Financial Empires fall -- HSBC to fire 35,000; E*TRADE sells to Morgan Stanley for $13B; Legg Mason's $800B of managed assets bought for $4.5B

Hi Fintech futurists --

In the long take this week, I examine the unbelievable transformation and restructuring happening in high finance. Global bank HSBC is planning to lay off over 10% of staff, looking at reductions of 35,000. E*TRADE is being acquired by Morgan Stanley, integrating its 5,000,000 accounts and $360 billion of assets into the Wall Street investment firm. Legg Mason and its $800 billion of assets are being folded into Franklin Templeton for $4.5 billion, less than what Visa had paid for fintech data aggregator Plaid and half of what Robinhood is likely valued privately. How do we make sense of these developments? How do we appeal to the heart?

These opinions are personal and do not reflect any views of ConsenSys or other parties. Still, you should check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments here.

Thanks for reading and let me know your thoughts here!

Weekly Fintech & Crypto Developments

If you’ve found value over the years from my newsletter, now is the time to give back. I am adding a premium subscription option.

A free "Futurist" tier will continue to include the weekly Long Take. Nothing lost!

A premium “Architect” tier will include an additional 12 key weekly updates with graphs and analysis on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality. You can see an example here: https://lex.substack.com/p/weekly-fintech-and-crypto-analysis

If you subscribe during the next four weeks, you can get a 25% discount for the next 12 months on the list price of $12 per month or $99 per year. Click below to support the work that goes into this writing and subscribe!

Long Take

The human animal did not spread across the world through high quality financial compliance and regulatory conservatism. No. In our lizard brain, there in our spines, is the written fate of our species. This impulse to make tribes, unite, hunt for food, and find fresh water -- this impulse is written into the stories we admire and the thrills we seek. At some point, our ancestors began to build empires and surround themselves with walls of stone. They began to police where once they ravaged. And so too we admire the skyscraper and the cathedral. But we yearn for adventure.

Sitting here now, staring into a rectangular lightbulb, think of what motivates your thinking. Is it the biological thirst for the horizon? Or is it to shield the ornate walls of what has been accomplished?

The empires are falling.

HSBC is laying off 35,000 people. Franklin Templeton is acquiring Legg Mason for $4.5 billion. Morgan Stanley (Smith Barney) is buying E*TRADE for $13 billion. As we move into the digital asset age, the assumptions on which we have built global financial services companies fall apart. The revenue pools supporting mid-market firms evaporate. Profit margins for niche players compress. Everything turns free. Even more importantly, scale becomes an advantage, not a liability. As the tech giants grow, their defensive moats widen and the data monopolies increase.

