Long Take: The Fed freezes Evolve Bank and BaaS; SEC clears way for Ethereum

Ethereum's resilience contrasts with the operational challenges in traditional fintech

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We highlight a massive win for the crypto industry where the SEC decided not to enforce action against Ethereum, reinforcing its status as a commodity. This contrasts sharply with the Fed sending an enforcement letter against Evolve Bank & Trust for its challenges in open banking. We also discuss the current state of the Synapse bankruptcy and the $85MM missing deposits between the various ledgers. This underscores the importance of real-time validation in financial systems and questions whether the future lies in patching existing banking systems or fully transitioning to blockchain-based solutions.

Topics: SEC, Ethereum, CFTC, Coinbase, Consensys, Uniswap, Synapse, Evolve Bank & Trust, BlackRock, BCG, Mercury, Unit, TabaPay, FIS, Fiserv, MakerDAO, Marqeta, Federal Reserve

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options here.

Podcast Conversation

Had a lot of fun talking about innovation theater and what’s possible on the Finimize podcast. Check it out below on Spotify or YouTube.

Long Take

The Crypto Win

We have spilled much ink on how the SEC has been pursuing crypto projects, including Ethereum, in attempting to classify various blockchains as securities.

One of the largest threats would have been to go back on the definition of ETH as a commodity, communicated previously publicly by the CFTC, and re-classify the token as a security. Our understanding is that the ETH switch to Proof-of-Stake over Proof-of-Work, as well as details around the original token offering, were being used as justification for a potential enforcement action. Arguably, the statute of limitations had also run its course.

In pursuing this path, the SEC targeted a number of high-profile companies in the space, from Coinbase to Consensys to Uniswap. Several of them were sufficiently capitalized to strike back. Consensys in particular countersued the SEC in a recent case, pushing them to articulate a clear position on ETH, staking, and developing decentralized software.

However, with the lead-up to the US election, crypto has become a highly politicized issue.

Unlike Fintech, which remains the subject matter for investors, operators, and the occasional newsletter writer, Crypto is widely owned by the people — anywhere between 7% (according to the Fed) to 20% (according to Coinbase) of Americans. Republicans have leaned into the new demographics and its alignment with libertarian and hyper-capitalist ideals. Democrats are struggling, trying to find a middle ground consistent with their prior attempts at destruction through enforcement, and the political reality of a well-funded, highly engaged, young cohort of voters wanting supportive policies.

As a result, we have seen capitulation from the SEC on the Bitcoin ETF, and also recently the Ethereum ETF. In the latest win for the industry, the SEC has sent the below letter to Consensys in regards to the ETH token offering.

It reads — “we do not intend to recommend an enforcement action”. This is as close to “ETH is not a security” as we are going to get before the ETFs come. We won’t speculate as to Solana and the rest of the blockchain alphabet soup. Let’s just pause and enjoy an incremental victory.

It is, of course, incredible the extent to which US regulators have come to try and destroy one of the most important vectors of innovation in financial infrastructure. From payments to banking to capital markets, we now have a broad public ledger that can be used by any party to store valuable digital assets. Remember this, as we will come to the value of a public ledger in a moment.

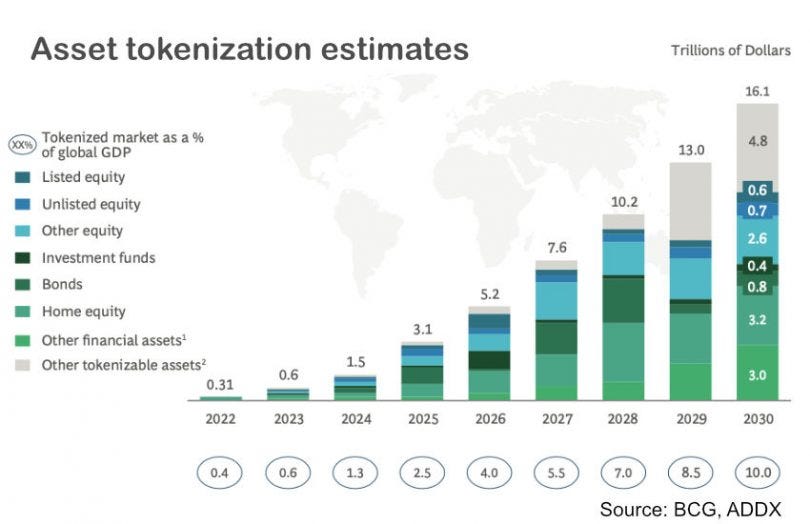

Here is where BCG thought tokenization would take us after 2022 at the top of the prior market — getting to $1.5 trillion by 2024 and $5 trillion in 2026.

And here is where we are today — about $10B in private credit and $150B in cash equivalents. The scale is off by an order of magnitude, but the direction of travel is accurate. Ethereum is a platform, and platforms grow by attracting multiple sides of the market. The current scalability attempts — through L2s, ZK, modularity, parallelization, and so on — are a mess. But it will get there eventually, just like other technologies that have scaled out of their baby years into the full-fledged vision.

What’s that in the distance? We hear it already! The endless skepticism.

Nobody needs blockchains. You’ve been talking about tokenization this since 2019. What’s different this time? It’s a solution looking for a problem.

Yes, but this time we have BlackRock and the banks.

The Fintech Loss

It is with this backdrop that we pivot to look, again, at Synapse and Evolve.

Last we checked in on Synapse, it was about to be acquired by TabaPay. However, the deal has fallen apart, and things have gotten worse by far.