Long Take: Can we be optimistic about 2Q2023 Equities, Crypto and Venture markets?

While macro indicators have stabilized, downstream markets are still struggling. Except for Big Tech.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We look for key indicators suggesting a risk-seeking environment, potentially favorable for growth and innovation. Despite recent volatility, equities show resilience over a five-year span. Crypto and AI, represented by Bitcoin and NVIDIA, are enjoying substantial gains, hinting at deep tech's growing appeal. Venture capital, although subdued compared to its 2021 zenith, maintains a steady pulse in fintech, with banking and lending drawing the lion's share of investment. Our analysis points towards a cautious optimism as we navigate through the economic fluctuations, keeping an eye on the horizon for emerging opportunities in fintech and beyond.

Topics: capital markets, equities, investment flows, Bitcoin, factor investing, venture capital

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Diving Deeper

Welcome back.

Last week, we looked at the macroeconomy and its current state.

The cost of money, the capacity for personal consumption, and the possibilities of growth tell us a story about the temperature of our economy. That story highlights whether it will be easy or hard to pursue growth and innovation, rather than cost cutting and profitability. It tells us whether investors want to take on risk, and what kind of risk they are willing to take. That, in turn, helps make decisions about where to allocate your own time and money, putting cash into banks or into YOLO NFT projects.

As we transition further towards a risk-seeking environment from a risk-off period — if that happens of course — liquidity will structurally flow into alternative assets, private investing, and digital. While the price of Bitcoin and NVIDIA stock suggest that some risks are becoming more delicious, the low levels of venture activity show that we still have a long way to go.

Once the coffers of these alternative investments are filled up at the asset class level, money will flow into long tail projects, start-ups, DAOs, digital art, and all of the other strange and interesting novelty seeking that skeptics like to criticize. Capital gains lead to brash investment decisions. Capital losses lead to fear.

The markets are often recursive, self-fulfilling prophecy machines. There are waves within waves, moved around on the tides of capital.

After parsing the macro situation, let’s dive deeper into Fintech- and Crypto-specific market metrics. Next week, we will look closer to the fundamentals by looking at Web3 and AI core metrics.

Equity Markets

Here’s one way to slice public market performance:

We are trying to understand what has happened to asset classes overall. How have things rebalanced this year, after correcting harshly in 2022?

Equities are up 10% year to date, and up 55% on a five year time horizon — suggesting that despite recent volatility, the asset class is still doing well over the long run. Meanwhile, bonds are down 5% this year, which is a mechanical function of interest rates rising. For the average person, you want to earn yield by holding fixed income, rather than speculate on marking bonds to market. Gold is up 8% this year, which highlights its value as an inflation hedge, even though inflation has slowed.

The key indicators for us are Bitcoin and NVIDIA. These are representatives of two deeptech sectors relevant to financial services. Bitcoin — a proxy for crypto — is up 480% over five years, and 110% this year off from a market bottom. While many investors have lost their shirt, a patient allocator still looks smart over the long term. Separately, NVIDIA — a proxy for AI — is up 660% over 5 years and 190% YTD. Similar stories can be seen in Google and Microsoft, but NVIDIA is the closest to a pure-play bet that we have so far.

Let’s cut things a slightly different way.

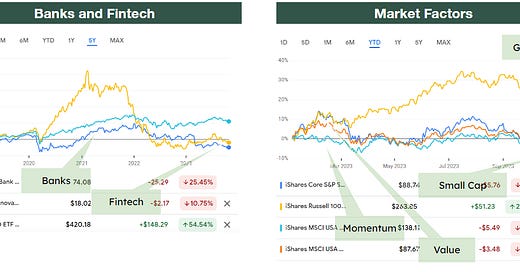

Banks, despite arguably being well positioned given their exposure to net interest income, have performed poorly when compared to equities generally, down 25% over five years and down 27% year to date. Fintech, represented above by the Ark Fintech Innovation ETF, is down about 10% over the long term, having recovered 27% year to date.

This is bad story for the sector. It reflects the utility-like nature of banks — all risk management and profitability, low growth and limited fundamental tech innovation. Fintech brings some digital magic to the model, but is being penalized for looking like finance, rather than rewarded for looking like tech.

If you want to parse things further, see the following excellent analysis from Financial Technology Partners, showing Price/Earnings multiples by vertical below.