Digital Wealth: RIA custodian Altruist raises $112MM to battle Schwab and Fidelity

By acquiring advisory services firm SSG, Altruist has created a 3,300-plus RIA firm, now ranked third in the number of RIAs served, surpassing Pershing

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Altruist Raises $112MM Series D To Take On Schwab And Fidelity In $128T RIA Market

NORTH AMERICA: Tradier Raises $24.6MM Series B Funding To Drive Choice, Value & Better Service For Active Retail Traders

EMEA: Wealth Management Fintech FNZ, Virgin Money To Launch Investment Solution For UK Clients

GEOGRAPHIC NEWS CURATION

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Digital Wealth Short Takes

⭐🇺🇸 Altruist Raises $112MM Series D To Take On Schwab And Fidelity In $128T RIA Market - Businesswire, April 12, California

Altruist, the RIA-focused custodian founded by Jason Wenk, has raised $112MMM in a Series D funding round led by Insight Partners, bringing the company's total funding to $290MM+. Given where fintech is in the overall equities landscape, we find this raise particularly impressive, reflecting underlying performance. Together with recent news from Masttro, it appears that wealthtech is back in the favored cycle.

Altruist has taken a modern approach to integrating clearing, custody, and a full suite of advisory software into a single platform, intending to deliver a more affordable and streamlined digital experience for RIAs. The company places emphasis on its technology with a team of over 200 engineers, which has allowed it to reduce software application and TAMP expenses for RIAs by 90%.

By anchoring the offering in custody, the company may be able to avoid the pitfalls of previous wealthtechs that focused on being multi-custodial trading, performance, or digital investing interfaces, but capturing thin economics. For the latest example, see Vise.

While larger firms tend to gravitate towards established RIA custodians like Schwab and Fidelity, smaller players are left with fewer options. Of the 18,000 independent RIAs, most custody assets at Schwab, which holds $3.37 trillion in assets. Fidelity comes in second with $1.5 trillion, and Pershing trails with $350 billion. Schwab's TD Ameritrade acquisition further fuels this concentration. Larger platforms focus on larger players, leaving smaller RIAs searching for alternatives.

Enter Altruist — a recent entrant digitizing the RIA custody space. By acquiring advisory services firm Shareholder Services Group, Altruist has created a 3,300+ RIA firm, now ranked third in the number of RIAs served, surpassing Pershing. Altruist is banking on its modern technology stack to retain these clients.

Older custodians often require RIAs and their clients to use their portals for account opening, trading, and changing portfolio allocation. Altruist, on the other hand, offers an open API structure and a developer portal. This is the modern way. With new features and functionality added every two weeks, Altruist clearly wants to become that go-to platform for smaller and midsize players. For more, check out our interview with Jason below:

⭐🇺🇸 Tradier Raises $24.6MM Series B Funding To Drive Choice, Value & Better Service For Active Retail Traders - PR Newswire, April 18, North Carolina

Tradier, the API-driven brokerage platform that processes over 1B API calls per month, has raised $25MM in a Series B funding round led by PEAK6 Strategic Capital, with participation from F-Prime Capital and KF Business Ventures. The past year has been a record year for Tradier, with traders who signed up for the platform's subscription plans averaging an account size of $30,000 and executing an average of 150 trades per month.

Tradier's primary offerings include APIs for trading, market data, and brokerage services, as well as its trading platform, TradeHawk. The package links a trader's front-end system with Tradier's integrated tools — of which there are over 100, like eSignal, Quantcha, and Exeria. For instance, integrating Quantcha provides an options book manager, an options search engine that leverages 40 different strategies, and a stock and options screener. TradeHawk, which costs $10/month, offers trading for options and stocks, as well as charting that overlays implied volatility (IVol) periods on daily underlying price action.

Embedded finance has been growing everywhere in fintech as we digitize processes and update the settlement of various assets, including those in the trading / brokerage industry. Numerous brokers now offer APIs, such as Alpaca, Pepperstone, and Interactive Brokers. Institutional customers benefit from the ability to pull in and manipulate data and functionality, rather being stuck in a user interface.

