Fintech: Are Bank of America’s stablecoin plans a sign that incumbents are winning?

A quick compare and contrast of challengers and incumbents

Hi Fintech Futurists —

Narratives change quickly in the attention economy. In crypto, they change even faster. The past few months have been rough for markets as Solana (and other) memecoins shifted from being a potential escape from financial nihilism to a manipulation vessel for the rich to get richer — who knew?

Just as we began recovering from the collateral damage of this profound realization, the U.S. president publicly posts his support for a strategic crypto reserve with, you guessed it, Solana, Cardano, and Ripple. This was later clarified to include Bitcoin and Ethereum too, resulting in a market-wide uptick over the weekend. We see this as a negotiation tactic. Ask for more then settle in the middle. Any reserve will likely have to pass through Congress first or may risk being dismantled under the next administration; we will enjoy a green day in the meantime.

Today’s agenda below.

FINTECH: Are Bank of America’s stablecoin plans a sign that the incumbents are winning?

ANALYSIS: How bad is the $1.5B Bybit exploit by North Korea (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Regulation & Policy, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

Digital Investment & Banking Short Takes

Are Bank of America’s stablecoin plans a sign that the incumbents are winning?

In recent news, we saw Bank of America’s plans to launch a stablecoin and JP Morgan’s neobank experiment coming ahead of UK competitors in recent customer satisfaction surveys.

Meanwhile, a leadership shakeup and floundering profitability at Varo Bank point to potential issues with the digital-first business model. Are the incumbents beating the fintech challengers at their own game? Let’s take a look.

Three years ago, a McKinsey report estimated that fintechs around the world could meaningfully eat into local retail banking revenue pools. In the US, fintechs were expected to nearly double their share from 6% in 2022 to 10% in 2025 if they focused on aggressive customer acquisition.

Of course, the macro environment has changed dramatically since the publication of that report. The increase in global interest rates shifted investor focus to near-term profitability vs. long-term growth. For many this looked ugly, with multiple down rounds in valuation and heavy downsizing. For some, higher rates unlocked a major revenue stream from the re-investment of customer deposits into customer loans and other investment products.

In 2023, the major UK neobanks Monzo, Starling and Revolut made a combined £1.8B in interest income, up from £0.65B the year prior, and driving Monzo to profitability. This income now makes up over 80% of income for Monzo and Starling.

Meanwhile, a single UK incumbent like Barclays made £35B in interest income during the same period. For scale, that means a single local incumbent made nearly 20x times more from lending than all major UK neobanks combined — a far cry from the predicted 10% share.

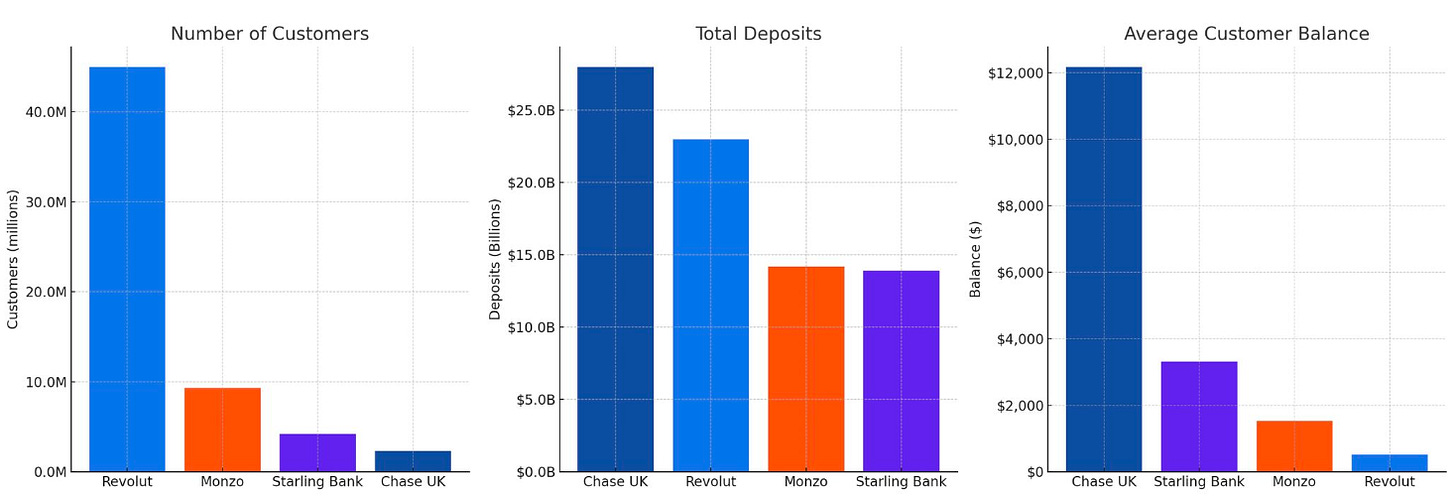

Major banks are still very, very good at the core banking business; partially because they can leverage their perceived trust and a wider age demographic. This in turn leads to higher average balances which get re-invested across a more diversified lending portfolio.

