Fintech: Public launches ChatGPT-powered chat within its investment app; Zip gets $100MM for integrated procurement and payment platform

Plus our podcast with A16z on investing in the sector

Hi Fintech Futurists —

Quick note on format before we get into it. We are combining the Blueprint Short Takes and the Digital Wealth edition to create an issue focused on digital investing, banking, and payments sent out on Mondays. These sectors are going through analogous transformation, as automation digitizes existing services and replaces distribution channels. A separate email focused on DeFi and digital assets will be sent on Thursdays starting this week. We hope this change helps you make the most of the Blueprint, and as always we welcome any feedback.

You’re the best, today’s agenda below.

DIGITAL INVESTING: Public Launches Alpha, Powered By OpenAI's GPT-4 For Investment Research (link here)

PAYMENTS: Zip raises $100 million Series C at $1.5 billion valuation (link here)

LONG TAKE: Now is the time to learn Generative AI, not after the knowledge worker layoffs (link here)

PODCAST CONVERSATION: Investing in technology platform shifts, from Fintech to Generative AI, with A16z General Partner Anish Acharya (link here)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Digital Investment & Banking Short Takes

DIGITAL INVESTING: Public Launches Alpha, Powered By OpenAI's GPT-4 For Investment Research (link here)

Public is a mobile-first brokerage and credible alternative to Robinhood, charging subscription fees instead of opting into order flow. In 2021, the company had raised ~$310MM at a valuation of $1.2B, backed by investors like Tiger Global and Accel.

The fintech is launching Alpha — a new feature aimed at enhancing the retail investing experience with artificial intelligence. This is a play on words. In the investment industry, "alpha" is the excess returns relative to an underlying benchmark, as well as the early stages of a tech product. In the case of Public, Alpha is an conversational interface powered by OpenAI’s GPT-4 via a plugin. It offers users the ability to conduct research, access market and company data, and stay updated on news relevant to investments.

We are just starting to see the deployment of LLMs into finance, but some precedent exists. Bloomberg’s AI-model BloombergGPT, trained on finance-specific data, is used for news classification, sentiment analysis, and named entity recognition. In the RIA advisor space, Orion Advisor Solutions was the first to integrate ChatGPT into the client/advisor communications interface. Further, Morgan Stanley’s Wealth Management group announced it would leverage GPT-4 and feed its research data to provide AI-powered financial advice via its 16,000 advisors.

Not all welcome the advent of LLMs with open arms, given the legacy concerns about proprietary intelligence and intellectual property. JPMorgan, Citigroup, Bank of America, Goldman have all recently restricted staff from using the software.

From a financial standpoint, most digital brokerages are still struggling to monetizing their client base. Novel features, like ChatGPT integration, enhance the user experience, but do not always translate into higher assets under management. For context, traffic to the Public site is about 4% of the traffic to Robinhood, which has been under market pressure. Robinhood lost 1.8 million monthly active users in 3Q22, whereas in 2021 Public had 1 million users and likely saw similar relative performance. The company reportedly sought to acquire Amsterdam-based Bux last year, but no deal happened.

We think AI-powered guidance will inevitably be plugged into most financial applications. The challenging question is whether most of the engagement with an LLM will happen inside the fintech footprint, or the AI one.

👑 Related Coverage👑

PAYMENTS: Zip raises $100 million Series C at $1.5 billion valuation (link here)

