Long Take: What Apple's AI push means for Fintech and Privacy

Privacy concerns loom as Apple integrates AI deeply into its ecosystem.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we discuss the competitive landscape among Microsoft, Apple, and NVIDIA, all vying for the title of the world's most valuable company, with a combined market cap of $10 trillion. The driving force behind their growth is generative AI and foundation models. Apple recently launched its AI initiative, Apple Intelligence, with features integrated into the operating system, enhancing tools like Siri. This move positions Apple to dominate AI just as it did with previous technologies, potentially sidelining smaller competitors. However, this raises concerns about privacy and the broader implications of AI integration into daily life.

Topics: Microsoft, Apple, NVIDIA, Klarna, OpenAI, Siri, Facebook, Google, Fidelity, Schwab, Meta, Mistral, Anthropic, Gemini, Vision Pro, ChatGPT

If you got value from this article, let us know your thoughts!

In Partnership

Ground-breaking research from Cornerstone Advisors and TruStageTM uncovers the impact of embedded loan payment insurance on lenders:

Reduce defaults

Attract borrowers at a lower cost

Increase revenue

Attract more capacity

Differentiate offerings

Long Take

Apple’s AI Opener

Microsoft ($3.29T), Apple ($3.27T), and NVIDIA ($3.19T) have been vuying for the spot of the world’s most valuable company over the last week. Combined, their $10T marketcap is over 20% of the S&P 500 and bigger than China’s entire stock market.

The primary growth story behind all of these companies — and arguably the entire Covid recovery and the return of American exceptionalism in Big Tech — is generative artificial intelligence and the magic powers of foundation models. While we may be in the perfect storm of hype bubbles, often the sweetest sugar rush comes with the greatest kinetic energy.

As an example, Klarna, the BNPL company, has deployed some of the AI tooling within its marketing arm and is reportedly saving $10MM per year as a result.

While we have questions about spending $10MM on manual image generation in the first place, digital-native players will asymmetrically benefit by being early adopters of AI. Distribution-focused Fintechs with a large web and mobile reach will reap the largest rewards.

Speaking of distribution, Apple is the ultimate storefront of everything digital and has launched its own AI initiative.

The company has revealed Apple Intelligence at its most recent product conference. Claiming that Apple is providing AI for the “rest of us” definitely feels a bit out of touch coming from the world’s second largest tech monopoly, but we will leave that as a sidebar.

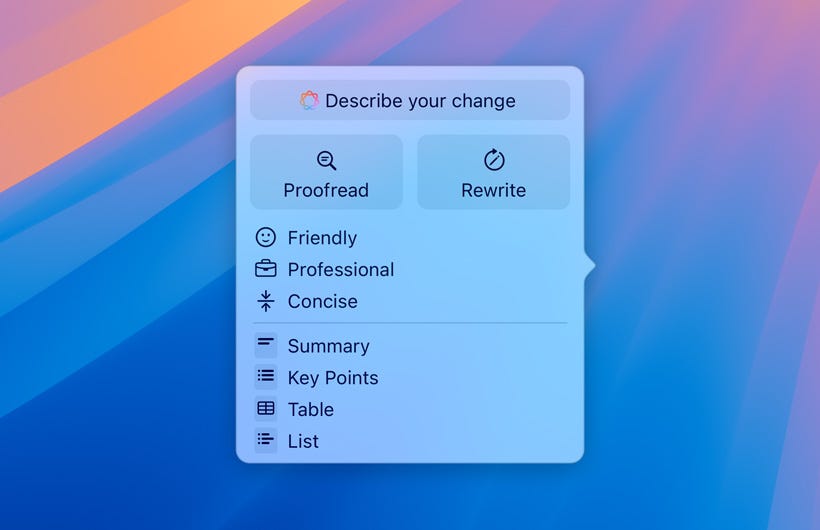

The AI functionality is currently quite narrow, but deeply integrated into the user journey within the operating system. There is a handy “Writing Tools” feature, which embeds the summarization and writing functionality of LLMs directly into the editing experience. You can also use image generation to build custom emojis or upgrade sketches into fully styled illustrations.

This is nice but not yet futuristic.

The changes to Siri — the AI assistant and brain of your phone — are a bit more profound. It appears that Siri is going to get a lot more context, and will acquire the ability to understand what’s happening across your photos, calendar, email, and other local applications. In fact, Siri will likely know everything happening on your local device. We assume the AI access settings will be controlled through permissions, but also that most people will be oblivious and opt-in to full surveillance mode just as they had on Facebook in the mid-2010s.

You can see in the illustrations above those integration and data-sharing concepts coming through. We can assume that Siri knows everything happening on your phone. It is designed like an AI agent, which can take a particular task — also known as an *intent* — and translate it into a combination of inference and execution. The inference will come from an AI model, and the execution will come from any particular application that Siri can control on your behalf.

