Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Anish Acharya is a general partner at Andreessen Horowitz where he invests primarily in financial services and adjacent technologies. He currently serves on the boards of Deel, Mosaic, Silo, and Titan. Anish joined Andreessen Horowitz in 2019.

Prior to joining A16z, Anish held multiple roles at Credit Karma including the General Manager of Core Product and General Manager of U.S. Card, which he helped scale to over 100MM members and nearly $1B in 2019 revenue. Anish joined Credit Karma in 2015 via the acquisition of Snowball, a notifications startup he founded a year earlier.

Prior to creating Snowball, Anish founded SocialDeck, a social-gaming company that was acquired by Google in 2010. He went on to lead various mobile product efforts as well as invest at Google Ventures. Anish graduated from the University of Waterloo and lives in the Bay Area with his family.

👑See related coverage👑

Digital Wealth: Retirement platform Smart raises $95MM for payroll-roboadvisor integration

[PREMIUM ACCESS]: Web3: Worldcoin's $100MM raise, as it reaches 1.7MM eyeball scans hashed onchain

Timestamp

1’54”: Anish’s foundational experiences with early stage startups & what pulled him towards entrepreneurship

7’05”: Reflecting on SocialDeck's beginnings: early hypotheses, insights from Facebook APIs and mobile behavior patterns, and the evolution of reality

12’22”: Analyzing modern platform Shifts: a deep dive into adoption rates and Disruptive Impact"

17’04”: Journey into FinTech: from mobile startups to Google and Credit Karma acquisitions - A founder's tale of innovation and acquisition Interests

20’14”: Insights from scaling Credit Karma: understanding consumer behavior and navigating the financial life of its users

25’08”: Walking the ethical tightrope in FinTech: balancing paternalistic products and dopamine-driven loops, lessons from Credit Karma and A16z

29’19”: The challenges of active and social-following copy investor platforms: examining the successes and shortcomings of companies like Covestor, Wealthfront, eToro, and M1 Finance

31’26”: Evolving the investment thesis at Andreessen Horowitz: reflections on a journey shaped by COVID, Web 3.0, NFTs, and the rise of generative AI

38’15”: The Future of FinTech: envisioning AI-integrated investment plugins and their potential role in Big Tech - insights from an Andreessen Horowitz GP

40’35”: The Convergence of AI and Web 3.0: exploring the future of privacy, digital ownership, and personalized AI agents in the evolving technological landscape

42’36”: Investing beyond the mainstream: uncovering under-the-radar opportunities in financial services and consumer sectors

44’39”: The channels used to connect with Anish & learn more about A16z

Sneak Peek:

Anish Acharya:

