Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Today we look at the interface between eCommerce and payments technology, digging into issuers, processors, and acquirers. Commerce is of particular importance as the thesis about DeFi shifts from a standalone financialization engine, to the banking sector for the Web3 economy. We think through what such an economy may need, and discuss DAOs as an atomic commercial unit organizing labor and building products.

Topics: payments, Web3, DAO, DeFi

Tags: 3AC, Revolut, Square, PayPal

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

Economies

We were recently hosted on the One Vision podcast. Check it out below.

One of the core narratives that emerges is the transition between traditional finance to fintech, fintech to DeFi, and now DeFi to the Web3 economy.

As we rhetorically covered last week, fintech democratized the distribution of financial services, and DeFi decentralized their manufacturing. But a financial sector drifting unmoored from underlying economic activity is just a stacked casino, rehypothecating derivatives on top of derivative, until, well you know.

Anyway, we are rebuilding our view based on the idea that Web3 needs a valuable economy for DeFi to be valuable as its banking industry. We need the following chart to have a GDP line item called Metaverse, and to start rivaling that of sovereign states.

A connected concept to the idea of the economy is the idea of commerce. Those of us so focused on financial products can forget that (1) labor, and (2) economic surplus are tied to a qualitative, subjective experience, not some abstraction. The exchange of goods and services through a market or a venue is what enables value creation. Remember, both parties are better off in terms of utility — i.e., a concept of sort-of-happiness — in an uncoerced economic exchange.

Which means that if you want to understand how Web3 GDP will grow, or more generally how GDP will grow, you need to understand commerce and its shape. For example, here’s a chart showing Europe’s GDP numbers divided by eCommerce volumes, ranging between 1 to 8%. Lots of room to grow.

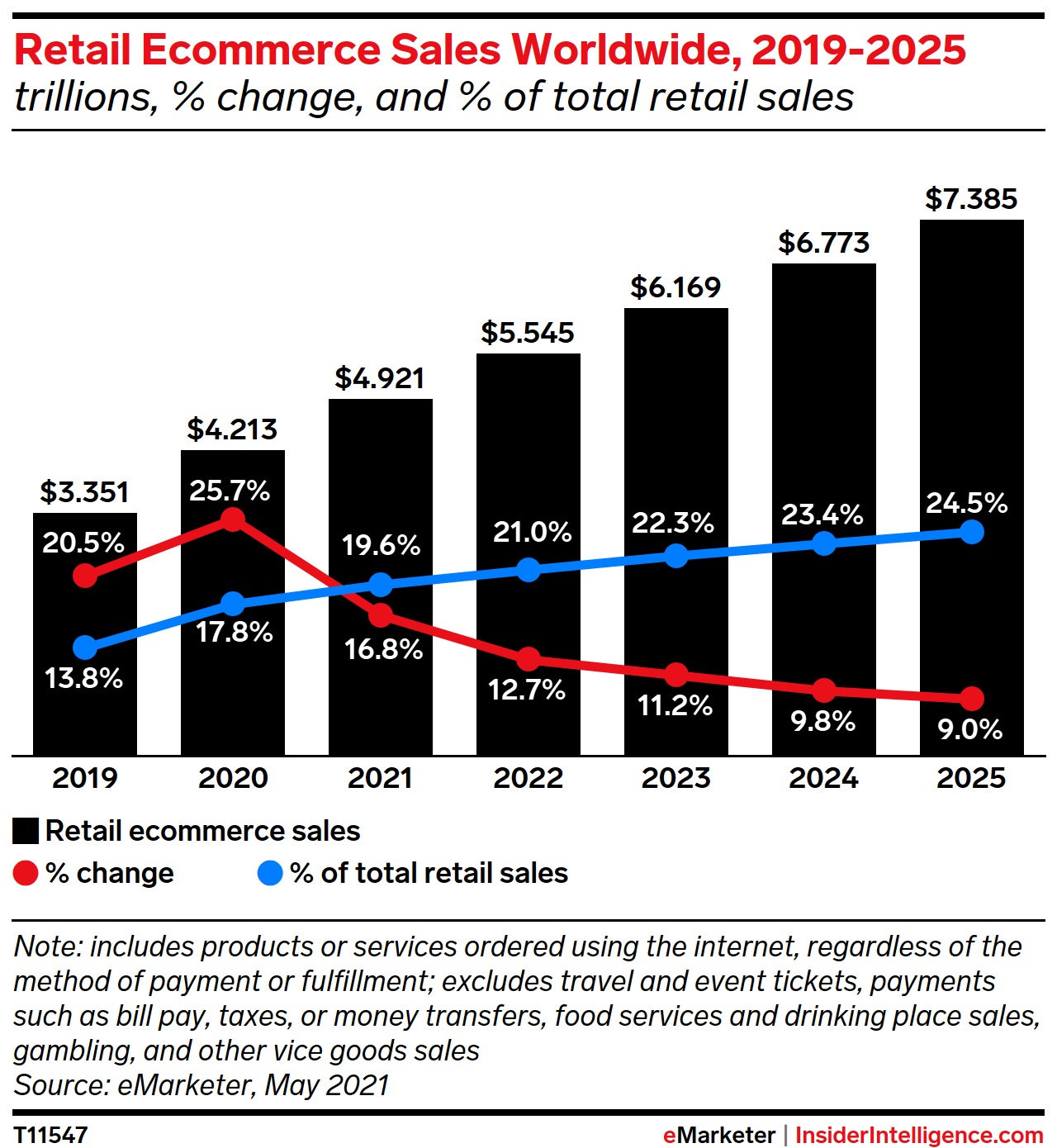

eCommerce is an interesting pre-cursor to the Web3 economy discussion, because it it still only 20% or so of global retail sales, at $3-4T per year. But it is in many ways an example to what could be. It is a venue — a giant ocean of buyers and sellers — whose infrastructure was in many ways built out separately from the retail footprints of the past. Not only were you shopping in a new environment, i.e., the website, but you were also using different on-ramps and off-ramps to get there.