And more importantly, trust is a transferable asset.

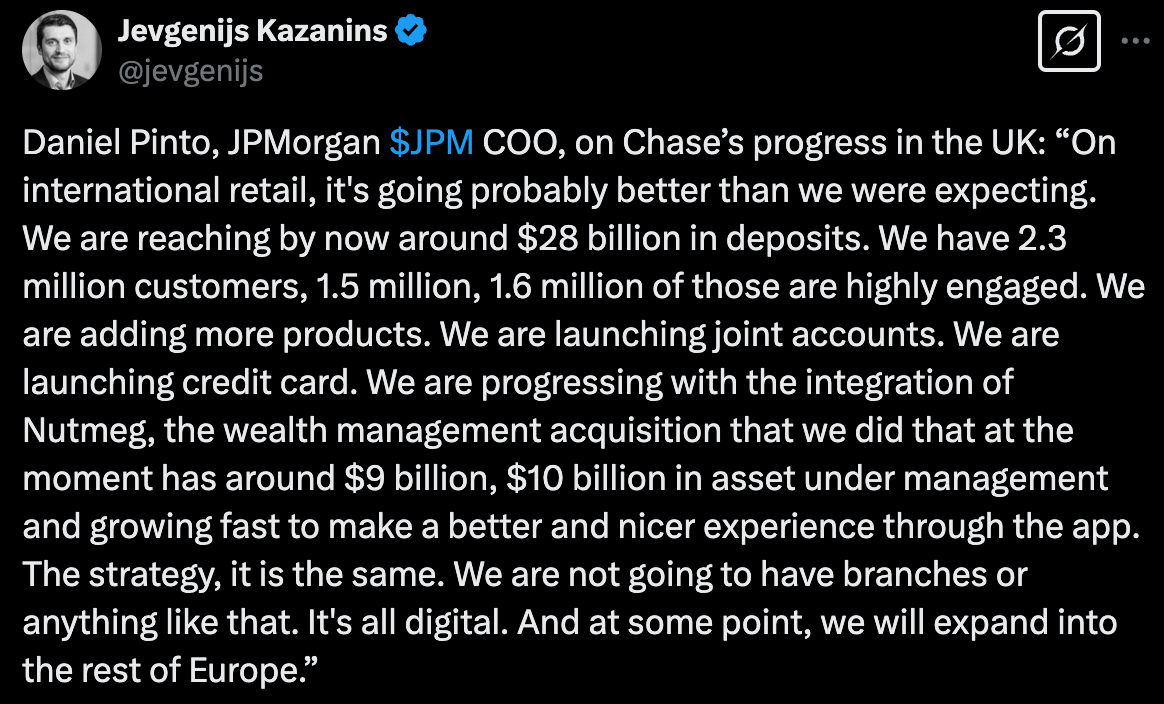

When a large institution like JP Morgan launches its own neobank, Chase UK, it’s able to attract higher average deposit sizes than any other challenger bank in the region. The result is fewer but higher quality customers.

In stark contrast to this stands US-based Varo Bank, which just announced its CEO Daniel Walsh is stepping down after posting $65M net loss last year. Jason Mikula wrote a fantastic deep dive into the bank’s financials last month.

As the first neobank to win a banking charter, Varo would in theory have been a major beneficiary of higher interest rates. Instead it struggled to attract the customers necessary to make it happen. As Jason put it, “Varo’s reported number of accounts increased 20% vs. the end of 2023, its total deposits increased by less than 4%, suggesting the customers it’s acquiring either aren’t actually using the accounts they’re opening at Varo or are keeping very little money in them.”

The average customer balance at Varo is just $65 compared to the $12,000 held in a Chase UK account.

In order to compete, Chase UK had to build an experience at least on par with that expected by a neobank. Last month, it officially succeeded by ranking first place in the UK customer satisfaction survey conducted by Ipsos. Monzo is a close second, but all neobanks ranked above the incumbents.

Other incumbents are also investing in the digital experience.