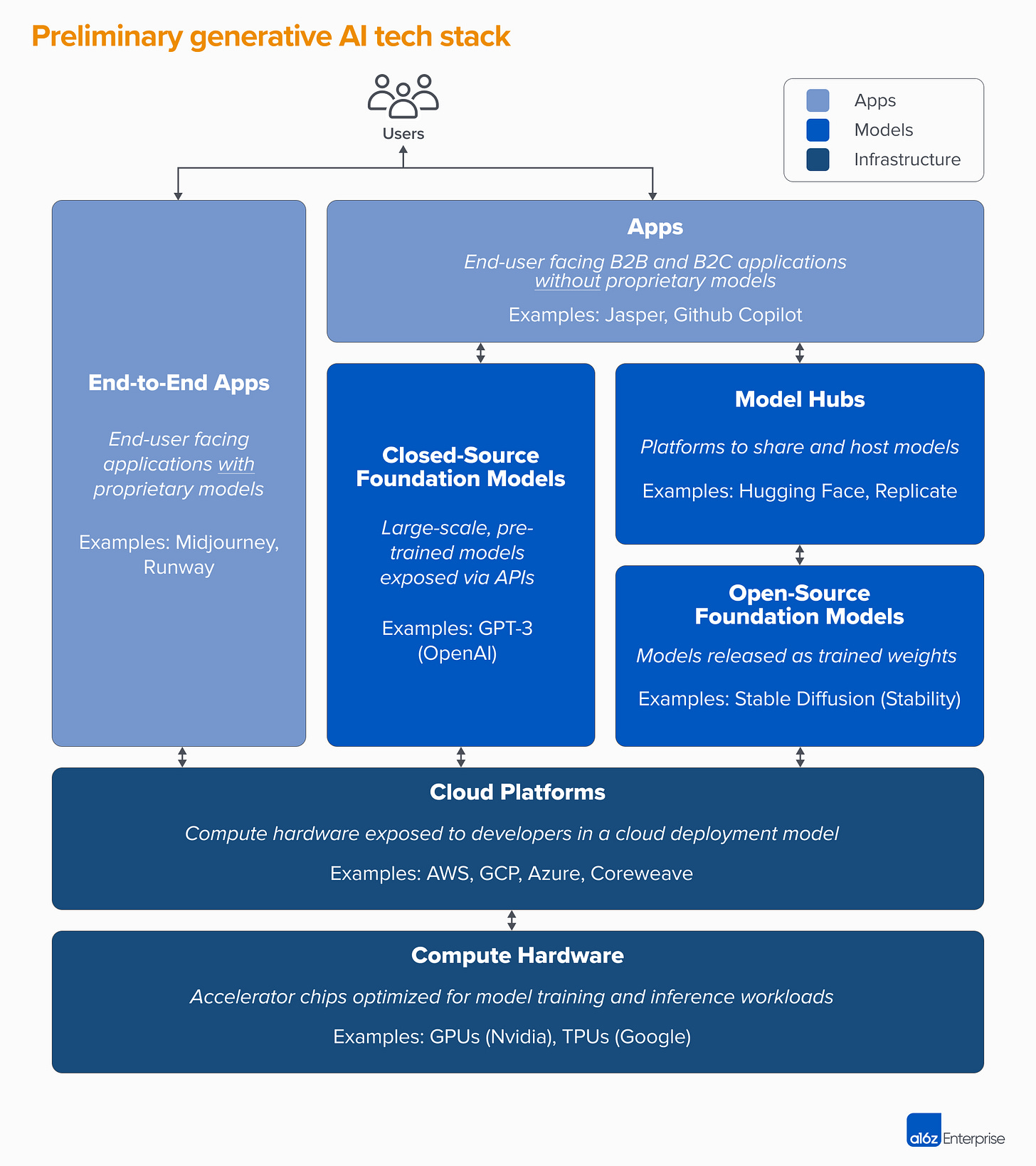

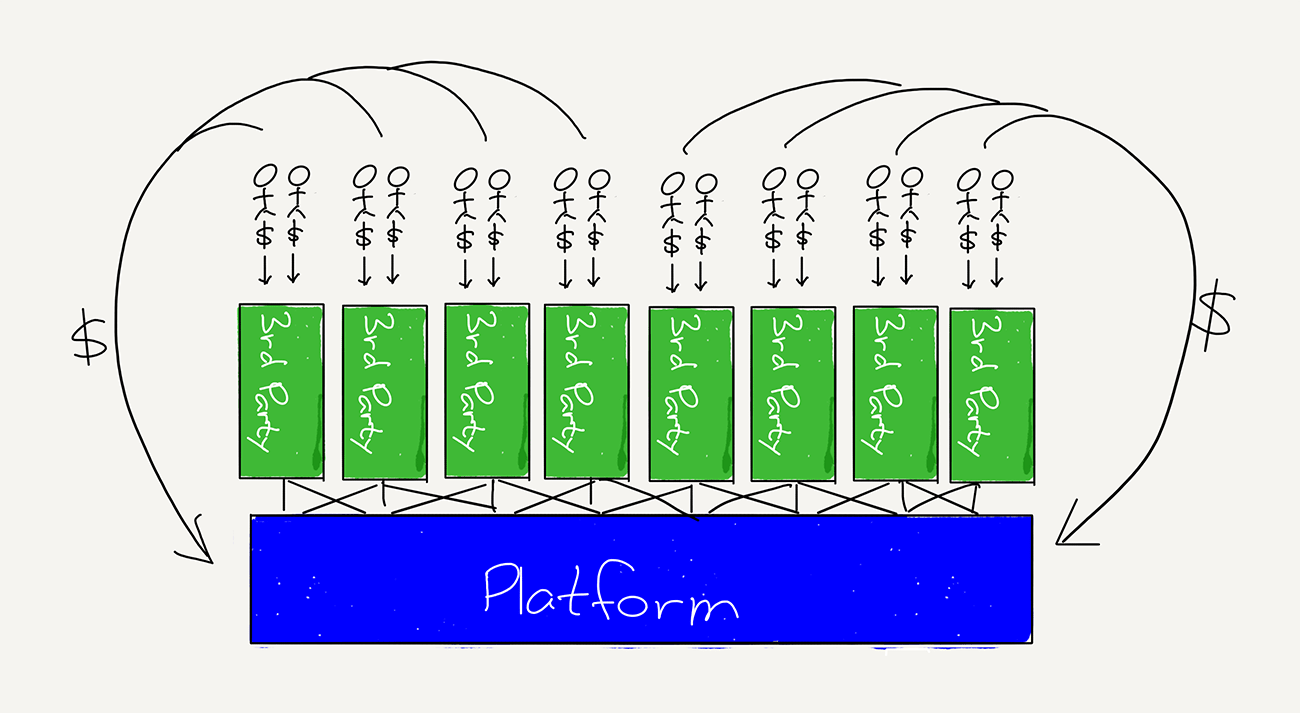

…one interesting question is simply, what is a platform? And Ben has covered this from Stratechery. I like his definition, which is, it's a sort of system in which the economic value that is captured by participants is greater than the economic value that's captured by the sort of operator of the platform. I think that's an important definition because a lot of things are thrown about and represented as platforms these days.Ultimately, platform shifts rarely end up looking like the sort of prior shifts. I would argue that Web 2.0 was actually an important platform shift. It wasn't a 10X in terms of new technology. There was a new technology in paradigm that was introduced, but it was a sort of new model for how you deliver applications to the consumer. Consumers developed new mental models for how they can interact with these applications. It was the early days of social and a social overlay in these web apps.

So, in a lot of ways, the platform shifts just always end up looking different than the prior shifts. I think when we try to be too tightly held in how we fit the patterns of the past shifts to the future shifts, we tend to get it wrong. And this is why I think a lot of the focus on AR/VR whether correct or incorrect, it just ended up being a little too on the nose after the mobile shift. Everyone was thinking, "Oh, there's going to be a new piece of it, hardware with a new app store, with a new monetization model, the new consumer interaction model." Maybe. Maybe. But if you look at what's happened with the Gen AI thing just in... I mean, it's been less than 12 months, things that we're seeing today that are becoming commonplace, perhaps you and I would've said were impossible or near impossible 12 months ago, it just felt like it came out of nowhere.

I would argue that this platform shift feels important enough to potentially double GDP. It really does affect and impact everything at mobile scale at a minimum. So, I don't know that I agree that the platform shifts are becoming less impactful. And if you look at the sort of period of 2009, 2010, really to 2020, yes there are some new sort of product cycles of course with technologies like Web 3.0, but the major cycle that was playing out was the deployment and the sort of maturation of mobile. So, I would argue that we sort of were in a lull and now we're in this gestation period where…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions