Analysis: From Vanguard to Believe App, investing collapses into short form content

The Technium is leading us to create faster systems, but for worse outcomes.

Gm Fintech Architects —

I have opened up this premium edition to everyone given the importance of the subject matter (to me). Hope you enjoy it.

Today we are diving into the following topics:

Quick Analysis: We discuss the rationale and outcomes for the acquisition of Circle by Coinbase and Ripple.

Main Article: We reflect on how the relentless pursuit of technological novelty — the expansion of the "Technium" — has led to unintended consequences, particularly in financial services. As investment models evolved from traditional asset allocation to angel investing, tokenization, and meme-driven crypto trading, the financial landscape has become saturated with short-form, speculative instruments lacking real economic substance. Platforms like “Believe” now enable near-instant memecoin launches, turning financial markets into social performance art. This shift reflects broader societal issues: fragmented attention, politicized discourse, declining fertility, and economic inequality, all amplified by technology. While building onchain capital markets remains a worthy goal, what gets built matters — and nihilistic speculation is not a sustainable foundation.

Topics: Vanguard, BlackRock, Fidelity, JP Morgan, Goldman Sachs, Wells Fargo, BNP Paribas, Autonomous Research, Solana, Cliza, Believe, Kevin Kelly, Peter Thiel, Marc Andreessen, DOGE, Trump Token, Kelsier

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

On Circle’s path — IPO, Coinbase, or Ripple

A lot of you have been wondering about the rumors of Circle being acquired by either Coinbase or Ripple.

Circle would entertain this path if its IPO looks less attractive than getting acquired.

Assessing the outcomes of the IPO would be to look at (1) initial consideration, (2) long term growth, (3) amount of management team control. Given the tariffs uncertainty, the Russia/Ukraine war and political uncertainty, and general volatility in the markets, the fintech IPO window is flickering — generally on, but sometimes off. We have only written this many IPO primers during the SPAC boom of 2021, and that turned out badly.

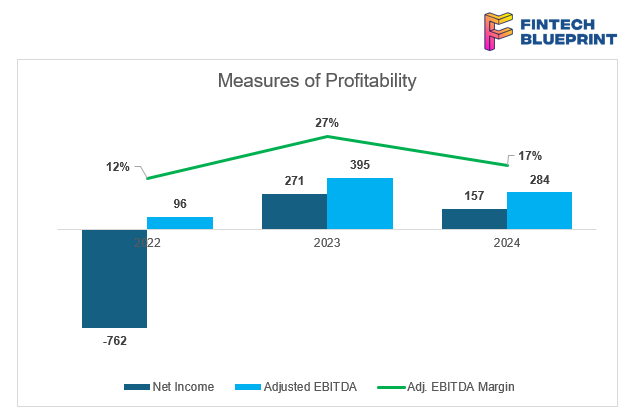

Here’s a reminder on Circle’s economics and the key chart.

The company generates a lot of revenue from the USDC pure bet. It has a number of projects in the wings, like the Circle Payment Network, and it also massively benefits from the Stablecoin-related GENIUS Act making its way through Congress.

But from a financials perspective, distribution costs — primarily to Coinbase — are high and getting higher. On a revenue basis, $6.5B marketcap is 10x 2024 net revenues, and 20x Adjusted EBITDA. Who knows how the initial roadshow had gone with bank analysts looking at this asset and pricing it. A $10B target is a bit expensive.

Coinbase and Ripple are both motivated buyers, and have strong strategic synergy to own the asset. There are many things to say about Ripple, but let’s just frame it as follows: Ripple has always been in the institutional payments business, has acquired and/or launched various money remittance and payment orchestration initiatives, launched its own stablecoin, likely runs at a few hundred million of revenue, has spent $1B+ on prime broker Hidden Road, and is backed indirectly by a $230B asset in the form of $XRP.

They are capital rich and interested in legitimacy and market position. Ripple is likely the least price-sensitive of the bidders.

