Fintech: $300MM bet on wealthtech Alpheya by BNY Mellon & Abu Dhabi-based Lunate

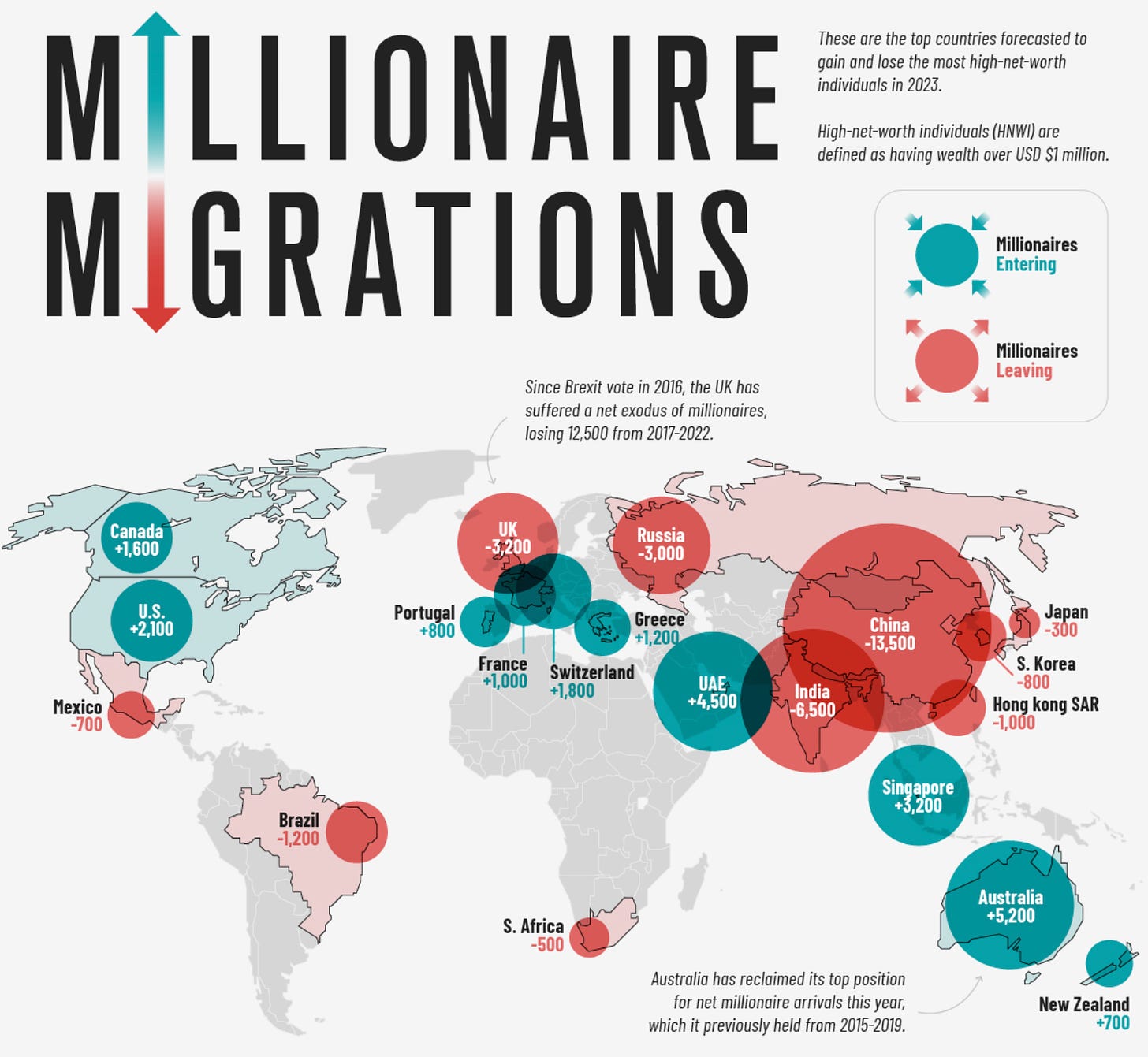

The UAE experienced an influx of 5,200 High Net Worth Individuals (HNWIs) in 2022, the highest among any country, with a projected 4,500 more this year

Hi Fintech Futurists —

You’re the best, today’s agenda below.

