Digital Wealth: Trouble at Masterworks, the art investment platform, which bought $475MM of art in 2022

In 2021, aggregate sales of art and antiques by dealers and auction houses reached an estimated $65B, up 29% from 2020, surpassing pre-pandemic levels of 2019

Hi Fintech Futurists —

Welcome to the first Digital Wealth publication of 2023. To kick off the new year, we're going to start differently than usual and take a deep dive into Masterworks, the fractional art investment platform.

Thanks as always for your time and attention. To dive deeper into our covered topics, check out the premium options below.

North America News

⭐🇺🇸 Rising Startup Masterworks Beset By Internal Rifts, Alleged Recklessness, And Staff Cuts - ARTnews, December 27, New York

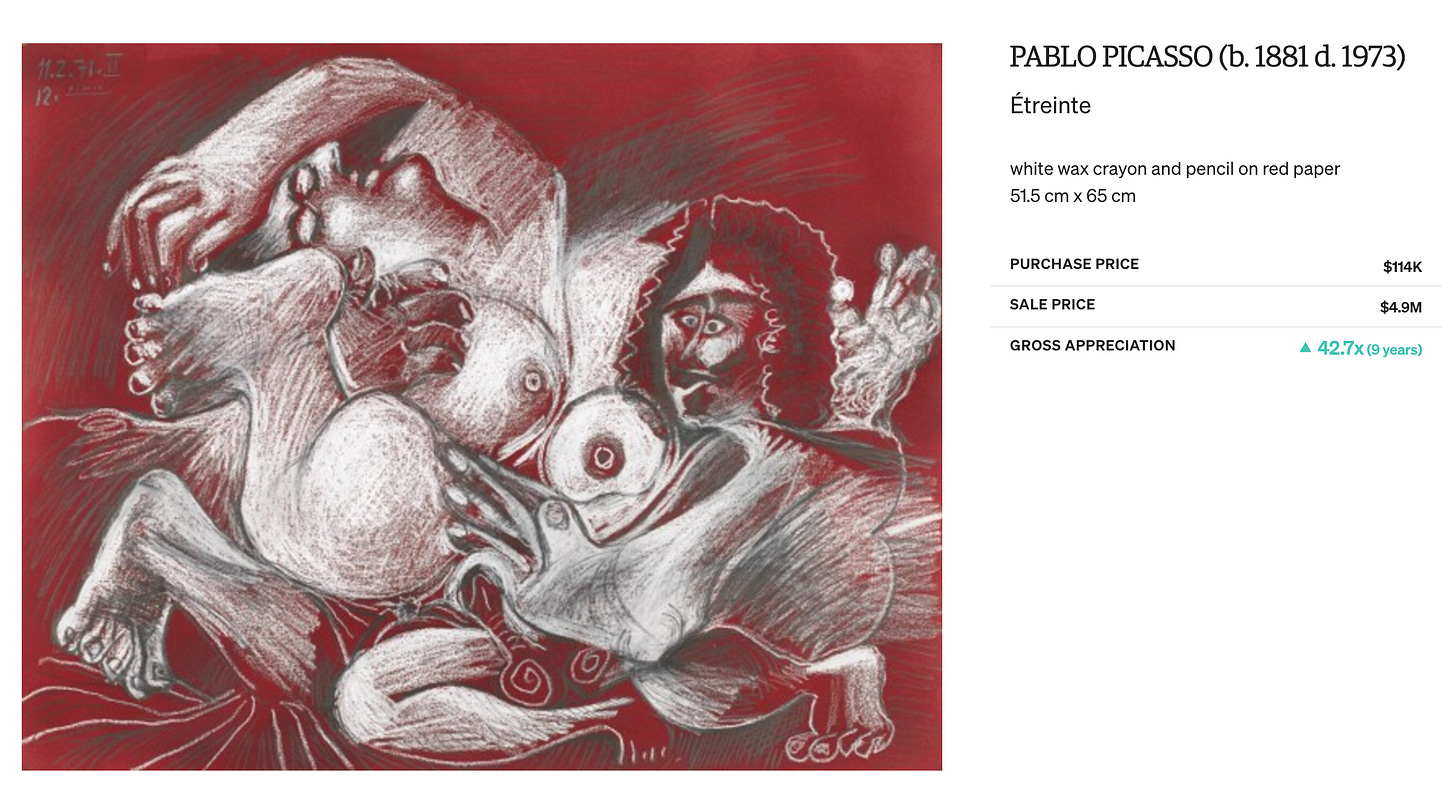

Since 2017, Masterworks has gained a reputation for introducing the world to securitized blue-chip art investing. The startup has amassed a lineup of world-famous artworks by Picasso, Warhol, and Monet in the last five years. It is known as a fractional art investment platform, letting retail users acquire portions of famous painting in order to get exposure to the high end asset class. And we aren’t talking about NFTs.

