Fintech Price War -- Goldman's $1.3B Marcus burn, Neobank £200MM loss, ETrade's $75MM trading fees; plus 14 short takes on top developments

Hi Fintech futurists --

In the long take this week, I dig into the price war that has been started by Fintechs and is now extending into traditional industry. Goldman is losing $1.3 billion on Marcus, trying to build a Fintech leader. Etrade is going to lose $75 million from cutting trading fees to $0 to keep up with Robinhood. Revolut is losing £35 million on £60 million in revenue, with another £140 million burned by Atom, Monzo, Tandem, and the rest. Until markets become rational again -- from interest rates, to public valuations, to private equity -- the bonfire of technology burn will shine ever brighter.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

Spend enough time talking with financial operators, and you get the 360 degree view of what is happening in our industry. Talk to a bank CEO, an innovation officer, a venture capitalist, and a Fintech entrepreneur. Do this 300 times. Listen to the public markets, listen to the private markets, gaze at the crypto markets. Watch the blinking lights, until the macro pattern emerges. Human belief, pumping like blood through the organs of our economy. Don't listen to the persuaders (like me), but look instead at the data. What are the results of our collective experiments?

We are like the hungry at the all-you-can-eat buffet. In the beginning, there is not enough! Let's democratize access to food; to music; to transportation; to healthcare; to finance; to payments; to banking; to lending; to investing. The billions in institutional capital across universities, pensions, and sovereigns are delegated to smart portfolio managers. The day before yesterday, it was allocated by small cap stock pickers (hi Warren!). Yesterday, it was the alternative managers of hedge funds and private equity. Today, it is the trading machine and the venture capitalist. Tomorrow, it is the cryptographic artificial intelligence.

These delegates fund our all-we-can-eat Uber, WeWork, Revolut, SoFi, Coinbase buffets, looking for investment returns. We enjoy the fruits of this labor, don't we? Price competition drives the costs down, and technology drives efficiency up. Everything is free! And still, we are unsatisfied. This time, because we are too full! There are too many banks, too many payments channels, too much lending, too much trading! You know what happens to businesses with large fixed costs (e.g., Airplanes or Compliance) and large volatile variable costs (e.g., Oil Prices or Interest Rates) when margins get thin and shocks hit? Bankruptcies happen. I'll leave it to you to plot interest rates against bank failures -- that's the variable part that has been artificially depressed for a generation.

