Long Take: $700B Franklin Templeton buys wealth tech AdvisorEngine, while digital investing DeFi revolution only starting

Hi Fintech futurists --

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

These opinions are personal and do not reflect the views of any other parties. Thanks for reading and let me know your thoughts here!

You can get more content like this in your Inbox for $3 per week -- the humble price of a delicious Fintech coffee. For exclusive analysis parsing over a dozen frontier technology developments every week, become a Blueprint member below.

Long Take

It is the end of an era, at least for me.

AdvisorEngine, the digital wealth platform company, was acquired by Franklin Templeton, the $700 billion asset manager last week. My roboadvisor startup NestEgg Wealth was bought by and integrated into AdvisorEngine in 2014, and I considered myself a founder and was Chief Operating Officer until 2016. Franklin Templeton is no $7 trillion BlackRock, but it is bigger than $30 billion WisdomTree, our prior investor in the company. This is a lot more powder for the team to pursue the dream -- and there is a growth story embedded in the acquisition.

Another comparable piece of news was Motif Investing. Motif was funded over $120 million, and built scalable direct indexing technology that allowed for fractional share trading and rebalancing across thematic investment baskets. The software and team were compelling, and have recently been acquired into Schwab to build out a similar product within the brokerage giant. Notably, the client base was sold off to Folio Investing and not included in the acquisition.

A business is not just the technology or the product. A business needs a thriving distribution channel and a crazy-successful customer acquisition machine. You can have fantastic, visionary approaches to the mouse trap, but remain a "hidden gem". You need a break out moment.

Sometimes that break comes from $1 billion raised from a SoftBank (e.g., looking at you Robinhood, Revolut, SoFi).

Sometimes that break comes from some gigantic enterprise deal (e.g., SigFig & Wells Fargo).

Sometimes it comes from being a cog in someone else's supersonic rocketship (e.g., Plaid / Venmo).

Sometimes it comes from practiced luck, when the requisite hustle and grind come up against a market or platform that is about to explode in virality (e.g., Coinbase, Binance).

The skill of the entrepreneur is to divine these moments together and create alchemical gold.

What I do think we can say pretty uniformly of early Fintech, and wealth tech in particular, is that it has not radically altered its target industries. The incremental approach to digitization, process automation, and digital transformation does not lead to a new thing. It leads to a better previous thing. Perhaps this is the cycle of economy, where we polish and improve the prior generation's endowment. But when looking at the step-function outcomes in media, this incrementalism is deeply frustrating to me.

Some wealthtech companies like Orion, Riskalyze, and others have built recurring SaaS businesses that private equity companies find appealing. You can see FTV or Stone Point Capital taking interests across the space. That tells me that the businesses are not expensive (i.e., not crazy venture multiples) and have well-defined, achievable objectives. While many early venture rounds are priced at 20-50x revenue, private equity investors are more likely to stomach 3-8x revenue as a valuation metric.

Biting the hand that feeds is not one of those objectives. Similarly, nearly all wealthtech firms are reliant on the RIA custodians for data and workflow integrations. With Schwab acquiring TD, we are really just left with 3 big players in the industry (controlling $4 trillion in assets), including BNY / Pershing and Fidelity. That means, as an enabling wealthtech firm, you are an app in someone else's ecosystem. And like Apple does, the custodian has a gun to your head. Just with worse technology integrations and heavier legal requirements!

Other wealthtech companies, like Betterment, Wealthfront, and Personal Capital, have remained on their digital advisor paths. I am impressed by the $20+ billion AUM numbers and the growth in functionality. In several years, I can see some of these companies housing $50 billion or more in AUM, larger than WisdomTree and closer to the customer. But let's be clear. These are the Millennial versions of Merrill Lynch, Schwab, and Smith Barney, watered in the garden of venture capital and grown with display banner advertising.

Let this water run. Let the hard winds blow over. It is time to build something new.

I've searched broadly for that something to be really excited about it. And all roads keep coming back to Ethereum, the open source programmable blockchain. We just wrapped up the Ethereal conference at ConsenSys, and the light burns bright. We are watching the Gen Z version of finance unfold before our eyes.

There is a sin to stereotyping an entire generation, but I'll put the blame on McKinsey and summarize. Gen Z follows Millennials, but instead of growing up with an undefined promise of the Internet, the generation is growing up in an age where algorithms have created misinformation glut and dystopia. Those algorithms are housed in large monopoly tech companies. Facebook is not a Harvard start-up, but an agent of the government -- American, Russian, or otherwise. Add to this the current economy, COVID, and the political climate, and I would wager to guess that institutional trust is going to be at an all time low.

Let's not overplay the crypto narrative, and just anchor back to digital wealth and portfolio management technology. I think about the following factors and how much faster it would have been to develop real solutions for clients. If you are building an investment technology company, just imagine if:

All client data has built-in open, real time APIs to both (1) see and display the data, but also (2) to move and invest assets with appropriate client permissions.

The data is secured by billions of dollars of encryption activity, which you do not have to pay, but get to leverage. Nobody needs you to do sensitive data storage.

You do not have to pay for these APIs or fill out any contractual documentation in order to access it. This reminds me of a time where TDA Institutional needed my company to get business insurance in order to pass through the vendor approval process, and I was choosing between getting that insurance or paying my student loans.

Every single asset class, from payments to stocks to bonds to alternatives sits on the same data standards. Yes, even alternative assets are in this data repository and can access the same markets and platforms.

If you like someone else's technology platform, you can just integrate their calculation engines into your own user experience. If you like Envestnet's rebalancer, just connect to it and use it, without signing any commercial agreements.

Instead of having to go to conferences and pay $20,000 per booth, there are hundreds or thousands of people having conversations about how to move the technology forward on Twitter, Discord, and Telegram every day. To access a CEO, you just send them a Direct Message on a social network and they respond.

Product announcements are not sent out as Press Releases, but directly to clients through social media, and clients spread the news and provide real time feedback.

Imagine the incredible feedback loops you could get for creativity, and speed of delivery.

But, you don't have to imagine. Let me give you a few examples.

The first project on my mind is called Zapper.fi, which builds on two prior projects called DefiZap and Defi Snap which have come together. I know, amazing names! The overall platform takes inspiration from the Web automation suite, Zapier, which allows you to create programmable actions without writing any code. Anyway, Zapper builds portfolios that interoperate between 20 or so various decentralized finance protocols, from lending, to derivatives, to staking within a single interface. The stuff uses highly technical language today, but it took me all of 2 clicks to connect my account into the system. No roboadvisor in the world has an account opening process as easy as this.

