Long Take: Google has come to Banking. What does that mean, and what should we do about it?

Hi Fintech futurists --

This week, we look at:

Google rolling out its finance super-app, Google Pay. Big news for Citi!

What else do you need? Some delicious bacon bits sprinkled in about Square, PayPal, Mint, Yodlee, Trim, Cleo, Plum, Acorns, Wealthfront and everyone else that is in the cross-hairs of this juggernaut.

And as a financial institution, what should you do about it?

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Recent Content

Podcast Conversation: How roboadvisors, B2C fintechs, and high tech giants are causing deep shifts in wealth management

Long Take

An incredible spate of news hit our radar last week.

From Affirm's IPO, to BBVA's $11 billion exit to PNC in the United States, to Chainalysis raising $100 million at a $1 billion valuation, things are moving fast towards the end of 2020. Let's not forget the DeFi hacks, hitting the Pickle Finance protocol for $20 million and the Origin stablecoin for $7 million. And we were stuck a few weeks back asking whether there were still interesting questions to answer!

But there is something even more incredible than that.

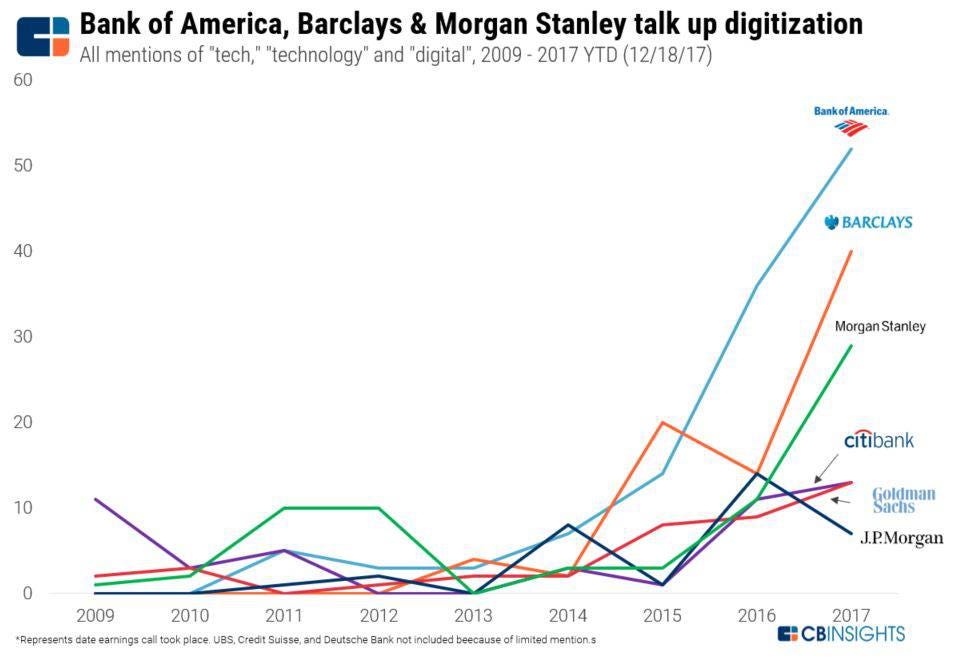

Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

The first thing you can do is Pay. Google has been slogging through payments for decades. It has fought to get NFC chips into phones, and new point of sale terminals into stores. Apple also has put an inordinate amount of investment into training people to use their phones instead of their cards for transactions. And there is a simple reason for this prioritization. Paying is the closest financial services to messaging. It is the movement of information between one party and another. That messaging must be secure, encrypted, and protected against fraud.

The core user experience innovators in payments are Square and Venmo (PayPal). Venmo entered the space in 2009 by targeting bill-splitting and other group payment question. It had also combined a social media stream with financial transactions -- something ridiculed at the time by invoking the spirit of "privacy", which greatly misunderstands the Kanye West, Kim Kardashian, Donald Trump world that we live in. To be known for your financial extremes is the Instragram Influencer's dream state.

Square entered paytech through small business point of sale terminals, and expanded into social payments with Cash App. It tells us everything we need to know about the potential feature bundling available to Google Pay.