Implications of AI Bundling

Apple’s approach is a coup de grâce.

While thousands of companies are building out AI agent apps, hoping to get distribution in a large platform like Apple, Android, or Windows, Apple has just pre-installed its AI models on nearly 2 billion devices. That’s not entirely accurate, since many devices will not be able to run these AI services, but you get the directional picture.

Just like Internet Explorer owned the browser category for Microsoft in the early days, so will Apple’s default AI squeeze out many competing attempts. Similarly, consider the impact of Apple Pay on any fintech firm that would want to involve the iPhone in a payment transaction. How good does it feel to be PayPal or Square in a world where Apple is launching products to kill you every single year?

As an example, Apple has been making it easier and easier to send digital cash from one Apple Pay customer to another in a feature called “Tap to Cash”. A similar feature called “Tap to Pay” is already live for merchants and customers in the UK. End of the day, the consumer experience wins. But fintech start-ups suffer when their platforms disintermediate them.

Such strategic moves aren’t special to Apple or tech companies. Look at the large brokerage houses, like Schwab and Fidelity. Imagine being a provider of money market funds on those platforms in the early days, only to have to compete with proprietary investment funds offered by the underlying asset manager that owns the broker dealer.

This is a key lesson in distribution and manufacturing. If you are vertically integrated, like Apple or Schwab, then you can own both and starve your competitors.

So here are things that are in trouble, unless your name is OpenAI.

If we look out a few more iterations, an even more interesting implication becomes clear.

In the current paradigm, we do work on a device by opening a program, like Excel, and then doing work within that program. The program is what enhances our functionality. Phone apps are like this too. We open them up to achieve some particular goal. If you want investment advice or financial planning, you go into the app and perform the labor needed — like entering data or answering inane questions — to get the desired outcome.

In the emerging paradigm, the work we used to do inside of applications will be done by robots outside of applications. That financial decision or data entry we discussed above? It will be read by Siri or some other assistant from the context of your device, and then Siri will transform that into an object it understands and can send to a model, which in turn will package some inference to the next application, and so on.

From a consumer perspective, this will be preferred as the easy experience. From the perspective of any application within the Apple ecosystem, the consumer becomes Siri, the All-Knowing-Robot, not the human user. Traffic, attention, engagement — all of these things may come from an AI inference model, and not from a human being.

Privacy and Creepiness

One of the corporate values that Apple often discusses is privacy.

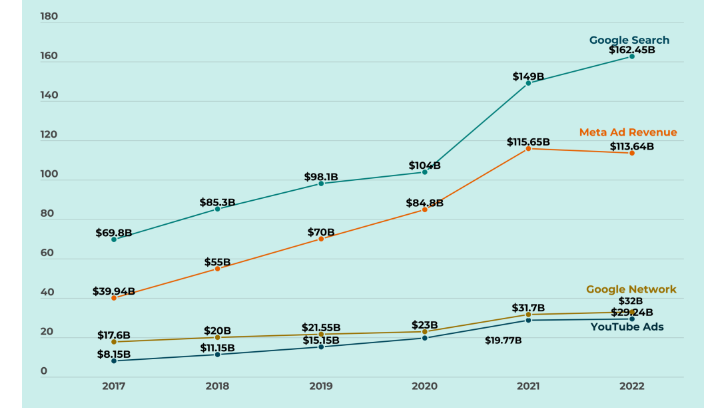

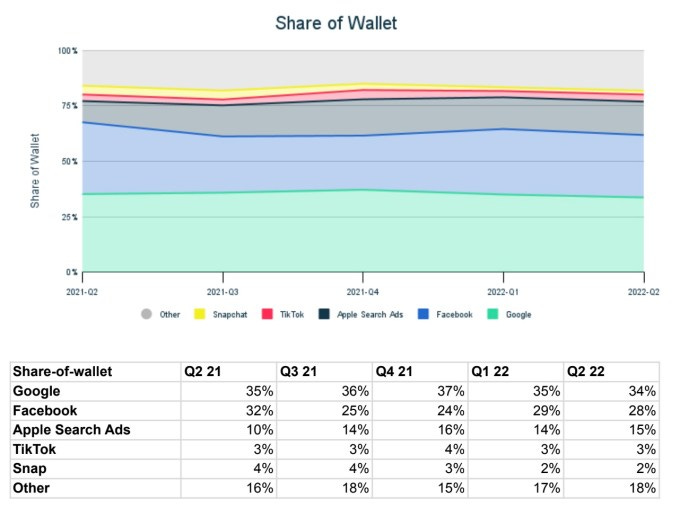

But that comes from an old world where Apple is a hardware manufacturer and Google and Facebook are advertising companies. More recently, Apple has used its control over the device as a manufacturer to create its own advertising business. Whereas Meta generates $110B of revenue from advertising, Apple makes somewhere between $5-$20B from the category.

