Fintech: Collective gets $50MM to build freelancer financial platform; Prolific stress tests AI models with 120,000 people

The freelance workforce in the United States has reached 70MM individuals, and it is projected to surpass 85MM, or 50% of the total workforce, by 2027

Hi Fintech Futurists —

You’re the best, today’s agenda below.

PERSONAL FINANCE: Collective Raises $50MM To Build A Financial Management Platform For Freelancers (link here)

AI: Prolific Raises $32MM To Train & Stress-test AI Models Using Its Network Of 120K Human Contributors (link here)

LONG TAKE: Starbucks and Nike NFT strategy, with potential for $1B in additional revenue (link here)

PODCAST CONVERSATION: How embedded finance leader Synapse grew to powering 10MM+ consumers, with CEO Sankaet Pathak (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Digital Investment & Banking Short Takes

PERSONAL FINANCE: Collective Raises $50MM To Build A Financial Management Platform For Freelancers (link here)

Collective, a platform providing freelancers bookkeeping, payroll, and tax advice, has raised $50MM in a funding round led by Gradient Ventures, Innovius Capital, The General Partnership, General Catalyst, QED, Expa, and Better Tomorrow Ventures. This brings the total amount raised by Collective to $82MM. The company serves thousands of members across the US, with a waitlist exceeding 100,000 freelancers.