From money in motion (i.e., payments), you can quickly hop into money at rest (i.e., banking), credit products like payday lending, trading and investing, and of course, cryptocurrencies. This is why PayPal is now in the Bitcoin and Ethereum business. This stuff naturally lives and grows out of the payments app, which accrues the most usage and engagement by being closest to commerce and the user experience with money.

As an aside, let's footnote here Ant Financial and Wealthfront. Ant Financial does exactly this, but on a much larger eCommerce chassis. That provides it $300 billion or so of enterprise value. When you are Alphabet, unless the market opportunity ends with "hundred billion", it's not worth doing. Thus payments is about mapping onto commerce and monetizing through the fintech bundle. Watch Shopify (to be acquired) and Instagram (to be the increasing focus of Facebook) carefully when thinking through this hypothesis in the West.

Second, for a company like Monzo or Acorns or Wealthront, which provides a financial app but shies away from over-engagement, stuff like this is a real competitive problem. To grow market share against incumbents like Schwab, BlackRock, Morgan Stanley is essentially zero-sum economic trench warfare. So you turn to the digital realm. But the digital real now has attention platforms in the financial domain, with better data modeling, infrastructure, and dopamine addiction.

It's even worse for the data aggregators / PFMs of the world. Here we have Google's analytics and insights.

There is nothing revolutionary about the concept of budgets and aggregation. Hundreds if not thousands of Seed stage Fintech decks showed some sort of financial tracking on top of a spending graph ever since Mint.com sold for $170 million in 2007. Yodlee (acquired by Envestnet), Plaid (almost acquired by Visa), Finicity (acquired by Mastercard) all provide this underlying data and have monetized against it. Google is probably paying for it! And yet, what is scary and powerful here is the machine learning algorithm.

Transaction data is normally a mess. It is full of junk information and, often, errors. Mint beat its early competitor Wesabe on the layer above the transaction data -- categorization and visualization. When it comes to categorizing messy unstructured data better than anyone else in the world, Google holds the ground by a mile. Of course Google categorizes the written web. It also categorizes the visual graph. You may remember how shocking it was to see Google Photos provide the ability to search your photo library by the word "cat" or the name of a loved one. It is still an amazing marvel of image recognition.

Now apply this power to your financial data. Do you think Mastercard or Goldman Sachs or SoFi can do better?

Categorization makes the data useful, creating the potential for actionable insights. It also models out a financial avatar of the user, which can then be converted into offers and other products. Remember that we have not even talked about the overall user footprint yet. We are only pointing out that a structural advantage in AI (i.e., recruiting, languages, mathematics, research, data footprint) makes Google the best place to park a personal financial management tool.

Could we have said the same thing about Google Finance, the Yahoo Finance competitor that never really became the de facto Bloomberg of the web? Could we have said that categorization and analysis gave Google the best tools to create investment signals? Yes, and No. The company had an opportunity to build a quantamental practice for money managers that unearthed and packaged search data, and generated sentiment-based recommendations adjacent to web data. But while this market may seem attractive to someone in Fintech, it is awfully small to someone in high tech (see research budgets), and dangerously close to providing a research recommendation and triggering regulatory scrutiny.

Onto rewards and commerce.

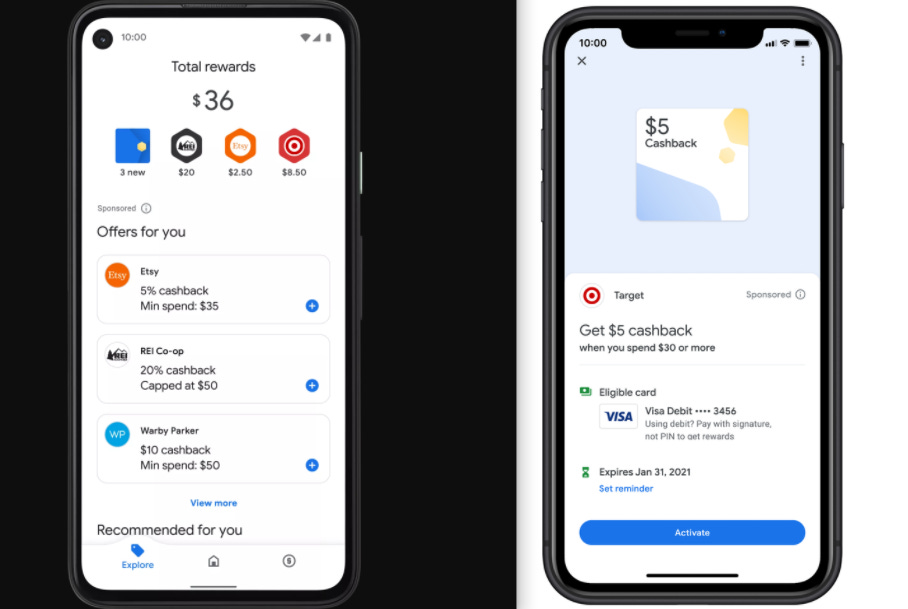

If you swipe away from analytics and towards the left, you will see an Explore screen. Two things are of importance: (1) the QR code reader, and (2) rewards. On the QR code, our narrow observation is that Americans and Europeans are finally being trained by Covid track and trace to use QR codes for checking in, ordering, and paying. This is fruitful not just for traditional payment systems but also for digital assets in the future. But in this case, the QR code is an echo of Eastern payments apps: both enabling merchant processing, as well as peer-to-peer payments.

As it relates to rewards, people like free things and there is a neat set of integrations involved here. Digital coupons are surfaced and integrated into various spending cards connected into Google Pay. The user does not have to apply codes or fidget with physical copies; everything is done automatically. This section is, in essence, the customer acquisition cost that merchants pay to Google to be represented on its shelf-space. Think of it as the Google Ads of payments -- an economic clearing engine for sponsorship that lives inside of a payment app. If Google made no money from payments, you would see a LOT more rewards. But we assume it does both.

Let's acknowledge the network effects. Google Maps has been planting businesses in a virtual world for over a decade, with companies like Yext working as an aggregator of the terrestrial footprint into the Maps footprint. Google has also made countless of voice robots and other integrations so that you can order food from a restaurant or trouble shoot some particular outcome. All this sits on top of the business data set we are discussing. The high tech company has commercial relationships at scale that are only now starting to show their monetization potential.

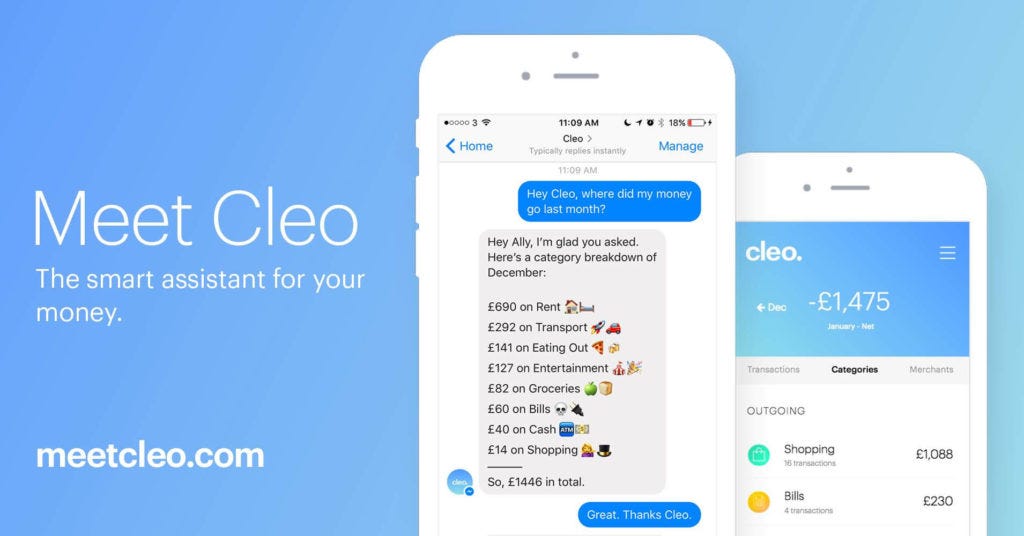

If you are Trim, or Cleo, or Plum or any other chatbot focused on cutting expenses and subscriptions, this section is a target on your head.

