Digital Wealth: $1.5T asset platform FNZ acquires New Access, core-to-digital private banking tech

FNZ has been on an acquisition spree in the past year, with the acquisitions of: investment platform Hatch, German B2B bank Fondsdepot Bank, and client-onboarding firm Appway

Dear Fintech Futurists,

The technology world is rapidly changing.

At the Fintech Blueprint, we are fascinated by DAOs and will be highlighting the concept for you in our upcoming monthly Greatest Hits Report. Remember, these reports curate the most relevant Fintech Blueprint articles focusing on a key concept.

This month’s Greatest Hits Report on Decentralized Autonomous Organizations (DAO) will be released on Tuesday, 26 July.

Full access to the Greatest Hist Report will be exclusive to the premium subscribers of the Fintech Blueprint newsletter.

If you’d like to unlock the Greatest Hits report, then upgrade your subscription.

By upgrading your subscription, you will unlock immediate access to the full experience of the Fintech Blueprint newsletter, including:

Access to the upcoming Greatest Hits Report on Decentralized Autonomous Organizations

3 industry newsletters per week, including short takes covering the latest Fintech, Web3, and Digital Wealth news via expert curation and in-depth analysis, with full archive access

Weekly Long Takes on Fintech and DeFi topics, providing deep, comprehensive, and insightful analysis without shilling or marketing narratives

Our upgraded weekly industry insider Podcasts with value-added data-driven, annotated transcripts

North America News

⭐🇺🇸 Magnifi By TIFIN Announces International Expansion Through Acquisition And Integration Of SharingAlpha's Professional Investor Community - PR Newswire, July 14, Colorado

TIFIN, a wealthtech that aims to bridge the gap among retail investors, intermediaries, and investment managers, announced its acquisition of SharingAlpha, a community of over 15,000 professional fund investors and analysts.

SharingAlpha offers investors a community view on potential fund performance. According to the firm, over 95% of funds lack independent qualitative analysis and don't receive significant flows, since most capital goes to “mega funds”. This website lets investors and analysts build a track record of fund selection, which is like a synthetic fund-of-funds performance tracker. There is also a ranking mechanism based on commentary, as voted by other community members.

TIFIN already offers several digital investing engagement applications — (1) Magnifi, a marketplace for self-directed investors and advisors, (2) Financial Answers, a digital platform of investor communities, (3) TIFIN Wealth, a personalised advice and planning service, and (4) Distill, a digital distribution and insights engine for wealth and investment managers. Following the acquisition, SharingAlpha will be integrated into the marketplace, augmenting the AI-powered investment intelligence with a community overlay.

This is an interesting application for gathering user attention and conversations about investment ideas. We think the market for this type of active management is fairly limited, but perhaps the whole is larger than the parts.

🇨🇦 Rise People Partners With OneVest To Create A Private, Fully Integrated Wealth Management Offering On The Rise Platform - GlobeNewswire, July 19, Vancouver

🇺🇸 Pontera And Hilltop Wealth Advisors Announce Partnership To Improve Client Retirement Outcomes - Businesswire, July 14, New York

🇺🇸 YourStake Launches New Integration With SS&C's Black Diamond® Wealth Platform To Give Clients A Full View Of Their Investment Impact - PR Newswire, July 19, New York

🇺🇸 True North Networks And RightSize Solutions Combine To Form Visory - Businesswire, July 18, Missouri

🇺🇸 Aloha Wealth Partners Announces New Alternative Investment Services - Yahoo Finance, July 19, California

🇺🇸 Bank Of America’s Digital Platforms Continue To Thrive Despite Stock Market Volatility - Diginomica, July 19, North Carolina

🇺🇸 Morgan Stanley To Cut Costs While Still Investing In Wealth, Retirement Biz - Financial Advisor IQ, July 18, New York

EMEA News

⭐🇨🇭 FNZ Acquires Swiss Private Banking Technology Company New Access To Open Up Wealth Together - PR Newswire, July 20, Geneva

FNZ, a platform with $1.5T in assets under administration and 20MM+ clients, acquired New Access, a digital core banking system for private banks. The company has been on an acquisition spree in the past year — a $40MM deal to acquire Hatch, a B2C digital investment platform, the acquisition of Fondsdepot Bank, a German B2B bank with €60B+ in assets under administration, and the acquisition of Appway, a Switzerland-based client onboarding firm. As a reminder, the firm had also raised $1.4B in equity funding from CPP Investments and Motive Partners in February.