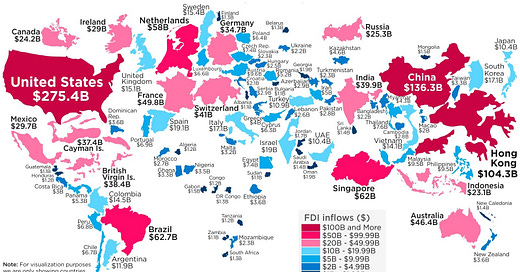

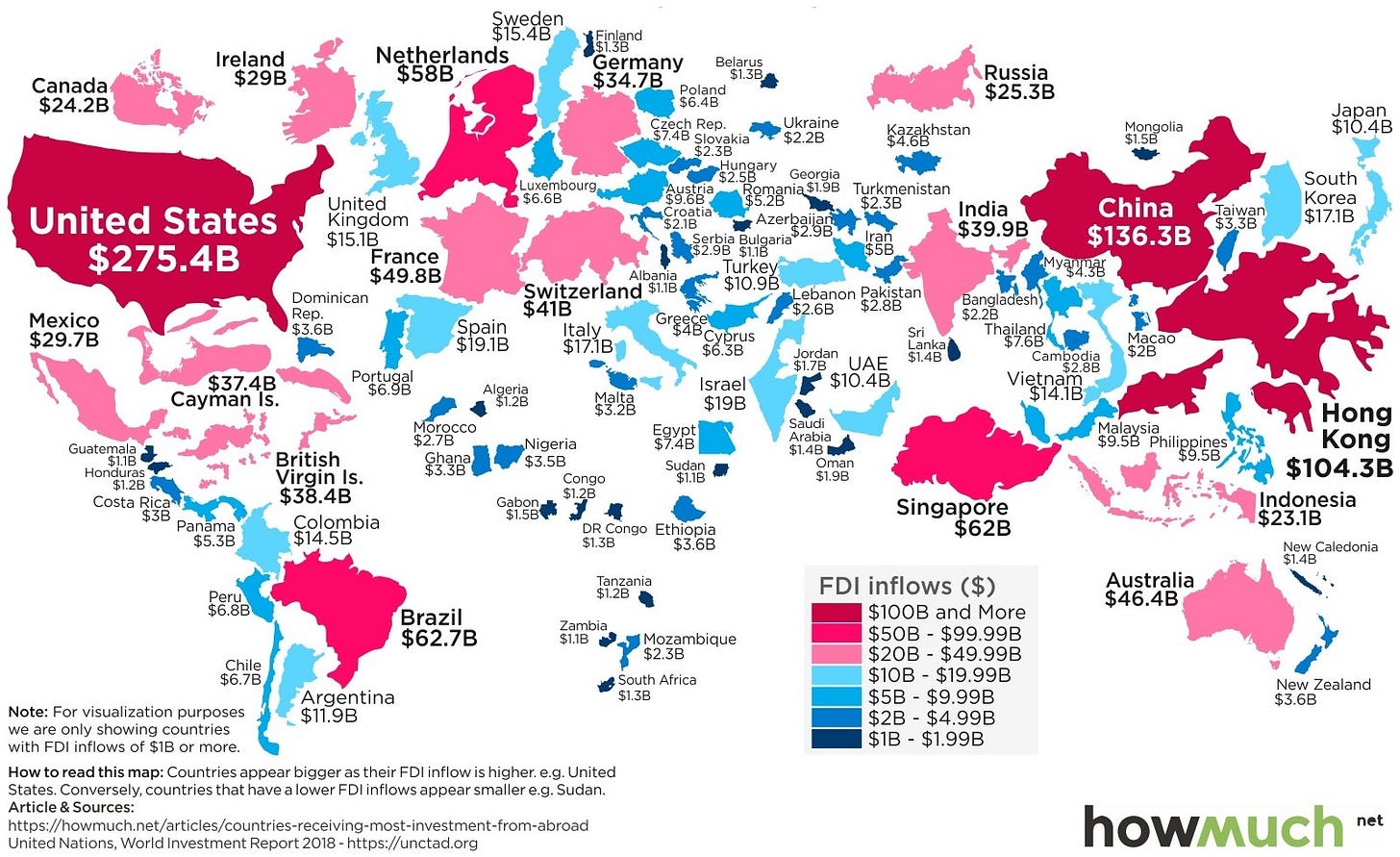

Forgive me for being cryptic. What I am really talking about is the funding, proliferation, and pyrrhic victory of the Fintech neobanks and roboadvisors. A great feature in the Financial Times just highlighted the economics of the UK leaders in the space. Twitter is ablaze with early entrepreneurs talking about the correctness of the theme, and the importance of market timing. I'll reproduce a few of the charts below, so we have a common factbase.

Generally speaking, from a deposit point of view, these are still all small businesses at £1 billion in assets (e.g., Betterment manages $20 billion). But they have done interesting and different journeys to get to consumer prominence. Some leaned into pre-paid cards before getting a banking license and a chance to collect deposits. Others have moved into mortgages, or bought struggling traditional banks. Several have multi-million user bases, capturing large swaths of young consumers and their mobile obsessions. Neobanks don't tend to be the primary banking relationship (which benefit from getting the direct deposit salaries); instead, these are second or third relationships, for everything from travel to easier credit.

The interesting bit in the FT article is that these companies claim to no longer be losing money on the marginal customer. That's a big deal from a venture perspective. Still, the economics are heavily subidized by the "delegates" I mentioned previously. Revolut may generate almost £60 million in revenue, but loses £35 million for the pleasure. Monzo and Starling are not much better. This truth is a stark contrast to the story-telling spin of the founders you usually encounter. When do these companies reach the scale at which they get to break even? When you ask this question to Uber and WeWork, the answer may be -- NEVER.

I am borrowing an analysis from ARK Invest above, which shows the market valuation of a user in various financial digital experiences, including those of the banks. There are several ways to read this chart. The first is that the Robinhoods and Monzos of the world are 10x overpriced relative to the payments apps. I can sort of buy this -- though money in motion is way easier to capture than money at rest. The second is that venture investors think a finance user is worth $1,500 in a digital bank. Given that a few thousand dollars is the average user balance, this is a pretty insane valuation.

Last, one can spin the higher $3,500 incumbent bank digital user valuation as "room to grow" for Fintechs. That would be overly simplistic. What is happening at the large banks is that a digitizaton process is converting traditional customers to digital ones. This means there will be more incumbent digital customers effortlessly, seeing rapid growth per year -- outnumbering the organic growth the Fintechs can generate. As a result, those high per-user figures will be trending down over time. And second, the average account balances at banks tend to be 5-20x larger. As a result, the venture capital tendency to look at eyeballs and users, rather than assets, is leading to some intense non-economic decisions.

So what's the net effect? A price war has begun, and it will not end until interest rates have been raised, a recession has hit, venture capital starts drying up, traditional banks get their revenue source back, and the Fintechs go bankrupt one after the other. Look again into the history of the airline industry, and what price competition has done historically. In our world, eTrade, Schwab, Interactive Brokers, J.P. Morgan and the rest have responded to Robinhood by matching is $0 price point. As a result, eTrade will lose out on $75 million in commissions. Revenue generation will likely shift to invisible monetization, like it has done with the rest of the web -- selling order flow, data, analytics, cash sweep, and adjacent services.

