Fintech: $30B in fraud targeting seniors, Carefull raises $16MM to protect elderly

Carefull works with banks and asset managers, compiling the issues faced by their users to give a holistic view of threats and trends.

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Hi Fintech Futurists —

You’re the best, today’s agenda below.

AI: Carefull lands $16.5M to shield seniors from financial fraud (link here)

LONG TAKE: The difference between Generative AI and Machine Learning for Finance (link here)

PODCAST CONVERSATION: Mastering fintech from public to private investments, with Portage CEO Adam Felesky (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Digital Investment & Banking Short Takes

AI: Carefull lands $16.5M to shield seniors from financial fraud (link here)

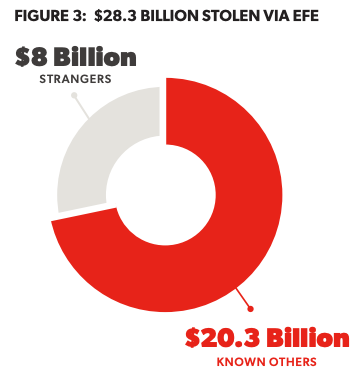

Carefull has raised $16.5MM in Series A funding, bringing total funds raised to $19.7MM, as it builds tools to prevent financial fraud targeted at seniors. Currently, seniors lose $28.3B to criminals annually. Further, 72% of scams are perpetrated by people known to the victims, such as advisors, friends and family. Seniors are often targeted for their socioeconomic circumstances, lack of technical proficiency, and even the declining state of their health.

Carefull focuses on the association between cognitive decline and financial vulnerability. Research indicates that there is a link between potential early warning signs of certain neurological disorders and financial issues. For instance, Johns Hopkins research shows that missing payments could indicate the beginnings of dementia, with those affected by Alzheimer’s developing subprime credit up to six years before their diagnosis.

Carefull’s solution is using AI to scan customer financial accounts to identify activity indicative of financial exploitation. Its models claim to be able to identify behavioral and anomalous financial patterns, which are then flagged for the user or financial institution. Beyond algorithmic monitoring, Carefull also assists with negotiating and canceling bills, performs identity and credit monitoring, and reviews home titles quarterly to identify fraud and tampering. Carefull also works with banks and asset managers as customers, compiling the issues faced by their users to give a holistic view of threats and trends. For instance, Carefull may notice that users within a particular town are falling victim to mortgage scams and can flag this to the relevant institution to identify culprits or to provide warnings to users within that geography.

Carefull sells directly to customers for $299 a year or $29 a month, with enterprise plans available for advisors and wealth managers that enables them to offer the service to clients for free. We like Carefull for its psychological research approach to financial fraud. There are other competitors in the AI fraud detection space, including Fraugster and Hawk AI, but this is the first player we have seen specifically focusing on the challenges faced by seniors. Not only does it help those more vulnerable who may not have the necessary support, but it also takes the workload off of caregivers who may be talented at elderly care, but not at personal financial management and/or fraud detection.

👑Related Coverage👑

In Partnership

Mule in the middle: Where all new account fraud, ATO & scam money lands

👉October 19 at 2pm ET

Financial Institutions of all stripes are grappling with the uptick of money laundering accounts in their portfolio today. All of this bad money often lands into a web of interconnected accounts that are used to launder it.

Join experts from BioCatch and Varo as they discuss:

The common fraud schemes that are in use today

The new-age technology that is effective in protection

The biggest pain points for all banks and fintechs

How to Reach 195,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging. Contact us to learn more about our custom opportunities.

Blueprint Deep Dives

Long Take: The difference between Generative AI and Machine Learning for Finance (link here)

We delve into the progression and potential of generative AI in the current technological landscape.

Examining generative AI's position in the hype cycle, we highlight how this technology transcends mere decision-making to actively create human-like content, primarily appealing to human senses. Drawing parallels to transformative tech shifts like personal computers and mobile phones, the potential for generative AI to become a core part of human interaction and productivity is underscored. Yet, amidst the optimism, there's caution to discern between genuine utility and mere novelty as the technology evolves. Finally, we explain the difference between machine learning and generative AI applications in financial services.

The AFC Policy Summit serves as a pivotal gathering for industry leaders, regulators, academics, and policymakers.

Confirmed speakers include Congressman French Hill, Chairman of the Subcommittee on Digital Assets, Financial Technology & Inclusion, Mark Gould, Chief Payments Executive, Federal Reserve Financial Systems, among many more.

👉Register before 11:59pm October 20 and SAVE 20%!

Podcast Conversation: Mastering fintech from public to private investments, with Portage CEO Adam Felesky (link here)

In this conversation, we chat with Adam Felesky - Co-Founder and CEO of Portage.

Adam is responsible for overseeing Portage’s strategy to invest in leading fintech opportunities on a global basis. Within the investment portfolio, Adam is a board director of Alpaca, Boosted.AI, Borrowell, Clark, Hellas Direct, KOHO, LoanStreet, Socotra, and TheGuarantors and executive chairman for Grayhawk Investment Strategies. Adam is also a Managing Partner and a member of the Management Committee at Sagard, a multi-strategy private asset manager.

Curated Updates

Here are the rest of the updates hitting our radar.

AI

Payments

Wealthtech

⭐ Goldman Sachs Sells GreenSky Platform and Loan Assets - PYMNTS

BlackRock Invests in German Fintech Targeting New Investors - Bloomberg

Alpaca seals $15m strategic investment from Japan’s SBI to boost Asian financial services - Fintech Global

Armed with $40M in fresh capital, fintech Stash says it’s moving toward an IPO - TechCrunch

Financial Operations

⭐ Open banking led to a fintech boom — as Brite raises $60M, account-to-account payment grows - TechCrunch

Block acquires music financial services startup Hifi - TechCrunch

Canopy Servicing’s $15.2M Series A1 shows fintech startups that raised in 2021 can still get money - TechCrunch

Office Hours: Surviving the Trough with Federico Travella

👉October 19 at 11am ET

Office Hours is a live, digital roundtable discussion exclusively for Premium Members of The Fintech Blueprint community. This Thursday we welcome Federico Travella, Founding CEO & Executive Chairman, Novicap for a conversation about navigating the current environment and the levers founders have in the absence of venture capital.

All Premium Members receive a zoom link prior to the event. If you are not yet a Premium Member, subscribe here to join this week’s Office Hours.

Shape your Future

Curious about what is shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands

Merci