FINTECH: Abu Dhabi-based Lunate And BNY Mellon Place A $300MM Bet On Wealthtech Alpheya (link here)

LONG TAKE: What would AGI do to the economy and financial industry? (link here)

PODCAST CONVERSATION: Modernizing private investment infrastructure, with Templum CEO Christopher Pallotta (link here)

CURATED UPDATES

Our 🔥 Cyber Monday 🔥 deal is here! Elevate your experience and become a Premium Member at 50% off! Offer expires at midnight (ET) November 28th.

In Partnership

Join Fintech Meetup (March 3-6), the new BIG event with “the highest ROI” for attendees & sponsors with reasonably priced sponsorships, tickets, and rooms. Join 45,000+ double opt-in meetings, and Network with 5,000+ attendees.

👉 Get tickets Now!

Digital Investment & Banking Short Takes

WEALTHTECH: Abu Dhabi-based Lunate And BNY Mellon Place A $300MM Bet On Wealthtech Alpheya (link here)

Alpheya, a new B2B wealthtech startup, has secured a $300MM investment from Bank of New York (BNY) Mellon and Lunate, and Abu Dhabi-based alternative investment fund with $50B in assets under management (AUM). Lunate is also in talks with Chimera Investment and Abu Dhabi wealth fund ADQ to potentially increase its AUM to $100B — even though the fund only launched in September.