The New Access solution suite includes (1) a core banking system, which offers credit and fee management, treasury and cash management, financial statements and general ledger, and data management for both clients and securities, (2) a portfolio management system, which provides portfolio valuation, situation analysis, and risk indicators, and (3) a digital client lifecycle management platform, which offers portfolio analysis and client document management.

Private banks are under significant pressure to digitize their offerings as roboadvisor and neobank features become default across global markets. Most banking and wealth management strategy (e.g., see Bain report) reports emphasise that technology must be deployed, quickly and at scale, to capture the attention of Gen Z and Millennial users. FNZ is using a whole lot of capital to participate in that trend through acquisition.

🇬🇧 FIS Expands Wealth Offerings In The United Kingdom With New Pension Services - Businesswire, July 19, London

🇫🇷 The Largest Bank In The Eurozone To Launch Bitcoin, Crypto Custody Platform - Bitcoin Magazine, July 19, Paris

🇬🇧 London & Capital Sets Up Shop In Spain - International Adviser, July 19, London

🇬🇧 Sanlam Wealth Rebrands To 'Atomos' In Diversity Push - FT Adviser, July 16, London

🇬🇧 Schroders Buys Minority Stake In Blockchain Technology Firm Forteus - Private Banker International, July 20, London

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇰🇷 Korean Startup Alchemi Lab Develops The World’s First MPT-Based Crypto-Trading Platform - KoreaTechDesk, July 20, Seoul

Seoul-based fintech startup, Alchemi Lab, released its new crypto-trading platform, Zolbo. The platform’s algorithm uses Markowitz’s Nobel prize winning Mean-Variance Portfolio Theory (i.e., Modern Portfolio Theory) to help crypto investors.

Some background — Sam Kim, the CEO of Alchemi Lab, was a quant fund manager looking for a more institutional approach to trade crypto assets. Sam combined his interests in roboadvisors and deep learning, gathered a team of quants, got three funding rounds from the Korean government ($40K in 2018; $100K in 2020; $80K in 2021), and rolled out the Zolbo app. Does a quant hiring other quants to achieve alpha returns sound familiar? Back in 1982, Jim Simons, founder of Renaissance Technologies, used his mathematical background to build algorithms that identified and profited from patterns in the market. That firm is also known for hiring people with PhDs in Mathematics and Physics rather than traditional Wall Street bankers. Since 1998, Renaissance’s flagship Medallion Fund has returned 66% annually. Zolbo isn’t Renaissance, but we like the origin of Alchemi Lab’s approach.

The startup claims that although there is an increasing number of crypto traders, 99% of them lose principal within 300 days. In fact, active traders underperform by 6.5% annually and only 1% of them profit net of fees. Alchemi Lab says this is a behavioural finance problem, and can be mitigated that implements MPT on top of the traded assets.

In MPT, an investor assumes the rate of returns on assets as random variables based on historic statistics, and then chooses portfolio weighting factors such that the portfolio achieves an expected rate of return with minimal volatility. You are welcome to read the mathematical proof here. Nassim Taleb would remind us that MPT assumes returns are normally distributed, which is super-not-true for crypto, which is susceptible to constant black swan events. Roboadvisors tend to use MPT for their asset allocations, but this hasn’t crossed over to digital assets yet. Zolbo ran this trading strategy about 15 months between 01/03/2021 to 21/07/2022, and their prototype reached a cumulative return of 164% with a Sharpe ratio of more than 300%.

We welcome this potential new combination of crypto trading apps with more sophisticated wealth management asset allocation concepts.

