Long Take: The financial extremes of the current market & unbelievable Evolve hack

Gm Fintech Architects —

Today we are diving into the following topics:

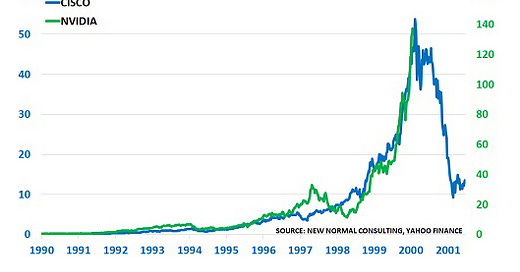

Summary: We explore the current financial market's barbell distribution, with a potential for both significant gains and losses, but unlikely to remain stable. We reflect on past misjudgments, such as the unexpected economic resilience during COVID-19 and Russia's financial recovery post-sanctions. Presently, interest rates, inflation, and employment trends are mixed, with tech stocks like NVIDIA driving market performance disproportionately. Despite favorable political conditions for crypto, its prices remain stagnant, creating uncertainty. The article concludes with the possibility of either AI-driven market growth or a downturn, in the context of various economic factors.

Topics: Federal Reserve, NVIDIA, Bitcoin, Ethereum, Solana, VanEck, Point72 Ventures, Steve Cohen, Google, Apple, Cisco, Mechanism Capital, Green Dot, The Bancorp, SoFi, Ark Fintech Index, KBW Bank Index

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Advertise with the Fintech Blueprint

If you want to reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Short Take: Evolve and Equifax

This is absolutely insane, so we are flagging it for your attention.

Evolve Bank & Trust, the banking-as-a-service provider to much of the Fintech industry, including the large names of Marqeta, Mercury, Stripe, and Dave has been hacked for a massive personal data leak. Last week we wrote in detail about Evolve being frozen through a regulatory enforcement action. That alone put depository processing for Fintechs between a rock and a hard place.

A ransomware group called LockBit has stolen Evolve customer data and held it hostage. The ransom was not paid — you see their demands above. As a result, the entire thing reportedly hit the dark web. According to Evolve, “The data varies by individual but may include your name, Social Security Number, date of birth, account information and/or other personal information.”

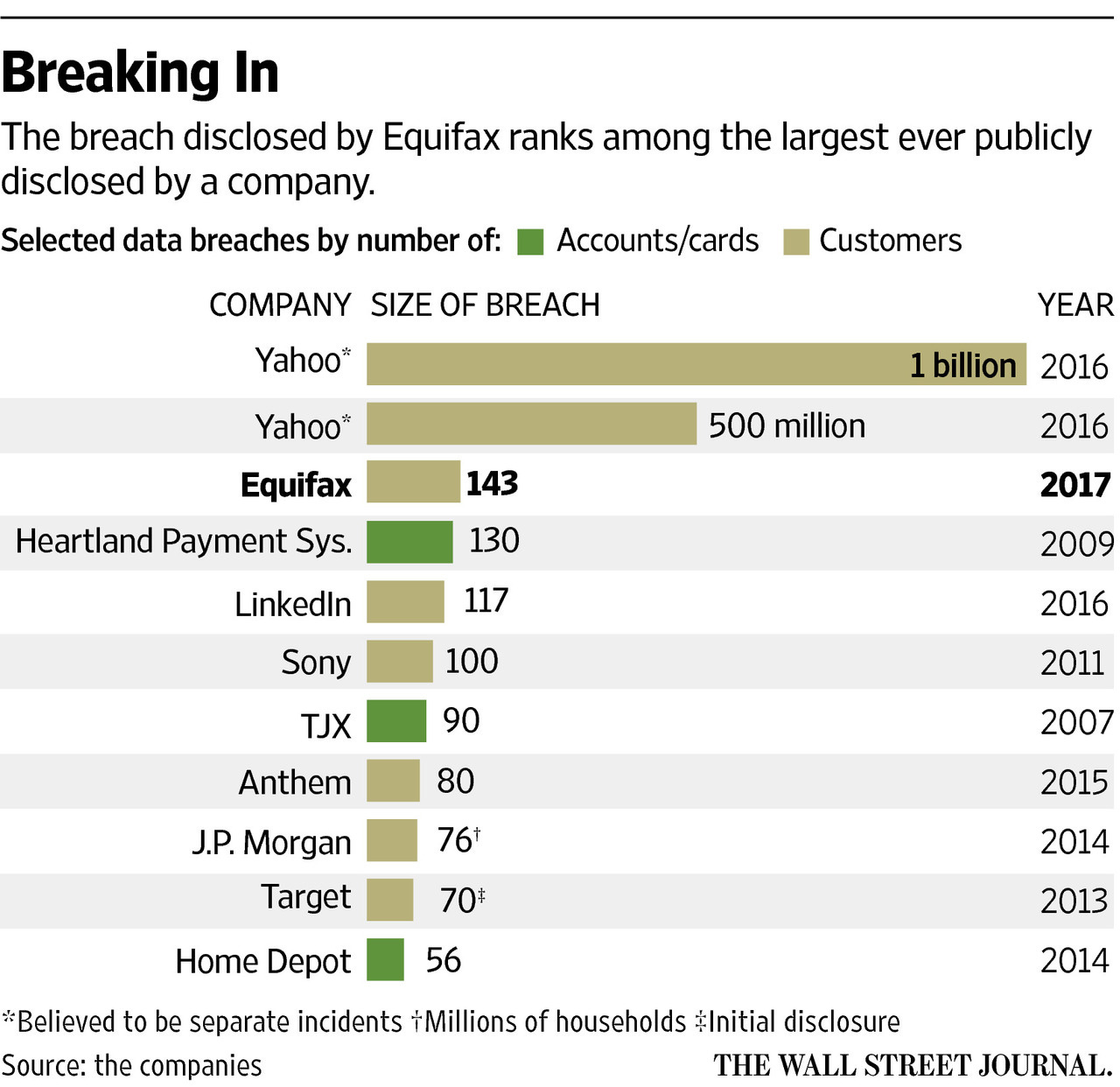

This reminds us of the Equifax data breach, affecting 143 million US consumers and costing the company up to $425MM. But financial companies are not alone in being targets of and succumbing to data thefts. Everyone from Yahoo to Facebook and LinkedIn has had the pleasure of being popped open by a criminal outfit.

The Equifax price fell 40% as a result of the breach in 2017, and the security of all the credit rating agencies came into question. So it is reasonable to speculate that Evolve — a much smaller and less profitable entity — will be in financial trouble as a result. Is that the end of BaaS?