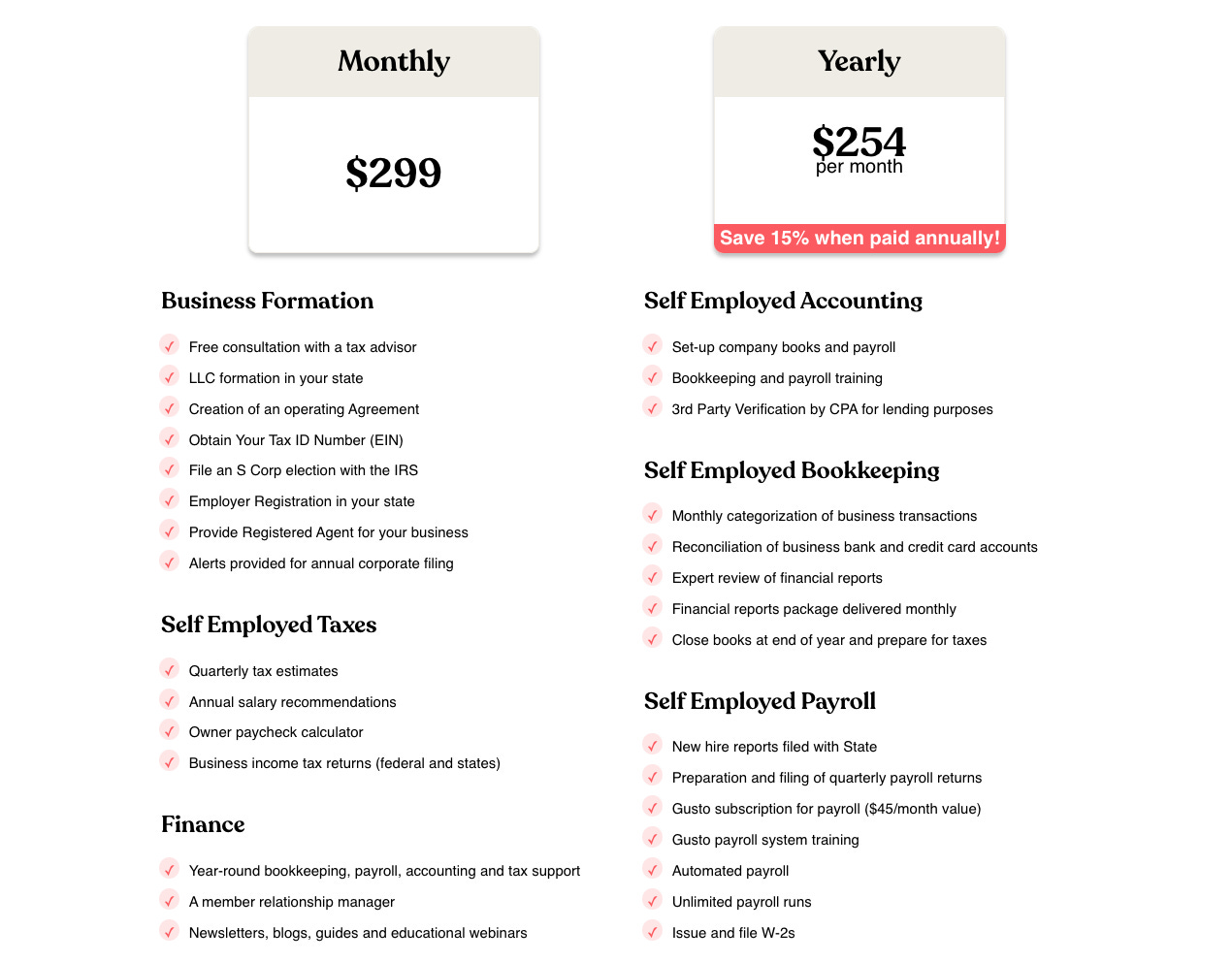

By leveraging OpenAI's GPT-4, the platform automates tasks like expense categorization and bank reconciliation. In addition, Collective offers monthly bookkeeping, administration, S-Corp formation, annual business tax filings, and quarterly tax support — essential functions but also administrative headaches. The primary objective is to eliminate the need for self-employed individuals to rely on multiple separate tools, streamlining their financial management processes for a monthly membership fee of $299. Remarkably, the company claims that its members saved an average of $10,000 in taxes in 2021 by using its platform.

