Long Take: JPM's frank $175MM M&A mistake and the dangers of synthetic humans

Gm Fintech Architects —

We are going to take a break from the *Build It* series for this week, and parse a weird but important topic.

Summary: Today we are going cover JP Morgan spending $175MM on Frank, the … frankly fraudulent … financial aid fintech. We look at the topics of student lending, the cost of acquiring customers, and explore why JPM would want to own this asset. The interesting bit, however, is trying to figure out how Frank faked 4 million accounts. This connects to the current trends in generative AI, and in particular the attempts of building out synthetic humans at scale — people who seem real, but aren’t. Those may populate video games and the metaverse, but also fraudulent sales of neobanks.

Topics: capital markets, M&A, student lending, fraud and crimes, generative AI, synthetic humans

Tags: JP Morgan, Frank, Chat GPT, Open AI, DALL-E

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

The Jokes Write Themselves

It was called Frank.

This financial aid or digital lending or whatever fraud website that JPM got tricked into buying. You know, Frank is a great way to call your fraud. You could also call it, “Not Fraud”, and “We totally don’t do crimes”, and other similar good names.

To be clear — Frank was definitely not frank. It was super, duper, extremely not frank at all about its business operations, number of customers, and other things that a big investment bank analyzes in careful due diligence. Which JPM totally did.

Let’s rewind.

There was a fintech startup targeting students and their financial aid applications. Student loans are a ridiculous asset class in the United States. Totally, utterly, insanely absurd high costs of private education, with deeply regulated interest rate setting by semi-governmental entities, usually completely inappropriate for the level of risk that they cover. We know this because we once went to graduate school.

