Long Take: Surviving the recession and understanding low unemployment, RPA, and AI's rising role

What's happening with all the people workers and the robot workers?

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Today we think about jobs. Despite recession concerns, unemployment rates remain unexpectedly low, particularly in the tech sector where layoffs were a strategic response to market changes rather than economic downturn signals. The wider economy appears stable with high interest rates, but this may conceal difficulties within specific sectors like fintech and crypto. The enterprise sector is being reshaped by the rise of Robotic Process Automation (RPA) and AI, which automate mundane back-office tasks. Innovators like FlowX.AI, UI Path, Workfusion, and Hyperscience are integrating these AI-driven solutions into traditional systems, creating new applications, and establishing 'digital workers' to work alongside human teams. The wide-scale adoption of such technologies could disproportionately impact the workforce, especially those within the fintech and crypto sectors.

Topics: macroeconomics, unemployment, artificial intelligence, recession, Workfusion, UI Path, Hyperscience, FlowX.AI, robotic procession automation

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

People Jobs

We are in a sort-of schizophrenic moment.

Remember how high inflation is being countered with high interest rates, but then those high interest rates have crashed out the markets, and then we are all waiting for a recession? And in preparation for a recession, large companies are cutting their workforce 30%? And on top of that, generative AI is meant to cause unemployment for knowledge workers?

There is some evidence for that.

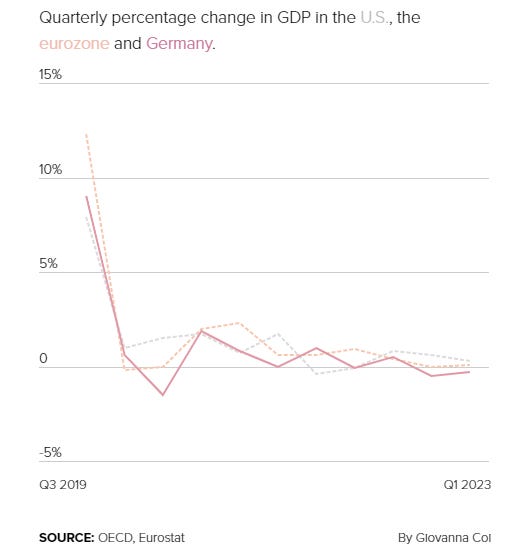

For example, Germany is now officially in recession after two quarters of negative GDP growth. It is somewhat special in its relationship to Russian energy and the detrimental effect of sanctions, but you can see that the US and the rest of the Eurozone are lagging down too. The end of Covid brought a big rebound in economic growth, but we have since been sliding down towards negative real growth as the Fed makes money relatively more expensive.

The OECD projects GDP growth at 0.5% for the US and Europe. A wiggle in either direction would imply a recession. That should make things worse in the short term, not better, because consumers have less money to spend, which means lower GDP, which means fewer jobs, and so on.

The personal savings rate is at a low again — almost as if the Covid savings bump didn’t happen — and consumer credit is at a high. You can see the line spike in 2020 below, and then collapse way below the 2010-2019 average in the recent year. Meanwhile, personal consumer debt dipped during Covid, but then ran all the way back up and more. We are back to consumers being on the financial edge.

You would expect to see this in the jobs data too. But this is where things get a bit confusing. Unemployment is very, very low, back to the levels of the last decade. Labor participation has not fully recovered, which means some people are structurally unemployed or opting out of whatever “late-stage-capitalism” hellscape they are trapped in. But we are still surprised to see such low unemployment numbers.

Alternately, take a look at the 2022-2023 tech layoff data above. While there are spikes of companies doing layoffs in mid 2022 and early 2023, these were changes in relation to the market environment. Put another way, there was a “repricing” of tech companies given a new price for risk, and as a result, tech companies adjusted their cost base to align with the new reality of shorter runways and premiums on earnings over growth.

Further, let’s say this is about 1 million tech jobs. The US labor force is about 165 million. What looks like a lot of people in the crypto / fintech world is just a finance niche getting punished for its particular sins. The regular world celebrates in schadenfreude.

From this perspective, we haven’t had a particularly brutal recession or unemployment issue at all. People might be discouraged or unhappy given their personal financial situations, but on a macro level, the Fed has room still to contract the economy. It must have been surprising to them, on some level, that the black swan event was the fragility of the long tail of the American banking system.

Rather than causing unemployment, they caused balance sheet financial engineering to crack and blow up.

What conclusion can we draw when there is particular pain in fintech / crypto, but a reasonable broad system equilibrium at these higher interest rates? Our view is that there are stimuli which are acceptable to the overall socio-economy, but are still very difficult for our sector. Meaning, something might be fine or even popular on average, but very damaging for the reader of this newsletter.

Robot Jobs

We are going to fish here for something interesting.