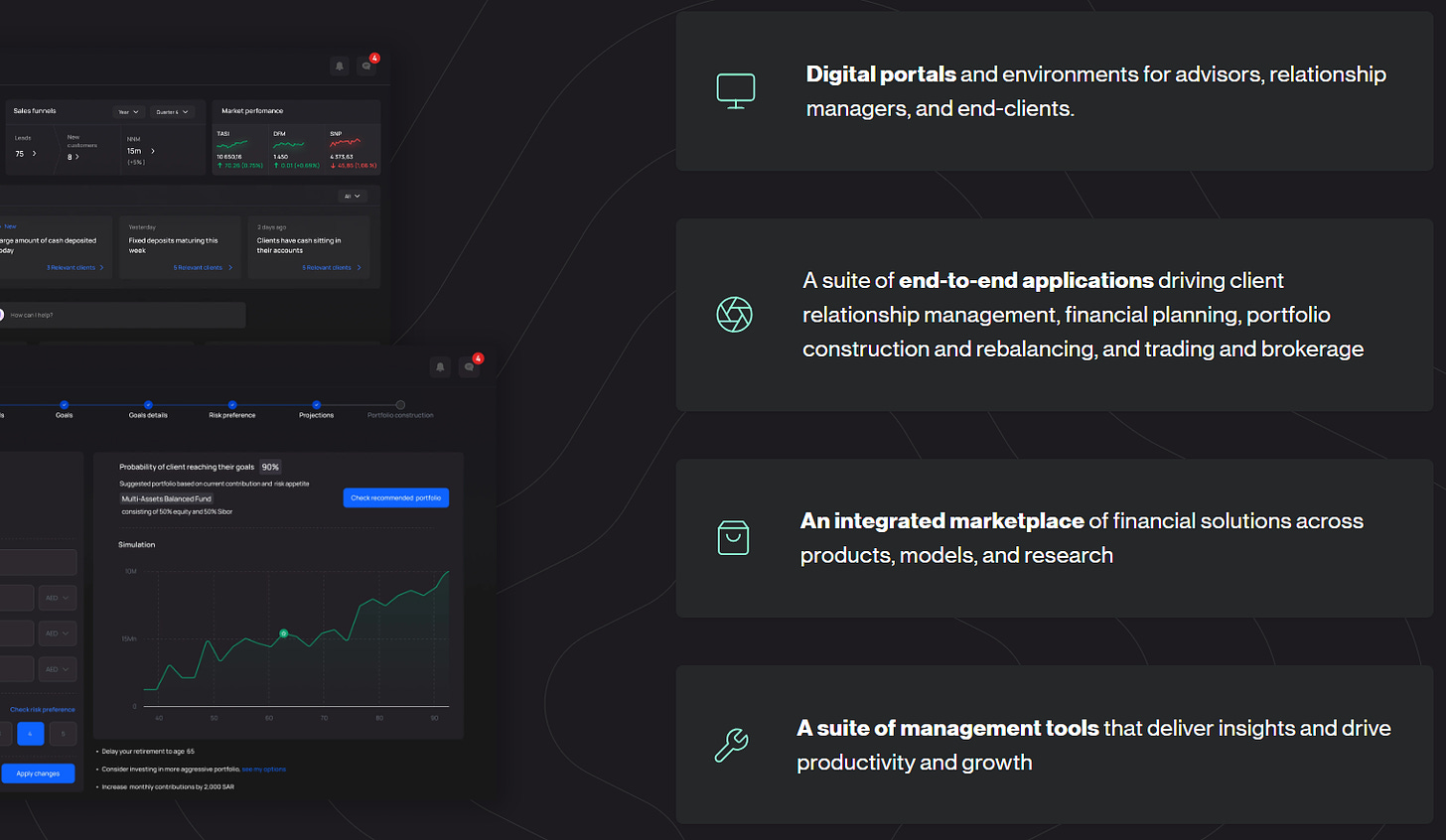

Alpheya will target the UAE’s underdeveloped wealthtech market by offering client onboarding, financial planning, portfolio construction, trading and rebalancing, risk management reporting, and analytics services on a B2B basis to financial institutions starting in Q4 2024.

