Long Take: Should Plaid launch a payments network on Arbitrum?

Or Optimism for that matter. How many Venmos would fit in?

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We start by discussing the challenges that the leaders in embedded finance, Stripe and Plaid, have faced this year. Both companies drove layoffs of 14-20% of their workforce. The decline in fintech company usage has impacted the underlying providers of infrastructure as well. However, one of the main value drivers for Plaid was the probability of launching a payments network given it holds most of the US financial identities. We look at the rise and transaction counts of Ethereum roll-up scalability solutions, and consider whether it would be possible for Plaid to launch its payments network today in Web3.

Topics: payments, blockchain, data aggregation, embedded finance

Tags: Arbitrum, Optimism, Ethereum, Plaid, Visa, Mastercard,

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

Connecting The Weird Dots

We sit at the intersection of two generations of financial technology innovation. The first, Fintech, uses existing banking infrastructure, digitizes its interfaces, and builds modern distribution footprints. The second, Crypto and DeFi within it, builds its own programmable infrastructure, creates on- and off-ramps, and uses new and old distribution footprints equally.

We are still waiting for some magical convergence, some foretold prophecy where pioneers realize they want the same things, and they come together to cooperate and make the world a better place.

Obviously, this isn’t how it worked out, nor how it works in general, nor how capitalism clears its markets. People build tribes, identities, and stories. Sitting here at the intersection, we see how these factions use different words, dress in different clothes, and want different end-states of the world. To us, however, they are equally interesting. Driven by the same desire for entropy and change, they are novel and compelling.

So here are two dots from these worlds to connect.

The Strain on Embedded Finance

We covered in last week’s conversation with Will Beeson the problems that fintech infrastructure companies are facing after their clients, i.e., new fintech companies, begin to fail out. You can listen to that here:

You don’t need a complicated mental model here. If your company provides a rentable and embeddable set of financial products, and the number of clients and prospects that can reasonable embed and sell those products goes down, so does your own infrastructure business. This doesn’t have to imply incompetence, or negligence, or fraud. It just means that some companies can’t outgrow their costs, and close down.

A bit of regulatory headwind doesn’t help either. See here, for example, an effort to use Elon Musk’s loose plan to turn Twitter into a money superapp being used to literally legislate away the opportunity. Like, are we really that afraid of a Twitter-PayPal meme factory?

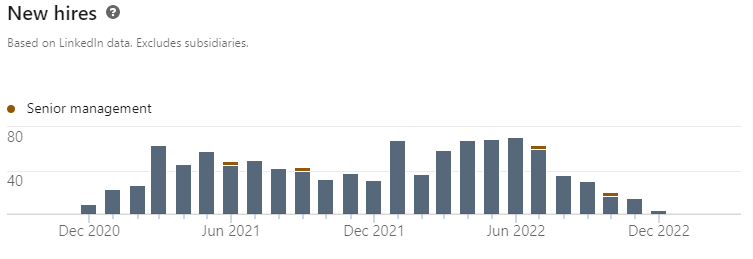

Anyway, our point is that arguably even the best players, like Stripe and Plaid are having a bit of a bad time. Stripe has reportedly fired 14% of its workforce, or 1,100 of its 8,000 people. When we check LinkedIn, this change hasn’t yet been reflected in the aggregate numbers. But we can make a mental note and a prediction of where things are going. We also notice the slow-down in hiring leading up to the more aggressive measures.

Plaid is hitting the same wall. It is laying off 20% of its workforce, or 260 employees. You can similarly see the slow down in new hire numbers, and now the more drastic changes as we get to year end. Again, we believe this to be a fintech-wide phenomenon, not something specific to these companies. We all had believed the party would go on longer than it has, and predicting the depth of the macroeconomic stress and risk repricing sounded like crazy talk. Even here at the Blueprint, having at first complained about SoftBank and its blitzscaling rounds into industry champions, we eventually got used to 50x revenue valuations.

You know, it’s probably pretty reasonable to trim the size of these companies to 2021 YE numbers. It’s probably even reasonable to trim them further. Are we really better off and more bullish right now on these bets than at the start of 2020?

So API-first finance is hurting. When we think back to what makes Plaid valuable, with $5B being what Visa was willing to pay and $13B being the last round, it’s not the data aggregation. Rather, it was the existential competitive threat of creating a new payments network that could flow around interchange fees.

And while Stripe has gone into competing with Plaid’s services, Plaid has not yet stood up the payments network, instead of focusing on other value-add data services extracted from their tentacles into banking infrastructure. They have not thrown the spear into the eye of the Cyclops, choosing instead to shore up resources.

But maybe now is the time. And here is what we see.