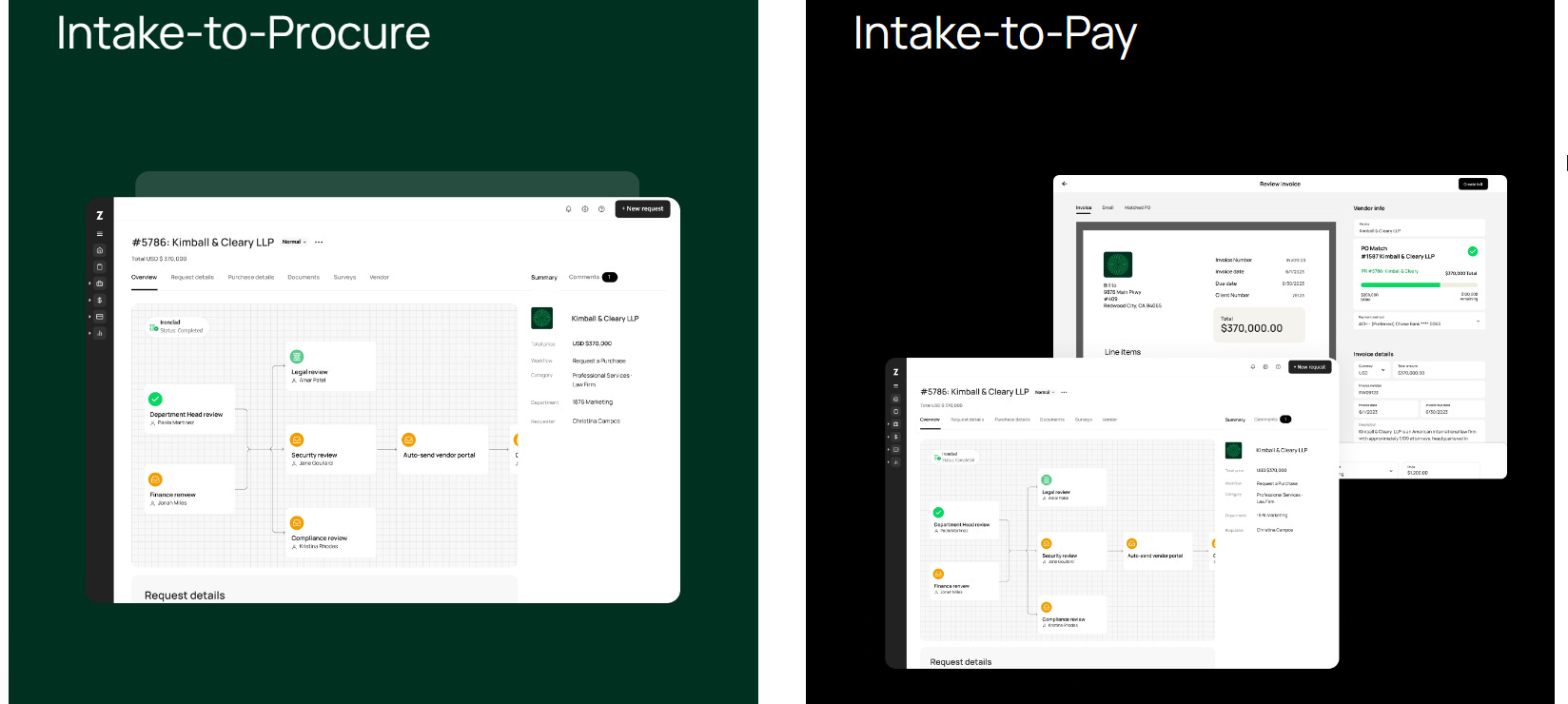

Zip is a procurement and spend platform digitizing the workflows of the finance function, such that employees can initiate purchases and approval is automatically routed across relevant teams. Such automation creates clarity of process, costs savings for the company, and insights into business spending.

The company raised $100MM at a $1.5B post-money valuation from investors including Y Combinator, CRV, and Tiger Global. This is a young start-up founded during the pandemic in July 2020, after the founders experienced how difficult it was for employees to complete a business purchase, typically involving multiple steps, approvals and tracking. Given the rise in remote work, such platforms are increasingly commercial.

Zip recently launched intake-to-pay functionality, which includes features like issuing purchase orders, payments, and invoice processing— covering the procurement lifecycle across B2B payments, accounts payable automation, and purchase order management. This holistic procurement approach has helped the company land clients like Coinbase, Canva, Databricks, as well as other mid-stage startups. The platform is currently processing about $1B each month, and claims to have generated over $900MM in savings for customers.

Demand for automating the finance function continues to grow, integrating workflows with payment rails and other financial products. Since its Series B in May 2022, Zip has doubled its customer base. Payment inefficiencies and manual internal processes remain a key challenge for organisations. Digitization not only allows our our data troves to grow, but also supports the application of analytics and AI to generate insights and future actions. To that end, despite the increasing competition in this space, we are optimistic on the sector.

👑 Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 170,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

Blueprint Deep Dives

Long Take: Corporate Raiders of DeFi treasuries attack, starting with Aragon & Rook DAO (link here)

We look at corporate raiders emerging in the Web3 financial markets.

Once the value of a project’s treasury falls below the market capitalization of its token, there are incentives for financial actors to purchase sufficient voting power to create a spinout or a dividend of the project’s underlying assets. This activist investment strategy is only now showing up in Web3 with Rook DAO and Aragon as targets, after decades of being successful in traditional equity markets. We touch on the distinctions between insider trading, market manipulation, and legal but damaging vulture investing. Last, we talk about defenses — whether those are poison pills, or Aragon’s grants program response.

Podcast Conversation: Investing in technology platform shifts, from Fintech to Generative AI, with A16z General Partner Anish Acharya (link here)

In this conversation, we chat with Anish Acharya is a general partner at Andreessen Horowitz where he invests primarily in financial services and adjacent technologies. He currently serves on the boards of Deel, Mosaic, Silo, and Titan. Anish joined Andreessen Horowitz in 2019.

Prior to joining A16z, Anish held multiple roles at Credit Karma including the General Manager of Core Product and General Manager of U.S. Card, which he helped scale to over 100MM members and nearly $1B in 2019 revenue. Anish joined Credit Karma in 2015 via the acquisition of Snowball, a notifications startup he founded a year earlier.

Curated Updates

Here are the rest of the updates hitting our radar.

Digital Investment Management and Capital Markets

Digital Banking and Payments

⭐ JPMorgan and Barclays back German InsurTech wefox with $55MM

Jenfi raises more funding for its ‘growth capital as a service’ platform

M-KOPA snaps up $250M+ debt, equity for its asset financing platform

Private credit marketplace platform Percent lands $29.7m Series B funding

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.