Digital Wealth: Opto gets $145MM for private markets tech and investments, with Joe Lonsdale as chairman

The startup is now in direct competition with alts tech incumbent iCapital, which services 1,300+ RIAs

Hi Fintech Futurists —

Before we jump into today’s interview, let me remind you of the referral program that we are currently running for the Fintech Blueprint newsletter.

You could earn:

A link featured in the Fintech Blueprint newsletter, if you refer 2 people.

One-time exclusive access to Lex’s Research Library + a 30-day FREE Fintech Blueprint Trial, if you refer 10 people.

A chance to get on a 30-min call with Lex + a 90-day FREE Fintech Blueprint Trial, if you refer 35 people.

All you need to do is share the Fintech Blueprint newsletter and your invites need to subscribe (for free) by September 30th.

Good luck ✌️

North America News

⭐ 🇺🇸 Artory/Winston Launches Its First Tokenized Diversified Art Fund On Securitize - Securitize, September 20, New York

Artory / Winston, a joint venture between Artory and Winston Art Group, has created a $25MM tokenized art fund. The offering is available on Securitize, a digital asset platform that uses blockchain tech for private companies to tokenize assets and raise capital. Winston, a US-based art advisory company, appraises $10B worth of art annually. Artory captures the artworks’ (physical art, digital art, NFTs, and collectibles) due diligence data on the blockchain and provides investors with digital certification.

The fund, which has a 1.25% management fee, contains about 65 artworks — 3 x Blue Chip ($2MM average value), 15 x Mid-Career ($600K average value), and 50 x Emerging ($200K average value). The fund will be tokenized on Polygon due to its lower fees, and investors will be able to purchase those tokens and trade them on Securitize’s secondary market after a one-year lock-up period.

The offering provides investors with a way to diversify assets and hedge against inflation as blue-chip art has outperformed the S&P 500 since 2000, according to the Artprice100 index. A recent BCG and ADDX report forecasts that the total size of illiquid asset tokenization globally could be $16 trillion by 2030. Securitize tokenizes various other real-world assets besides art — e.g., this month it tokenized KKR’s Health Care Strategic Growth Fund II on the Avalanche blockchain.

For more on the art market, check out this long take.

⭐ 🇺🇸 Opto Investments Emerges From Stealth With $145MM In Series A Funding To Unlock Access To Private Markets For Investment Advisors And Their Clients - Businesswire, September 20, New York

A new wealthtech, Opto Investments (Opto), has emerged from stealth with a $145MM Series A round led by Tiger Global. The funding values the startup at $475MM. Mark Machin (CEO of Opto) and Joe Lonsdale (Chairman of Opto) are quite the rockstar team behind the company — Machin was recently President & CEO of CPP Investments, which manages over C$500B, and Lonsdale is the Managing Partner at 8VC and founder of Palantir, OpenGov, and Addepar. Reminder that Addepar figured out wealthtech distribution into family offices, and scaled into a $2B+ in valuation.

Opto sources investment opportunities in PE, real estate, private credit, and infrastructure to create custom portfolios, and the startup has already partnered with 80+ RIAs. The platform handles sourcing, diligence, monitoring positions, capital call schedules, investing, and reporting. Its differentiation is in co-investing with the money managers that use its platform.

The startup is now in direct competition with alts incumbent iCapital, which has $135B in client assets. iCapital’s platform — used by 1,300+ RIAs — offers access to funds, due diligence, performance reporting, custodian integration, compliance, and tax reporting. If the pitch reminds you of Artivest, well that’s because Artivest was bought by iCapital too. Wealthtech firms such as TIFIN also provide RIAs access to private markets, and there are quite a few secondary private market plays, such as Forge.

⭐ 🇺🇸 Advisor-Focused Investment Platform Ethic Raises $50MM - Wealth Management, September 14, New Jersey

Digital asset manager Ethic has raised $50MM in a Series C funding round, nearly double its $29MM Series B round in April 2021. Last year, Ethic garnered media attention when Prince Harry and Meghan, Duchess of Sussex, joined Ethic as “impact partners”.