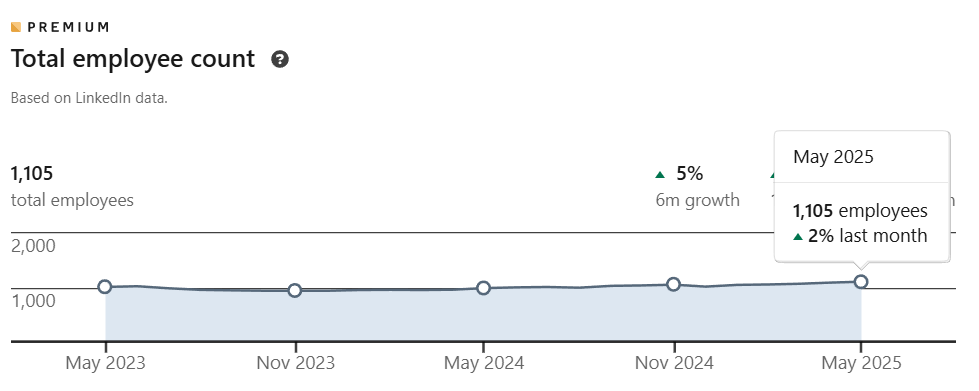

Coinbase, on the other hand, already has 50%+ of the economic benefits of USDC without regulatory risk, and Circle’s 1,000-person headcount.

For Coinbase, I would expect the acquisition to be about control and vertical integration. They would continue defaulting USDC as the cash-sweep for the main exchange as well as the Base chain, and they could also super-charge the payment orchestration business a bit as a result. The revenue would not be that material, but incrementally Coinbase could probably grow the asset. The downside is having to remove cost synergies from the business — i.e., firing a meaningful portion of Circle staff — and potential issue where other exchanges would be less interested in USDC.

From a competition perspective, we hope Circle stays independent and is able to grow into a $1T tokenized money market fund used by the West more broadly.

Leave a comment if you want us to dive deeper on any part of this.

Opinion

The Chalice

We have all been poisoned.

I’ve been in this business for a long time, relatively speaking.

My compass is pretty straightforward — curiosity and novelty in the systems surrounding financial services. Novelty search is the best algorithm for finding breakthroughs and explains why I have been earlier to markets and trends than many others.

This approach allowed me to see that Web2 companies deliver user experiences more efficiently than humans, and that roboadvisors would be the interface of wealth management and asset allocation in 2010. It helped me understand the importance of fintech more broadly and the rise of neobanks in the UK in 2016. It led me from innovation theater at big banks to decentralized finance in 2019, as coin offerings and computational blockchains emerged onto the scene. It pulled me towards tokenization in 2020 and to the economics and money systems underneath AI-led GDP growth in 2023.

It puts me here, now, in front of you, writing with anxiety and frustration.

Because I have noticed that with each move through this frontier, with each incremental step towards newness, progress, and tech innovation, something about human nature gets progressively worse.

It gets amplified in a way that warps and distorts us. I am not really sure what I am saying. But I am writing it down so that I can notice this moment and pay attention.

What Technology Wants

Let’s first lay out Kevin Kelly’s foundational framework of “the Technium”. Kelly is a titan of philosophy about technology, and this book struck a profound chord when I read it, maybe a decade ago.

Kelly’s idea of the Technium describes technology as more than just tools. It includes systems, methods, infrastructure, and habits that all work together. Things like the Internet, science labs, and electric grids are part of it. The Technium acts like a living system, growing over time. It becomes more complex and more connected as new inventions build on old ones.

Instead of being something we fully control, the Technium is more like a partner that grows with us. Kelly believes we live inside this system, and that we should not try to stop it, but understand it and help guide it in ways that are useful and responsible. In other words, it is a superorganism of human intent, captured in complexity and human logic.

Here is some of our early thinking on the topic of fractals and superorganisms.

Kelly says the Technium has its own direction. It tends to create more choices, more abilities, and more variety. It doesn’t plan this, but the growth pattern is similar to how nature evolves. While people invent new technologies, the Technium also shapes people back. It changes how we think, how we work, and how we live together.

Now, in the year 2025, we can see some of the strange outcomes of the science fiction meta.

Capitalism and the attention economy have power law distributions. The Technium amplifies capital, wealth, and noise. It accrues enormous returns to the important nodes in its network. This means that nodes with wealth will become larger, reflected in a higher median age of home ownership. People are renting and subscribing, not purchasing and owning.