Last but not least, the non-bank bank. Like, a bank account with a card and all the other stuff, without fees. You used to actually have to go to a local bank branch or into some other torture chamber to get access to a deposit account. Since the rise of digital lenders, roboadvisors, and neobanks, supply of digital banking has gone through the roof. As a result, basic economics suggests prices go to zero. Introducing, Google Plex --

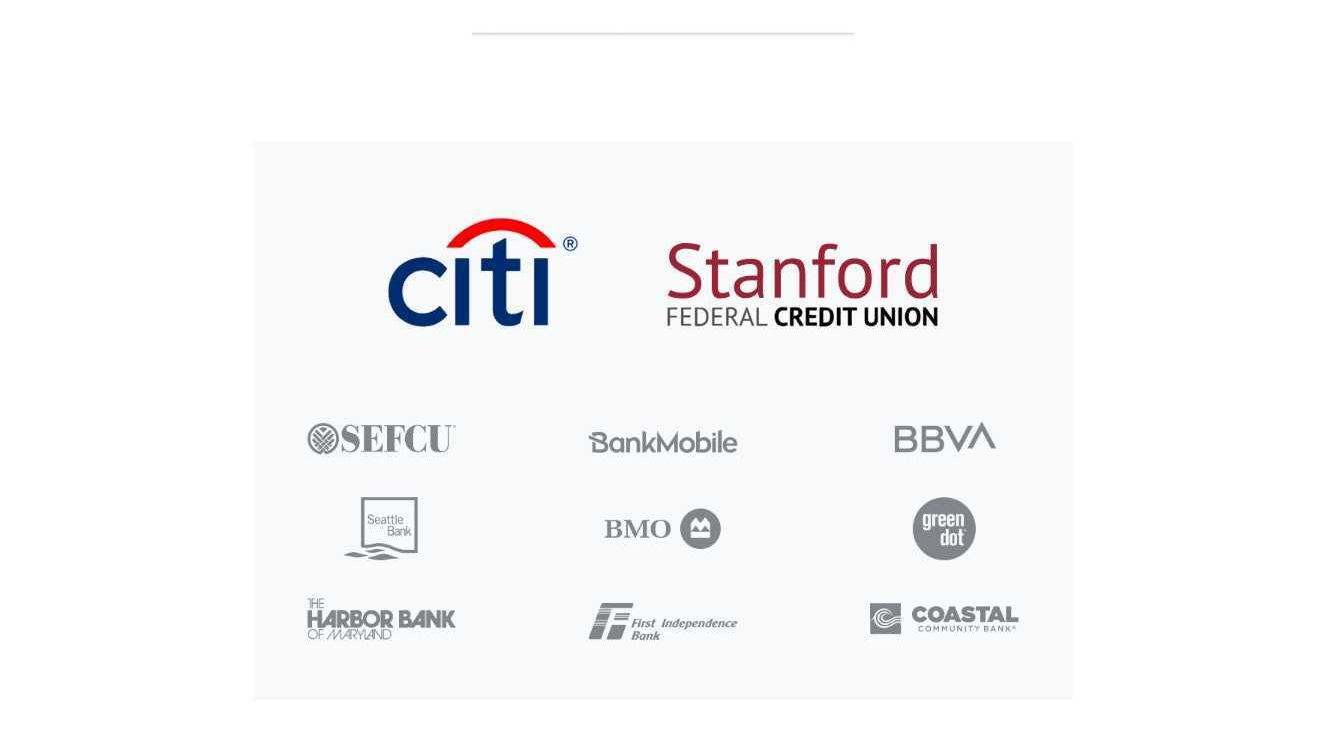

This is a bank account wrapper for Citi and the Stanford Federal Credit Union. There are 11 or so slated integration partners, also pictured below. BBVA US is being sold to PNC, but more globally BBVA has a reputation for banking-as-a-service innovation, having bought Bank Simple for $117 million in 2014 (and largely written it down). Green Dot has been involved in powering up high tech for a while, including Apple's earlier efforts. Goldman is Apple's current preferred partner. But can you make out the common thread below?