Ethic provides personalized ESG investment solutions, such as sustainability training, portfolio creation and management, and investment analytics. The platform has 97 clients totaling $1.8B in AUM and operates as a sub-advisor to RIA firms, which access it via their custodial platform. E.g. in the case of Fidelity, advisors access Ethic through the Fidelity Separately Managed Accounts (SMAs), which include mutual funds, ETFs, sub-advised portfolios, and model portfolios.

Numerous ESG-related controversies have spawned, mainly concerned with ESG assessments and greenwashing. This even turned political, with Ron DeSantis, Governor of Florida, banning fund managers from investing in ESG via state pension funds. Also, this year, ESG ETF flows stand at $4.5B, an 88% decline since 2021, exacerbated by a highly concentrated investor base, greenwashing scandals, and financial market instability.

🇺🇸 Composer Raises $6MM For Automated Investing Platform - Fintech Global, September 15, New York

🇺🇸 ĀTHŌS Private Wealth Launches First Of Its Kind Crypto Investment Platform - Businesswire, September 20, Utah

🇺🇸 Robo Adviser Touting Green-Only 401Ks Is Latest ESG ETF Entrant - Bloomberg, September 19, California

Fundraising?

Are you building in Fintech or Web3? We are investing in great teams at the pre-seed and seed stage. Do you have an awesome idea — click below to let us know!

EMEA News

⭐ 🇧🇪 Wealthtech Firm InvestSuite Finalizes €6MM Series A - Crowdfund Insider, September 18, Leuven

B2B wealthtech InvestSuite has raised €6MM in a Series A funding round, bringing the total raised to €15MM since inception. The platform has four main offerings: roboadvisor, self investor, storyteller, and portfolio optimizer.

The roboadvisor is implementable as a standalone app or an embedding into an existing platform using REST APIs. Investment policies can be configured using variable parameters like sectors, transaction costs, tax matters, rebalancing frequencies, and currencies. The storyteller solution explains portfolio performance in an interactive way to retail investors through visuals and human-like explanations, similar to Cleo, an AI-based financial assistant platform.

Bambu, another B2B wealthtech, has raised $13.4MM since its inception and also provides a configurable robo platform. This week, Bambu launched its wealth management predictive planning solution for Microsoft Cloud. The solution leverages AI, the Hidden Markov Model (HMM), and Generative Adversarial Network (GAN) Machine Learning models to generate thousands of timelines of future events, namely marriage, family, career, and financial situations … in order to sell you financial products.

🇸🇨 QK Group Launched A One-Stop Platform QKEx, With Various Derivative Businesses To Service Crypto Finance Management - GlobeNewswire, September 19, Seychelles

🇬🇧 Investing App Hedgehog Exceeds Crowdfunding Target - Fintech Global, September 16, London

🇬🇧 CoinShares' HAL Automated Trading Could Revolutionize Retail Crypto Investing - Cryptonews, September 21, London

