Long Take: Sizing up Roblox, Minecraft, and Fortnite as places for financial economies

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We look at the key digital environments that can support a new virtual economy, and parse their economics and adoption. In particular, we review the scale of Roblox, Minecraft, and Fortnite, as well as their industrial logic. We also higlight the longer tail of relevant projects — Second Life, World of Warcraft, Eve Online, The Sandbox, Decentraland, and Otherside. This isn’t mean to be an exhaustive list, but a highlight of some key properties that might become a foundation for Web3 commerce and their posture towards NFTs. The logic connects to our prior explorations of DAOs as business organizations, and DAO tooling as the CFO tech stack equivalent in Fintech.

Topics: commerce, Metaverse, NFTs, big tech, GameFi

Tags: Roblox, Minecraft, Fortnite, Second Life, World of Warcraft, Eve Online, The Sandbox, Decentraland, Otherside

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

Video Game Financial

We continue to look what a Web3 economy can look like, and today we want to jot down some comparables to use as future anchors.

As many others, we’ve started non-ironically reading and digesting Matthew Ball’s The Metaverse: And How it Will Revolutionize Everything. A review and set of reactions to the book will come in due time, integrating its thesis with our Web3 banking system concept. Today, however, we just want to size some things up.

This matters because (1) video games predict future consumer patterns in fintech, and (2) the Metaverse is an organizing principle uniting artificial intelligence tooling, AR/VR hardware and digital worlds, and onchain Web3 economic systems, and (3) this will need financial rails in the way that the Internet needed new gateways and processors and banks and asset managers.

Roblox - 50mm+ active users

Roblox is the YouTube of videogames for young people. It’s also the equivalent of the video camera, in that it powers up developers to make games themselves. This is a two sided network of (1) players, and (2) builders.

We don’t advise you to watch any content related to Roblox (we did) unless you are in the mood for a teenager screaming at vector graphics. So let’s switch to the economics.

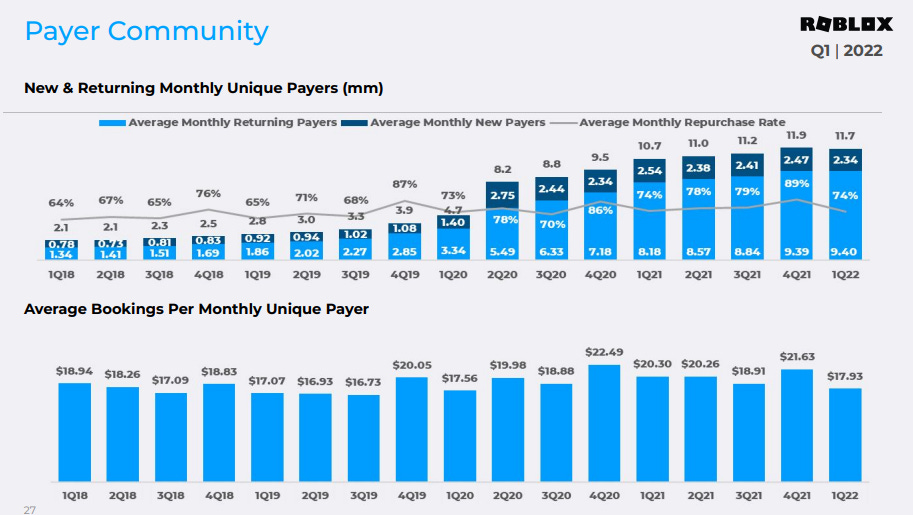

There are 54 million people who, on a daily basis, play a Roblox game. Of those, about half are under 13 years old. North America, Europe, APAC are each about 25% of the DAUs. The games are free at first, but you need in-game currency to get to the good stuff, like virtual items within games. Around 11 million people every month pay for something in this digital world.

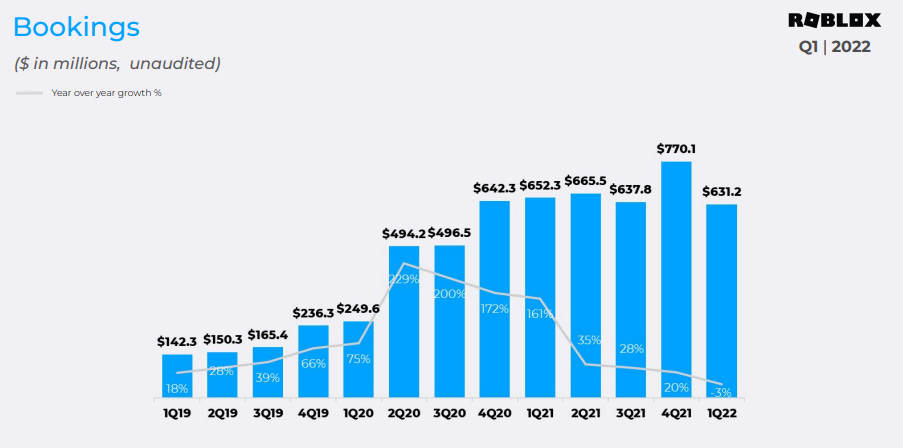

This bookings number — around $600 million per quarter — is users loading up on virtual currency in packs, essentially pre-buying digital consumption. That’s about $20 per quarter for every paying monthly user, or $80 per year. As a reminder, here are some Fintech ARPUs, which you know, aren’t higher than $80 per year at Nubank, Chime, Ant, Revolut or CashApp. But who’s counting!