Building Company Playbook #2: Creating a B2C fintech marketing strategy

And the differences to the B2B path

Gm Fintech Architects — Our agenda is below.

Summary: Today we are continuing our Build It Series, focusing on the differences between B2C and B2B strategies, and on the implementations of some foundational marketing principles. We discuss branding and the two ways of doing it right. Then we dive into the various programs that can be implemented to generate demand, from content, to social media, to paid acquisition. Finally, we touch on the importance of CAC and LTV, in particular during a year like 2023.

Topics: marketing, strategy, economics, fintech

Tags: Betterment, Mint, FutureAdvisor, LendingClub, Coinbase, Softbank

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

Building It with Marketing

In the last installment of our *Build It* Series, we talked about ideating business opportunities around the shape of demand, and how to do that. Having a reasonable hypothesis around what is and isn’t useful is a requirement for your entrepreneurial experimentation.

Today, we will continue down the path of talking about structures and strategies to engage with customers and capture attention.

In figuring out your desired model, you’ve probably come to a fork in the road about B2C and B2B, applications or infrastructure. These things follow a predictable cycle, at times where it is more profitable to sell the shovels for the gold rush, and at times it’s better to look for gold. You can see our review of the dialectic here.

Both of these directions require building out a specific go-to-market strategy. In B2C, you are going to be focused on finding very many customers — likely millions of converted individuals into free accounts — and using the levers of brand marketing, content strategy, growth and paid advertising, events, and various other programs. You are also likely to structure your product in such a way that there is a freemium conversion funnel, and some single digit percentage of free users end up as paid ones.

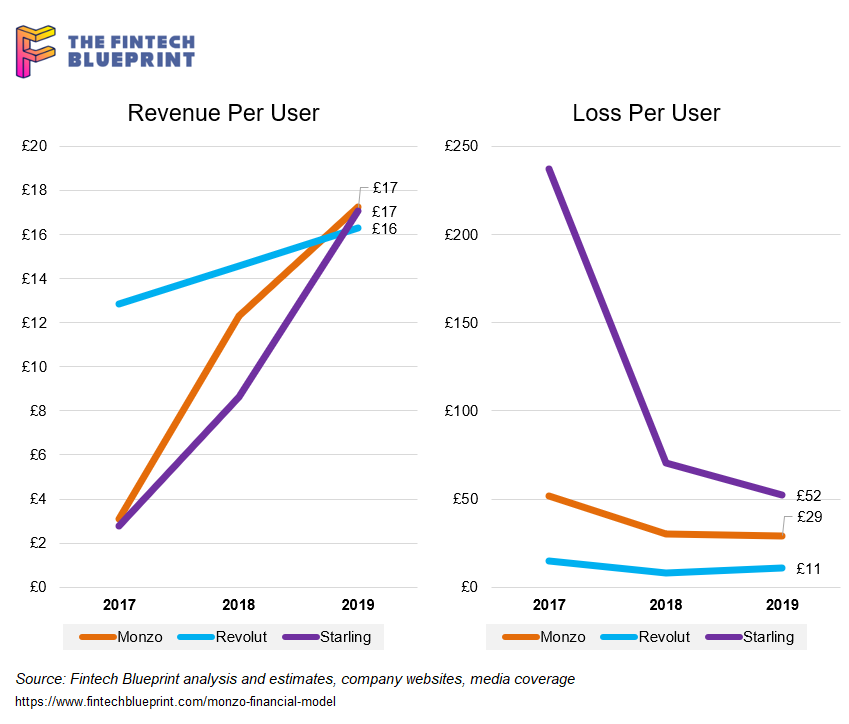

Thereafter, for paid users, you would expect annual revenues anywhere from $10 to $500, depending on your niche, per user. We cover some of those numbers here, though it bears saying that the Revolut and Monzo type numbers were not sufficient to maintain the business they want. Starling, on the other hand, has had success by deepening share of wallet and expanding into the small business segment, thereby increasing average revenues.

In the B2B or enterprise approach, things are quite different. You will end up targeting institutional customers, or consultants and intermediaries that target institutional customers. We use enterprise, corporate, and institutional interchangeably here, though of course they have different meanings.

Let’s think of it instead as the average ticket size per customer being $10,000 or more per year — something like 1000x more than in the retail case. This means you don’t need millions of customers, you need hundreds or thousands to make a valuable business.