These names are balance sheet. They are capital. They are not fintech. They are not the next generation of core banking, or some global investment firm trying to be a tech company. Credit unions are as close to raw capital as you can get. Citi is lagging JPM and BAML on technology innovation. It does not lead in digital wealth, or blockchain, or artificial intelligence. But it is big, broad, efficient capital.

And Google is big, broad, efficient user acquisition. There are over 100 million Android smartphone users in the United States, and about 20 million of that is also Googe Pay users. We are not counting India and Brazil, where Google Pay already knows how to run local money apps.

The outcome of the launch is then a very large consumer B2C footprint receiving a near-free or entirely-free banking experience, powered by API integrations into hand-picked financial partners that will be happy to provide capital without usurping the user experience. It allows Google to index finance consumer spending transactions they way they have indexed other data sets. That in turn is a Pandora's Box for artificial intelligence and machine learning. It is still hard to know the unintended consequences of building out our financial robot doppleganger. Knowing the experience of the average person with social, on the margin they will trade all of their private data for a $5 iTunes rewards card.

Implications for Finance

What we could say with some certainty is that banking, transaction, and behavioral financial data is the core mana that powers financial planning, goal setting, and investment recommendations. All the contemplated features of expense management, automated savings, interest maximization, and retirement funds sit neatly inside of this new upgrade -- just look again at Ant.

They may not have instantiated yet. Google needs to prove that people want it, that they aren't scared of re-signing The Pact. But if the answer is *Yes*, that we do want to give into beautiful, simple, blue-color-optimized Google Pay, expect all of consumer Fintech to fall.

You might be a financial planner figuring out what software to use. Or you might be a brand looking to embed a little bit of banking in your web shop. Or you might be the mighty Square and PayPal. Or you might be Goldman, excited about growing Marcus and Folio Financial into a digital finance home screen. Well, Google and Amazon have been used as Boogeyman for finance for a decade. Here we are. A unicorn graveyard.

The room that remains, if such a thing comes to pass, is that -- as we have been saying for a while -- distribution is largely done by high tech firms. There will be some mass scale exceptions in the form of vertical fintech applications, bundled and funded by SoftBank (e.g., SoFi, Robinhood, Revolut). But they will be competing within their enemy's domain.

For the long tail of regulated capital, like the small state banks and credit unions, this may end up being good news. If we were a tech firm, we would sprinkle out demand for money the way we sprinkle out demand for attention. Through a giant matching exchange engine that maximizes our profit and allows millions of small companies to put their balance sheet to work.

What remains, besides the collapse of the middle market, is an opportunity for institutional business and product manufacturing. The networks supported by Visa and its payments rails, or the relationships behind the fixed income capital markets of UBS, or the trading venues of the NASDAQ -- these wholesale and enterprise businesses are much closer to the vein of money, and therefore far less attractive to the tech firms. Yes, Google is using AI to figure out how to underwrite mortgages. Maybe it won't put that in Google Pay to intermediate distribution for a few years. But it certainly won't want to pony up the risk capital if that is required. The main opportunity for the financial sector is -- also as we have been saying for a while -- manufacturing. Look to blockchain and DeFi.

Not all is Lost

It is fun to tell the above story. It is scary, and exciting, and drives *strategy*.

But look, Google might also fail out on this one. It wouldn't be the first time -- see this fantastic running list from the Verge. Whether it is the $10 billion miss with Motorola, the phone manufacturer, or the attempt at beating Facebook at the social media game with Google+, the company is not invulnerable. Another example is the slow dissolution of the Daydream VR project, an early attempt to cement the phone as a preferred virtual reality headset, as well as the sort-of-dopey Google Glass project.

We can guess at why those bets failed. Trying to beat Facebook on its own turf by recreating its social graph is hard. There is no particular network asymmetry that tilts things in Google's favor. Making a hardware play when your strength is data indexing and open source is also hard. Crunch the numbers, Google, and leave the design stuff to designers.

But finance, finance is just a relational data set with human intent behind it, like the Internet. Google Play is easily a default app in the Android ecosystem. There are multiple industry comparisons about why this model works, and proof points from other geographies. In our view, the main third rail for Google is really regulation. If Facebook bungles its stablecoin, or Ant gets humiliated even more publicly, there is a chance that American regulators will find this particular application to be over the line.

But what can they do about it?

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.