However, recent coverage reveals a more challenged business model in the current financial market — struggling to sell multiple paintings to prospective investors, driving up a painting's market value, spending $1MM a day on marketing, potentially hitting against various FINRA and SEC regulations, pitching the idea of "deaccessioning" art to Museums, and more.

In 2021, Masterworks raised a mammoth $110MM in a Series A funding round led by Left Lane Capital, valuing the startup at over $1B. By May 2022, the company purchased 100+ paintings for $475MM, available to its 400,000+ registered users. Reportedly according to a former employee, 5% of those users are actually invested, which is not an unreasonably conversion into paid from free, but not enough for a large wealth management business.

To acquire an art piece, Masterworks' acquisitions team works with auction houses and private dealers to select "investment quality" works. The company's licensed brokers then sell fractional shares of securitized artworks by blue-chip artists to retail investors. Paintings include Basquiat's All Colored Cast (Part II), valued at $22.5MM, which Masterworks sold for $20/share (with a minimum investment of $5,000). Once a piece is purchased, Masterworks must sell all the painting's fractional shares before the money can leave the company's escrow account to the seller of the artwork. Behind the scenes, however, the company has had conflicting business strategies and rifts between management, leading to high pressure attempts to capture more sales despite the cost. Combine brokerage with start-ups existential risk.

The Art News article does a good job covering Masterworks recent challenges. Here’s what stood out to us:

(1) targeting HNW men over 35 specifically, instead of everyday consumers as advertised, and encouraging employees to use investor bank account information via Plaid during prospective investor calls;

(2) using heat maps to chart which employees were selling the most shares to stoke internal competition around quotas — FINRA and the SEC have strict guidelines related to sales contests to ensure that representatives do not engage in unethical or deceptive practices when selling securities to customers, see SEC ruling and FINRA rulings 2010 and 2111;

(3) waiving investment minimums to as low as $100 instead of $5,000 to close deals, potentially creating a false impression of the type of financial product offered. Boiler room sales cultures have always been a problem for financial asset distribution businesses — think of the 2016 investigation into Wells Fargo, which revealed a culture pressuring workers to create fake client accounts to meet quotas, costing Wells Fargo $3B in fines; and

(4) placing the company's needs above those of investors by pushing sales reps to sell shares in paintings that were seeing little interest. End of the day, this isn’t a fiduciary RIA advisor trying to take care of a customer’s portfolio.

Despite the internal rifts at Masterworks, we see a lot of promise in the fractional art investing industry. A Bank of America study showed that demand for portfolio diversification away from traditional stocks and bonds and more towards alternative assets appeals to younger investors with at least $3MM in investable assets.

Last September, we had analyzed Artory / Winston, a joint venture between Artory and Winston Art Group, which created a $25MM tokenized art fund. The offering is available on Securitize, a digital asset platform that uses blockchain tech for private companies to tokenize assets and raise capital. The fund, which has a 1.25% management fee, contains 68 artworks — 3 x Blue Chip ($2MM average value), 15 x Mid-Career ($600K average value), and 50 x Emerging ($200K average value). Masterworks introduced this index-fund approach to "close out" commercial works that brokers were struggling to sell out, targeting accredited institutional investors, starting at a $100K minimum investment.

The concept of investing in art for purely financial purposes isn't new. The early generation of art investment funds (e.g., the British Rail Pension Fund in 1974) has long attracted interest among investors looking for higher returns and diversification benefits. Today's fractional ownership model is an extension of the same desire to provide access to investing in an alternative asset class that has long been limited to UHNWIs.

Securitization and fractionalization of the asset class make art more accessible to the retail crowd. That creates volatility in the short term, but opportunity in the long term.