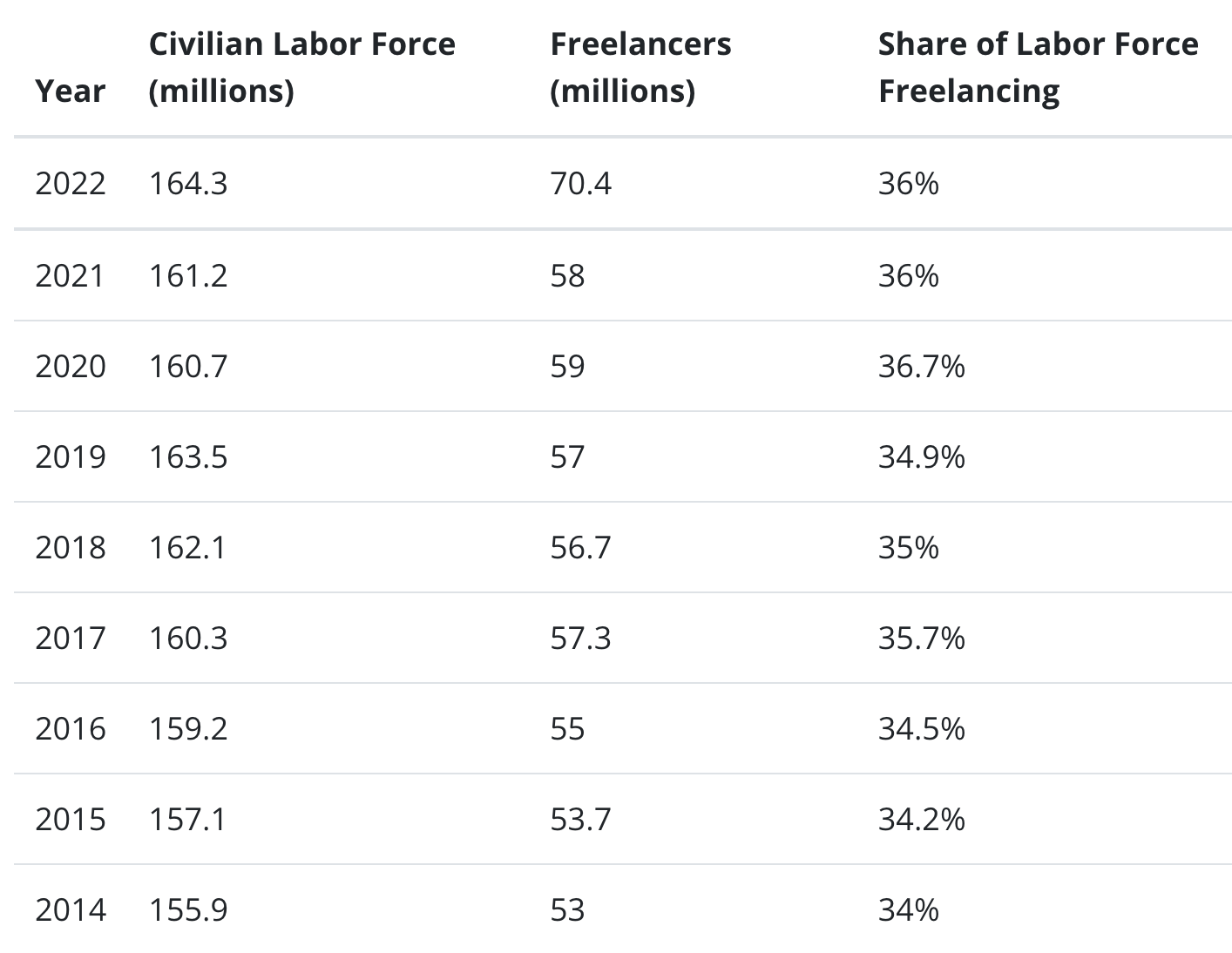

The freelance workforce in the United States has reached 70MM individuals, and it is projected to surpass 85MM, or 50% of the total workforce, by 2027. The global freelance population is also set to grow as nearly 60 countries now offer digital nomad visas. While there are several personal finance management platforms available like april, Invoice2Go, and FreshBooks, Collective distinguishes itself by catering to high earners and automating a broader range of processes, akin to those found in an enterprise-level finance department. However, the $3,000 annual fee for Collective limits its total addressable market (TAM), particularly considering that many tax management startups fail to provide a substantial ROI in terms of actual savings.

Hence, Collective plans to collaborate with companies such as Google and Meta to offer its services as a benefit to contractors. This B2B approach could find a toe-hold in the market, given that in 2021, Google employed over 150,000 temps and contractors, surpassing the number of full-time employees at its parent company, Alphabet. Collective's large raise and apparent traction puts traditional service providers on notice, who will have to step up their game and cater to the needs of the freelance workforce. The question is whether Collective can capture the niche and expand to scale before that happens.

AI: Prolific Raises $32MM To Train & Stress-test AI Models Using Its Network Of 120K Human Contributors (link here)

