Long Take: The opportunities in the Web3/DAO CFO tech stack, compared to its Fintech counterparts

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Today we look at the analogy between the CFO technology stack and the potential tooling needed to run DAOs. If the Web3 economy is going to see DAOs create a lot of the core value, then DAOs need to be performant in their payment processing and financial functions. This is a very early stage sector currently, but has potential as more and more people contribute their labor in novel ways. We look at a number of comparisons by functions, and suggest gaps and opportunities for the current solutions.

Topics: DAOs, CFO tech stack, Financial function, Web3, payroll processing, accounts payable, billing, spend management

Tags: Oracle, SAP, Dune Analytics, ADP, Utopia, Coordinape, Paymagic, Rise, Machinations, Bill.com, Coinpayments, Moonpay, Stripe, Juicebox, Brex, Expensify, Mover, Rain, Redpoint Ventures

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

The Producer

We had established last week that finance follows the economy, and in trying to understand the next frontier of finance, we need to understand the next frontier of the technology-enabled economy.

In particular, we focused on commerce in Web3 as an analog to eCommerce and physical commerce, and that led us to think about merchant acquiring and the financial problem sets of payments. You can see the analysis here, and listen to the accompanying discussion with Simon Taylor here. We learned a lot about how small businesses generate and charge for value.

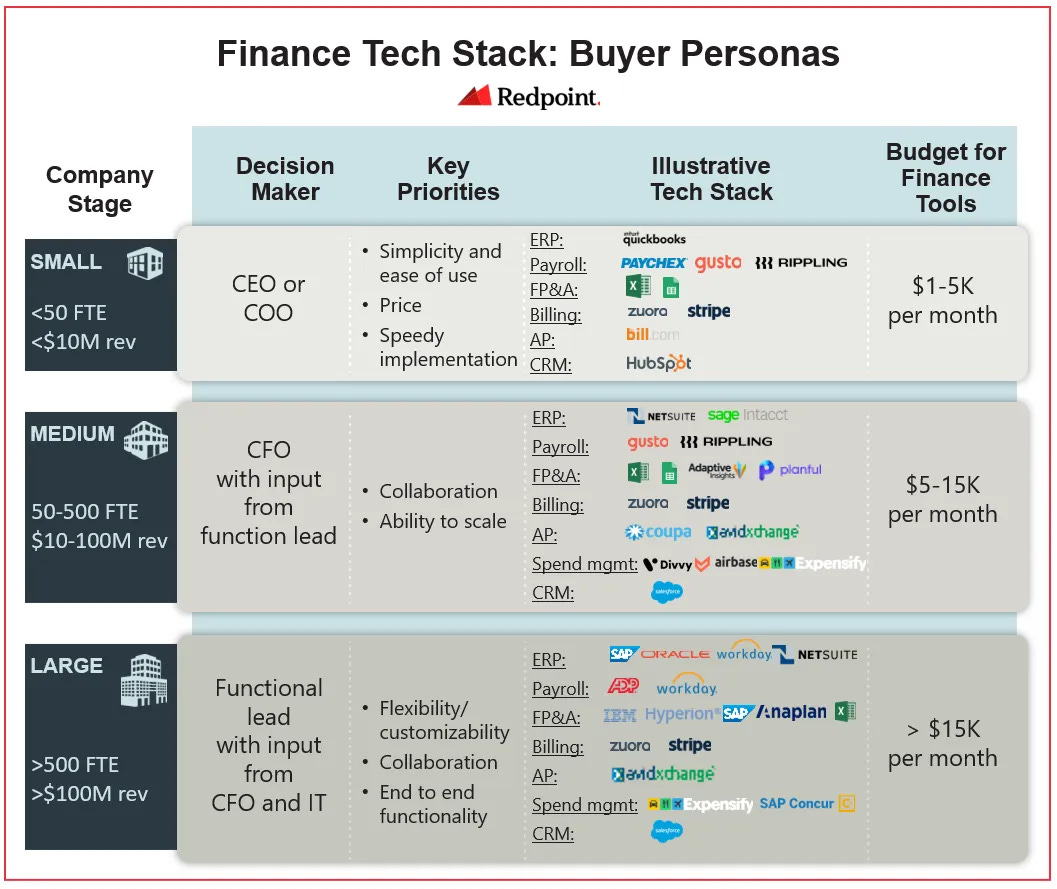

Let’s think further today about players in this game, and analogies that could be helpful. One of the emerging focuses of fintech in the last five years has been the CFO automation suite, or the CFO tech stack as described by Redpoint Ventures in the diagram below.

This is technology for people in a company that are responsible for managing the flow of money and assets *within and throughout* the company organism. Make sure to notice the difference from technologies involved in the creation and distribution of financial products to customers. According to our conversation with Redpoint's Urvashi Barooah —

the CFO tech stack is really all of the software that the finance department of a company relies on to do their jobs. And that can spend everything from the accounting, the backbone of the system, the ERP, to payroll systems, to whatever they're using for FP&A, spend management, APAR, bookkeeping. So, the whole gamut of things, all of the software that's used by each of the divisions within finance is what we refer to as the CFO tech stack.

If we push this further, we start to encounter a question about monetization and value. Are the solutions in the CFO tech stack software products, or are they something else? As embedded finance and liquid financial infrastructure (i.e., payments automation) starts to integrate into the workflows of these businesses, these solutions start to look much more like financial products sold through deep integrations.

To go deeper, listen to our conversation with Modern Treasury about payments operations, or with Monite about workflow automation in digital banking, or check out the following Long Take — Is the CFO automation suite (Brex, Ramp, Jeeves, Digits) an SMB underwriting Trojan Horse?

Which brings us to DAOs and Web3.

The DAO CFO Tech Stack

Let’s start with the assumption that DAOs are the business unit of blockchain-based economies. Crypto has seen a lot of individuals contributors, as well as some well-organized traditional corporations and/or foundations, participating in the space.

Individuals find themselves right at home in the world of self-sovereignty. There, they self-custody, control keys, and wave the banner of libertarian anarchism under a PFP avatar. For businesses, and especially financial businesses under banking, investment, or payments regulation, things are far less easy. They don’t quite fit the mold, and it requires quite a bit of square-peg-round-hole type of work to use Web3 native tools for those types of entities. If you start with a single account and no controls, it’s quite difficult to get to multiple accounts across multiple clients with different permissions and compliance flows.

That’s why things like Fireblocks and MetaMask Institutional are growing, creating interfaces for traditional organizations to interface with a very atomized Hobbesian world.

However traditional organizations are not the *native* animal that lives in blockchain environment. They are not shaped by the systems, narratives, or technical structures of Web3 and its tools. Decentralized autonomous organizations, i.e., DAOs, are that animal. Forget “decentralized” and “autonomous”, and just focus on them as Web3 collectives that organize labor using token-based systems and incentives. DAOs are not just an Internet forum with a treasury, but rather the basic collective unit of production in the local economy.

And just like the business, the DAO needs a finance function tech stack.

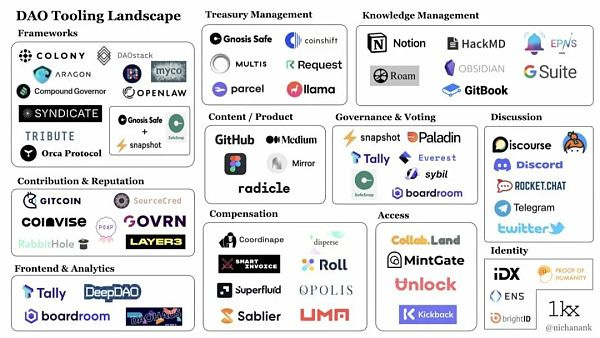

Right now, when people say “DAO tooling”, they usually mean something to do with governance, or perhaps treasury management. In a way, that’s the start of maintaining a financial heart and deciding how to use it. But, such tooling implies primarily an investor’s mind set — that the work of a collective is to hold assets and spend them. Of course, there is far, far more involved in actually running an economic entity.

Here are some industry maps.

And if you want to see how far the rabbit hole goes, check out Organization Legos: The State of DAO Tooling and The Importance of DAO Tooling for Social Cohesion.

Since 2017, there has been an evolution in DAO tools from broad platform-like frameworks like Aragon, to more point solutions that solve particular problems, like Gnosis Safe for asset management, or Coordinape for compensation. This specialization makes sense as the problems faced by different DAOs are now quite different. An investment syndicate will be thinking about different issues than an protocol manager, which is different from a labor or service DAO, which is different from a social club.