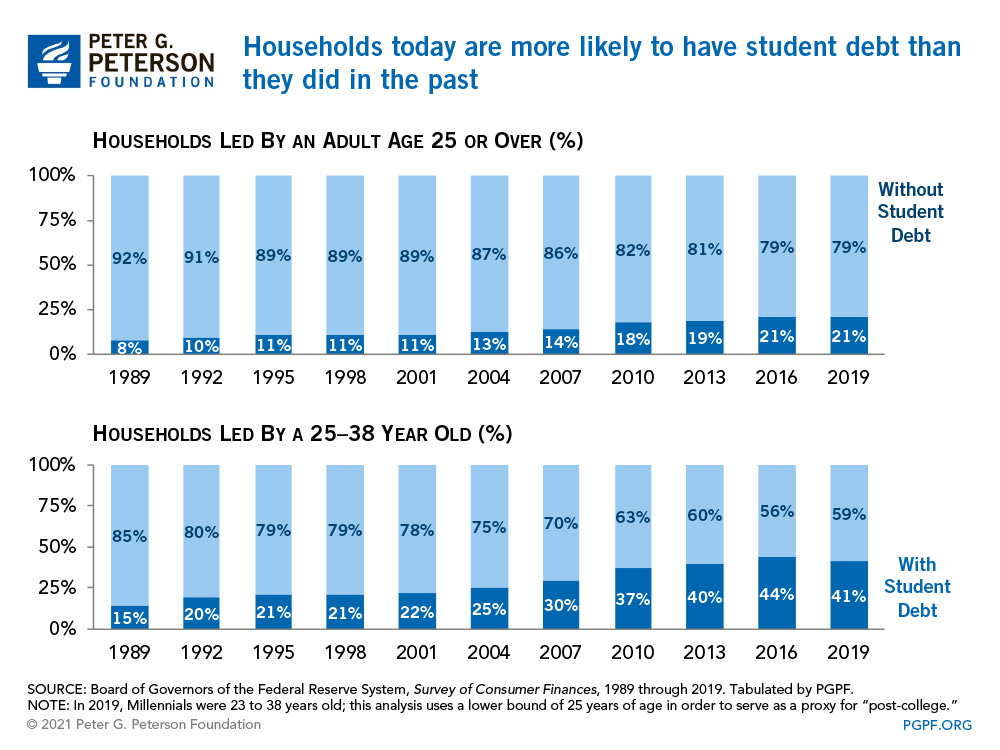

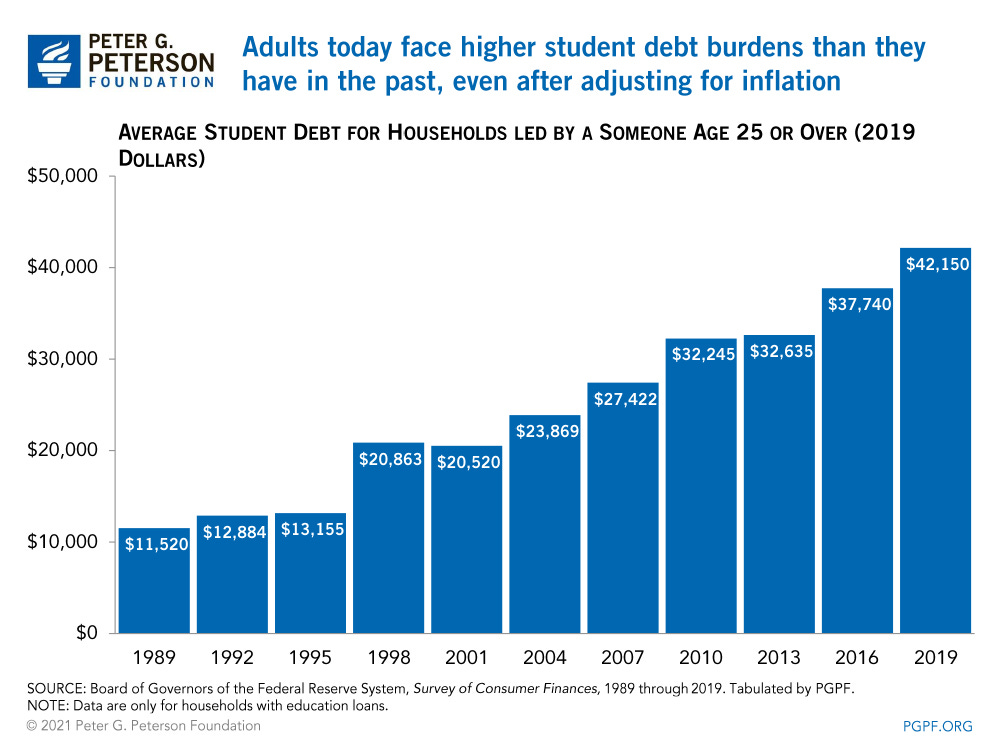

As you can see above, the total student debt in the US is over $1.6 trillion, higher than auto loans and credit cards. The average student debt for households led by someone over 25 has gone from $12,000 in 1990 to $42,000 in 2019. It is the American dream life of indentured servitude.

Look, the private education bit, frankly, isn’t the fraud we want to talk about. Rather, we want to highlight how lucrative it is to underwrite this population, because also they can’t default on government student debt — it survives bankruptcy. Unlike FTX creditor balances!

Anyway, as JP Morgan, one of the largest banks in the world, what you want to do is own the top of funnel for this process, because it is a great way to start selling financial products to students. If you get a college student to open up a bank account with you, it’s likely to persist for years. Not to mention the work of the underwriting and refinancing itself.

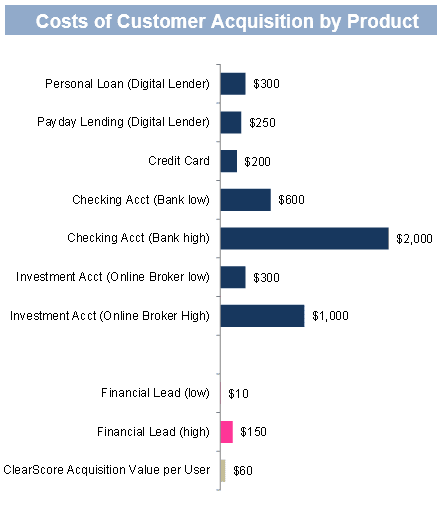

So you might want to purchase the hottest Fintech targeting this top of funnel, acquiring students at a fast clip. You might want to pay $175 million for 4.25 million users. That’s an acquisition price of about $40 per user, which is quite cheap relatively speaking (see comps here).

Companies like Credit Karma, Bankrate, and other lead generation sites can sell you leads for $10-150 per user. Fully loaded customer acquisition cost is anywhere between $250 to $2,000. Lifetime value pays for this initial investment. So $40 for 4 million students is a pretty good deal, relatively speaking!

You might even hire the CEO of this student market lead generating unicorn with a $20 million retention bonus and make her MD!

Note to self — be the CEO.

However, there is a plot twist. And that plot twist is that there weren’t 4 million students at all, but maybe 300,000 customers. We’re not sure what customers are? Maybe people signed up for the website’s help on getting financial aid application support? Those might convert at 0.50% into financial products, but we are getting ahead of ourselves. The main problem is that the 4 million customers weren’t real.

Instead, they were, frankly, super fake.

We don’t intend to be mean. Mistakes happen, and the excitement of an acquisition like this just might slip through diligence. If anything, what we’ve learned is that a $175MM check isn’t really that important to a bank the size of JPM.

Faking Till You Make It

There’s something about the current generation of entrepreneurs getting on the Forbes 30 under 30 list that leads to doing crimes.

The detail of this particular misrepresentation is really interesting to us.

The Charlie Javice, the CEO, tried to have her own team fake a bunch of accounts, and her team refused. So she went to — and you can’t make this up — a Professor of Data Science! We can’t find the name, let us know if you do. Like, there weren’t enough students who had signed up for Frank. So they did what all economists do, which is make an “informed assumption”, which in this case was to generate a fake list of customers.