🇸🇬 Amber Group Focuses On Growth And Strengthens Its Commitment To Security And Compliance Amid Market Downturn - PR Newswire, July 20, Singapore

🇮🇳 Moneyfy Partners With Taxblock And TaxSpanner.com To Enable E-Tax Filing - IBS Intelligence, July 20, Lucknow

🇭🇰 Asian Wealth Management Unit Of RBC Fined $7.7MM In Hong Kong - Finance Magnates, July 20, Hong Kong

🇸🇬 Syfe Turns Three - Syfe, July 19, Singapore

Blogs, Webinars, Podcasts

🇺🇸 Time For Wealth Firms To Revisit Their AUM-Based Pricing Models? - Wealth Professional, July 20, Massachusetts

🇭🇰 Traditional Vs Digital Wealth Managers: Sales Funnel - Caproasia, July 15, Hong Kong

🇺🇸 Could Robo Advisors Really Make You More Money Than Index Funds? - Yahoo Finance, July 19, New York

🇬🇧 How To Move From Client Experience Laggard To Leader - WealthBriefing, July 20, London

Events & Reports

⭐🇺🇸 Wealth Management M&A Activity Still On Pace For Record Year - NAPA, July 18, Virginia

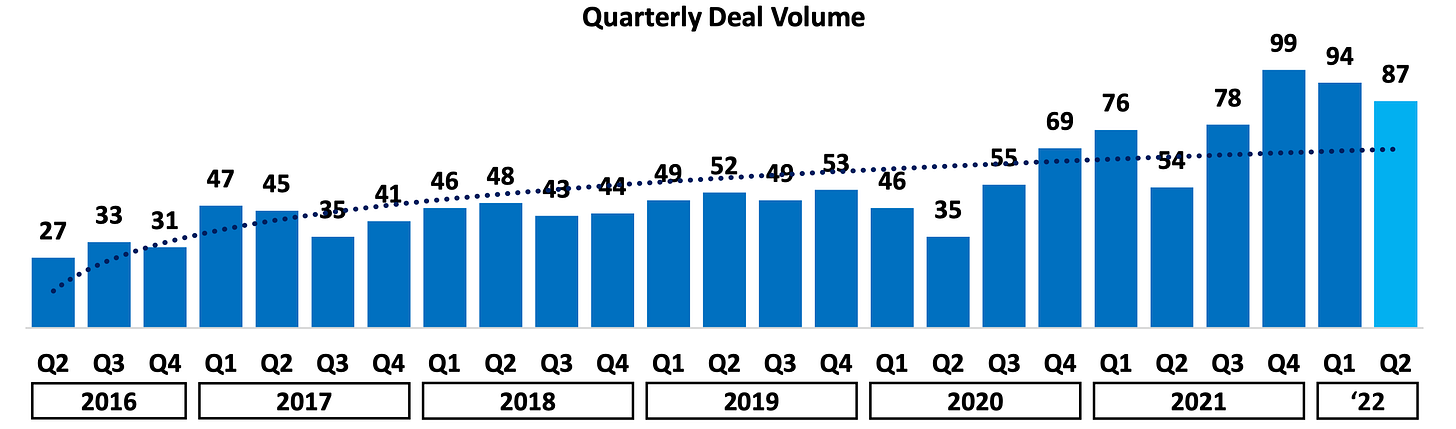

ECHELON’s RIA M&A deal report showcases that the decrease in deal activity observed in 1Q22 continued into the second quarter, but only by 7.4%. Despite macroeconomic uncertainty, acquirers remain interested in growing through M&A.

The report also mentioned that the the top wealthtech turnkey asset management platforms (“TAMP”) were all active acquirers this quarter, to capitalise on the trends of continued outsourcing, scale their current client bases, and build new service lines. The report highlights deals such as CAIS’s funding rounds and $1.1B valuation, iCapital’s acquisition of SIMON Markets, Orion Advisor Solutions acquisition of TownSquare Capital, and more. To read about the latest wealthtech deals, see here.

