Long Take: What Goldman's institutional financial cloud on Amazon means for embedded finance

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

Topics: big tech, investment banks, embedded finance, neobanks and digital lending, institutional capital markets, data and analytics, cloud, open source, blockchains

Tags: Goldman Sachs & Marcus, Kensho, Thought Machine, Amazon, Google, Microsoft, Ethereum, Binance, Solana, Polygon

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

Are you not impressed with Cloud Finance?

Goldman Sachs and Amazon just announced an embedded finance offering using Goldman’s finance capabilities and Amazon’s cloud service at Amazon’s big conference. But nobody in the Fintech world seems to be talking about this!? You’d think the key words “Goldman Sachs Financial Cloud” would ring some sort of alarm bell, but so far crickets. Let us at least point to the coverage here, and here on the GS site.

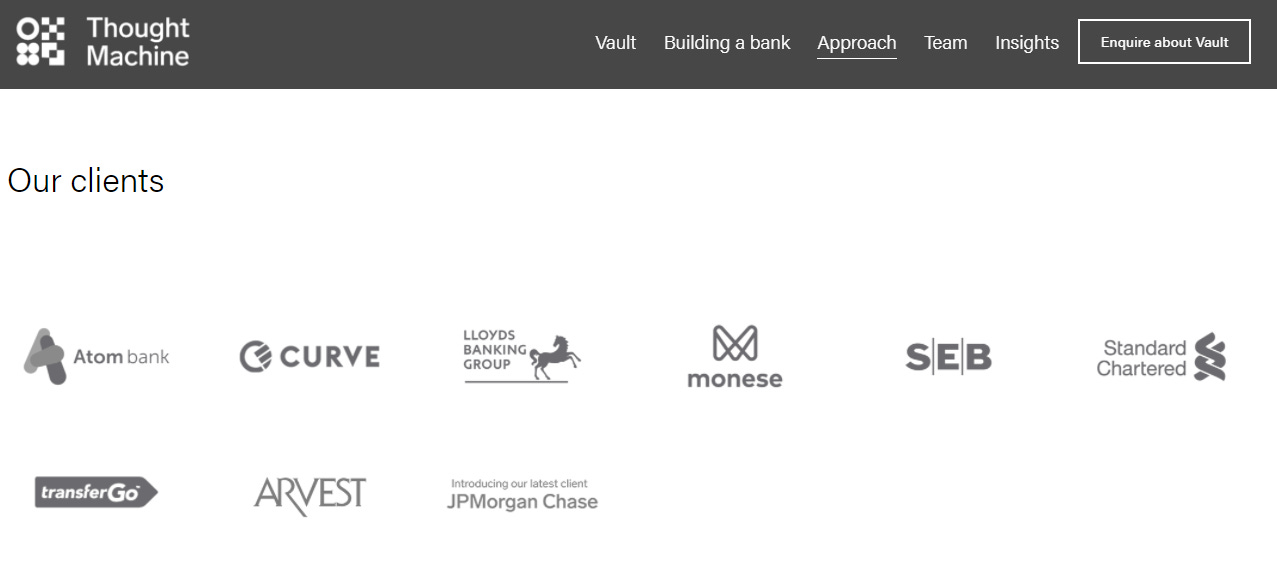

In the same vein, let’s highlight that Thought Machine, the core banking provider with Google tech roots, raised $200 million from JP Morgan and reached unicorn status. While that amount has become somewhat pedestrian in the B2C and crypto world (looking at you FTX), it still a very meaningful amount for banking infrastructure. Such infrastructure can be summed up as — “core banking but in the cloud” — and is being used by Standard Chartered, JPMorgan Chase, Lloyds, and a few other adventurous banks. A bit of coverage is here.

Let’s meditate a bit on these developments, and then place them within the context of Cloud and embedded finance, their industry functions, and thereafter within the transformation from Web2 to Web3. Because we think this is a big deal still.

Clouds and Embedded Finance

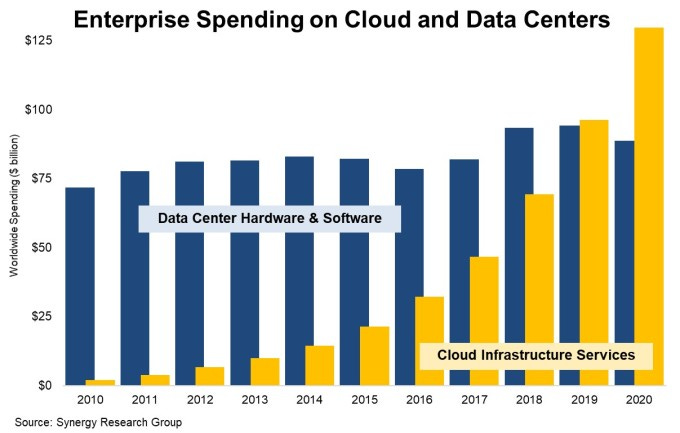

We have this intuition that all software runs in some sort of magic Internet place. Which of course it does, but also, a lot of it runs on proprietary data centers owned (or rented) by companies for themselves. The IT story of the last two decades has been the move of valuable software, and the data exhaust it produces, from those on-premise servers to third party cloud providers.

To put it into human terms, when you use an installed version of Microsoft Office on your laptop, that’s your own hardware and software. Especially if you are a broker/dealer still forced to use MS Office 2007. But if you are using Google Docs through the Chrome browser, that runs on Google’s server farms in the “cloud”.

In the first instance, you have to maintain your computer and software yourself, and there are lots of unpleasant capital costs. In the second instance, you pay a subscription fee and upload all your company secrets into Google for scanning. Just kidding, but also maybe!

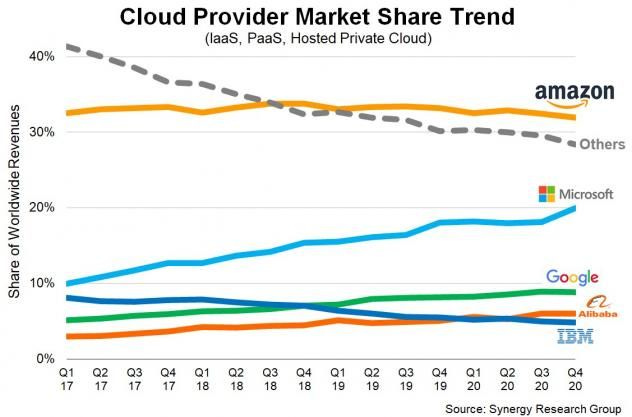

Most of the market is split between Amazon, Microsoft, and Google, with IBM melting away market share. And while you might think of all this description as dry background text you have to scroll through to get to a joke, the punch line is that these aren’t just hosting providers.

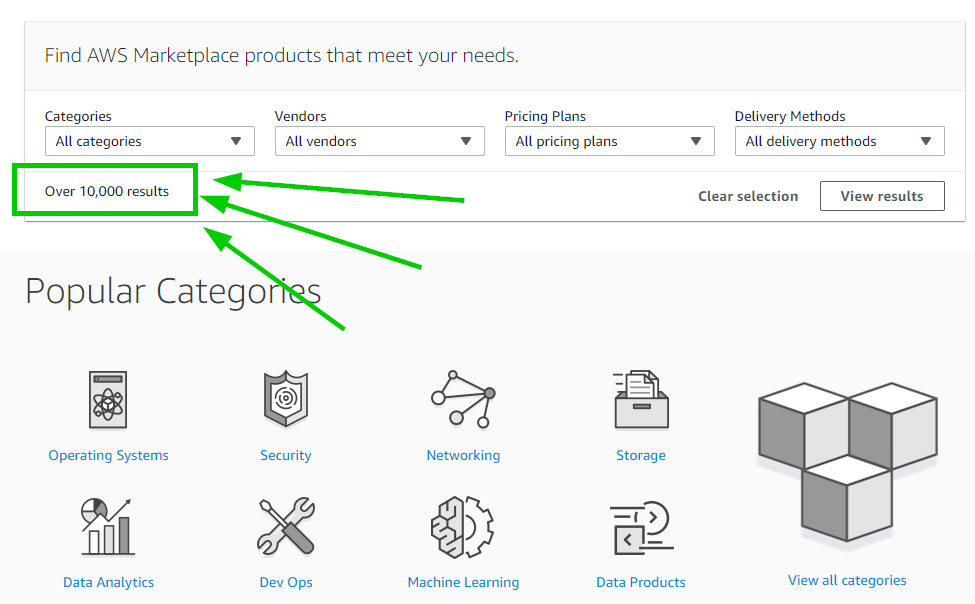

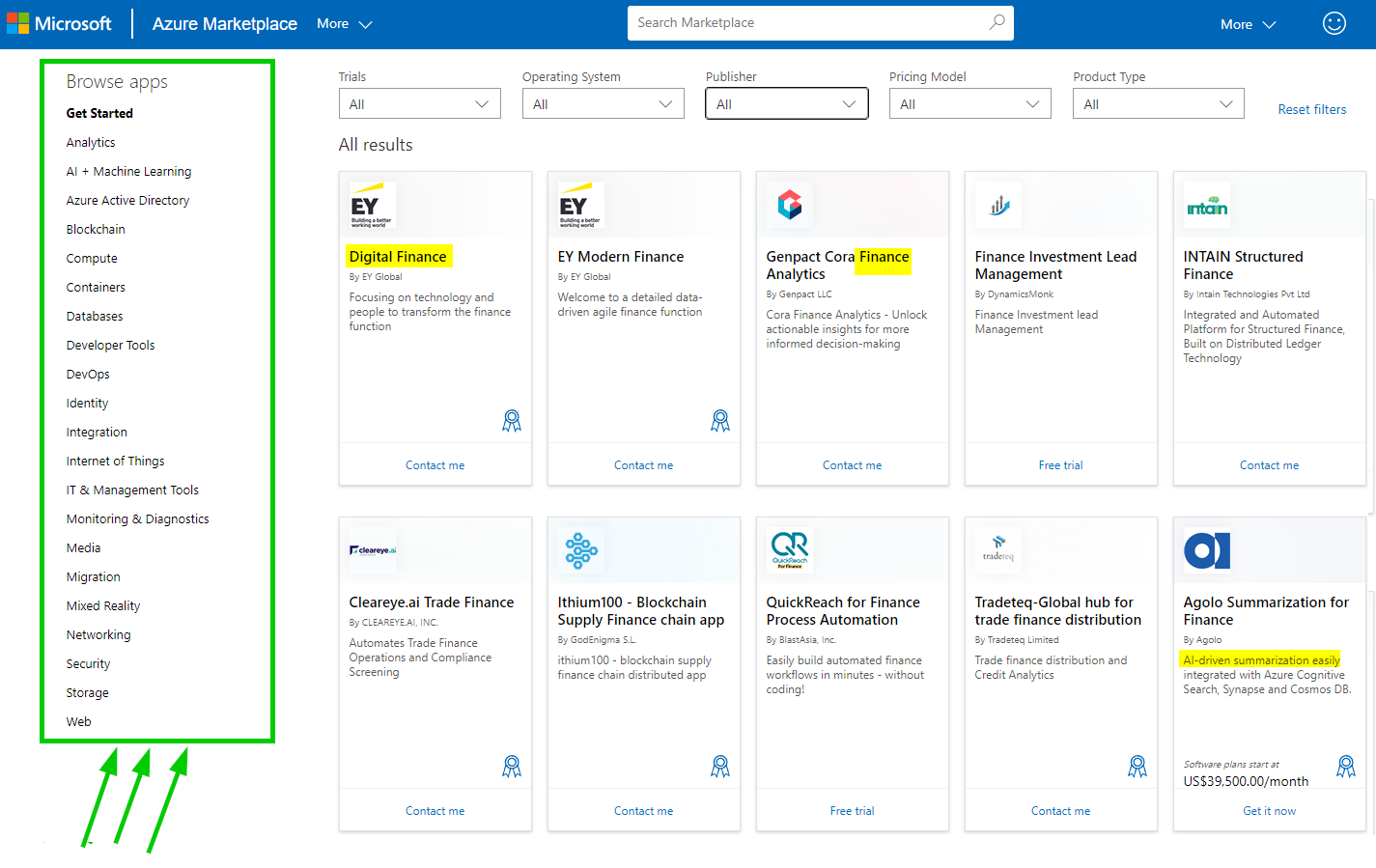

They are some the largest enterprise developer storefronts in the world.

These storefronts are how anyone using AWS or Azure can easily and quickly buy and install fintech capabilities compatible with their cloud software. And as we established previously (by assumption), *everyone* is going to be running on cloud software, and therefore being embedded in these ecosystems is one of the fastest ways for a developer-focused fintech to grow.

Of course, this is a bit of an oversimplification. Plenty of embedded finance providers, like Plaid, DriveWealth, Zero Hash, and others, have been able to win market share without relying primarily on cloud market-place distribution approaches. But think about how much friction one removes by going this route, and how much leverage you can get with the right brand in the right place.

A brand like Goldman Sachs.

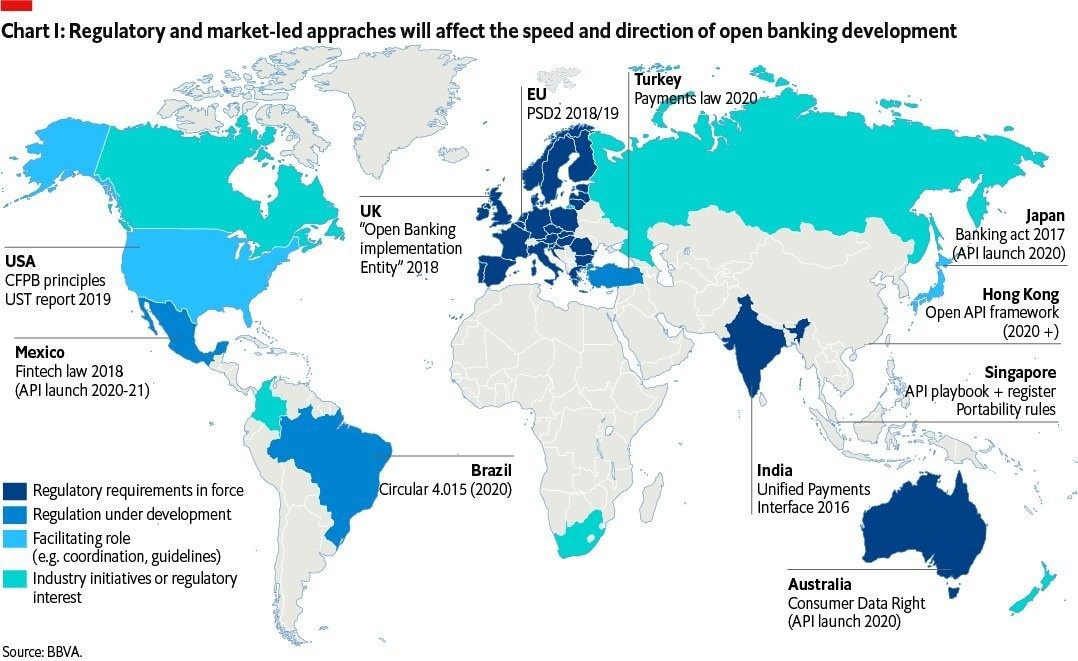

Also, remember how PSD2 and Open Banking were supposed to use regulation to drive lots of banks to open up APIs, and then for start-ups to use those APIs?

Lots of banks did open up their APIs — as well as spend excessively on digital transformation consulting from Accenture and EY. But none of them have yet become a vibrant fintech ecosystem, in part because developers have been going to bespoke banking-as-a-service providers that are well configured as enablers. Alternately, if all of the banks are integrated into cloud marketplaces, that might tip the balance towards actually using bank APIs much more.

It would also permanently shift the power of distribution, and the associated customer relationships, to the big techs.

Embedded Institutional Finance

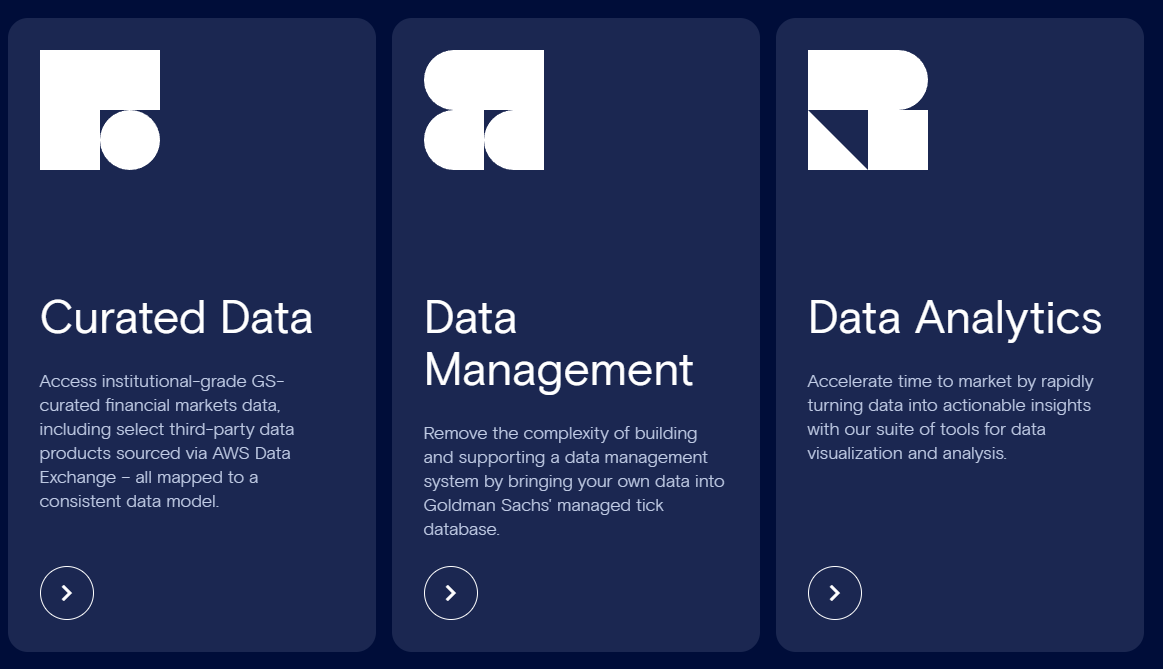

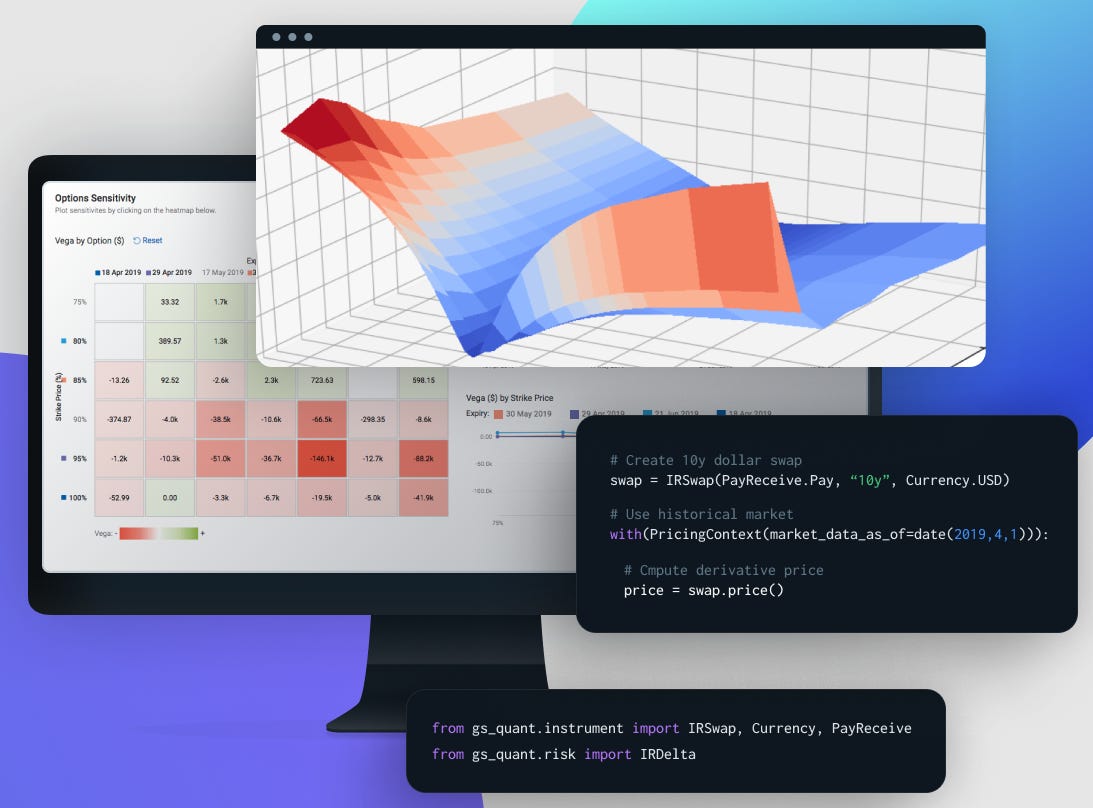

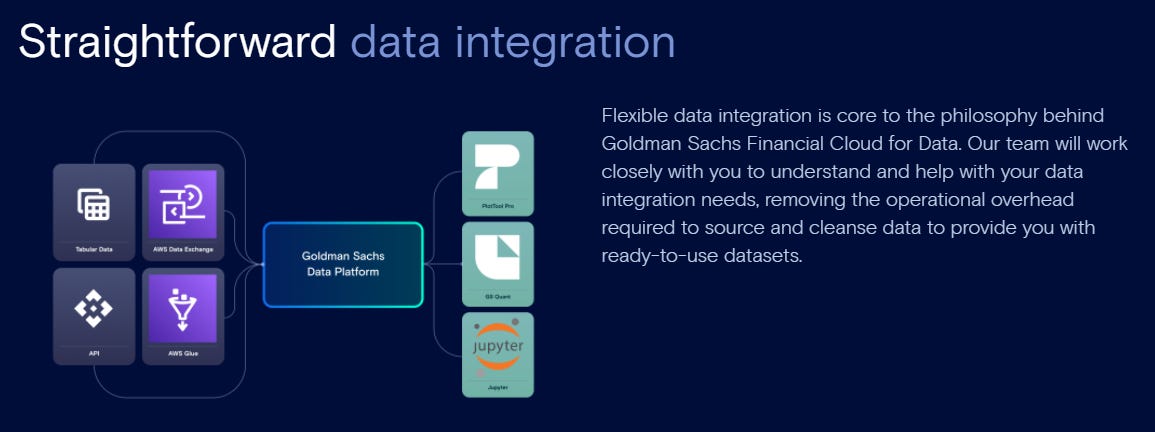

So what is it that Goldman actually launched? The first part of the institutional finance API section is all about data and analytics for a trading or asset management business. Think about it as quant-fund-in-a-box.

Goldman’s trading desks ingest and process unbearably large amounts of market data, all of it packaged and standardized to be comparable. Whether you are talking about price data, alternative data, or third party analytics enrichment, Goldman is already wiring everything together for itself as part of its IT spending. For context, that spending amounts to about $1.3 billion per year on communications and technology.

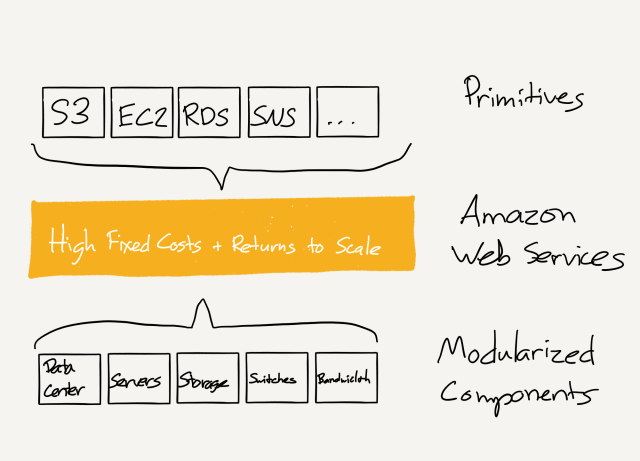

You can see Goldman recreating Amazon’s core strategy of being its own first best customer (hat tip to Ben Thompson for being so right about monopolies). One of the several secrets to Amazon’s success has been to build services for itself, and then open those services up into a platform or marketplace. This is how AWS went from being the cloud architecture for the Amazon website to the cloud architecture for most websites, and how Amazon’s fulfillment infrastructure went from being used to deliver only Amazon goods to being used to deliver all Amazon marketplace goods.

So here, Goldman fulfilled the needs of its own capital markets business, and then the clients of the capital markets business (i.e., hedge funds). Now, it is opening up that tooling for others to use as an architecture. And from an economic perspective, this is likely to win because the massive fixed cost of creating this architecture at the level of quality that Goldman likely has is enormous. So renting is rational.

There are some other interesting bits floating around about value propositions and tools around data, from standardization, to risk and analytics engines, to third party integration. Check out the screens below.