While not overwhelming, we think Apple has a material incentive to figure out ways to work with user data for both advertising and AI business lines. Even if it creates layers of privacy software or claims to be encrypting everything one way or another, we still see this as a slippery slope of temptation. Having most things on the device is a good starting point, but it will not be enough.

We provide a case in point for the Vision Pro.

What are these deepfake Vision Pro personas, how are they controlled, and how are they owned? Once we trend towards hyper-realism, digital twins and avatars become *assets* to be owned, not features to be turned on. Nobody will mistake your picture for you, but someone might mistake your deepfake for you! Consider the potential outcomes in financial fraud and payment risk management.

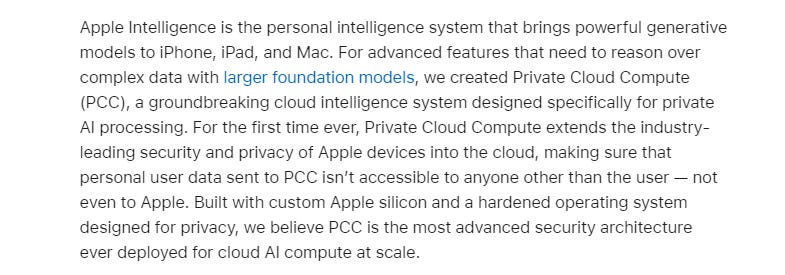

As we look under the AI hood for Apple Intelligence, there are two destinations where inference workloads can be done. The first is on the actual device. In this case, as long as you control your device, this is private. The second destination is for more complicated and sophisticated queries, and those go to Apple’s private cloud.

This is fascinating stuff, and likely to be the state of the art in building a data center that respects user data. Requests come into the hardware node and are processed, but no trace remains. This probably protects against the majority of attacks and should be best practice for the rest of the industry. We hope it is enough of a counterweight against various compromises that could undermine privacy over time.

What’s the fear? Is your personal on-device data — including your financial information — being used to train some general large language model? Apple says No. What would OpenAI say if it had access to this data? Note that while Apple has a partnership with OpenAI, ChatGPT is not the default model used in these examples. It is integrated into parts of the product, but is not the main way that Apple is playing in artificial intelligence.

Instead, Apple has trained its own set of models.

The company built both small and large models, to be deployed on the phone and in the private cloud. On the data collection side, Apple claims to have scraped licensed and publicly available data, but not any personal user information from devices. It then followed the full process of pre-processing, training, and optimization, using “adapter layers” — small neural network modules — to further fine-tune the general models on the required use cases. Think about making the model good at editing emails or making emojis in the right style.

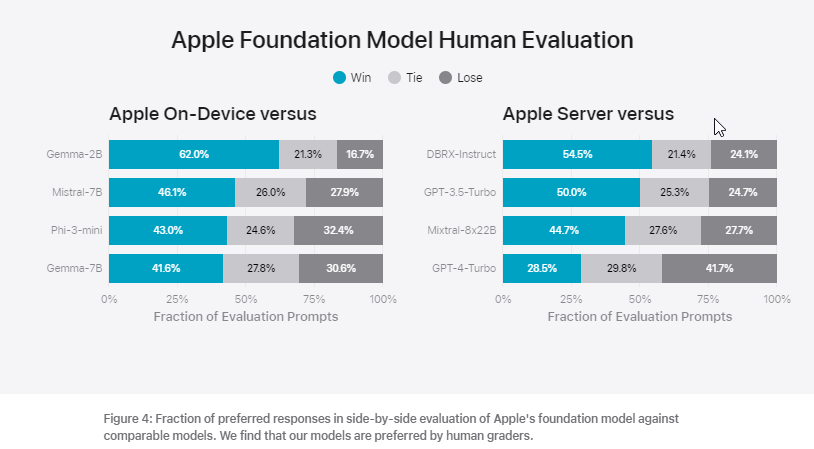

So far so good. When looking at performance, Apple’s models perform well both against the state of the art from OpenAI, as well as against the open source models built by other providers like Meta, Mistral, and Anthropic. Below we show comparisons both using human input and more structured benchmarks.

That’s a lot of charts to say a simple thing — Apple’s homegrown AI is as good as it gets. The company has clearly been investing in its own deep capability, and the OpenAI partnership at this stage seems to be a hedge in case its proprietary tech fails out. Consider how Google’s Gemini glitched all over the Internet, both with incorrect answers to search results and overloaded safety prompts. Perhaps Apple doesn’t want to be embarrassed if something goes wrong.

AI is likely a technology that Apple will own vertically over time. Just like they have integrated much of the payments value chain and taken a profound share relative to financial players, they can certainly invest their $160 billion of cash in running a lot of GPUs.

Recent figures show that GPT4 was an $80MM endeavor, and Google’s Gemini Ultra cost $190MM. Apple will gladly pay this price many times over to control the next major platform shift.

Do we want them to win?

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.