Such an approach includes long sales cycles, often a need for certifications and ecosystem integrations, and a stellar sales team. Sales-led businesses might spend time exploring customer needs through consulting and customer success programs, and build products driven by very explicit requests for features from their customers. One of the advantages of having a few deep customers, over millions of shallow ones, is the quality of feedback you can get about what to build. Consider a company like Envestnet, which will know exactly what to put on its roadmap based on the financial advisors it serves. This, however, is also the danger — to be so captive to some customers that your solution becomes non-generalizable.

We will cover B2B in more detail next time, so let’s focus on B2C today.

Brand Matters

We financial people tend to be terrible at understanding creatives. That’s not entirely true, but it’s true enough of the time. The analytical way of thinking, with its logic trees and Excel spreadsheets, and the empathetic emotive way of thinking, with its associations and imagery, are very different approaches to the world. So many fintech founders don’t have a good sense for brand, what brand does, and why it is important.

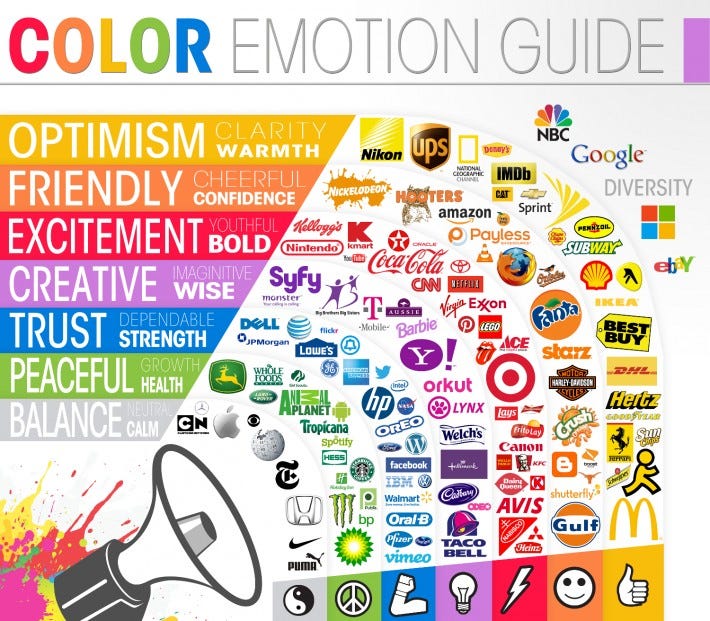

For example, do you understand how particular colors stand for particular emotions, or do you think that is just nonsense?

For the practical people, we will give you the practical answers upfront. When you are naming your company and thinking about its vision, mission, and brand promise, take one of these two paths. First, you can try to be as direct as possible, being incredibly literal about what your company does. No clever tricks, no aspirational imagery, no puzzles.

FutureAdvisor is an advisor from the future. Coinbase is a base for all your coins. LendingClub is a club that lends you money. Done! Other bangers would include things like — FootLocker, Laundromat, Coffee Shop, and so on.

For most people, this type of signalling is the best you can do without creating something incomprehensible. Remember, the brand isn’t for you — it’s not a special word that means that one time you were a kid and had a transformer robot, or that lake you swam in and liked (true story), or something that just sounded good. The brand is something much more complex. So to avoid the process, just be very direct about the product you are selling and how you sell it.