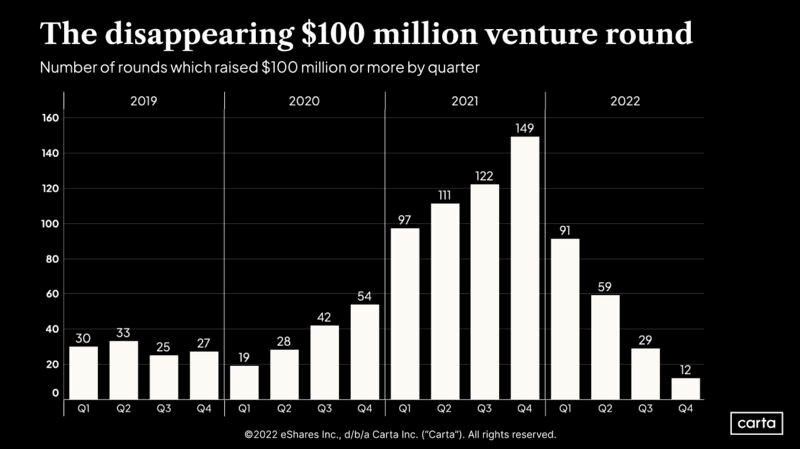

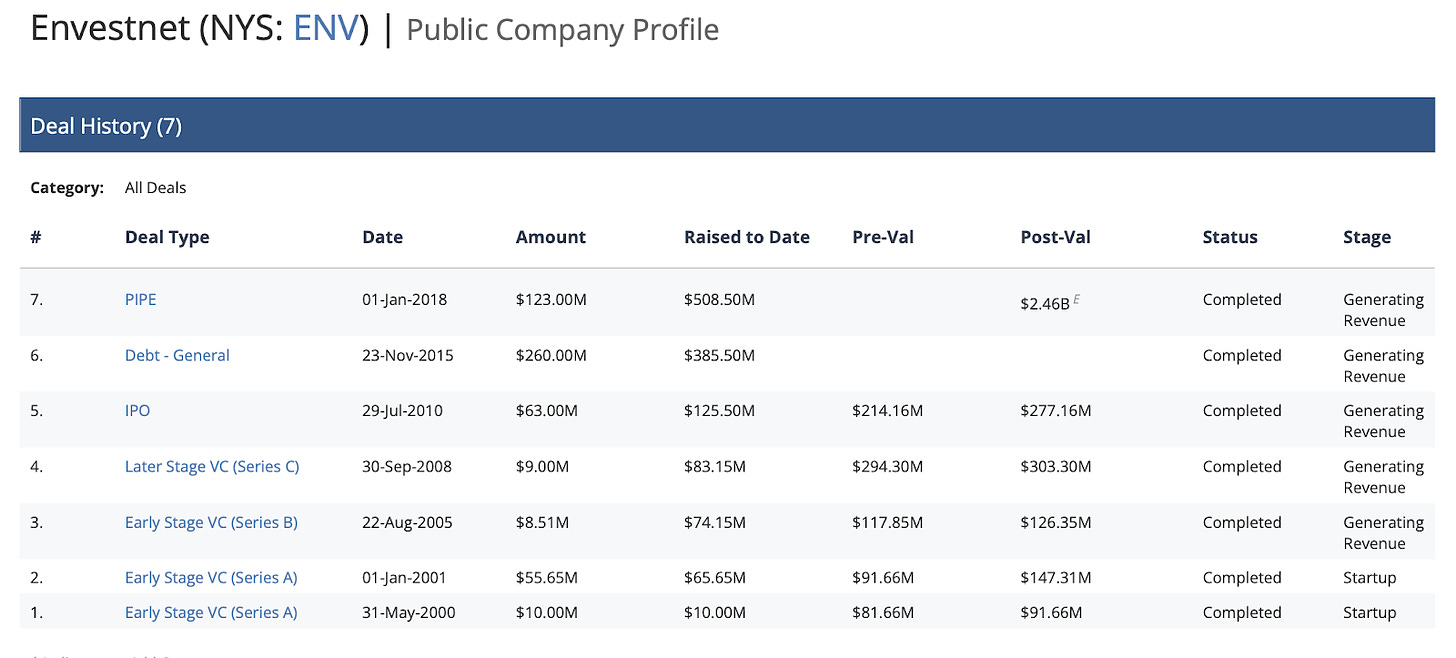

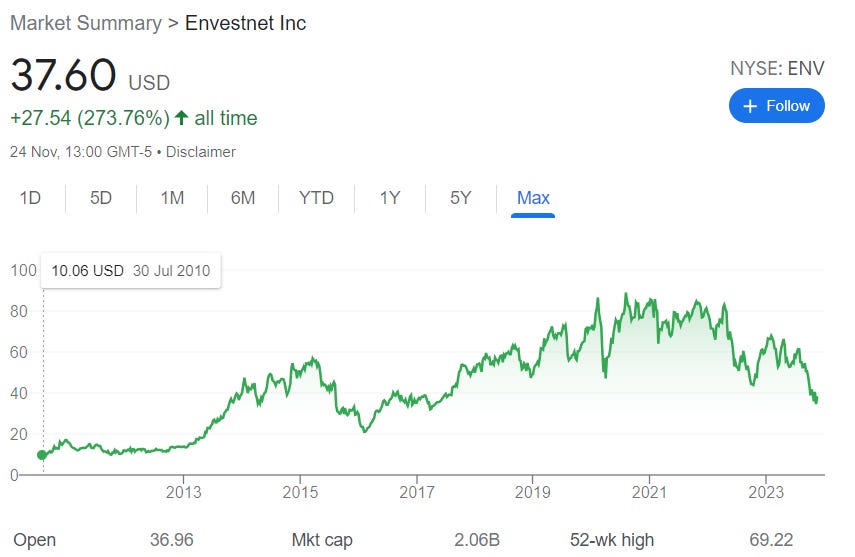

The $300MM raise came as a surprise, considering the dearth of venture rounds exceeding $100MM. Like the rest of the world, MENA's fintech investment has experienced a downturn, with a 75% drop in funding since last year. Additionally, established players like Orion, InvestCloud, Additiv, and Envestnet have been offering similar services and integrations for over a decade. To repeat the obvious — $300MM is a wild amount of money for a pre-traction company with an idea that has been previously accomplished by multiple players over several decades prior.

