Long Take: War over Money reaches new heights, as Libra opts into regulation, China launches national blockchain, and Financial Stability Board raises alarm

Hi Fintech futurists --

First off -- we are rebranding to The Fintech Blueprint!

The title is more search engine friendly, and aligns specificaly with what I am trying to do, which is to provide a blueprint how the financial services industry evolves and transforms. Under this name, we will explore adding new features, such as artistic and scientific analogies, how-to podcasts, and other exclusive features. Stay tuned!

This week, we look at cash -- blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

These opinions are personal and do not reflect the views of any other parties. Thanks for reading and let me know your thoughts here!

You can get more content like this in your Inbox for $3 per week -- the humble price of a delicious Fintech coffee. For exclusive analysis parsing over a dozen frontier technology developments every week, become a Blueprint member below.

Long Take

The war over money is reaching a new height.

And yet, the shape of what is to come has never been more obvious. I can't tell you how the cookie will crumble yet, but I can tell you the ingredients and the flavor. If you are not preparing for this world, your head is in the sand and you will miss a generational opportunity.

COVID has made transparent the playbook of sovereign states and their macroeconomic responses. Students of history will know that money has always been an instrument of the State, and that debt is how you build Empire. To wage war, you must borrow from the Iron Bank. Taxes are the royal lifeblood, and we are economic appendages for the body politic. In this frame, regulatory licensing is the granting of monopoly power over State privelege. Privelege enforced by the sword.

At times it may be sufficient to regulate reserve banking and oversee money flows with inflation and unemployment tageting. You would bat away at technology upstarts trying to weasel their way into the financial rivers. But sometimes you need to hand out $2 trillion in bailout money for a quarantine that you have mandated. One hand takes, the other hand gives. Sometimes the giving hand allows PayPal, Intuit, and Square to direct money without traditional licensing, because they are faster and more efficient.

But sometimes the money runs out and you've killed all the small businesses anway.

Anyway.

The money seems to be doing some weird things these days, if you are a country. Like, some really weird things! For example, the money keeps trying to transform itself into private cash equivalents and hide out in blockchains. Strange new companies, who are definitely not licensed to lend and borrow, keep buying up money, putting it into a box, and launching tokenized versions of units of account. It's not even clear that it is companies doing this -- sometimes it is just a bunch of open source-obsessed strangers on the Internet.

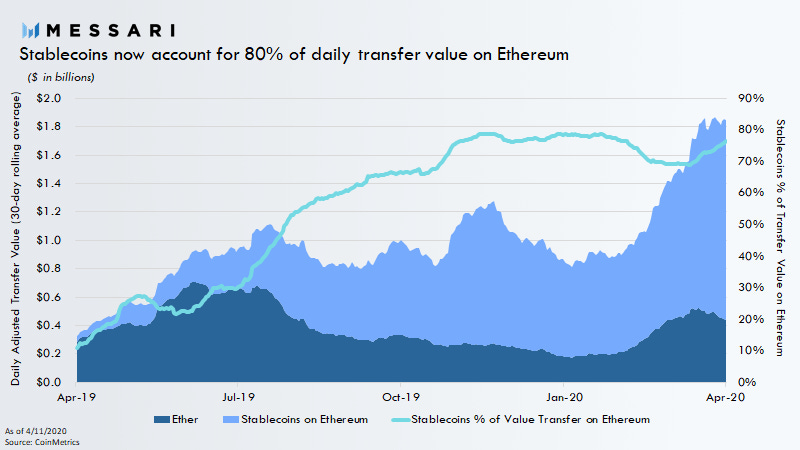

About $3 billion of tokenized cash sweep, in large part on the Ethereum blockchain and used in trading and decentralized finance, now sits in crypto exchanges. Tether alone is $7 billion of market capitalization today (not all is on exchanges). This is a sign of people entering the ecosystem to access new financial instruments. For more data on decentralized stablecoin adoption, see this Messari thread.

Note -- these are not investment trends. This is not about a stablecoin ever being worth more than one dollar per unit. Rather, it is about flows and where the money is going. This cash is the rounding error in your asset allocation. Below you can see that cash should be 5-10% of your net worth depending on risk tolerance.

The other thing your money is trying to do get pulled into the Libra association by Facebook and other Silicon Valley startups with billions of users. As a country, you may have a few hundred million people here and there. But the technology platforms are global and far better coordinated than international political bodies. They have people's attentions and hearts -- you just have taxes and the sword.

If you haven't seen it yet, the Libra Association released a second version of their white paper reflecting the comments and inputs of regulators. The initial cut was focused on a technology Council that issued a currency basket as an initial reserve, and then tech company users would contribute to that currency basket from across the world. Net interest income would flow to the Council, yielding billions as balances reached trillions. The new cut is both more modest, and more dangerous.

The Libra coin will be a mere basket (i.e., an allocation container) of underlying central bank digital currencies represented on the network (for my prior take on CBDCs, see here). This means that there will be a digital dollar, a digital Euro, and a digital sterling all traveling on the Libra blockchain rails. This is analogous to today's stablecoins traveling on the Ethereum rails. The white paper update is less ambitious in that it will not create a new money, and that the Libra rails will be fully permissioned. There is no decentralization and self-sovereignty in this proposal.

And that is precisely what makes it so dangerous and likely to be adopted. You certainly have heard that many central banks across the world are looking into, or already deploying, various digital currencies. The candidate technologies are R3 Corda, IBM Fabric, Libra, and Ethereum (Hyperledger Besu+). No Central Bank wants the chaos of billions of users having unfettered access to the royal lifeblood of money. Access should be parsed, compliant, and rigorous. It makes people safe. And it makes things orderly.

The Libra network is a strong candidate to subsume CBDC innovation, and see the launch of various regulated fiat coins on its protocol. The compliance bend highlighted above is not accidental. A number of features of public chains -- like transparent audit and a smart contracts language -- are replicated and made available to licensed participants. If the crypto ecosystem thinks it will be able to exclusively distribute small business loans or provide universal basic income in a post-COVID world, it is for a rude awakening on Libra's launch. PayPal, Square, Intuit barely eeked through. Facebook will crowbar the wedge further in its favor. Binance and Coinbase will need to wait in line.

The East is using the same playbook, just with more purpose and efficiency. Unlike the girations of animal spirits in American and European stock markets, blockchain rails are being layed by the government in China. Innovation, digital transformation, and national growth are core priorities for the Communist Party. Hundreds of billions of dollars are directed towards R&D and experimental technology -- the type of technology American regulators see as a systemic threat to sovereign systems. Further, that technology is exported to the smaller Asian economies and given as infrastructure to EMEA. See the scale of investment below according to SwissRe.

China has just launched the BSN Alliance -- a supergroup to rival Libra. I show the members below, and we also know that Ant Financial, Tencent, and Ping An have blockchains that will eventually plug into this group. For example, Ant runs "Open Chain" (irony of ironies!), which was just released to SMEs and developers. Some public chains, like Ethereum and EOS, will also be accessible through intermediation.

The interesting bit to me is that the BSN is not focused on one particular protocol or network, but instead on a multi-protocol integration layer that allows developers to build Web3 applications above all these infrastructures. So you might build a single application into APIs that write data into Hyperledger Fabric or Ant Open Chain, and abstract away the complexity beneath. The upside is efficiency and an ability to quickly deploy software. The downside is that you are using software with compliance and audit tools built by the CCP.

The idea is eerily familiar, because it is also how I think about what ConsenSys and Codefi are trying to do. We are working on APIs and developer tools that let anyone use the open, permissionless Ethereum to build decentralized financial machines. Already, Infura provides developers a gateway to deploying on Ethereum, and MetaMask gives access to a massive footprint of users. To get millions of people writing code, a simplifying toolkit is needed. I'd rather have the free market build it, than be designed and managed as a government service. Similarly, I would rather have free-market telecommunications companies provide us with the Internet, rather than sit behind the Great Firewall.

This is the war for money. This is the war for finance. Who gets to build the fortress?

I will leave you with one last data point.

The Financial Stability Board is not a fan of unregulated stablecoins. Countries don't like their money doing the types of weird things I have described without some sort of supervision. The good news, accordingly, is that the $5-10 billion of cash sweep is not systemically important yet at the macro level. However, things like Libra and the Chinese BSN -- classified by the FSB as a "Global Stablecoin Arrangement"-- definitely could be and warrant advance attention.

Less rhetorically, the FSB document is actually a fascinating, well-researched document about the types of Internet money assets evolving across different type of participants. See below for a rigorous classification framework.

Current regulations and classifications of these assets are all over the place globally. What is the difference between currency, e-money, commodities, crypto assets, or payment instruments? Does it matter? To get ready for money war though, allies have to get on the same footing. So what does the FSB recommend?

In short, it recommends controls proportionate to significance in the traditional economy and financial markets. The more significant the money, the more widely it is used -- the more KYC/AML, data retention and audit, and regulation will be necessary. All existing rules apply and there is no borderless, permissionless anything. A clear allocation of accountability applies, meaning that there is someone who is responsible, and can be subject to sovereign jurisdiction.

Do you see now how this lets Libra pass through, while catching and grinding the Bitcoin, Tether, and Ethereum alternatives in the filter? This text is recommendation, not policy. But it is also a flag. A war cry in Times New Roman.

Where is your flag?

Looking for more?

For just $3 per week, you can get the premium weekly summary, analysis, and exclusive content by subscribing here.

Want to send me a note? Reach out here anytime.