Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Before we dive into today's podcast, we have a special offer to share. For the next 2 days, we are offering The Fintech Blueprint Premium Membership at a 20% discount. In addition to Monday and Thursday’s free newsletters, you will receive full access to:

🔍Wednesday's in-depth Long Takes: Dive deeper into fintech's evolving universe.

🎙️Friday's Podcasts: accompanied by data-driven transcripts.

📚Archival Access: insights from 50+ leading Fintech and DeFi brands.

🚀The 'Building Company Playbook' Series: Your step-by-step guide to fintech mastery.This 2-day window is your golden ticket to remain at the forefront of innovation. Your passion, curiosity, and drive deserve the very best.

The 2-day window is your golden ticket to remain at the forefront of innovation. Your passion, curiosity, and drive deserve the very best.

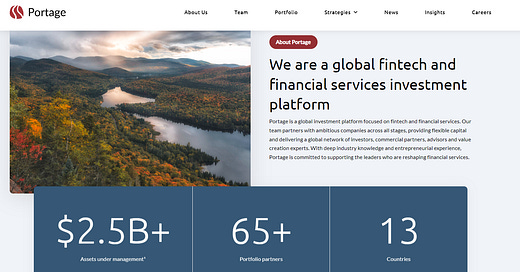

In this conversation, we chat with Adam Felesky - Co-Founder and CEO of Portage. Adam is responsible for overseeing Portage’s strategy to invest in leading fintech opportunities on a global basis. Within the investment portfolio, Adam is a board director of Alpaca, Boosted.AI, Borrowell, Clark, Hellas Direct, KOHO, LoanStreet, Socotra, and TheGuarantors and executive chairman for Grayhawk Investment Strategies. Adam is also a Managing Partner and a member of the Management Committee at Sagard, a multi-strategy private asset manager.

Prior to Portage, Adam was the Founder and Former CEO of Horizons Exchange Traded Funds, and a director and founding investor of BetaShares Exchange Traded Funds in Australia that was acquired by Mirae Asset Management of South Korea. Prior to this, he worked in JPMorgan’s Derivatives group in New York. Adam began his career in investment banking at CIBC World Markets.

Adam holds a B.Eng. and B.A. in Political Science from McMaster University.

Topics: investment, investment management, fintech, M&A, ETFs, venture capital, vc, private equity, roboadvisors, AI

Tags: Portage, Wealthsimple, Alan, Betterment, Wealthfront

👑See related coverage👑

Fintech: SoftBank unblocks Revolut from getting UK banking license; Apex launches Fractional Fixed Income

[PREMIUM]: Long Take: Why $ billions are flowing out of Banks into Money Market Funds, and how startups can benefit

[PREMIUM]: Long Take: Down from $6B to $500MM, better for Better Mortgage to stay private

Timestamp

1’21”: From early passion to industry pioneer: The journey of ETF entrepreneurship in 2005

8’29”: The intersection of asset allocation and individual investments: Navigating two worlds in wealth management

11’41”: Exploring the robot-driven dynamics of fund complexes, trading firms, and quant hedge funds

18’25”: Unpacking the Wealthsimple investment: From founding to differentiation in the digital investing wave

21’04”: Navigating investment stages: Assessing startups from seed to series A

27’33”: Valuation challenges in fintech: The blurred traction and market trends

30’02”: From entrepreneur to investor: Mastering the art of saying no

32’59”: Fintech's future: Portage Ventures' promising themes and market structure insights

37’53”: Assessing risk and the credit cycle: A conversation on market perspectives

41’12”: Unlocking growth potential: Strategies for overcoming valuation challenges in fintech

44’59”: The channels used to connect with Adam & learn more about Portage

Sneak Peek:

Adam Felesky:

…I'm a firm believer that markets are efficient, but sometimes they can be ignorant for a while. I do believe that M&A ... And I've been wrong on this, to be candid, because we really have seen a dearth of M&A. But I think M&A activity is going to be part of the solution. And I also believe that buyouts going to play a role here. That it's just going to make more sense for some of these companies to be taken out of the public markets and operate and exist in a private forum before ever returning to the public markets. And so, I think as a fintech investor in the private markets, you need to bet that these companies are going to have to be private longer because the scale for them to exist in the public markets, that threshold has just gotten a lot more significant. I think that's what a lot of people missed is going public seems like a great idea, but if you're on the cusp of what a mid-market cap company is, if you have any bumps in the road, all of a sudden, you're irrelevant to everyone.There are very few pools of capital looking for micro-cap companies. And so, I just think you're going to have to stay private longer, and as a result, investors are really going to have to think about how they reserve against their positions. And we're thinking about this a lot. We used to reserve…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions