Long Take: The evolution of embedded finance to $7T in flows, and the OCC's mandate to derisk it

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We look at the Bain Capital report about embedded finance growing to $7T in flows by 2026, and the recent OCC moves to regulate the evolution of fintech and crypto banking. This jumping off point helps us understand the process by which new things become popular, gain a mandate, and then cause an opposite reaction from their counter forces. We also touch on the SEC looking to gain jurisdiction over ETH post Merge, the White House working on a digital asset framework, and the OCC’s blocking of stablecoin based banking.

Topics: embedded finance, DeFi, stablecoins

Tags: OCC, CFTC, SEC, Bain Capital, ETH

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

The Social Physics

When you look at a drawing of a thing — maybe a design for a skyscraper — you are not looking at the actual thing. You are looking at an incomplete summary of it.

When you look at the actual thing — like the skyscraper — you are not experiencing the actual thing. Rather, your mind is constructing the amalgamation of your senses into a concept. That concept is what you imagine in your rendering of the universe, in order to take an action. More specifically, you’re not counting the atoms, or understanding their chemical connection, or incorporating the provenance of the building, or knowing the number of floors and people. You’re just using your mind’s eye to say, “yep, that’s a skyscraper”.

And so it is with our social relations and interactions. We have a view of the world, and a couple of different paths available to take. We might see a few moves ahead, colored in the terms of our prior experience, propelled forward by some momentum of expectations and creature comfort.

But we do not have the capacity to aggregate those for ourselves and all the people with whom we might interact, structure that into social relationships and identify incentives, and thereafter derive a social physics that describes *the shape* of the web of relationships in which we function.

Nothing, absolutely nothing, one does is in isolation. There is no action which hasn’t been squeezed by the particular actor from the surrounding context. We are in an interconnected web, which we cannot see, but which guides our velocity and ability to achieve our goals.

That’s all much deeper than what we can really articulate. We imagine some multi-dimensional self-similar fractal, vibrating from physical space to economic structure with the same curves and equations as the curls of a fern. And on that fractal, there you are, tugging in one way or another.

You might tug with purpose. Perhaps you are with many others, aligned in mission. There is a resonance, a velocity, a direction, a vector. And elsewhere are others, with their own vector and push. Cut in one direction slice, perhaps along the line of institutionalism and populism, one would see a dialectic. The vector is positive, then negative, until equilibrium.

But of course, the vectors are in all sorts of dimensions, like smaller waves stacked on top of larger waves. This thing is vibrating with creative destruction.

One way we can think about things is through the concept of a mandate.

How popular is some policy, how much energy does it have? How wanted is some change? What gives *legitimacy* to the policy or pursuit? In this way, we will land on our topic, considering the push and pull of innovation and regulation. The causes that provide authority, through legitimacy in prior periods, and those that provide a mandate *now*, through support in the moment, will be structurally at odds. We illustrate —

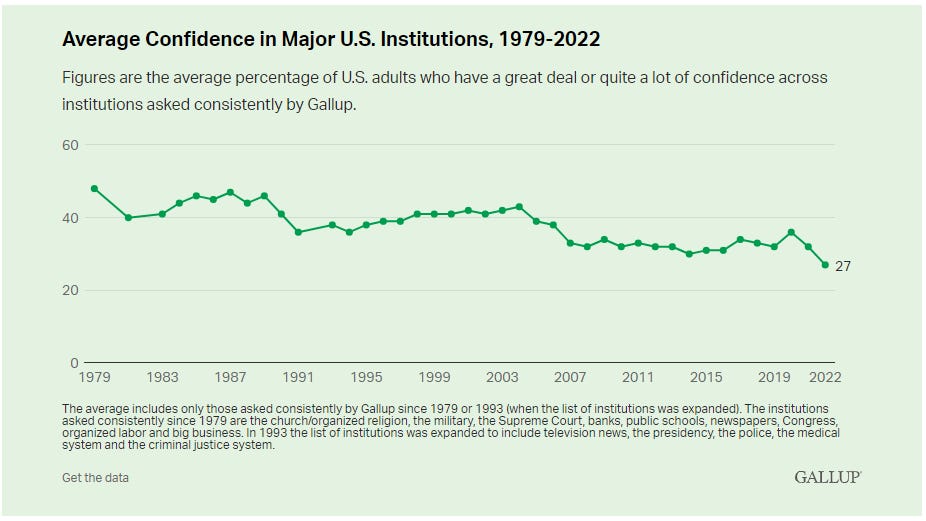

Confidence in institutions is falling across the board, with banks, large tech companies, the executive, and the legislative branches of government all taking a meaningful hit over the last year. We can explain this chart with rising inflation and mortgage costs, and falling net worths as explanation. Or we can say, this is ripe ground for anarchic libertarianism.

This chart shows us part of the reaction within the social physics. Popular support for orthodox structures is waning. Popular support for experimentation and exploration of new structures is growing.

So does a mandate matter?

The Mandate of Embedded Finance

Bain Capital recently released a fantastic report on embedded finance, estimating that nearly 5% of all US financial transactions in 2021 came from services embedded into eCommerce and software platforms. This $2.6 trillion in flow will increase to $7 trillion by 2026, as distribution of payments, banking, and lending continues to move closer towards intent. We understand that Bain is articulating their investment thesis and consulting pitch, but we also agree with their described shape of distribution.

The second order impact of the shift in distribution (i.e., where people get financial products) is the change in the shape of the value chain. How goods get delivered to the store changes when the store changes.

That’s a lot of slides to quote, but we love a number of the insights. First, most of embedded finance today is around payments, banking, and lending. These are the categories most adjacent to commerce, which is the closest thing to consumer intent. You self actualize through consumption in the West, and money in motion is the stream that powers the economy. That implies that embedded trading, investment, capital markets, and insurance are categories in their infancy; except in crypto, where they are the main attraction.