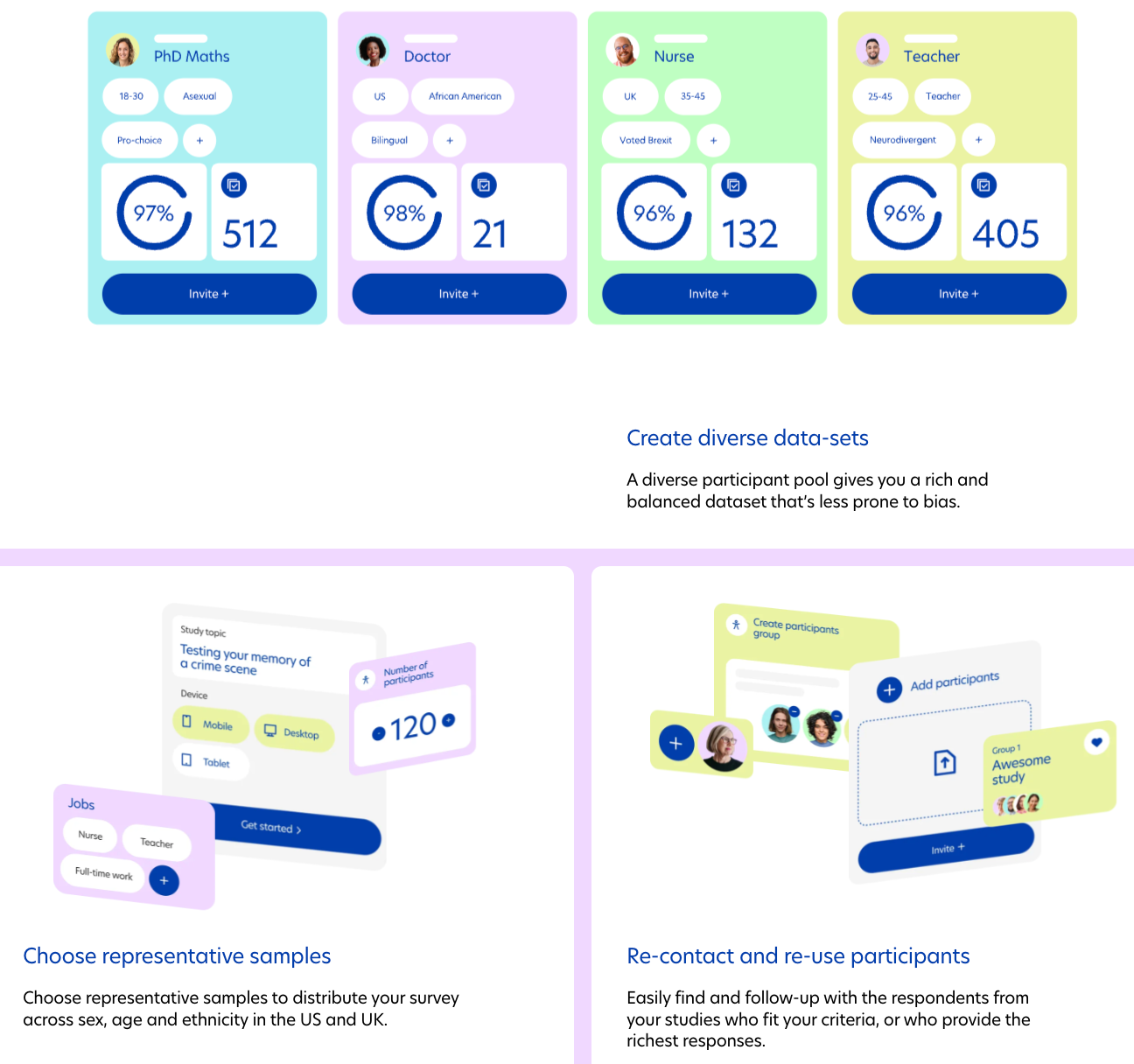

Data platform Prolific has secured $32MM in funding from Partech and Oxford Science Enterprises (OSE). Building upon its previous seed round of $1.4MM through Y Combinator (YC), Prolific has developed a system that leverages a network of 120,000 human participants to inform and stress test AI models. This approach directly tackles the challenge of AI models underperforming due to inadequate training data.

The Prolific platform integrates with custom and third-party annotation tools, enables the creation of individual or group tasks with audio, video, and games for simultaneous participation, and automates repetitive tasks like approving submissions, messaging participants, and processing bulk bonuses. Organizations such as Google, Stanford University, University College London (UCL), and Oxford University currently use Prolific's participant network. For instance, UCL employed Prolific to aid in detecting deep fakes for a human perception study. The platform facilitated the collection of high-quality human data, distinguishing it from research reliant on publicly available data.

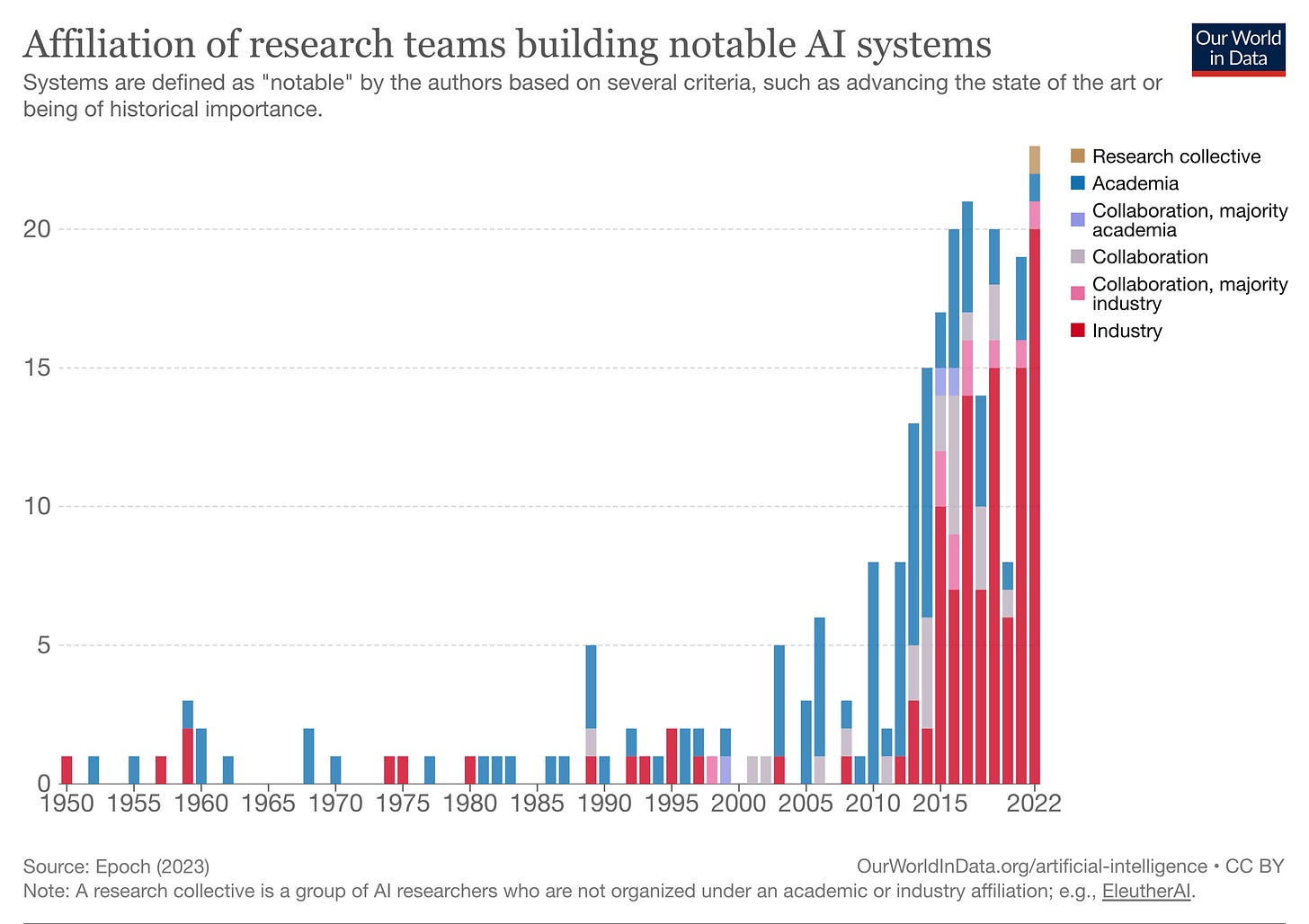

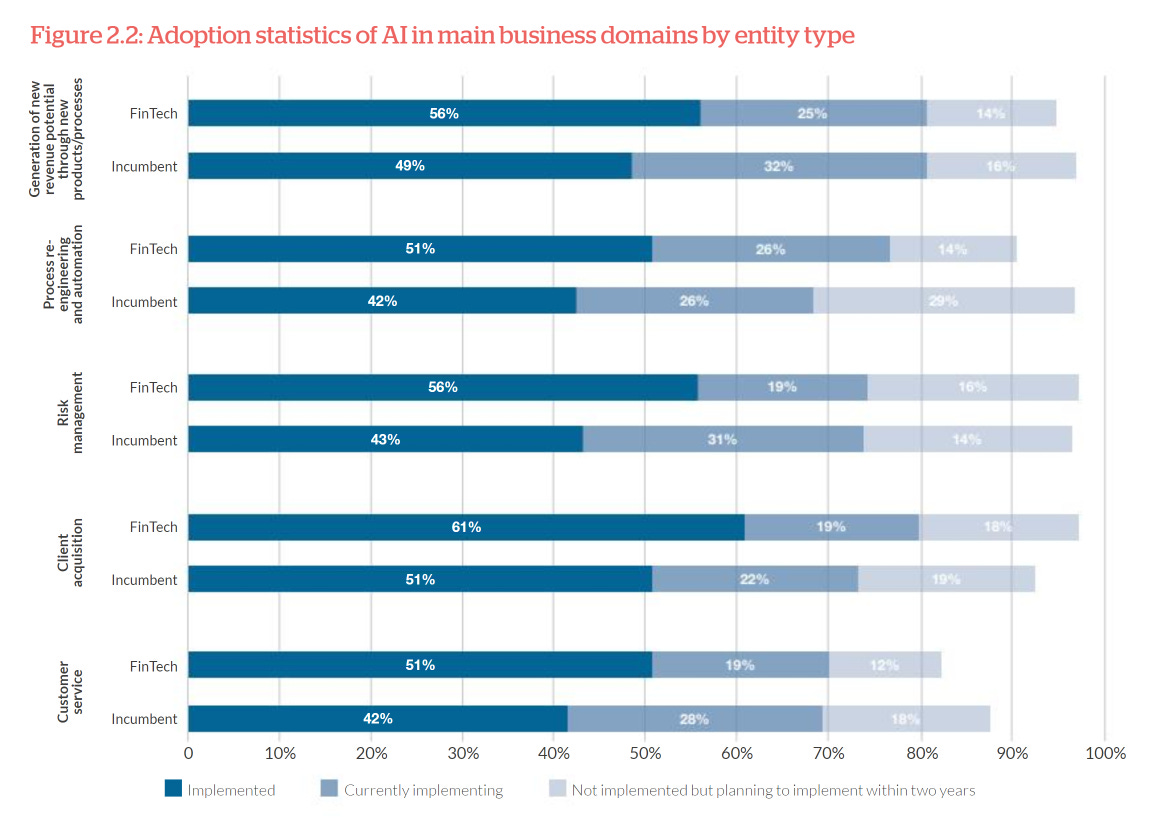

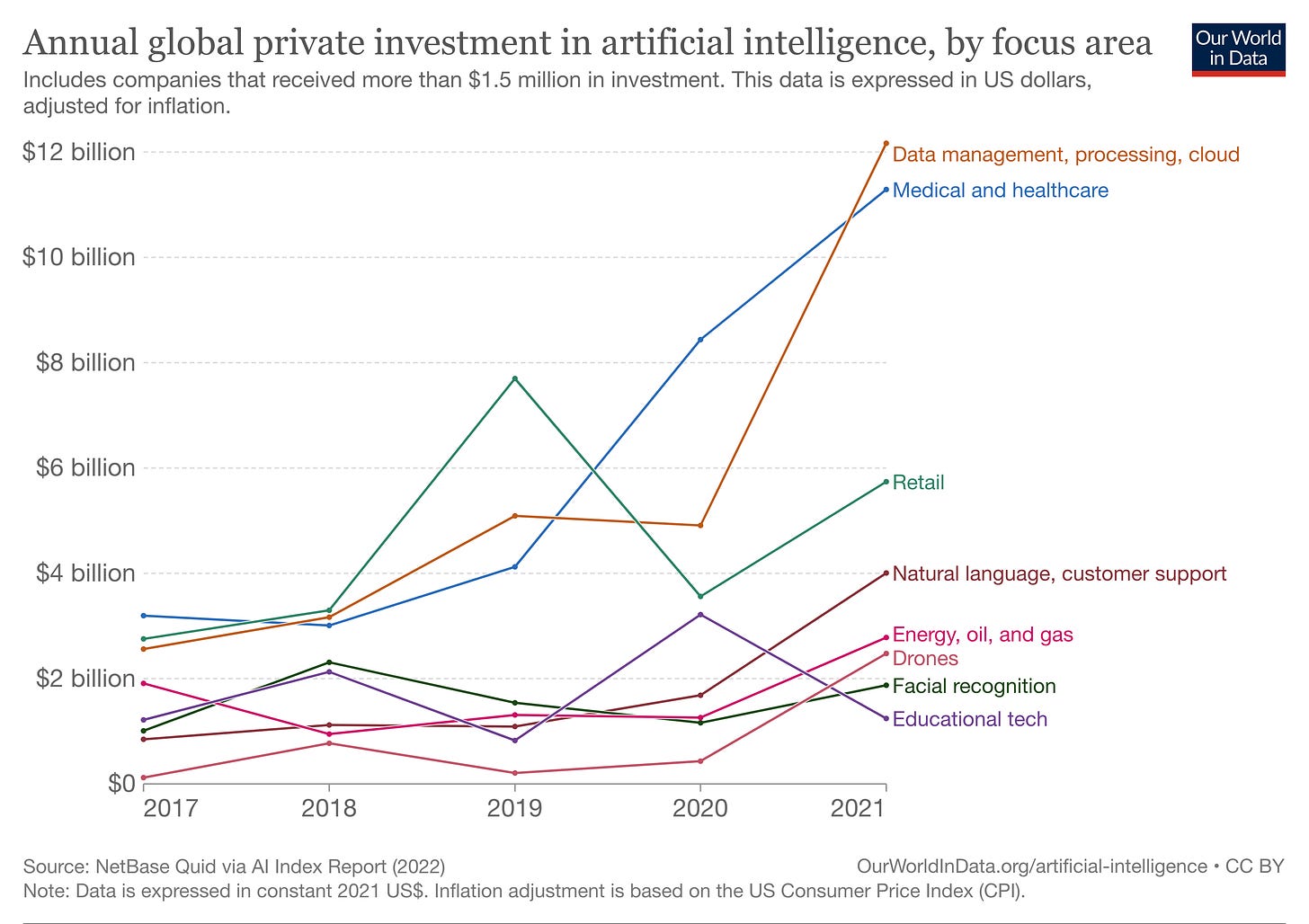

Platforms like Prolific and CloudResearch are addressing a critical need in the field of data science. Despite the soaring demand for data scientists — expected to create 11.5MM jobs by 2026 — professionals spend excessive time spent on mundane tasks like extracting and formatting data with SQL. This challenge is magnified by the influx of unstructured data, requiring extensive processing efforts. This directly impacts fintech companies, which meaningfully leverage AI already.

Generally speaking, AI is driving the transition to modernization, and its influence extends far beyond chatbot applications, permeating fraud prevention, payment processing, and process automation. Understanding that all these advancements hinge on the availability of usable data, platforms like Prolific have an important place in the AI value chain — at least while humans are needed to map our behaviors into the great computer hivemind for processing. Once that’s done, hold on to your universal basic income!

Or not. There is some evidence that the current AI hype cycle is slowing down, with darlings like Jasper starting to shrink their workforces despite the mammoth raises at the beginning of the year. Yet more granular, focused, and niche players — like those targeting financial services workflows and data sets — are likely to be both less expensive on a valuation basis, and more resilient around product economics.

👑Related Coverage👑

Blueprint Deep Dives

Long Take: Starbucks and Nike NFT strategy, with potential for $1B in additional revenue (link here)

Traditional brands are entering the Web3 ecosystem through an NFT gateway. Among the leading innovators are Starbucks, teasing the public rollout of its Odyssey program, and Nike with its .swoosh community. This week we dissect the NFT strategies in the context of an increasingly digital customer base and the growing virtual environments built by the likes of Fortnite and Roblox. We also briefly touch on the underlying enablers and advancements in user experience and transaction speed.

Podcast Conversation: How embedded finance leader Synapse grew to powering 10MM+ consumers, with CEO Sankaet Pathak (link here)

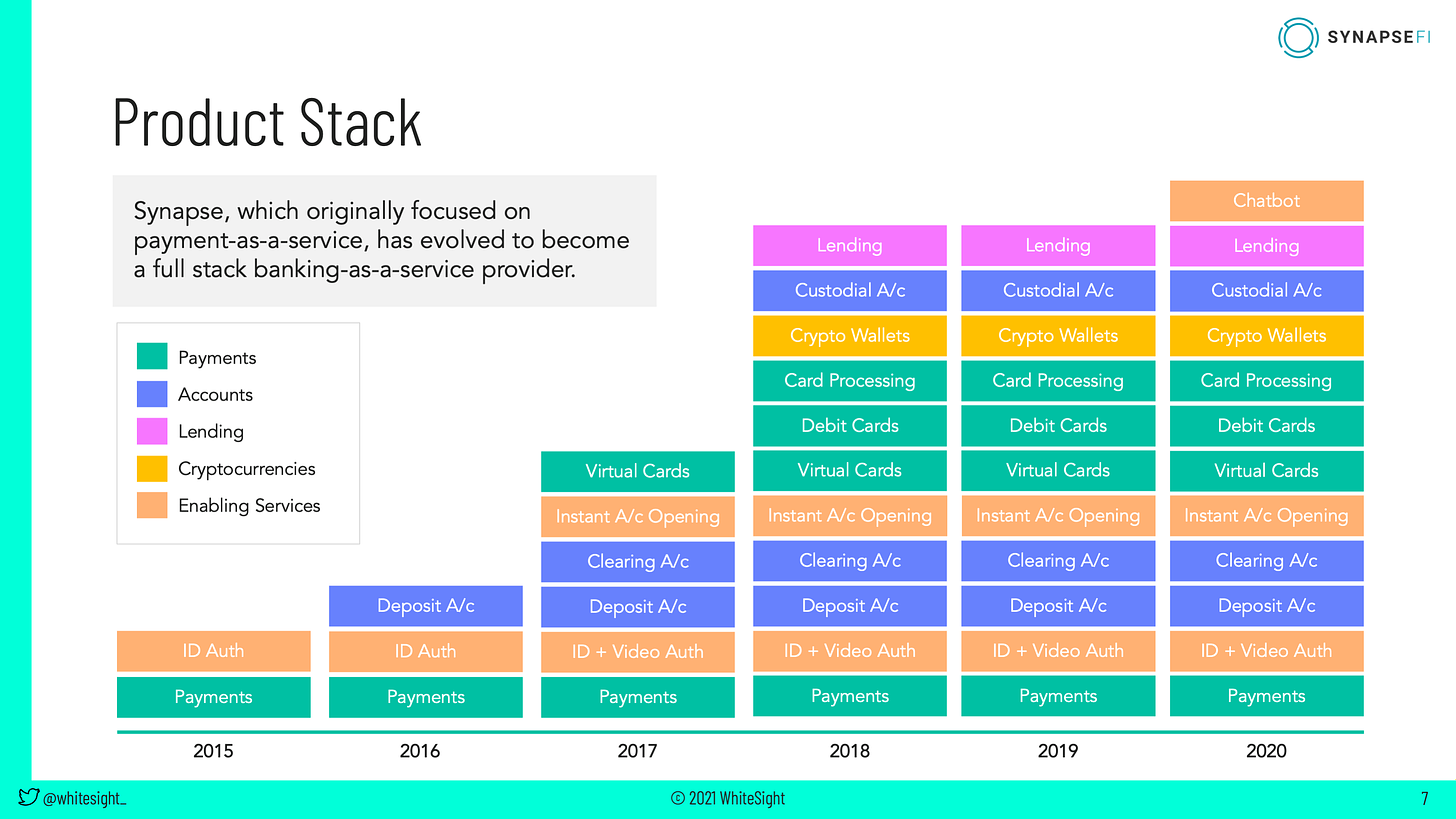

In this conversation, we chat with Sankaet Pathak - founder and CEO of Synapse, the largest regulated banking-as-a-service platform that provides payment, card issuance, deposit, lending, compliance, credit and investment products as APIs to more than 18 million end users.

After having emigrated from India to study Computer Engineering, Mathematical Sciences, and Physics at the University of Memphis. His experience of not being able to open a bank account due to his immigrant status, prompted him to launch a financial services company that could reduce barriers to entry for underbanked or unbanked individuals. Through his efforts, Sankaet found that the true barrier to entry was an outdated infrastructure which kept everyday folks from accessing best-in-class financial products. Today, Synapse services over 1.8 million end-users and processes over $10 billion in deposits. Many of Synapse's clients are early to late stage FinTech companies offering innovative financial solutions that are both accessible and affordable for end users.

Curated Updates

Here are the rest of the updates hitting our radar.

Neobanks

Payments

⭐ Apple's Tap To Pay Arrives In The UK With Revolut And Natwest First Out Of The Gate - Finextra

Swift Pilots Instant Payments Across Currency Zones - Finextra

Digital Investing

⭐ Investing App Robinhood Expands with Retirement Account Options - PYMNTS

Nutmeg Losses Swell 55% Two Years After JP Morgan Acquisition - Altfi

AI

⭐ Google’s Bard Chatbot Finally Launches In The EU, Now Supports More Than 40 Languages - TechCrunch

Musk’s Giant-Killing AI Project Is Starting Small With Huge Goals - PYMNTS

Shape your Future

Wondering what’s shaping the future of Fintech, Digital Wealth and Web3?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete in Fintech.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Monday Fintech Short Takes, with weekly coverage of the latest fintech, digital investing, banking, and payments news via expert curation and in-depth analysis

Wednesday Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Thursday DeFi Short Takes, weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Access to the Podcasts with industry leaders on building leading companies in Fintech and DeFi along with value-added data-driven, annotated transcripts

Full library of the weekly in-depth write-ups on 15+ topics and 50+ Fintech and DeFi brands, offering deep, comprehensive, and insightful analysis without shilling or marketing narratives

Exclusive Deep Dive reports into Fintech business models and brands that transform the Fintech and DeFi space

Access to our CEO & Founder focused 'Building Company Playbook' series, offering insider tips and advice on constructing successful fintech ventures.

10000