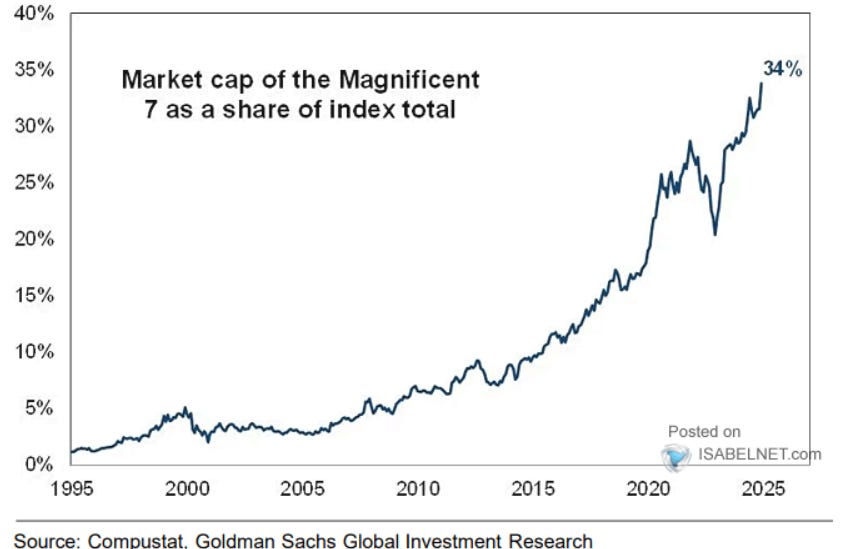

It also results in concentration of power and economics in the largest companies — the Magnificent 7 has risen to historic importance relative to the S&P 500 recently. Those tech companies are the economic growth engine of the West.

Society has similarly warped in response to being terminally online, and that has created powerful cultural feedback loops.

Politics is polarized and gendered. Fertility rates have dropped, and the demographics crisis is leading to negative debt spirals as borrowing outpaces taxation income. We are losing the pyramid schemes of replacing the population. It is unfair to expect young people to pay for the retirement of the older generation, who did not have enough children to sustain themselves into old age — an unpleasant thing to say. Strange experiments, like DOGE, will be attempted to get government finances back in order, but it is pointless when the social fabric is fractured.

This is the coil around which we are all floating.

The Technium, whatever it is and its organizing principle, has made us addicted to dopamine, lose our attention spans, fight with our neighbors, and forced us into adversarial game-theoretical equilibria.

It is strange to notice this in a moment of such profound abundance. We have better standards of living than ever before, more education, less infant mortality, overall better health, incredible technological tools, and broad financial access.

But something is off. We are being commoditized, and the seams are starting to show.

The Money Virus

I will describe my investment philosophy over time. It is possible that this transition is just a personal descent into madness. But I think not; rather, it is the outcome of following the Technium, or as Kelly puts it, following “what technology wants”.

In 2008, the right answer for investing was to place your money into an asset allocation. This asset allocation would be selected by professional investment managers at a large financial institution, like Goldman Sachs. Wealth management businesses continue to do well, and they are able to sell their services by highlighting how active investment managers rarely beat the index. That said, they still charge 150 bps for tactical tilts and access to alternatives.

Investment Banks were seen as experts and perceived to have an investing secret sauce. Delegating to the *custody* of the banks, so they would be your *fiduciary* was the high-status thing to do. However, as roboadvisors came onto the scene, asset allocations became commonplace. Vanguard, BlackRock, Fidelity, and many others offered the same services for a much lower price.

It was nothing special, just with a Web2 distribution game on top.

So I started to believe that for your core investments, asset allocation makes sense. But it is possible to create alpha in addition to the core — to build new companies, invent new things, and open up doors to new paths. I started to participate in angel investing and entrepreneurship. I also joined an equity research practice where analyzing particular companies with a Warren Buffett lens was important.

It was clear that some companies were better prepared for Fintech innovation than others. JP Morgan and Goldman Sachs were more interesting than Wells Fargo or BNP Paribas. With the use of alternative data scraped from the Internet — all those social media mentions and various search intents — you could understand how a company was performing relative to themes that would create alpha.

Remember, alpha is novelty, and novelty is the Technium.

In shifting the frame of analysis in this way, we collapse the time period. Asset allocation requires decades of data to construct portfolios. Here, focusing on innovation themes, we have 5-10 year periods of adopting new platforms. As 2017 hit and Web3 entered the space, these timelines became even faster.

