Digital Wealth: Roboadvisor StashAway raises $13MM after BlackRock distribution deal

The main investors are Hamilton Lane ($3MM), Square Peg Capital ($3MM), and Eight Roads ($2.9MM). Square Peg led StashAway’s $16MM Series C funding round in 2020

Hi Fintech Futurists —

Before we start today’s issue, let us tell you about our new referral program. You can now share the Blueprint newsletter with people you know and earn rewards. We track referrals on a leaderboard, and calculate the following on a monthly basis:

Here are the tiers of rewards:

Refer 2 people — Get your social media profile, a company, a startup, a job posting (or any other link) featured in an edition of the newsletter with a link

Refer 10 people — get a 30-day FREE Fintech Blueprint trial + lifetime exclusive access to Lex’s fintech research library for an email of your choice, composed of high quality in-depth research reports from top-tier institutions

Refer 35 people — get a 90-day FREE Fintech Blueprint trial + if you are among the top 3 referral sources, a 30-min “Business Vision Call” with Lex

Your invites need to accept the invitation and subscribe to the free version of the Fintech Blueprint newsletter by end of month, September 30th. And make sure that you’re logged in and click the “Share” button below.

Good luck, have fun ✌️

North America News

⭐🇺🇸 Wall Street Titans' New Crypto Exchange Aims To Seriously Cut Costs For Investors - Yahoo, September 13, New Jersey

Charles Schwab, Fidelity Investments, Citadel Securities, Virtu Financial, Paradigm, and Sequoia Capital have backed EDX Markets (EDXM), a new digital asset exchange. EDX will focus initially on tokens that aren’t securities (e.g., BTC) to avoid current regulatory drama. MEMX (Members Exchange), a securities exchange set up by nine financial services firms in 2019, will provide the tech infrastructure for EDXM.

EDXM differs from other venues as investors will access crypto through their traditional broker-dealer rather than via a crypto exchange. Thus, EDXM will use custodians to separate itself from investor assets (e.g., unlike Celsius). On September 9th, SEC Chair Gary Gensler stated that exchanges should separate the roles they play in the capital markets value chain, such as acting as a broker vs. custodian, into distinct entities per industry practice — Fidelity is not NASDAQ is not BNY Mellon, as an example. This approach is a competitive advantage from a regulatory perspective. EDXM claims it will settle trades on a blockchain connecting several digital custodians, though we are confused by the value of this concept as applied to crypto assets.

In related news in August, crypto exchange FTX partnered with liquidity network Paradigm to provide traders with “one-click” trading with “no leg risk” for the spread between spot, perpetual, and fixed maturity futures on eight cryptocurrencies (BTC, ETH, SOL, AVAX, APE, DOGE, LINK, and LTC). The feature would allow market makers to quote tighter prices and larger sizes, and the fees will be 50% less than executing two individual trades. This idea is more tailored towards experienced traders/institutions, but shows how much competition there is from the large players for volume of all sorts.

🇺🇸 Franklin Templeton Introduces Digital Asset SMA Models on Eaglebrook Advisors’ Platform - Franklin Templeton, September 8, California

Spoiler alert!

🇺🇸 Securitize Launches Fund Providing Tokenized Exposure to KKR Fund for the First Time in the US - Businesswire, September 13, New York

🇺🇸 Apollo, Carlyle launch funds on a16z-backed Titan as PE's retail push expands - September 13, 2022

🇺🇸 Mariner Wealth Advisors Selects CAIS to Scale Alternative Investment Capabilities - Businesswire, September 8, New York

🇺🇸 Marstone’s Community Bank Solution Launches with Bank of Oak Ridge to Rapidly Provide Digital Wealth Management for End Clients - Businesswire, September 13, New York

🇺🇸 AI Wealthtech Firm, FP Alpha, Announces Largest Integration To Date, With Automated Engagement And Onboarding Platform, PreciseFP - PR Newswire, September 13, New York

An interesting pass at financial planning outside of investments.

🇺🇸 EquityMultiple Delivers Self-Directed Investors Attractive Returns During A Volatile Year - PR Newswire, September 13, New York

Fundraising?

