Long Take: Is Apple's Goldman-powered 4.15% yield account the fintech apocalypse?

A comparison with Google, PayPal, Ant Financial, and Ethereum staking

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We look at Apple launching a Savings account powered by Goldman Sachs, offering a 4.15% interest rate. Our analysis puts this into context relative to earlier launches of big tech neobanks — in particular the experience of Google, PayPal, and Ant Financial. Further, we look at the psychology and importance of high interest rates, and whether there is anything actually exceptional about that yield. We briefly cover the Ethereum Shanghai upgrade and its inflation / yield mechanics to highlight the difference between real and nominal returns.

Topics: big tech, banking, lending, blockchain

Tags: Apple, Goldman Sachs, Citi, Google, PayPal, Ethereum, Ant Financial

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

The Applocalypse

The moment the banks have been waiting for is here.

That horrible, gut wrenching feeling of losing to a higher technology super organism. The thing no community bank or regional credit union ever wanted to happen. All the fear mongering, and lobbying, and otherwise hand waving about big tech. Will they enter into finance, asked everyone, hoping that they do after you personally retire.

But behold banker, it’s here!

Apple has launched a Savings account, yielding 4.15%, within its Apple Card wallet functionality. As we have said many times, financial products are mere features within the higher-level expressions of commercial intent — thus that’s where they will be embedded. This particular interest rate account is very attractive in the current environment, and feels like a killer feature.

As a result, Apple delivers equally (1) the Internet, (2) the media complex, and now (3) core banking financial product. It is to Apple that those economic pillars bend their knee. The particular bending here is done by Goldman Sachs, to whom the actual money flows. We know that the economics extracted by Apple tend to be very advantageous, but still the scale of distribution afforded to Goldman from Apple is unparalleled. It is worth to break even — or even lose money — in order to see the size of such a footprint.

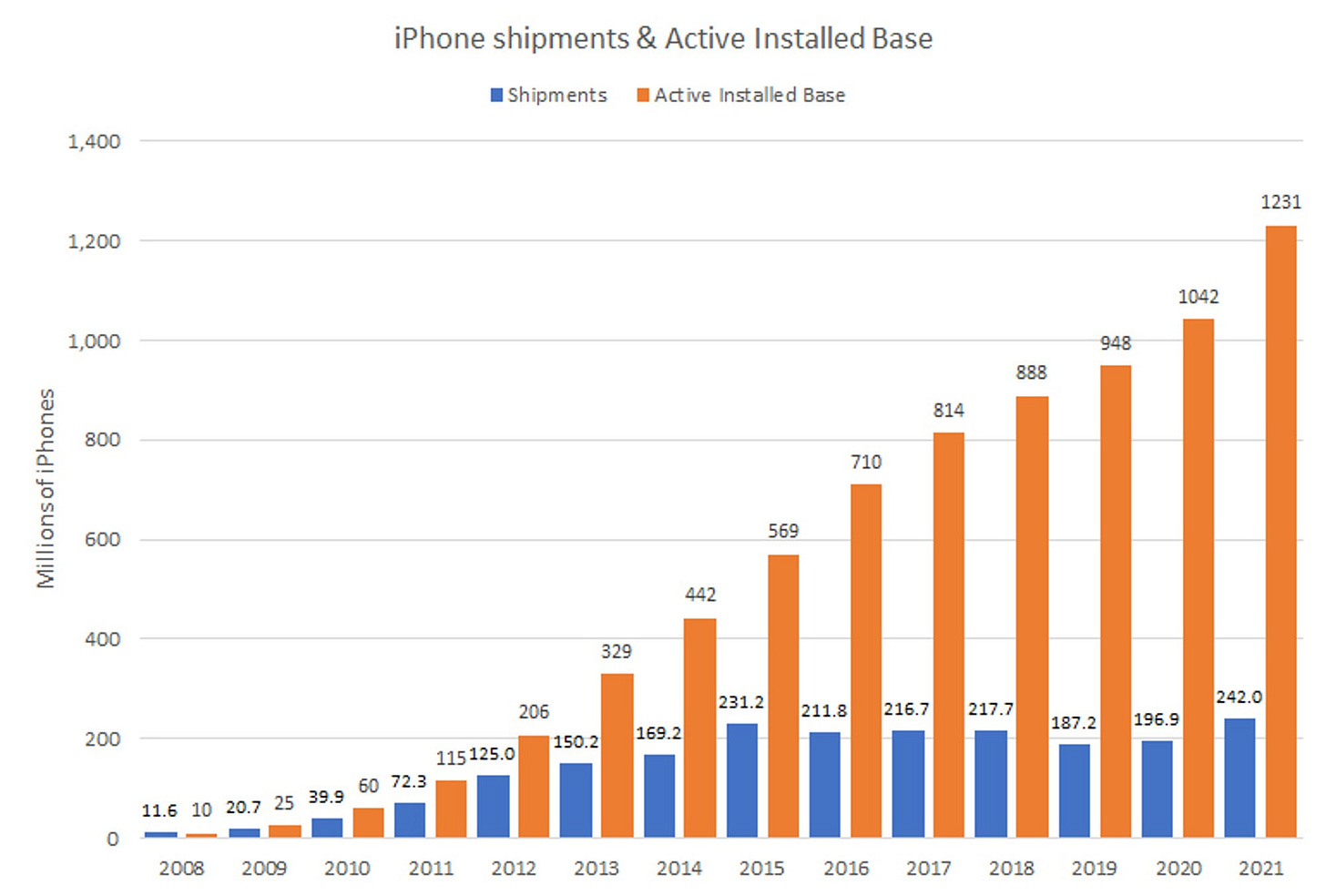

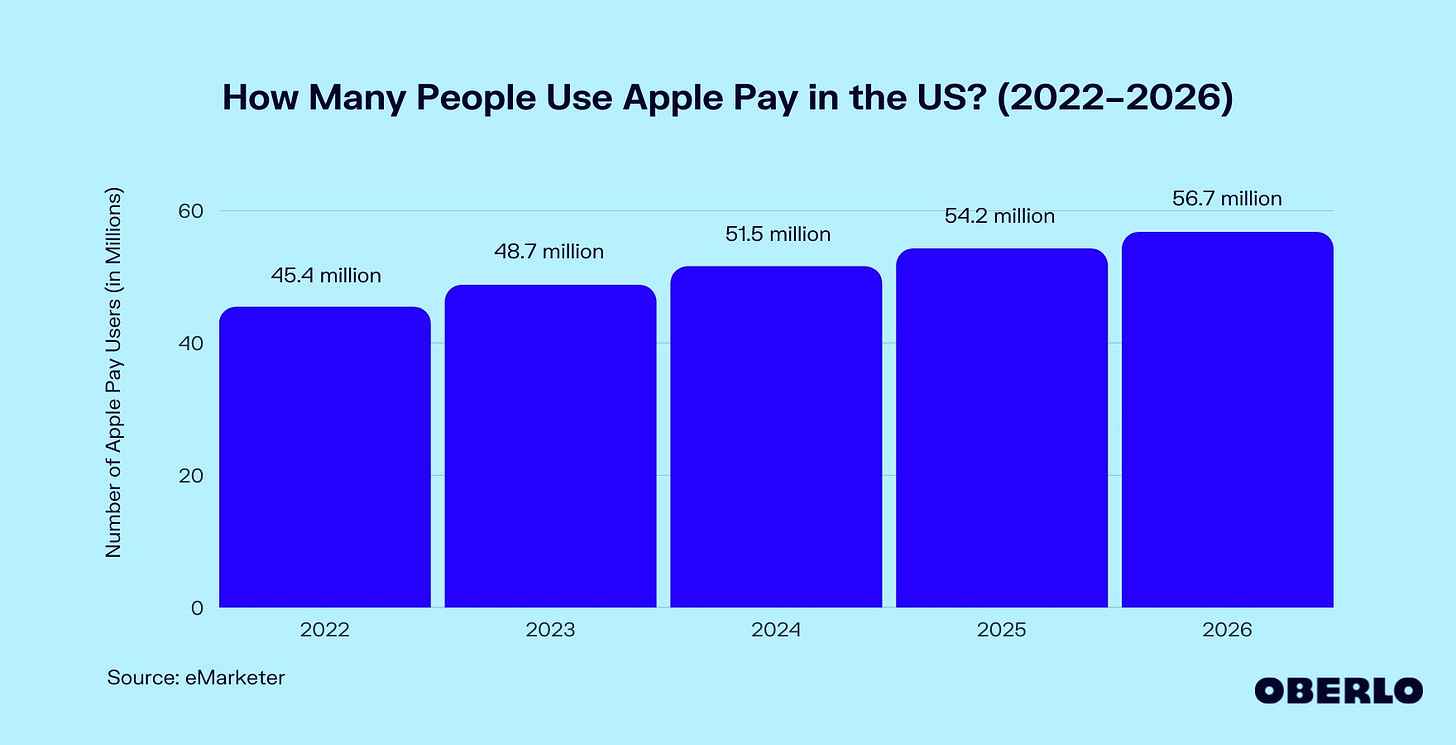

The iPhone install base is somewhere over a billion units, comprising 50%+ of the US smartphone population. Of those, 45 million are users of Apple Pay — a chunky share for a primary digital financial destination. By owning consumer spending through proximity payments, the iPhone become an indispensable digital wallet.

It should not be hard to imagine how this digital financial destination extends to the core financial value propositions over time. Apple’s services revenue is its fastest growing revenue source, and that is important given that device penetration has become so saturated. We do not yet have another platform shift to augmented reality or some other piece of hardware. To that end, Apple is forced to extract value from the application layer rather than from the distribution of its core devices.

It is interesting to us to track Goldman Sachs and its role within the product. We have previously covered Goldman’s reorganization, re-shuffling previously hot neobank Marcus and its adjacent consumer lending bets into the more private-wealth focused division. Marcus required $2B or so of annual expense, in addition to one-time capital outlays for acquisitions and integrations.

But no matter how successful Marcus ended up being, it could never have a 1.2B distribution footprint — unless it scaled up like Ant Financial attached to Alibaba. And such a path is prohibitive for a number of reasons. End of the day, Goldman makes most of its money in high-end finance manufacturing, not distribution, and Apple is the best distributor there is, aside from the open Internet. Which Apple also distributes.

The Googlocalypse, PayPalgeddon, and Antquake

And yet, have we seen something like this before?

Oh, right, the evolution of Google into a giant bank distributor as well, pulling together Citi, the Stanford Federal Credit Union, BBVA, BMO, Green Dot, and another 10 or so integration partners —