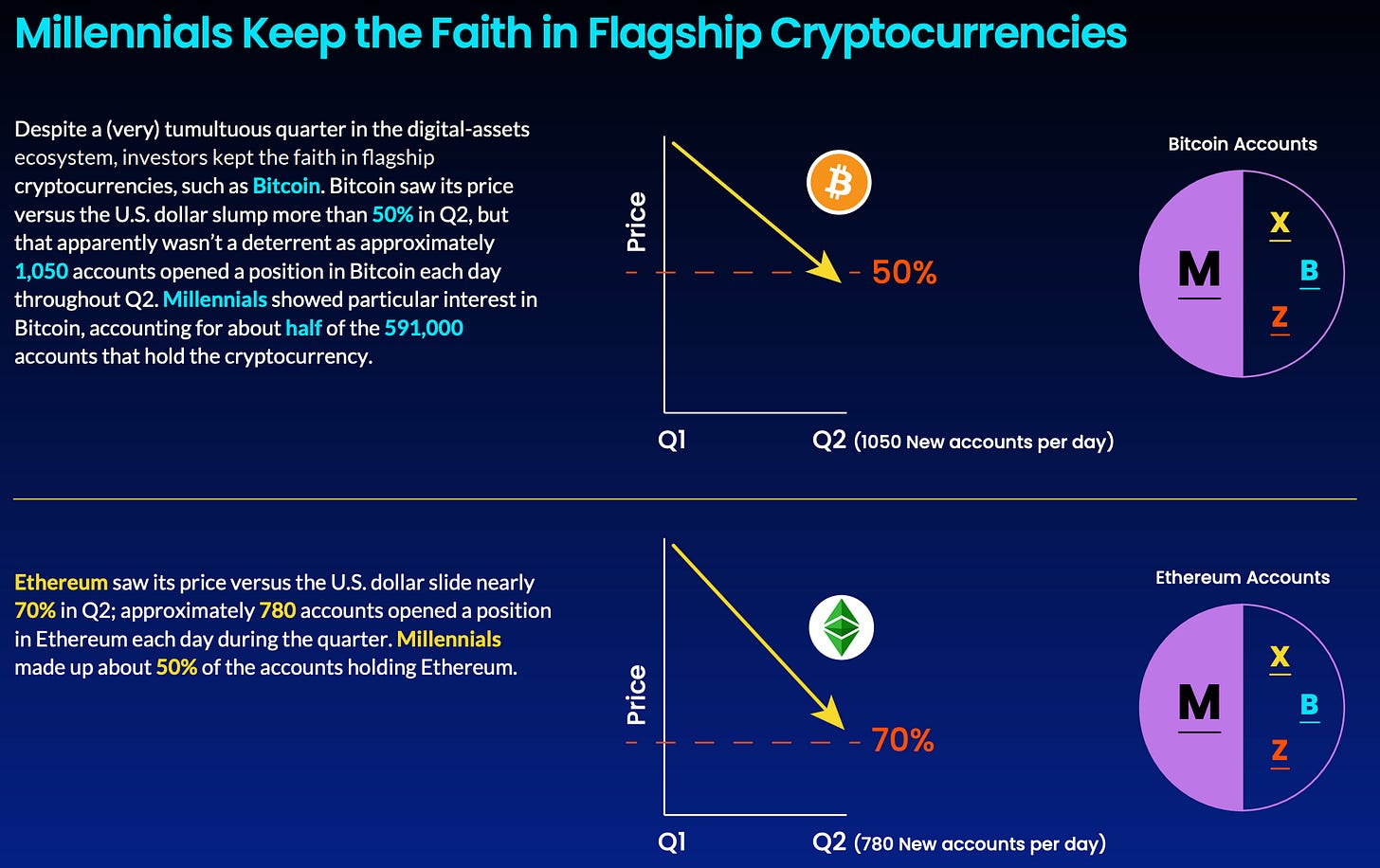

🇺🇸 Apex Next Investor Outlook: Q2 2022 - Apex Fintech Solutions, July 20, New York

🇺🇸 The Next Chapter In Driving Growth In Asset Management - Northern Trust, July 20, Illinois

🇺🇸 VenCent Fintech Summit - The Venture Center, August 15-18, Virtual

🇺🇸 Fintech Growth Summit - MGA, August 25-26, Florida

🇬🇧 The Future Of FinTech - Coltech Global, July 28, Virtual

🇺🇸 Fintech_Devcon 22 - Fintech_Devcon, August 23-25, Colorado

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinons of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.