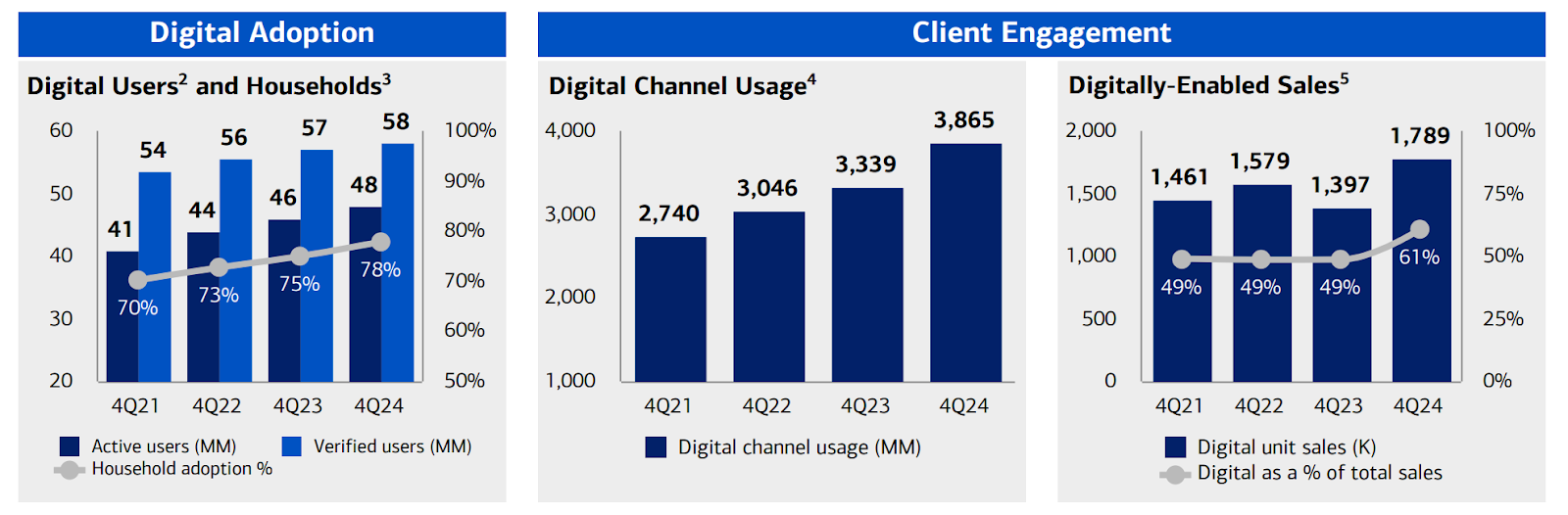

Banks upped their annual technology spend by 9% annually over the past few years to a total $650B (source). Bank of America makes up about $12B of that, with $4B dedicated to purely new initiatives such as AI and crypto. The bet is seemingly paying off. Engagement through the bank’s digital channels is up by +41% over the past 4 years with P2P digital payment volumes through Zelle up nearly double to $127B.

While some investors are frustrated that revenues haven’t been growing fast enough in comparison, the new focus on technology has certainly made banks appear more proactive. Bank of America recently announced it would enter the $200B stablecoin market once crypto regulation becomes clearer. This follows in the footsteps of PayPal that launched its PYUSD in 2023, but so far only accounts for 0.3% of stablecoins in circulation.

The bank cited faster and more efficient money movement — domestic ACH transfers settle between 1-3 days — as the key driver behind the decision. What’s also enticing for BofA is the $13B in profits made by the world’s largest stablecoin issuer Tether with USDT. Issuers make money through its reserve, which backs each issued dollar token 1:1 and is re-invested in short-term treasuries.

These developments suggest the incumbents are closing in on the challengers. This is of course not entirely the case. Some companies have continued to see strong customer growth and expansion. For example, Klarna is eyeing a US IPO this April after the region became its largest market by revenue and Revolut confirmed 50 million customers last November and a $45B valuation in the summer.

What we are likely seeing is the UX moat that drove many fintechs’ initial popularity beginning to wane, and the focus increasingly turning to unit economics and sound business models.

