Long Take: What do Jamie Dimon and Yifan He (Red Date Tech) accuse of being a Ponzi, and Why?

It rhymes with De Moines

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: The top banker in the US and the person managing the build out of China’s Blockchain Services Network are both in the news calling Bitcoin a Ponzi scheme. We don’t like it. So we spend some time addressing the rhetorical point — answering the Marxian criticism about the lack of labor, and the Capitalist criticism about the lack of value. We also highlight the launch of the Universal Digital Payments Network from Red Date, and the work of JP Morgan Onyx — both of whom rely on variations of the Ethereum codebase.

Topics: CBDCs, payments, capital markets, crypto, politics, privacy

Tags: JP Morgan, Red Date Technology, Ethereum, Bitcoin, Quorum, Hyperledger Besu

We welcome discussion and your feedback on these topics — leave a note for us in the comments.

Long Take

Wagging the finger

We are going to let the esteemed speakers speak for themselves.

Jamie Dimon (see source here):

“Bitcoin itself is a hyped-up fraud, it’s a pet rock,” said Dimon, adding that it’s different from blockchain technology. “Blockchain is a technology ledger system that we use to move information… we use it to move money. So that is a ledger that we think will be deployable.”

“Bitcoin itself is a hyped-up fraud,” says @jpmorgan CEO Jamie Dimon. “Crypto is a decentralized Ponzi scheme…It’s a pet rock.”“I called it a decentralized ponzi scheme. The hype around this thing has been extraordinary,” he said. “Crypto itself doesn’t do anything.”

Thrilling analysis!

But we have one more for you.

Yifan He, CEO of Red Date Technology, the “tech firm” developing China’s Blockchain Service Network (BSN) had written an article in the People’s Daily Online paper with the following gems.

Among the top 100 richest people in the world, at least 90 have publicly expressed their "bad-mouthed" attitude towards virtual currencies, including Microsoft founder Bill Gates and "stock god" Warren Buffett. Warren Buffett believes that the only certain thing about virtual currency is that "it will not generate any value". He publicly stated that "Bitcoin is rat poison and must be kept away." And his old partner Charlie Munger even bluntly said that investing in Bitcoin is an "evil and stupid" thing.

"What exactly is virtual currency?" As far as its essence is concerned, the author believes that virtual currency is undoubtedly the largest Ponzi scheme in human history…

The so-called "equity" of the equity-based Ponzi scheme is completely unrelated to any actual assets and productive labor, so it does not have any actual value. It can be considered that its distance from the real society is infinite, which means that its The risk is close to infinite.

Comparing several basic characteristics of virtual currency, it is not difficult to find that it is very consistent with the equity-based Ponzi scheme.

Or this quote in Cointelegraph.

Currently, all unregulated cryptocurrencies including Bitcoin are Ponzi schemes based on my understanding, just different risk levels based on the market caps and number of users,” He said in a statement to Cointelegraph on Monday.

The BSN chair added that he had not had any cryptocurrency wallet or related assets ever: “I don’t touch them and won’t touch them in the future even if they become regulated because I don't consider that they have any value whatsoever.”

Look, it is totally fair to look at the world and ask whether what is going on is real grift. We’ve certainly made our mistakes in analyzing Olympus DAO, FTX, and all sorts of derivative projects. Maybe everyone is wrong?

Maybe the whole thing indeed is an illusion, a collective hallucination into which we put our faith and get magic in return? That wouldn’t be out of character for the human race. Maybe crypto is just the techno-cyborg religion on the way to displace the belief systems of the world’s spiritual chassis? We believe in Nakamoto consensus! We think that money is the Borganism goo!

The Marxist Critique

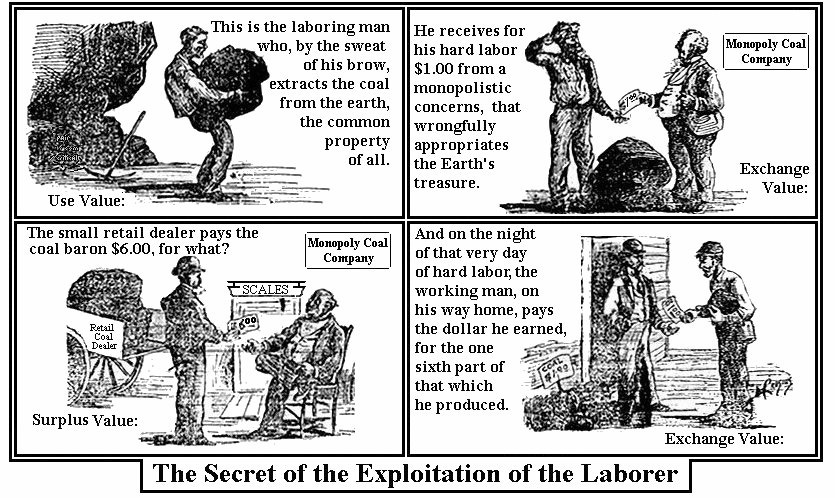

We love that Marxist part in the quote about not incorporating any labor from the real economy. We even sort of agree, and have talked about the Web3 economy being the most important growth vector for the space. Remember that in Marxian economics, goods are created through honest labor plus some capitalist exploitation surplus value.

So, you know, we should really pay attention to whether there’s any labor going on. Like, is anyone doing stuff? Anyone toiling in the coal mines of crypto protocols to bring us that surplus to protocol monopolists?

When you look at open source developer contribution to various decentralized protocols, there’s at least 25,000 people actively committing labor to building these things out. But you know, maybe their labor doesn’t count because they are dirty anarchist hippies?

Ok, how about the hundreds of thousands of developers using Infura and Alchemy to connect into nodes and write novel software that executes on computational blockchains? Or what about those who download Web3 developer libraries over a million times?

That sort of looks like labor, doesn’t it.

So our BSN network friends should be satisfied on an economic basis, we hope.

The Markets Critique

As for Jamie Dimon, we hope that as the CEO of one of the largest banks on the planet, he believes in capitalism.