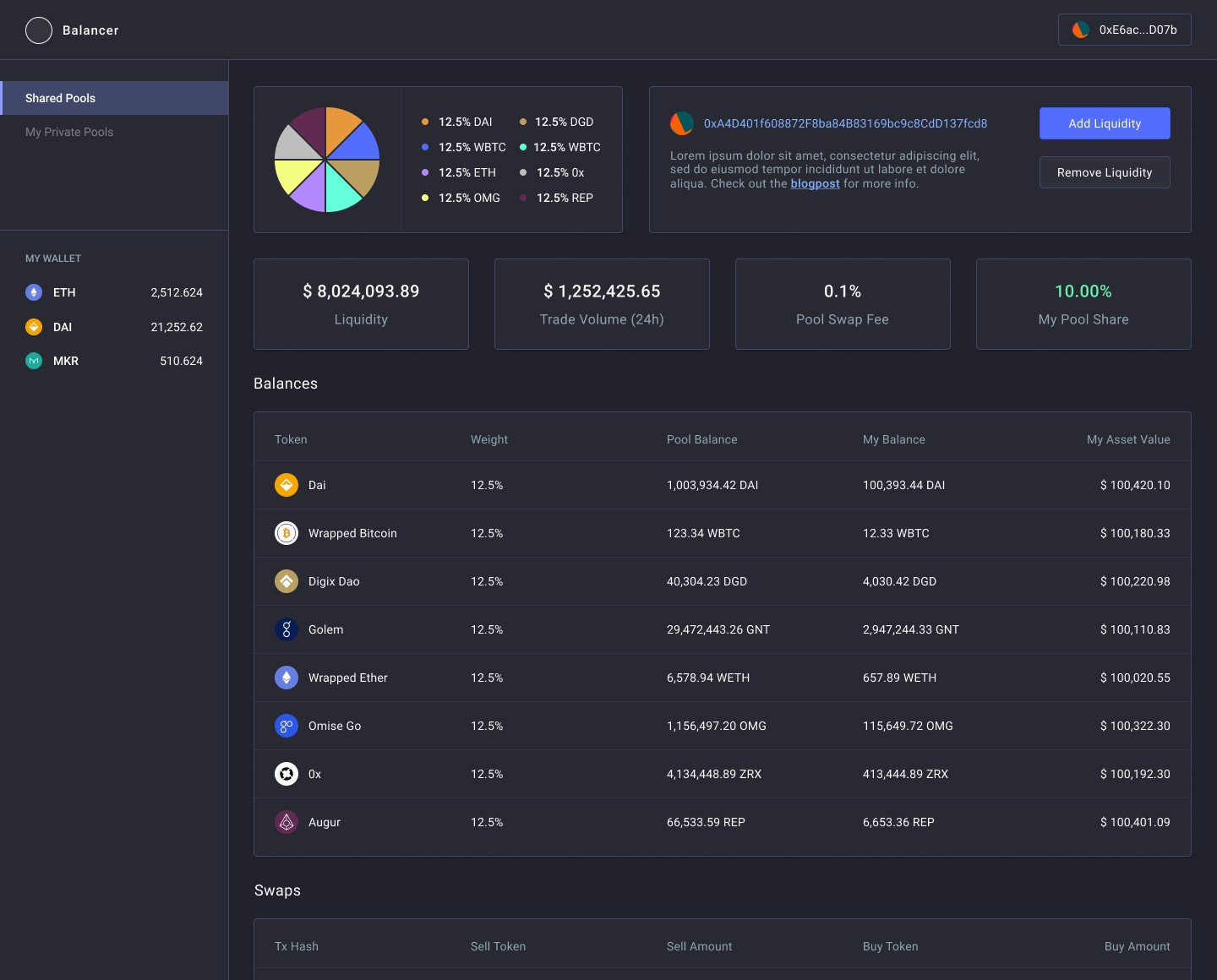

These icons and pie charts are asset allocations, or multi-stepped trading strategems. You can think of them as either Motif Investing (i.e., somewhat active management) or Betterment (i.e., somewhat passive management) executated against decentralized assets. What bears repeating is that you get all of these assets on a single blockchain infrastructure. Imagine integrating once into Schwab, and getting Fidelity, Pershing, Fiserv, Jack Henry, and VISA for free.

Another fantastic project is called Balancer. You may be familiar with traditional rebalancing software, which calculates drift and suggests trades across many accounts with asset allocations, like TD's iRebal or Envestnet's Tamarac. Balancer is an automated market maker for digital assets, and it wins by aggregating lots of assets to support liquidity (i.e., smooth trading). If you give it your portfolio, you will be paid for automated rebalancing because traders derive value from your assets being available in liquidity pools.

You can also invest in ETF-like instruments built by PieDAO, which places the investment decision in the hands of a decentralized autonomous organization. But if this is too much capital markets lingo for you, and you prefer some good old fashioned social trading, take a look at TokenSets. In about a year, this team was able to launch self-rebalancing asset allocation (i.e., "robo-sets") and trade-mirroring in a single platform. All you have to do to access the product is -- again -- bring your own wallet.

In the pre-blockchain days, it took a heavy lift for Kaching/Wealthfront, AlphaClone, and Covestor to stand up this integrated functionality, and it was generally not re-usable. For example, Covestor plugged into Interactive Brokers (a mid-size broker/dealer), and therefore did not reach across to investment assets sitting at other broker/dealers. TokenSets may be young, but their technology is generalizable to all decentralized finance. And while I am generally bearish on social investing, the speed at which the team can develop functionality is an order of magnitude faster that previously possible.

To wrap up this walk through the frontier, I want to leave you with the following thought. Digital Wealth from the 2010s may have stabilized and found its home. That may be AdvisorEngine to Frankling Templeton, FutureAdvisor to BlackRock, Motif Investing to Schwab. It may be a dozen B2C brands still standing. But the work is not done! Digital Wealth from the 2020s is just getting started -- and it's not too late to dive in.

What is the implication for financial services players?

While Ethereum has a strong lead in terms of decentralized applications and digital assets, it still needs support for the convergence between Fintech and DeFi solutions to happen. More monetary value and asset types should bridge over to this open source infrastructure to unlock the full potential of the technology. As a financial incumbent, try to understand the benefits we have outlined, and apply them to a particularly thorny asset type like real estate or carbon credits. If you can build better market infrastructure, why not start now!

As a financial technology entrepreneur in the wealth space, I would think about DeFi as just another integration project. It may seem like you need the Bitcoin ETF and a third party custodian, but that’s really not required from a functional perspective. Build a capability on your team to understand these systems, and start pulling in some small pieces of them into your stack.

As a DeFi builder, I would recommend researching the infrastructure of the current portfolio management and investment industry. What issues come up repeatedly in trading across many asset allocations? What happens when people own multiple accounts? What are the tax implications? Think this stuff through, before somebody forces you to refactor, which you might not be even able to do.

Looking for more?

Want to send me a note? Reach out here anytime.

Like this analysis? Tell the world!

Interested in a premium subscription for just $3 per week?