Are you building in Fintech or Web3? We are investing in great teams at the pre-seed and seed stage. Do you have an awesome idea — click below to let us know!

EMEA News

⭐🇬🇧 FNZ Set To Acquire German Wealthtech Provider DIAMOS - Fintech Futures, September 9, London

FNZ, a wealth management platform-as-a-service firm with $1.5T in assets under administration, has acquired German wealthtech firm DIAMOS. Last November, FNZ acquired Fondsdepot Bank, a German B2B bank with €64B in assets under administration. In February, FNZ received a $1.4B capital injection, valuing the firm at $20B+.

DIAMOS offers solutions for traditional and alternative investments: DIAMOS-A Suite for alternatives is a data management solution that automates data entry and generates portfolio reviews. The review showcases portfolio-related risks such as regional distribution and shareholding structures. Moreover, the suite helps plan capital allocation and offers an overview of subscribed fund participations and executed capital calls.

Is it possible FNZ will compete with iCapital, a B2B fintech for the Alternatives asset class, with $130B+ in assets, in the alternatives market with this acquisition? Maybe, but unlike iCapital, FNZ is not an alternatives specialist. Their priority is consolidating position in the wealth management space horisontally. Previous Digital Wealth Week publications have showcased FNZ's acquisition spree, which aligns with Bain's prediction that investment firms must provide scalable and high-tech solutions to attract younger investors. We think FNZ's acquisitions are less about the particular acquired company, and more about completing the jigsaw puzzle of capabilities, product, and geography.

🇩🇪 Deutsche Bank Plans App For Securities Investment - The Paypers, September 9, Frankfurt

🇧🇪 WealthTech Abbove Supports Quintet Private Bank to Bring Digital Wealth Planning to Their Private Banking Clients in Belgium - Businesswire, September 8, Etterbeek

🇬🇧 How Etcho Is Aiming To Help Save The Planet Through Conscious Investing - Fintech Futures, September 12, London

Asia Pacific News

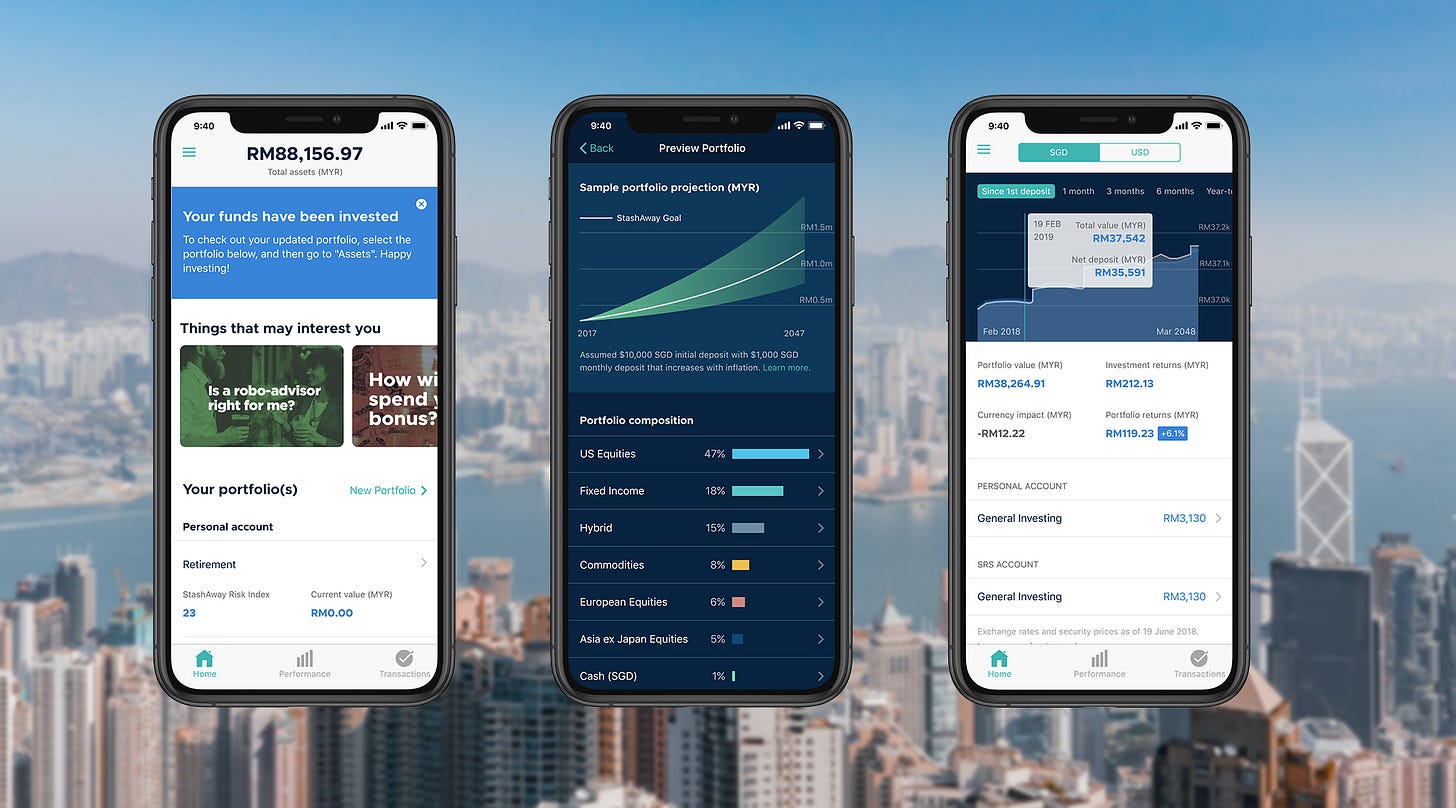

⭐🇸🇬 SG Digital Wealth Manager StashAway Raises $12.67MM So Far In Series D+ Funding Round - Deal Street Asia, September 12, Singapore

Singapore-based roboadvisor StashAway has raised $12.7MM so far in a Series D+ funding round. The main investors are Hamilton Lane ($3MM), Square Peg Capital ($3MM), and Eight Roads ($2.9MM). Square Peg led StashAway’s $16MM Series C funding round in 2020.

StashAway offers thematic portfolios, ESG portfolios, and last week they launched a BlackRock-powered strategy — the most aggressive option consists of 99% equities and 1% cash! StashAway also has a proprietary asset allocation using an Economic Regime-based Asset Allocation (ERAA), which seems to be Modern Portfolio Theory augmented with the state of macroenomic conditions.

The strategy is driven by (1) economic regimes, defined by observing the rate of change between growth and inflation, (2) risk controls, related to the momentum of growth/inflation if the economic data is unclear, (3) calculated valuation gaps within each asset class’s fair value to actual market valuations, and (4) asset-specific risk, in which there are asset limits based on the historical performance of each asset compared to a portfolio’s benchmark. Seems pretty hands on to us!

Endowus and KPMG published a report on Singapore’s wealthtech sector, highlighting that local wealthtech venture funding hit $161MM in 2021, the growth of which was catalyzed by the mass adoption of robo advisors. Further, in an Endowus Wealth Insights report, 90% of respondents mentioned they use roboadvisors, whereas only 25% use banking services for investing. If you’re not digital, you are the walking dead.

🇸🇬 Singapore-Based Central Asian-Focused Investment Firm Paladigm Capital Ventures Into Digital Investment Banking - Yahoo Finance, September 12, Singapore

🇮🇳 Kotak Securities Buys Investment Platform For Advisors, MF Distributors - Business Standard, September 8, Mumbai

Blogs, Webinars, Podcasts

🇸🇬 Singapore Wealthtech Sector Marks Seven-Fold Growth In Venture Investments To $161MM - KPMG, September 12, Singapore

🇺🇸 CTOs: 'Tech-Forward' Advisors Key To Better Tech Adoption - WealthManagement, September 12, New Jersey

🇬🇧 The Use And Benefits Of AI In Wealth Management With Toggle, TIFIN Wealth, Unifimoney And More - The Fintech Times, September 13, London

Events & Reports

🇺🇸 Boston Fintech Week - Boston Fintech Week, September 27-29, Massachusetts

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

🇬🇧 Global WealthTech Summit - Fintech Global, November 2, London

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.

Really insightful piece!