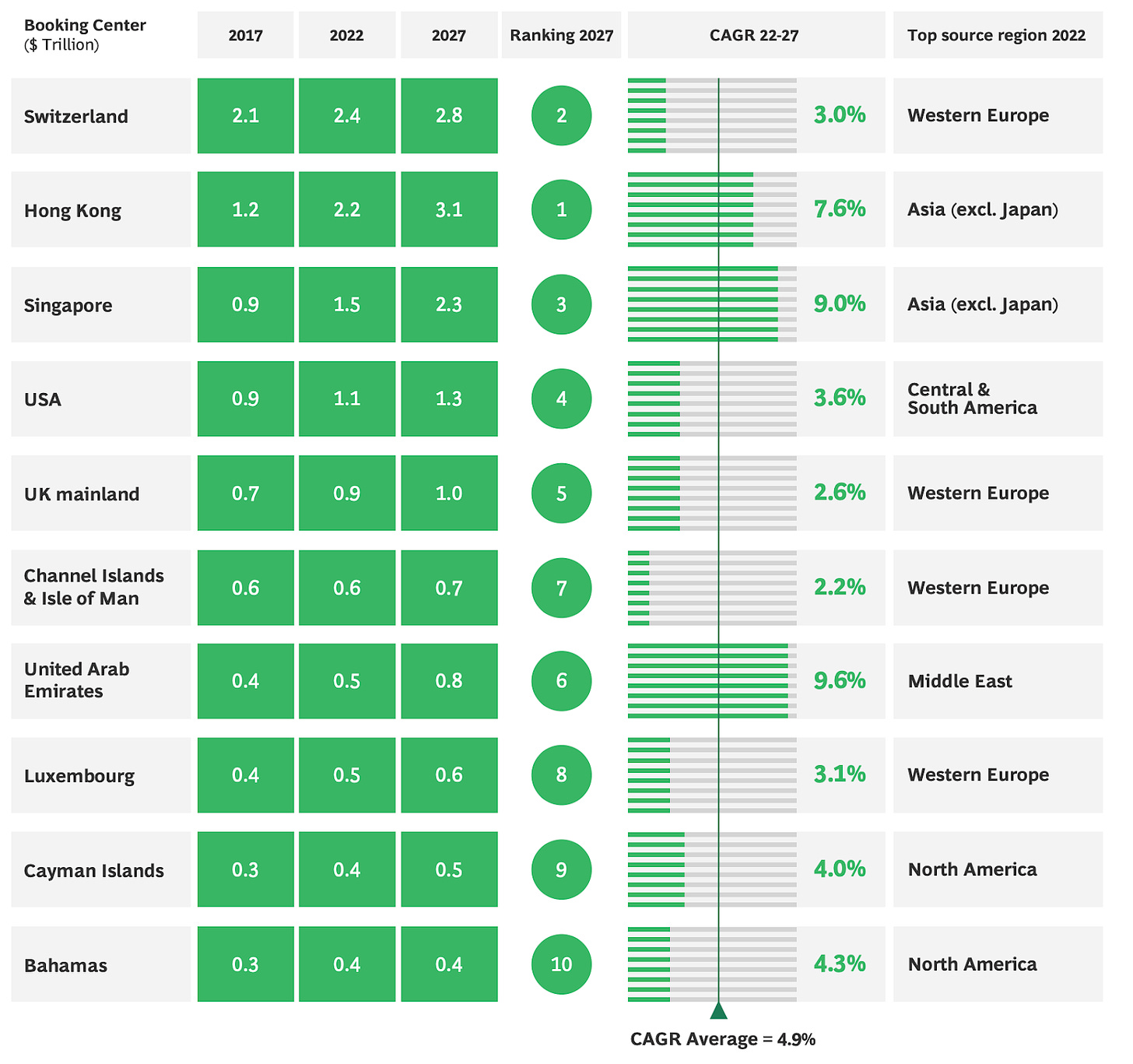

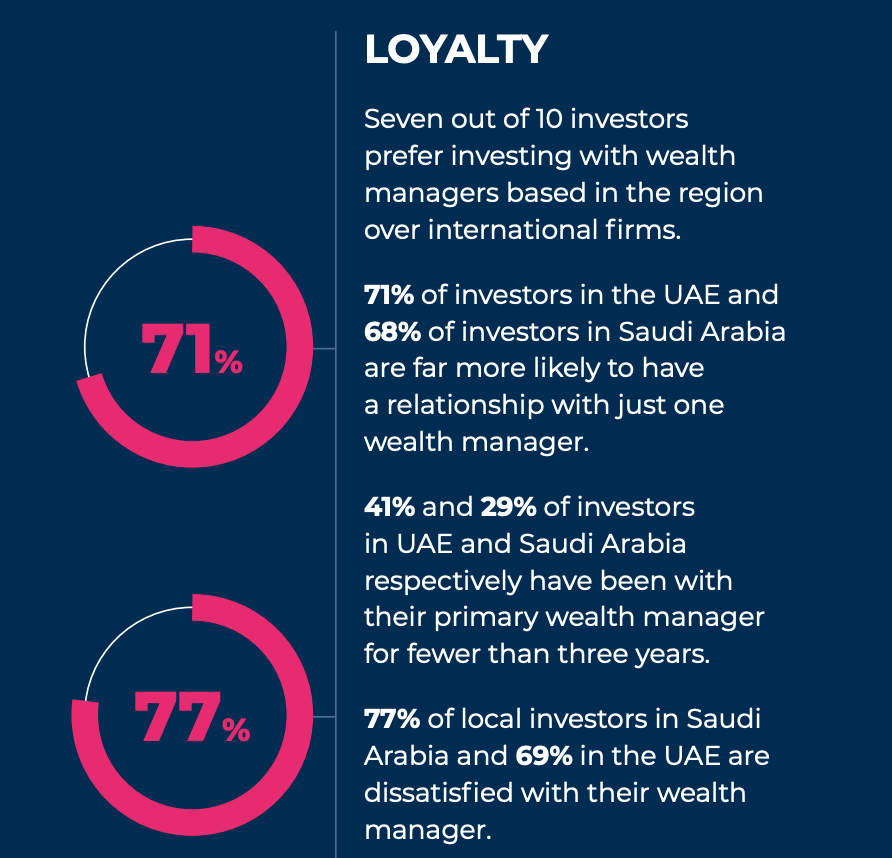

The huge investment can be explained by the limited presence of UAE-focused wealthtech companies catering to banks and large financial institutions. For instance, Neo Mena Technologies lacks the offerings provided by Orion or Envestnet. With 59% of wealth management investors in the Middle East planning to switch providers within the next three years (compared to the global average of 45%), there is an opportunity to consolidate the fragmented market by providing superior products. In addition to this, the UAE experienced an influx of 5,200 High Net Worth Individuals (HNWIs) in 2022, the highest among any country, with a projected 4,500 more this year. Alpheya, backed by Lunate and BNY Mellon, aims to capitalize on the likelihood of these individuals opening wealth management accounts in the UAE, which will be serviced through Alpheya's tech. Notably, the UAE's AUM is growing at a faster rate than other booking centers.

Taking a closer look at the funding patterns of major wealthtechs, these companies have achieved even larger raises (albeit over an extended period). Envestnet, for example, has a $2B public market valuation after IPOing at around $250MM, while Orion raised $2.72B. The backers of Alpheya likely recognize that this is a long-term infrastructure play that aligns with the broader vision of the UAE.