👑 Related Coverage 👑

Long Take

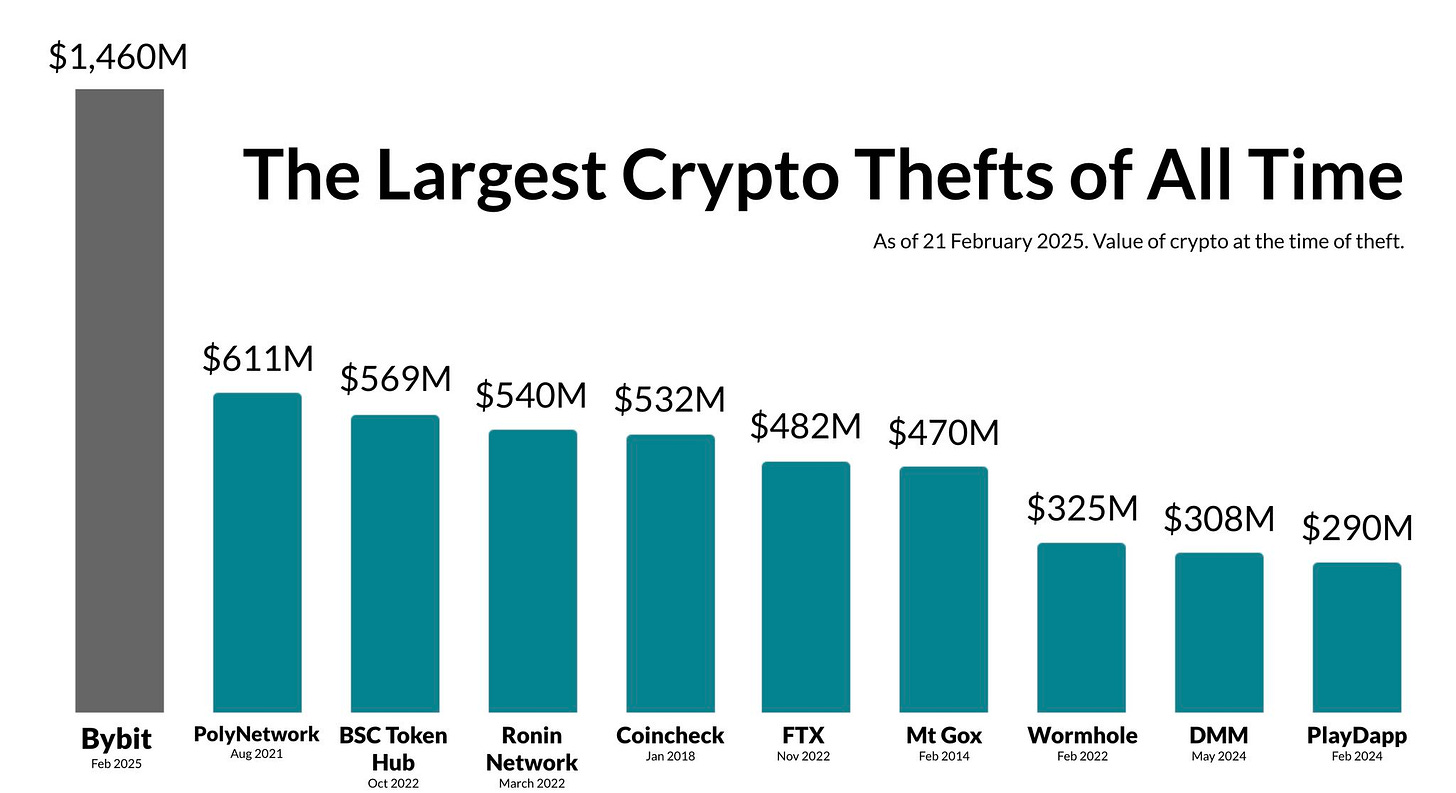

We examine the largest crypto heist in history conducted by The Lazarus Group last month, stealing $1.5B from the Bybit exchange through social engineering and phishing attacks on its multi-signature wallet system.

Despite rapid asset tracing by blockchain forensics firms, the hackers have already laundered $335M using tools like Tornado Cash and meme-token platforms on Solana. While Bybit managed to cover its losses through loans and asset liquidations, the attack has triggered a market-wide confidence crisis, erasing $1T from crypto’s total market cap and plunging sentiment into extreme fear.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ Stripe finalizes tender sale at a $91.5B valuation - Techcrunch

Rapyd reportedly in talks over new $300m funding round at $3.5bn valuation - Fintech Futures

Fraud Detection Startup Sardine AI Wraps Up $70M Series C - Crunchbase

Neobanks

⭐Taktile helps fintechs build automated decision-making workflows - Techcrunch

Alkami boosts account opening capabilities with $400m Mantl acquisition -Finextra

Brazil's Nubank expects to unveil new market this year- Reuters

Lending

Revolut Is Moving Into Commercial Real Estate Lending- Bloomberg

Method is helping fintech companies like SoFi build repayment functionality into their apps- Techcrunch

Paytm Ties Up With RBL Bank To Boost Digital Adoption Among Lender's Merchant Partners - NDTV

Digital Investing

EToro files for IPO - Finextra

Robinhood closes $300m deal to buy custodian TradePMR - Citywire

UK WealthTech Fundment raises £45 million - EU-Startups

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice