Hi Fintech Futurists —

Today’s agenda below.

FINTECH: Chime IPO Primer - Can it hit $15B?

ANALYSIS: From Vanguard to Believe App, investing collapses into short form contentise (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). Prices will be going up soon, so lock it in now.

Digital Investment & Banking Short Takes

Chime IPO Primer - Can it hit $15B?

Chime is among the pure-play neobanks that emerged post-financial crisis in the US. Its upcoming IPO is in many ways a full-circle moment. Some of the banks it set out to disrupt are now hired to run its public debut. For us analysts, it’s an opportunity to dive under the hood of one of America’s earliest challenger banks.

Founded in 2012 by the former CPO of Green Dot Chris Britt and his co-founder Ryan King, Chime set out to offer modern financial services to low-and-middle income Americans to counter the predatory fees by traditional incumbents. Today, the company serves 8.6M active users, of which an impressive 67% are primary bank relationships.

Let’s remind ourselves of the problem it’s solving.

Major US Banks make the majority of their revenues (circa 70%) from net interest margin (NIM), the spread between interest on money lent out versus what they pay to attract deposits. The majority of deposits are held by high-income households with large savings and good credit scores. This makes them a profitable source of net interest income for the Bank.

Meanwhile, less than 35% of deposits are held by the population of earners with salaries up to $100K a year; which represent 75% of the adult population in the US, or 196MM people. Banks struggle to monetize these users under the NIM model – lower credit scores and smaller deposits mean higher costs for worse profits.

To make it worth their while, banks will charge fees. Some of these fall under interchange and payment processing income, but many of them are late payment, overdraft, and ‘maintenance’ fees. Last year, around 95% of banking fees in the US were paid by households earning up to $175K a year.

The CFPB estimates that financially struggling Americans pay c. $300-400 in annual fees to legacy banks.

This is where Chime comes in.

“Chime is a technology company, not a bank.”

The first line of Chime’s IPO filing is a firm reminder of its business model. Chime outsourced much of the costly and regulated banking activities to third parties while building out its own cloud-native tech stack. A combination of the BaaS model and a stronger data engine enabled it to build a consumer finance app that offers traditional banking products but without many of the usual maintenance and overdraft fees.

Chime has built its ecosystem out to include lending, credit building, and innovative features like Get Paid Early (2 day advance on monthly salaries) and SpotMe (free $200 overdrafts).

The economics work because its annual cost-to-serve retail customers is 3x lower than the top three U.S. banks by deposits (Bank of America, JP Morgan, and Wells Fargo). One part of these savings come from ongoing efficiencies unlocked by the tech stack. In the last three years, fraud losses and customer support costs declined by 29% and 60% respectively.

But the main reason is that costs associated with compliance, balance sheet, and issuance are handled by Bancorp Bank and Stride Bank. The company previously outsourced payment processing as well to Galileo, but has recently shifted to its own internal ChimeCore stack.

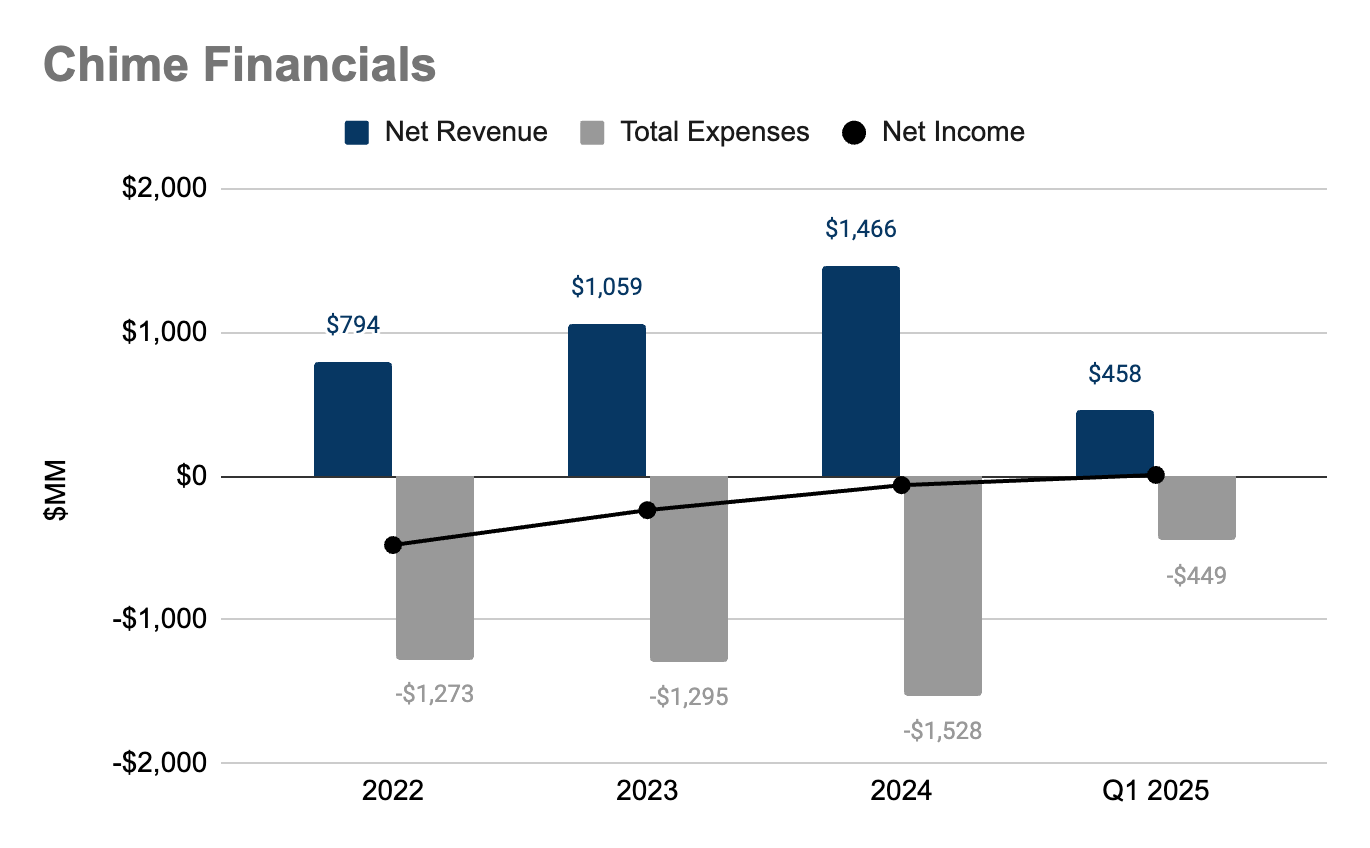

In 2024, Chime generated $1.7B in annual revenue (+30% YoY) with $115B in purchasing volume (+24% YoY) and 8.6M active users (+23% YoY). The company made a net loss of $62MM but this has been narrowing over the past few years. For the last two quarters, Chime was slightly profitable on net income.

Chime is ahead of major US competitors on most metrics except for Cash App,