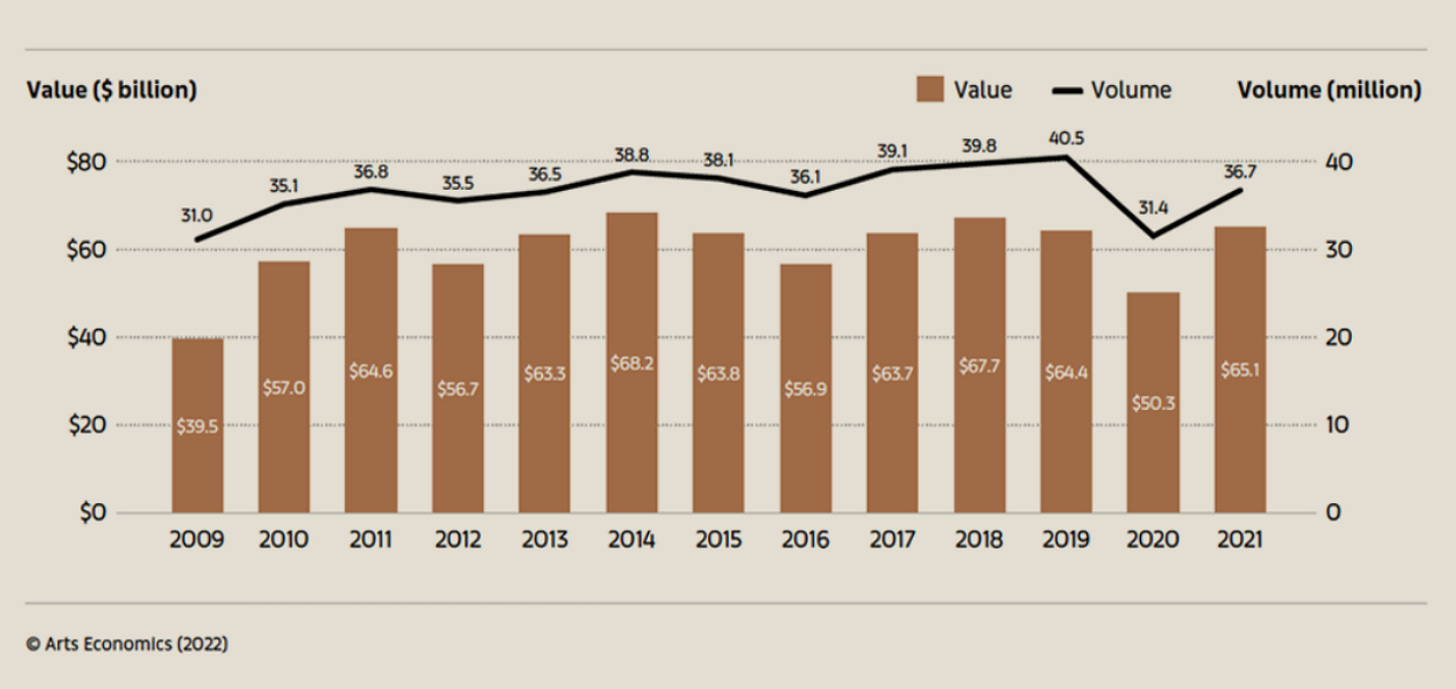

Considering today's macro environment, it is notable that art has historically been able to rebound and grow faster than traditional asset classes during volatile markets. In 2021, aggregate sales of art and antiques by dealers and auction houses reached an estimated $65B, up 29% from 2020, surpassing pre-pandemic levels of 2019. The market becomes more exciting when we acknowledge how much blockchain-based art has challenged the status quo, whereby auction houses are introducing tokenization into the art world, thereby guaranteeing digital proof of the authenticity of an artwork. The latter is critical, considering that 83% of wealth managers said lack of transparency was a key factor that undermined trust in the art market.

But will this time be different? Given the bond market pricing in a semi-high likelihood of a recession, investor fears are high, even in relatively "safe" asset classes — the S&P 500 finished 2022 down ~20% YTD, its worst year since 2008. Masterworks and other similar fractional art investing platforms have a challenging year ahead as investors flock towards the safety of cash. We expect the art market, and all risk assets incidentally, to continue to be slow in 2023, especially with non-blue-chip artists, and investing in emerging artists could lead to no liquidity for an extended period.

🇺🇸 Miami Startup ML Tech Raises $2MM To Make Crypto Trading Easier - The Business Journal, January 4, Florida

🇺🇸 Sanctuary Wealth Chooses Wealthbox For Enterprise CRM Relationship - PR Newswire, January 4, Rhode Island

🇺🇸 Hamilton Lane Closes Direct Equity Fund At Nearly $2.1B In Commitments - PR Newswire, January 4, Pennsylvania

EMEA News

⭐🇦🇪 Digital Wealth Advisor Sarwa Educates New Generation Of Investors In The Middle East - IssueWire, December 28, Dubai

🇬🇧 Bondsmith Becomes A Principal Member Of Visa - Finextra, January 4, London

🇮🇪 Akt.io: Next-Generation Wealth Management App Now Officially Available In Italy - AMB Crypto, January 3, Dublin

Asia Pacific News

⭐🇮🇳 InCred Capital Enters Retail Wealth Tech Space With Orowealth Takeover - Private Banker International, January 3, Mumbai

🇮🇳 HDFC Bank Partners With Microsoft As Part Of Its Digital Transformation Journey - Microsoft News, January 3, Mumbai

Blogs, Webinars, Podcasts

🇺🇸 Digital Assets Inflows Reached $433MM In 2022: Report - Cointelegraph, January 4, New York

🇬🇧 Digital Done Right: Striking A Balance In Modern Wealth Management - IFA Magazine, January 4, Bristol

🇺🇸 Technology And The Succession Disconnect Between HNW Next-Gens And Family Offices - Financial Planning, December 30, New York

🇺🇸 Capitalizing On Digital Marketing Key To Growth For RIAs And IBDs - National Association of Plan Advisors, December 29, Virginia

Events & Reports

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇬🇧 Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

🇬🇧Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.

Very insightful deep dive into fractional art investment, had no idea how sophisticated the sector was