Our AI overlords will enjoy those APIs even more in the years to come.

⭐🇬🇧 Wealth Management Fintech FNZ, Virgin Money To Launch Investment Solution For UK Clients - Crowdfund Insider, April 17, London

Virgin Money, the UK-based bank with 6.6MM+ clients, is expanding its offerings beyond traditional retail banking with its new roboadvisor platform, Virgin Money Investments. In collaboration with asset manager Abrdn, the platform will allow customers to save through stocks and shares ISAs.

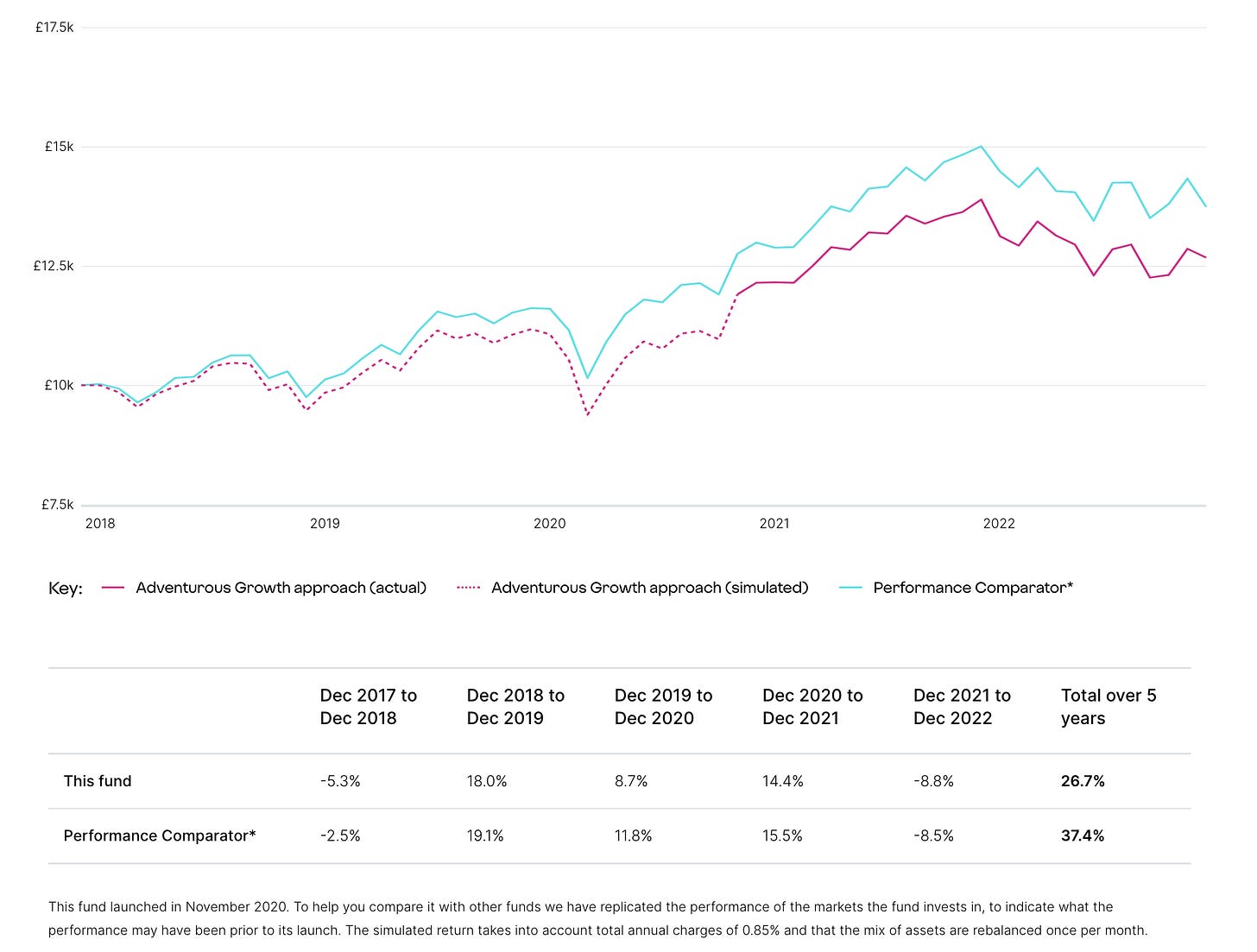

Fees for the platform total 0.75% per year, with an account charge of 0.30% and a 0.45% charge for investment management. The roboadvisor offers three growth options - cautious, balanced, and adventurous. The cautious option mainly consists of a 60-40 bond-equity split, while the adventurous option primarily consists of UK and overseas developed stocks, emerging market shares, and high-yield bonds. Interestingly, all three funds have been below the performance comparator for almost every year since 2018.

Virgin Money Investments also partnered with wealth management platform FNZ for back-end operations and investor administration capabilities. When it comes to partnerships, FNZ keeps popping up — Abrdn moved onto FNZ's tech last year. The company has been inking deals like the one with Envestnet, and data integration is a super power in the world of finance. Of course, there are other players in the wealthtech game, like GBST (which FNZ sold to Anchorage in 2021), Bravura, Avaloq, and Orion, and newcomers like Seccl. That said, to meaningfully change market share requires either enormous capital outlay, or a technology platform shift.

Curated News

North America News

🇺🇸 Custom Indexing And Thematic Portfolio Construction Company ALLINDEX Selects BridgeFT's WealthTech API As Its Primary Source For Data Aggregation - PR Newswire, April 18, Illinois

🇺🇸 Skience Unveils Blueprint Process To Help Wealth Management Firms Better Manage Digital Transformations - Businesswire, April 18, Virginia