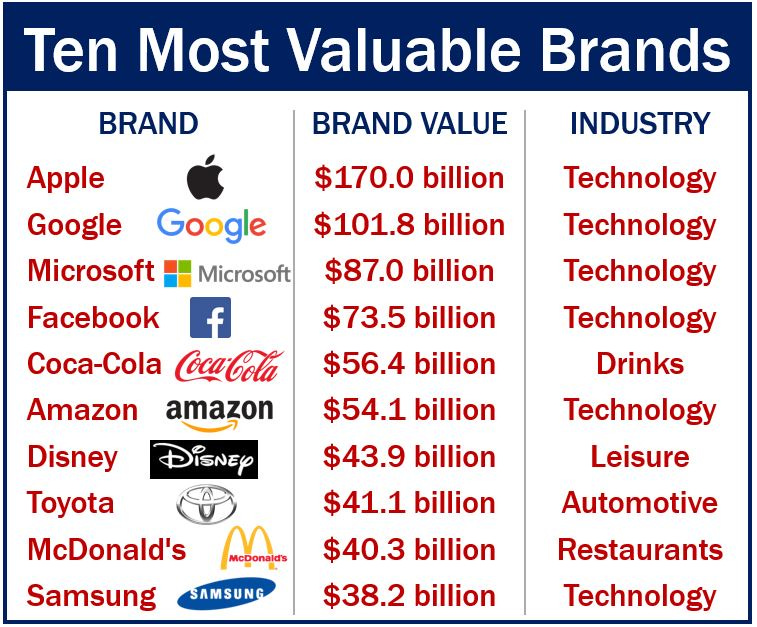

For those of you actually trying to create a “Brand”, remember not to get lost in the rabbit hole. Your small company isn’t yet Apple, or Nike, or Tesla. But you might see how almost none of the most valuable brands are “practical” or descriptive as in the first path. That’s because their job isn’t the logo or the words, but the story it represents and the feeling that the brand creates in people’s minds.

There are many wonderful resources on creating brands, but we point you primarily to this conversation, linked here. Every experience someone has with your company adds up to your brand, and good brands make everything easier — cheaper customer acquisition, more forgiving product users, easier hiring and fundraising. So from our view, one is worth developing.

However, it can be developed *after* your minimal viable product launch as well, you don’t have to get it immediately right. If you launch with a very functional company name, logo, and color scheme, and then pivot later, that’s OK. But look, sometimes it pays to stand out.

Marketing Programs

Building brands and brand attributes is different from building quantitative marketing funnels, whose purpose is to convert users into customers. You can ditch the paintbrush for the spreadsheet again.

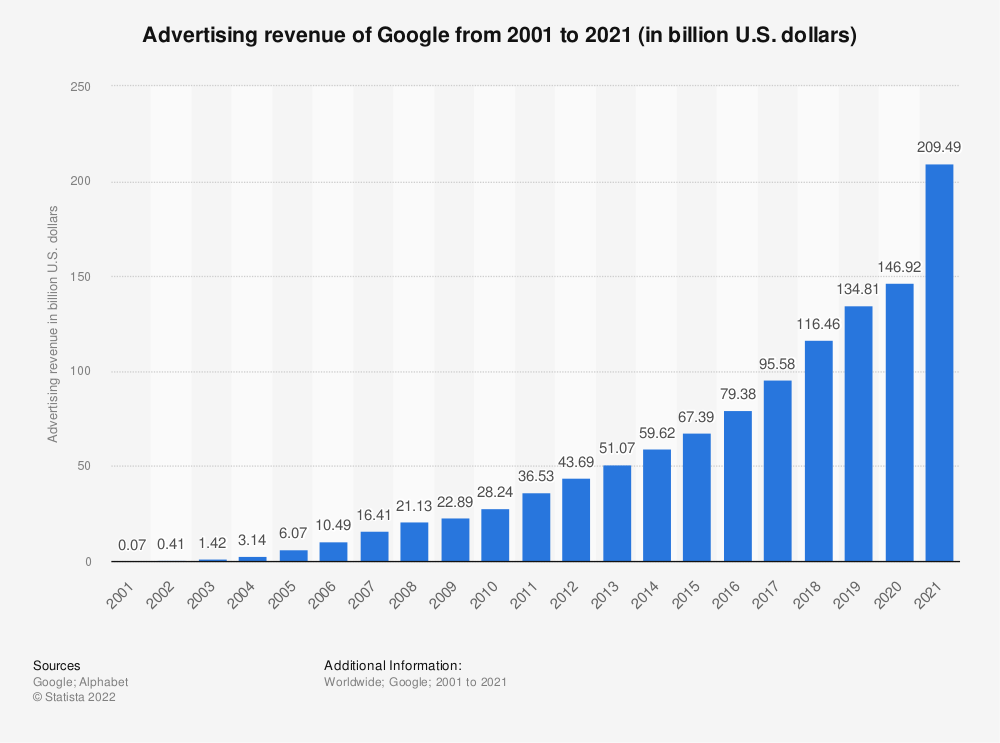

In the Web2 era, the primary lens by which to analyze marketing was to understand attention and demand. If you’ve seen us use the words “attention economy”, you understand that the last decade of “free” technology products have been fueled by the ability to put advertising in front of people and make them click.

Thankfully, you can do more than just buy growth, you can also build it for free in “organic” ways. For early stage struggling startups, figuring out how to get free attention is the holy grail. We would think about all the channels as follows: organic content and newsletters, organic social media, paid search, paid social and influencers, paid mobile ads, PR and traditional media, video and webinars, and physical events. As you shift towards Web3, there is more juice in community development, developer relations, grants programs.