🇬🇧 Sanlam Wealth Rebrands To Atomos - FT Adviser, September 21, London

Asia Pacific News

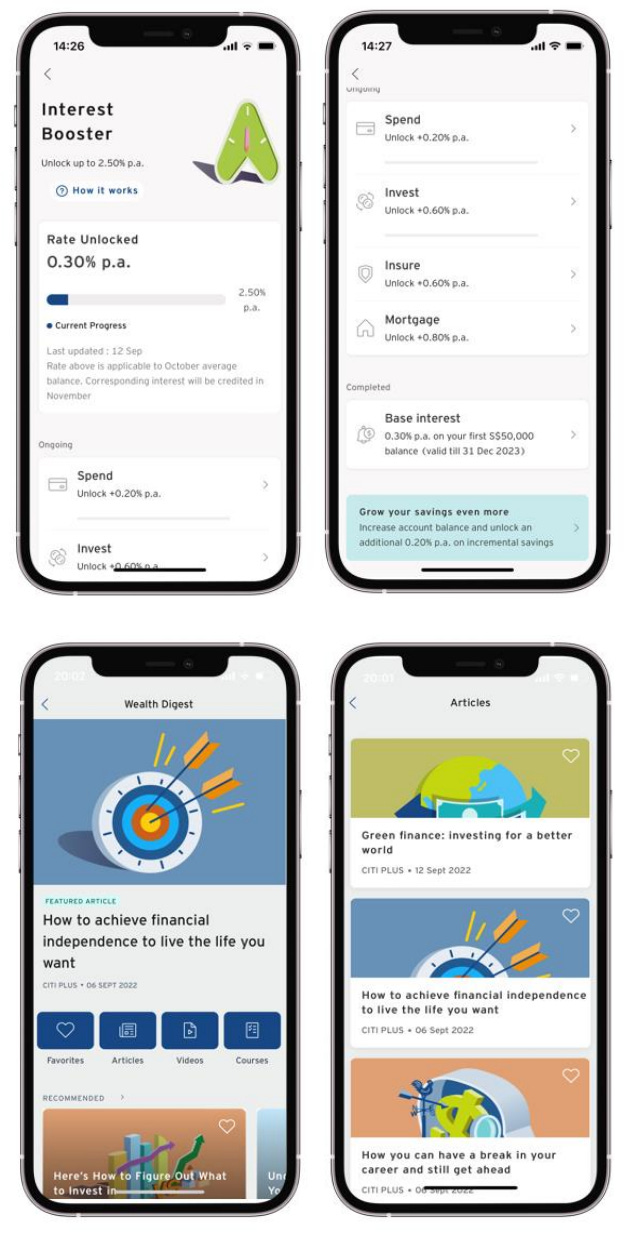

⭐ 🇸🇬 Citibank Singapore Launches Digital Offering For Younger Affluent Clients - Yahoo Finance, September 19, Singapore

Citibank launched Citi Plus®, a Singapore-based digital wealth platform. The platform is an extension of Citi’s “Win in Wealth” campaign that aims to increase wealthtech investments and add $150B to its APAC AUM.

Elevate, one of the Citi Plus offerings, is a digital wealth platform that contains a financial literacy guide, wealth-related articles and insights, and a personal financial goal-tracking tool. Other offerings include Invest, a stock, forex, and mutual fund investment platform, as well as saving, spending, and insurance solutions. Because of course everything is a fintech consumer bundle.

Last year, Citi launched a digital assets group to help clients invest in crypto, NFTs, and CBDCs, but Citi Plus does not offer crypto trading services at this time. The Monetary Authority of Singapore (MAS) mentioned it wants to attract crypto players to Singapore, yet it has a stringent licensing process for crypto-related services. We see that after the Terra collapse, the MAS position is against anti-crypto speculation for the public, not anti-crypto per se.

🇮🇳 Centricity Wealthtech Raises $4MM In Maiden Funding Round At $20MM Valuation - Adgully, September 15, New Delhi

🇮🇳 Bambu Offers Wealth Management Predictive Planning Solution For Microsoft Cloud For Financial Services And Microsoft Dynamics 365 Sales - PR Newswire, September 21, Mumbai

🇮🇳 Finnovate Raises Nearly $1MM In Pre-Series A Funding - Entrepreneur, September 15, Mumbai

🇸🇬 Hamilton Lane Expands Footprint Across Southeast Asia - PR Newswire, September 19, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Emergence Of Digital Assets In Wealth-Tech Space And Why This Is The Future Of Investment - Wealth Management, September 19, New Jersey

🇬🇧 'Storm Brewing' For Tech Providers As Adviser Satisfaction Falters - Professional Adviser, September 20, London

🇺🇸 Aite-Novarica Group Announces Winners of the 2022 Digital Wealth Management Impact Awards - Yahoo Finance, September 20, Massachusetts

Events & Reports

🇺🇸 Boston Fintech Week - Boston Fintech Week, September 27-29, Massachusetts

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

🇬🇧 Global WealthTech Summit - Fintech Global, November 2, London

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.

Interesting to see how the Artory/Winston index will compare to the Artprice100 index. I guess we'll find out whether 'Emerging' pieces beat the classics. Cool piece this week.