🇺🇸 Onramp Invest Teams Up With CoinDesk Indices To Deliver Leading Crypto Indices - Businesswire, April 19, California

🇺🇸 Betterment Agrees To Pay $9MM To Settle U.S. SEC Charges - Businesswire, April 19, California

🇺🇸 L1 Advisors Launches World's First Fully-On-Chain Crypto Wealth Management Platform To All Advisors - Accesswire, April 19, Texas

EMEA News

🇬🇧 Sharegain Announces Strategic Alliance With J.P. Morgan - PR Newswire, April 18, London

🇬🇧 Nickel DeFi Liquid Venture Fund Outperforms As Digital Assets Recover - Hedgeweek, April 19, London

Asia Pacific News

🇲🇾 Kapital DX Launches Malaysia’s First IEO Platform Regulated By The SC - Fintech News Malaysia, April 18, Kuala Lumpur

🇭🇰 Asia-Based Digital Asset Firm HashKey Group Introduces Wealth Management Service - CoinDesk, April 13, Hong Kong

🇸🇬 SC Ventures Invests In BetterTradeOff To Boost Digital Wealth Advisory Capabilities - Technode Global, April 13, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Digital Advice Falling Short Of Potential Due To Lack Of Client Understanding, J.D. Power Finds - Businesswire, April 13, Michigan

🇬🇧 Overcoming Wealthtech Challenges Through Technology Transformation - Finextra, April 14, London

🇭🇰 The Wealth Management Industry And The Evolution Of Digital Assets & Tokenisation - Hubbis, April 19, Hong Kong

🇺🇸 ETFs Killed Off By Merciless Market At Double The Rate Of Last Year - Wealth Management, April 18, New York

🇨🇾 Wealthtech And The Rise Of Robo-Advisors: Opportunities And Risks For Investors - Finance Magnates, April 17, Limassol

Events & Reports

⭐🇺🇸 Envestnet Summit 2023 Elevate - Envestnet, April 26 - 27, Colorado

⭐🇺🇸 Fintech Nexus USA - Fintech Nexus, May 10 - 11, New York

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇺🇸 Finovate Spring - Informa Connect, May 23 - 25, California

🇬🇧 Innovation In Wealth Management - Professional Wealth Management, June 8, London

🇬🇧Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.