The partnership connections of Chimera Investment and ADQ will undoubtedly assist Alpheya in penetrating the market. Specifically, Chimera is part of Sheikh Tahnoun bin Zayed Al Nahyan’s (brother of UAE’s President, Sheikh Mohammed bin Zayed Al Nahyan) conglomerate, Royal Group. And Sheikh Tahnoun bin Zayed Al Nahyan is also the Chairman of the largest bank in the UAE, First Abu Dhabi Bank. This network of connections creates ample opportunities for Alpheya to establish partnerships with the UAE-based financial institutions.

👑 Related Coverage 👑

Blueprint Deep Dive

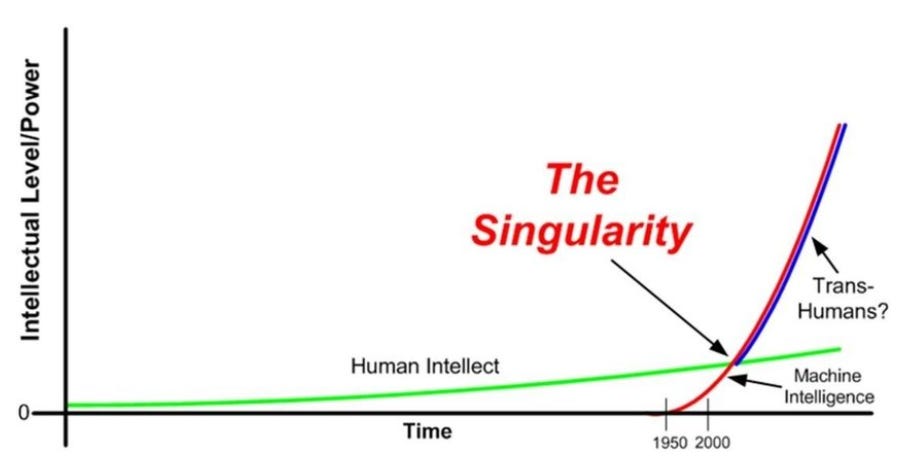

Long Take: What would AGI do to the economy and financial industry? (link here)

We reflect on the turbulence at OpenAI and use that as inspiration to think about Artificial General Intelligence.

What would happen to our economy and financial industry if AGI were released? What if that is what follows all this human drama around LLM models? Further, we point to how AI agents are becoming integrated with blockchains and financial systems for execution capability, pointing to a future machine economy.

🎙️ Podcast Conversation: Modernizing private investment infrastructure, with Templum CEO Christopher Pallotta (link here)

In this conversation, we chat with Christopher Pallotta - founder and CEO of Templum. Templum is the operating system for private markets and alternative assets, paving the way for investors to participate in new asset classes through integrated market technologies and APIs for primary issuance, secondary trading, alternative data and Templum One, its private markets and alternative assets ecosystem solution.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ Mastercard Scores China Breakthrough After Biden-Xi Summit - Wall Street Journal

Credit Fintech Petal Seeks Buyer - Finextra

Klarna Prepares For SEPA Instant Payments With Form3 Partnership - Fintech Futures

CBI Migrates Interbank Corporate Banking Network To Cloud - Finextra

Lending

Financial Operations

⭐ HSBC Customers Hit By Mobile Banking Outage - Finextra

Warren Buffett’s Berkshire Hathaway Exits Paytm At A 40% Loss - TechCrunch

Barclays Invests In WealthOS - Finextra

🚀 Level Up

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Upgrade your subscription today and take advantage of our Cyber Monday deal offering 50% off!

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, monthly digital roundtable discussions with industry insiders.

Next up: Lex’s quarterly report.‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Our 🔥 Cyber Monday 🔥 deal is here! Elevate your experience and become a Premium Member at 50% off!

Premium members receive all the Fintech and Web3 intelligence you need for just $10/month! Offer expires at midnight (ET) November 28th.

How to Reach 200,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.