In another fascinating article from the WSJ, we can get a closer look at the Marcus story. The quick takeaway is that -- as Goldman worked to build the Fintech firm of the future -- the investment bank has lost $1.3 billion on the experiment. Maybe that's just the price of admission! Maybe Deutsche Bank needs to fire 18,000 people and spend $13 billion on technology to become positioned for the next decade.

As an entrepreneur raising $500,000, it can be frustrating to hear that your digital bank is a bad idea from venture capitalists managing a few hundred million, over and over again. It can be frustrating going to corporate venture arms of the Wall Street titans, and getting rejected because these ideas are not part of the quarterly business plan. Some entrepreneurs could start thinking the ideas are bad, or that their money management audience knows better. What you are missing is that your ask isn't big enough! You are trying to lose only a few million. Try a few billion.

Featured Interviews, Podcasts, and Conferences

From Crypto to Decentralized Finance. Another great podcast with Will Beeson at Rebank: Banking the Future. Check out our conversation and subscribe here.

Digital Asset Strategy Summit, I've joined the speaking faculty at this great event for asset allocation and financial advisors docused on blockchain based assets, October 20-21st in Dallas. If you are interested in attending, let me know by email as I have limited passes. Only asset managers, pension funds, registered investment advisors, and family offices please.

Blockchain Insider. Had a great time with Todd McDonald of R3, Thomas Zeeb of SIX exchanges, and Simon Taylor of 11FS discussing the latest blockchain developments.

#ItzOnWealthTech Ep 25: How Software is Eating Banking with Lex Sokolin, ConsenSys. A fun conversation with Craig Iskowitz, covering everything from digital wealth, to artificial intelligence, to blockchain based assets and the evolution of banking. Highly recommended!

Short Takes

Rapyd, a London-based startup that bills itself as a “fintech as a service” provider, has picked up $100 million. It is good to power Uber. If your company can get attached to the venture growth of a real Silicon Valley company, a Stripe and a Rapyd are welcome byproducts.

PayPal pulls out of Facebook's Libra. Looks like PayPal doesn't want to disrupt PayPal. Wonder how much of this is regulatory, and how much of it is functional now that they've learned about what Facebook wants in payments.

Brex launches a new cash management account to nab more of the traditional lenders' market share. Starting with credit cards and accounting integrations (as well as very lose underwriting standards, because start-ups are "different"), Brex has now moved ints unicorn sights on business banking. $400 million in funding suggests there will be more funding.

Los Angeles-based money management startup Dave has raised $50 million from lead investor Norwest Venture Partners. Sort of personal finance, sort of financial planning, sort of credit provider, sort of overdraft protection. Apparently 4 million in traffic with a waitlist?

EOS Maker Block.One Settles With SEC Over Unregistered Securities Sale. It blows my mind that they got away with a $4 billion raise and a Times Square billboard by paying a $24 million settlement with the SEC. But at least, there is ongoing enforement against unlicensed brokerage. See also, the SEC case against ICO Box.

Morningstar Is Building A Blockchain Bridge To The $117 Trillion Debt Securities Industry. We learn that Morningstar has been thinking about rating digital assets, and is working with a number of crypto startups like Mike Cagney's Figure. Morningstar makes great products, but is fairly contrarian and particular about its partners -- often not reflecting the drivers of various Fintech sectors (e.g., remember Hellowallet?).

Vanguard to Challenge Banks’ Grip on $6 Trillion Currency Market. The world's largest asset managet using blockchain tech from Symbiont for trading. Like it.

Start earning crypto rewards on Coinbase today. Imagine if the money you were holding, and not the account you were holding it in, yielded an interest rate return. That's not quite true yet for Coinbase, since they control account access, but this vision is getting closer to mainstream every day.

This wearable projector changes your face in seconds. A link worth clicking on -- inspired by the HK protests and the issues around identity and image recognition, this object allows the user to project a new face onto their own. Rebel art. In related news, World Catching Up With China on Surveillance Tech. So you are being spied on too.

Forget Gordon Gekko. Computers increasingly call the shots in financial markets. The Economist's treatment on the capital markets: "Funds run by computers that follow rules set by humans account for 35% of America’s stockmarket, 60% of institutional equity assets and 60% of trading activity".

Active.Ai has partnered with Visa to provide banks and credit unions with out-of-the-box conversational artificial intelligence (AI) solutions. Chatbots gotta chat. Though they don't have much to say about new payments rails yet.

Inside the world's first modelling agency for virtual celebrities. Who is more valuable -- an aging, mammalian Instagram influencer, or a beautiful, perfect robot who wields style and commerce?

Is 5G solving real, pressing problems or merely creating new ones? Interesting take on what happens when the 5G infrastructure is instantiated in our world. Will it be a better one? Yes, if you like machines and radiation ("small cells") every 500 feet in your smart city.

Photovoltaic-powered sensors for the “internet of things”. And further to that point, how do we make them responsible from a climate perspective?

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime