Long Take: Understanding US government debt default impact on Fintech & Web3

7 million jobs and 4% of GDP

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We look at the potential debt ceiling crisis in the United States, and connect the core ideas to fintech. First, why does this even matter? We explore how the mechanics of government spending influence the value of the dollar, its interest rate policies, and the resulting economic environment. Further, we look at the potential outcomes from a default, and suggest the opportunity for those building in the space.

Topics: Federal Reserve, USD, Moody’s, government default, politics, macroeconomics, roboadvisors, neobanks

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

The Cake

We come to work in the economy. There, we bake a delicious, multi-layered cake.

The cake is finance. At the top are all the cool fintech things, from AI interfaces to mobile apps. A bit towards the middle, where the chocolate is most gooey, are the financial manufacturing machines making your favorite financial instruments. Loans, investment portfolios, insurance policies. Yum!

But what is there at the very bottom? It doesn’t look like fintech at all! It looks much more like politics and money, expressed through interest rates. Those interest rates are the waves on which all the rest of the asset classes sit. The rates say “risk on” and the financial instruments are sweet. They say “risk off” and formerly sweet things turn sour.

But wait, there’s more! Here we see a social layer of the government sector, burned into the sponge of the cake in some sort of alien, or maybe inalienable, social contract. Here is where the tribes come together to negotiate our responsibilities to each other, our property rights colliding amongst the throng until we make promises called Social Security, Medicaid, and “nuclear ICBMs”.

The Budget

Our metaphor above points at the machinery of the economic system. While the risk of United States default on its government obligations seems like a political problem, it is at the heart of all things fintech and finance. Risks are never free — they are always priced.

Here’s an example:

This is an obvious point. But why do you think a fintech can offer you 4.50% on your cash now, and 0.20% cash on your cash five years ago? Is it because Betterment or Wealthfront or Robinhood are better companies? Have they done something significant to change the types of financial instruments they can summon?

Of course not — they are animals sitting by the watering hole of money, as the river of central banking delivers industry-scale returns. There is nothing special they have done to be better companies, and yet their products are that much better for the consumer. Rather, inflation and risk are higher, and money now reflects that price. Further, this interest rate leads to a mechanical 85% discount on tech valuations, causing downturns in fundraising and innovation. Such things are exogenous to your efforts as an entrepreneur, but they are important to understand.

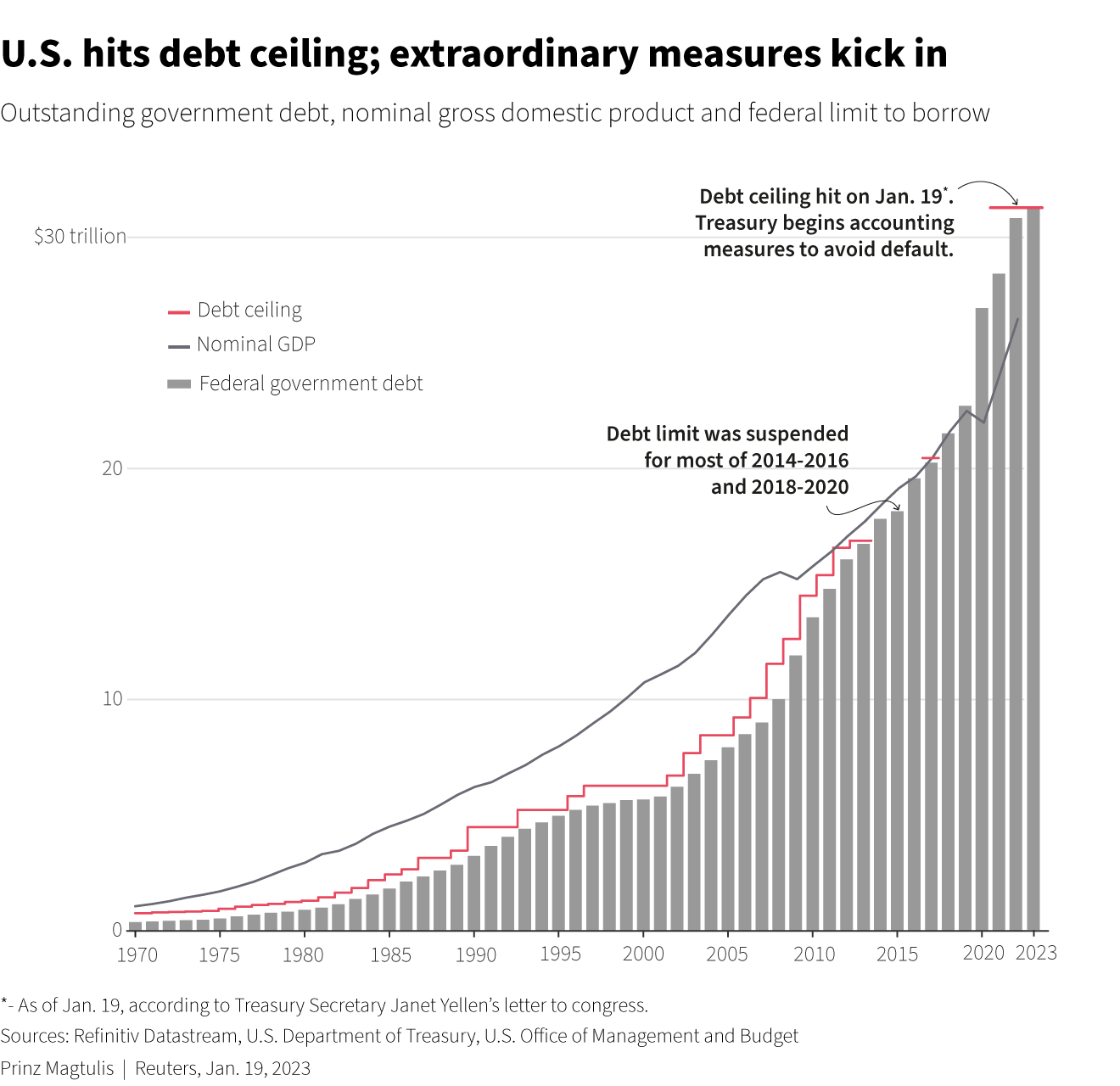

We are not going to go full macro geeking out here, but let’s touch on some of the key points so that, as people building on top of this cake, we track what is happening at the bottom. Lets start with the US National Debt, floating above $30 trillion. The debt, which is financed through instruments issued by the US government and held by retail and institutional investors — including, lol / RIP, SVB and Silvergate — raises moneys that the government can use for fiscal spending. In other words, the government is borrowing to pay its bills.

These figures are nominal, so for them to make a bit more sense, we should look at the ratio of debt to GDP. That ratio is at an historic high, in part due to pandemic spending and various tax cuts. But, we think it is primarily due to the fact that the US could afford the debt — since interest rates were at historic lows, the country could borrow more and maintain pretty low interest rate payments.

For context, above you can see the ratios for the rest of the world. The US is not exceptional — Greece, Japan, and Italy are more levered, while Switzerland is less levered. The ability of the US to print money as the world’s reserve currency, however, allows it to borrow much more easily than any other country in the world.

Several years ago, Ray Dalio penned a treatise showing the pressures of civilizational collapse, and in particular how maintaining relative quality of life while dealing with declining educational and economic standing in the world leads empires to over-borrow and then default. That in turn leads to the rise of hard moneys, like commodities and Bitcoin. See our summary here —