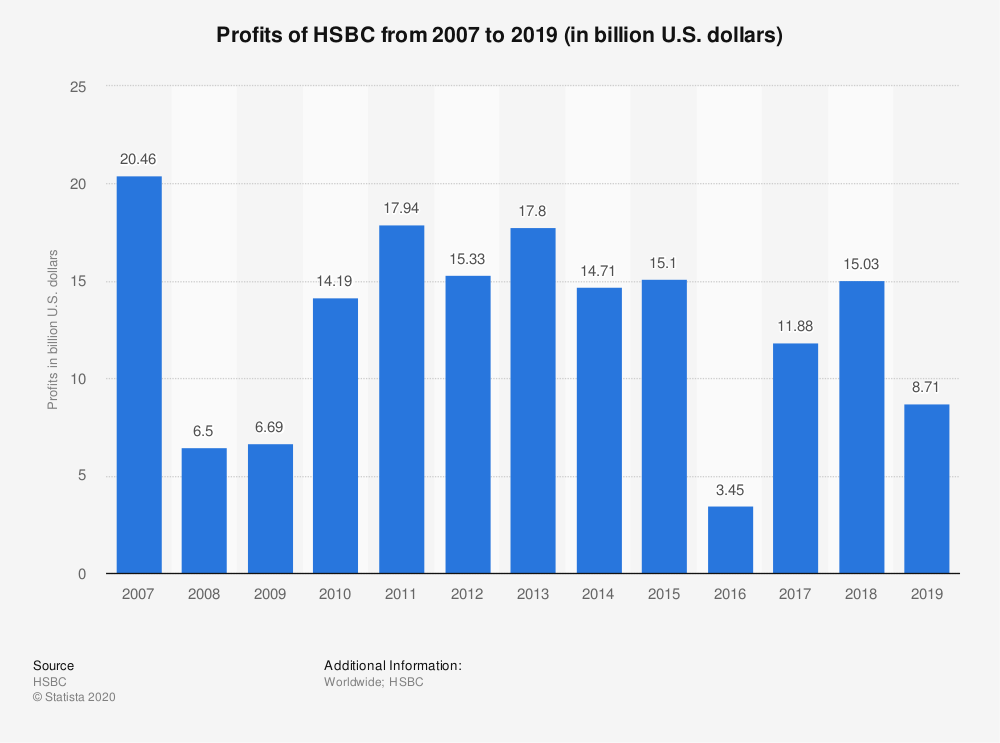

Let's first take a look at HSBC. The headlines point to the spread of coronovirus and associated decreased economic activity as the reason for this massive cut. There is truth in the epidemic (pandemic?) causing meaningful slow-down, up to a 1.5% GDP decrease this year in China, equivalent to a $250 billion annual loss as estimated today. But there are plenty of other international geopolitical factors causing tensions in the region, including the Trump trade-war dance and the battle over 5G infrastructure. If you are a bank correctly sized for a region, you would look at disease as a shock to be absorbed, not a cause for a permanent restructuring of your organization. You would not use it as the core reason.

Yes, HSBC is primarily exposed to Asia, relative to the other geographies. But it also has been on a roller-coaster ride for several years, doing nothing particularly compelling about its profitability. This is an empire being managed, not a set of explorers breaking new ground.

I live in the UK and use HSBC. I can tell you exactly why their offering doesn't work (for me), and why it is only a matter of time before inefficiency and opaqueness are rooted out. Take for example their savings account offering. The sticker savings interest rate is 2.75% -- until you realize that there is a maximum of £3,000 that can be put into this account. Everything above that is free net interest income for HSBC -- they disallow you to earn interest on saving deposits in their platform. For comparison, Goldman's UK version of Marcus goes up to £250,000. It is within the context of this competitive environment that JP Morgan plans to also enter the market. In the US, it would be fairly absurd to say that you cannot use an internet savings bank to earn interest. Just see Bankrate.

If you look at the options HSBC provides for its investment accounts, you get similar nickel and diming. Shares cost £10 per trade, and there is an annual £40 fee for investment asset custody on a brokerage account. For a £4,000 pure brokerage investment account, which is likely above average size for the country, you would be paying 100 bps for absolutely nothing. Shopping around on Lloyds, Barclays, and other UK banks shows the market price of brokerage custody and administration to still be around 20-30 bps. As we know, in the US, trading is priced at $0 via Robinhood, and asset allocation plus investment advice sits at 25-50 bps all in.

While you may think I am nitpicking, the reality is that pricing and product formulation are functions of customer centricity. If at the very edges of consumer offerings we see these disconnects, similar cultural approaches echo through the rest of the business. And in an endlessly venture-funded, Steve Jobs-parroting world, there is no room for anything but putting the customer first.

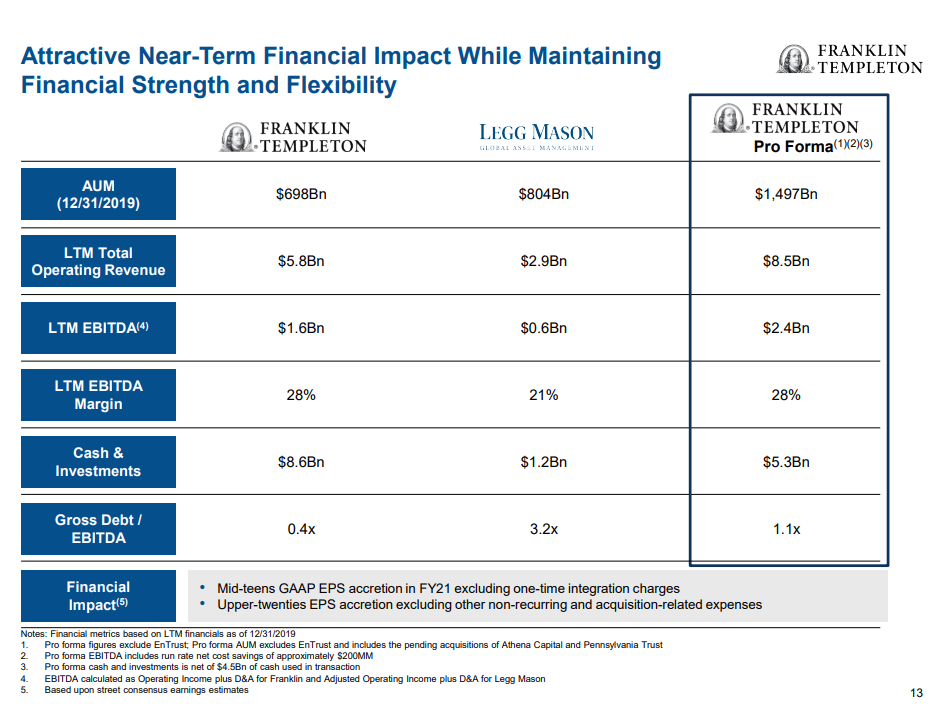

Next, let's look at the Legg Mason transaction. The numbers are mind boggling in many ways. The spreadsheet rationale for the acquisition, which will cost $4.5 billion in equity and $2 billion in outstanding debt (i.e., $6.5 billion in TEV), is $200 million of cost savings. The industry rationale for the transaction is Legg Mason's $800 billion of assets under management, creating a $1.5 trillion AuM money manager. Legg Mason also appears to be quite levered up, so the acquisition leads to a better set of economics for a company maximizing its cashflow rather than growth.

