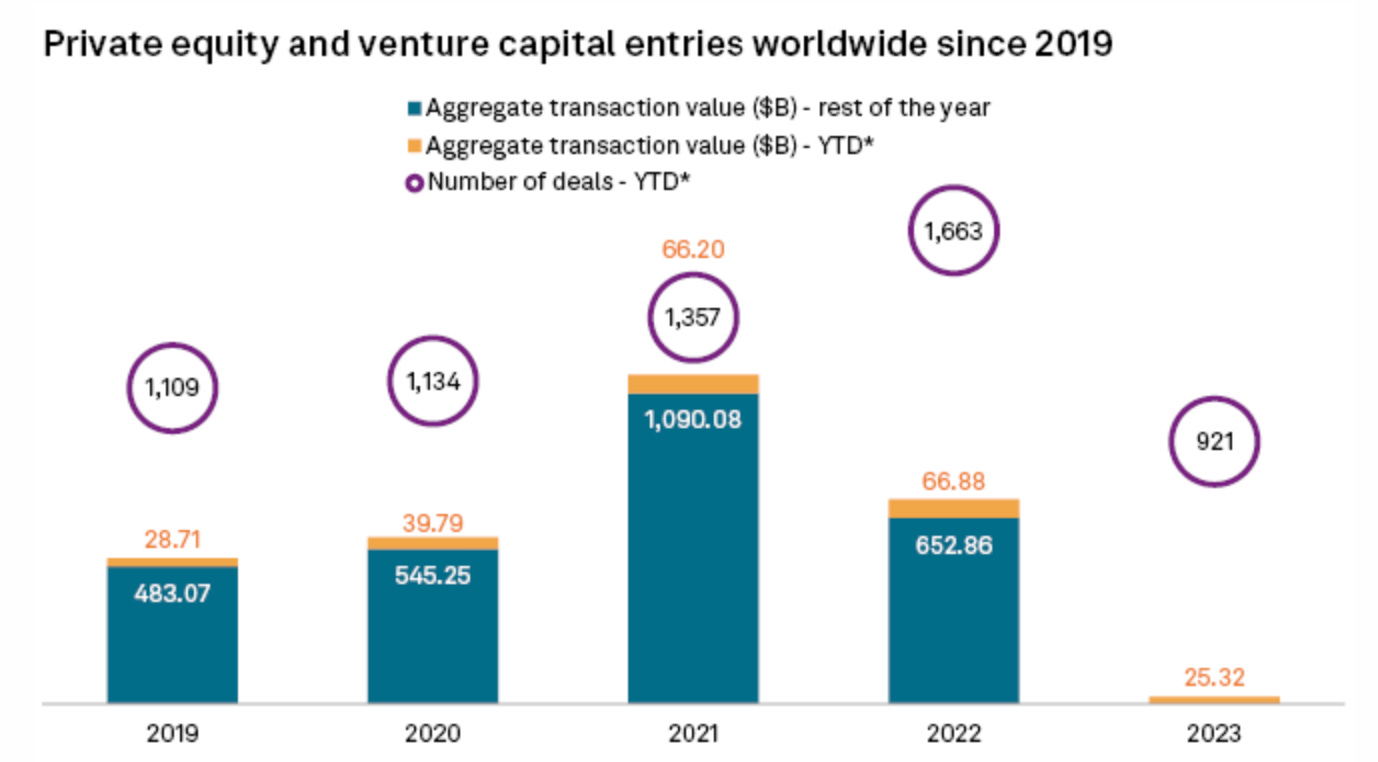

Alternatives are being positioned as the next wave for digital investors. Low-cost access to these previously “elite” asset classes is now available through digital distribution channels, exerting downward pressure on fees. Ironic, given that PE and VC firms remain pessimistic about fundraising conditions this year and valuation expectations among investors and startups have fallen. There is a natural time lag between when financial products get popular, and when access to them becomes possible.

Curated News

North America News

🇺🇸 Altruist Acquires Award-Winning SSG Custodial Platform To Expand Services Offering - Businesswire, March 15, California

🇺🇸 Morgan Stanley Wealth Management Announces Key Milestone In Innovation Journey With OpenAI - Morgan Stanley, March 14, New York

🇺🇸 TradePMR Launches A New Integration With CircleBlack Designed To Streamline Connectivity With The Wealth Management Platform - PR Newswire, March 15, New Jersey

🇺🇸 Envestnet Enhances MoneyGuide Platform To Drive The Future Of Digital Financial Planning - PR Newswire, March 13, Pennsylvania

EMEA News

🇬🇧 GBST Rebrands As It Launches Revamped Wealth Platform - Money Marketing, March 15, London

🇬🇧 Saxo UK, Moneyfarm Roll Out MF Portfolios For M&G’s &me Clients - Private Banker International, March 14, London

🇰🇼 Securities House Launches Zad App, A Shariah-Compliant Investment Platform With Alpaca - Crowdfund Insider, March 14, Kuwait City

Asia Pacific News

🇮🇳 Wealthtech Company Curio Capital To Raise Rs 200 Cr In India's First Land Opportunity With Ram Rattan Group - Business Standard, New Delhi, March 15

🇸🇬 Singlife Transforms Investment Capabilities Through Landmark Technology Partnership With Citi And BlackRock - Citigroup, March 9, Singapore

🇲🇾 Green-X Consolidate Its Digital Asset Exchange Businesses With CryptoSX - Accesswire, Kuala Lumpur, March 15

🇮🇳 Envestnet Data And Analytics Selects TCS To Accelerate Its Digital Transformation Journey - Tata Consultancy Services, Mumbai, March 15

Blogs, Webinars, Podcasts

🇬🇧 For Wealthtech Firms And Advisors, AI Has Entered The Chat - WealthManagement, March 9, London

🇺🇸 The WealthStack Podcast: Creating a Frictionless Wealth Management Experience With Stephen Daffron Of BetaNXT - WealthStack, March 10, New York

🇺🇸 What Advisors Really Want From Their Tech - WealthStack, March 29, New York

🇺🇸 Q&A With AdvisorHub CEO Tony Sirianni And Greg Cornick, President, Advice And Wealth Management At Advisor Group - Advisor Hub, March 14, Virginia

Events & Reports

🇺🇸 Envestnet Summit 2023 Elevate - Envestnet, April 26 - 27, Colorado

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇺🇸 Finovate Spring - Informa Connect, May 23 - 25, California

🇬🇧 Innovation In Wealth Management - Professional Wealth Management, June 8, London

🇬🇧Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.

Will there ever be a time in this life where obstacles come just enough to have a taste? each time we meet It is like a stone wall every time. There must be some time, it's likely to find a simple way like other people.

I can't do anything, I'm blocked, all I can do is look at the thing that took our money and still pay for it, seriously, how many meters wide and deep do I have to dig a hole? I don't want it to be too narrow because I have to plant hundreds of rai of forest, but the fertilizer is aiming for many places already, can it be used or not, I don't know either, I'm afraid that it will be used, even the trees will perennial die, because this type of waste is not worth using at all, but it may be necessary because the money would not have money to buy it anymore.