Since the public markets have been broken for IPOs, and venture shifted into long-duration private markets with secondary exits — dominated by SoftBank’s price-insensitive blitz-scaling of hopes and dreams — token markets sprang up to create liquidity for earlier-stage technology bets.

But ICOs did not last too long. After a year or so of price action, the market wiped out. In crypto, we refer to these things as cycles. In my earlier years, I thought of cycles, technical trading, and all the market structure stuff as voodoo. It is irrelevant to the efficient market hypothesis, and therefore irrelevant to long-term investment returns.

But now?

Now even the 3-year cycles for Bitcoin price action seem like an eternity.

The crypto crowd has been replaced by Solana’s degen traders, who live by the sword and die by the sword. Memecoins have infected all quarters of Web3 and pushed out many of the idealists in favor of the pragmatists. Forget building the new financial world order when we can make a quick buck. The warlords have defeated the artists and taken their castle, only to issue constant investment pump and dump scams from the Oval office.

The implied danger of the Wild West, where anyone can find land and build a new home, attracted the bank robbers and financial criminals. We are often critical of traditional finance for doing things like creating millions of fake accounts. And we defend crypto companies when they get debanked or accused of things they did not do. But recent market structure in the space is pretty rough — there are plenty of good players, and plenty of bad ones too.

The article on Kelsier above is a strong example of the kind of criminal nonsense we have had to tolerate to get to the next leg of the journey. You can’t get stablecoins, apparently, without a 20-year-old ripping off the country of Argentina.

You will be lucky if a memecoin investment lasts more than 2 hours. If it drags on its 80% loss for 3 months, like the Trump one above, that can be considered a success. I have started calling this stuff “short form financial content”. In the same way TikTok and reels on Instagram are visual short-form content, memecoins are short-termism at its finest. I issue, you buy, I sell, you lose, I win.

Attention is distribution, and any substance is unnecessary because the entire financial instrument is the performance art of the crowd.

The financial payload is not cashflows, but how other people react to the ownership and price chart of the token.

If you are not against taking investment advice from a Twitter duck, the below will be useful.

The chance to make money from holding this short-form financial content is basically nothing. Making money becomes akin to being able to figure out the Twitter social media algorithm, and having a group that is able to “work together” to amplify and spread the message. I have played around and launched coins myself using a bot called Cliza, and it is as easy as sending an email.

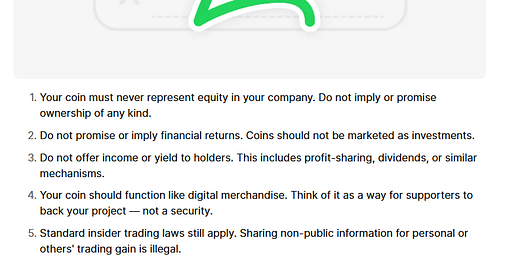

The next major version of this trend is being delivered by a platform called “Believe,” which allows you to use social media loops to quickly launch coins attached to games or applications. It has gathered traction by recruiting key Twitter-based Web2 entrepreneurs with large social media followings, and connecting them to Solana. Here’s what Believe says about its own financial product.

There has been $200MM of marketcap created in just a few days associated with all this ephemeral stuff. I am sure it will go to $0 and then to $10B and then to $0 again. This is how things are now.

It is pointless to rail against the inevitable march and evolution of progress. Everything will be democratized, decentralized, and tokenized.

The Technium expands, and it leads to here.

It leads to large AI attention platforms that amplify our differences, make us angry, and separate us into political camps. It leads to large returns for those who play harsh PVP games and sell at the expense of those who buy. It shortens our attention, pulling us away from books into 10-second rage-bait videos. It makes us prefer the dopamine hit of a 1000x bet over the certain but boring future of 6% annual asset allocation returns.

Financial nihilism is a failed philosophy. It brings us nowhere good.

Internet Capital Markets is a re-packaging of this idea that financial substance does not matter as much as financial audience. While we love the thesis of building capital market infrastructure onchain at scale, we think it matters what financial instruments are introduced on that infrastructure.

If you build a new global supply chain that is faster and better than anything else in the world, use it to deliver good products that help people achieve better financial outcomes.

All I want to do today is point to where we are going.

Support This Writing

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

For better or for worse .

What ever will be will be.

This party don’t stop 24/7.

And I’m loving it, loving it like this and loving it like that. 😉