It helps to have some macro industry context when the numbers are so large. Why are these players consolidating at such a rapid pace? I've linked to this fantastic Bloomberg study of the asset management market before, but you should revisit if it is not clear what the effect of passive investing is having on active asset managers.

It is a nuclear effect. In a world where clients and their financial advisors only have the attention span for a 5 second YouTube video, a large proliferation of identical equities-exposed fund families does not work. Only the biggest, largest, and cheapest options can sustain themselves.

If you are in the graph above and your name is BlackRock or Fidelity or Schwab or Vanguard, things are mostly fine. You have managed to transition from alpha to beta generation at scale, and you are deeply embedded into the future of the wealth management distribution landscape. If, however, you are in the chart below, life is a lot less interesting and a lot more anxious. You may have hundreds of billions of assets under management. You may be generating hundreds of millions of fees on those assets. You may be incredulous that a start-up like Robinhood is worth almost $10 billion, while you have an order of magnitude more clients and certainly an order of magnitude more assets.

Let's say Robinhod has 10 million users, with each user bringing between $500 and $5,000 to the mobile app. That looks like $5 to 50 billion in assets. Legg Mason has been bought for a price that is 0.50% of assets ($4.5B / $800B). A similar valuation for Robinhood (or Betterment or Wealthfront at $20B AUM) would put the firm at $100 million or so in valuation. Robinhood raises that for breakfast from celebrity rappers.

The reason why they can do it, and you can't, goes back to the beginning of this write-up. What does the lizard brain say? Will Legg Mason and Franklin Templeton go on exploring new frontiers and discovering new continents? Or will they carefully manage a hard-won empire, while being assailed by irrational barbarians? Anyway, I do wonder whether a B2C fintech should just bit the bullet, take out a $10 billion loan, and acquire Deutsche Bank. That would create some pretty profitable financial valuation arbitrage.

Finally, let's look at Morgan Stanley and E*TRADE. Morgan Stanley weathered 2008 somewhere in the middle. Unlike JPM, it did not have a large retail bank footprint. Unlike Bank of America, it did not get Merrill Lynch. But it did capture one meaningful asset from Citi -- Smith Barney. When it comes to financial advisor businesses targeting mass affluent and high net worth client, Smith Barney was one of the largest in America -- 17,000 representatives in over 700 locations. In 2020, bragging about human and branch footprint does feel anachronistic. Now, the company is fixing that gap by spending $13 billion on online broker E*TRADE to compete with Merrill Edge and the digital investing phenomenon.

There's lots of helpful information in the transaction deck. Of course you shouldn't trust forward looking numbers, like the $400 million in cost savings, but the comp is great. E*TRADE had over $50 billion of cash in checking and savings accounts, which will immediately be accretive. How much cash are Betterment and Wealthfront holding today? Further, $360 billion of assets (and 5 million of accounts) are worth $13 billion, with a valuation ratio of 4% on assets -- between the 0.50% for Legg Mason or 50% for Robinhood. I guess that makes sense too. E*TRADE is a 1980s company, weathering the Internet revolution and the shift to mobile in style, but behind stronger competitors like Schwab and Fidelity.

It is no longer the boat of adventurers hitting some distant unexplored shore, but it is not yet the conservative banking behemoth with a $500 billion valuation. Could E*TRADE have been Ant Financial? Could it have defended better from Silicon Valley's funding glut and ruled mobile? Likely No. And at least by intuition, it is more valuable within Morgan Stanley. Morgan Stanley has the human resources, brand, and strategic clarity to at least copy the playbooks deployed by Goldman, JP Morgan, BlackRock, and Schwab. Whether we can expect financial consolidation and spreadsheet conservatism to drive the future of financial services forward is a more difficult question, with a less likely outcome.

There are so many fun, smaller scale tactical things I would love to talk about. But we have to respect movement of the tectonic plates. We have to pause and gawk at how the experiments across the edges -- free banking, automated investing, financial APIs -- are eroding the titans of several decades prior. Sheets of rock are sliding off into the ocean, catalyzed by continuous onslaught. There are new wild and inventive waters coming into the mix, but for now let's just appreciate the spectacle.

Looking for more?

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.