Notice that Goldman is also selling its bundling of third party services through data science notebooks and analytics tools. This allows the company to leverage its reputational asset to create bespoke relationships with data providers, and then pivot the bundle into atomic, standard services. Apple did a similar thing in disintermediating the music labels — using its distribution power and heft, it renegotiated an entire industry.

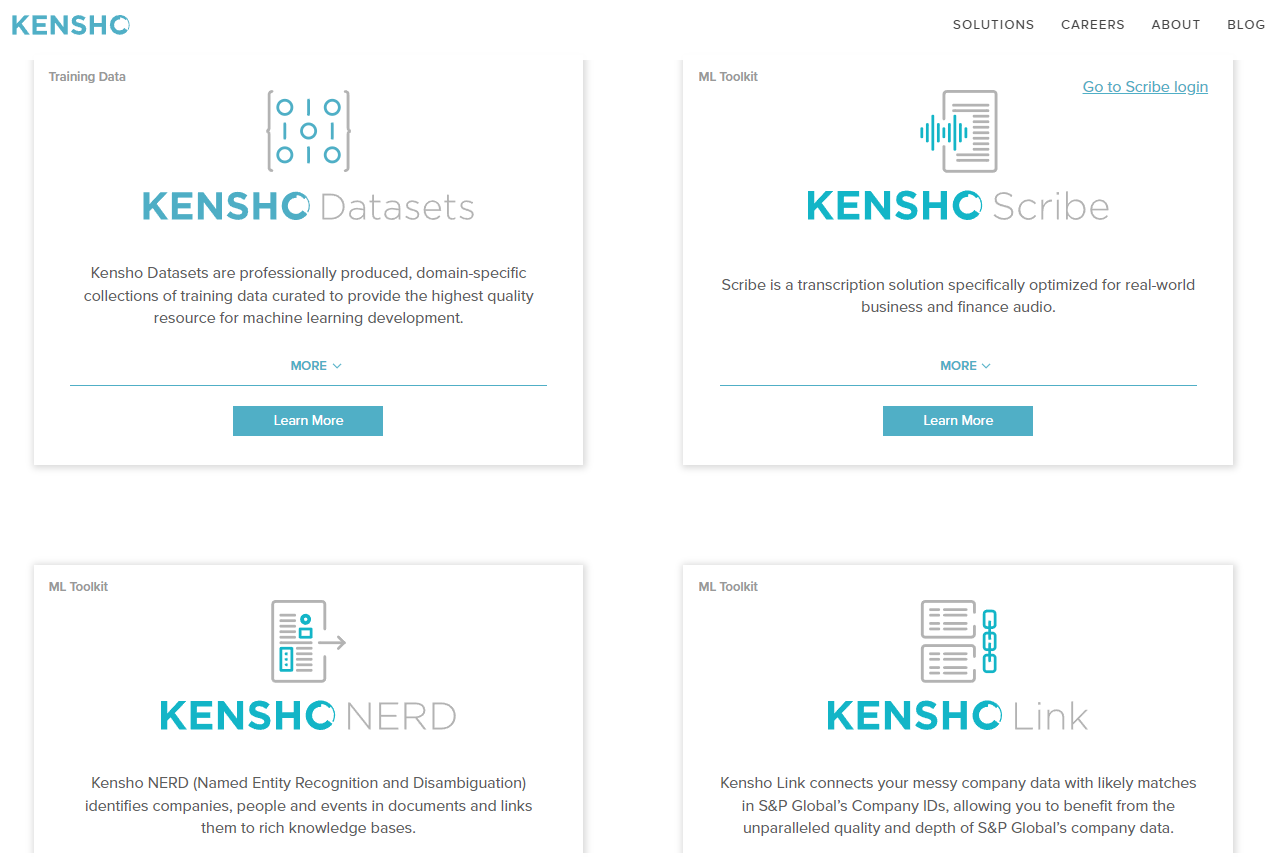

That said, we think back to Kensho, the artificial intelligence company seeded by Goldman Sachs and sold to S&P 500 for $550 million. The startup was cool — selling the vision of machine learning engines that do complex data analytics based on natural language inputs — but ran at about $20 million of revenue, selling for about a 27x multiple in 2018. In 2021, the financial results of the company are bundled into much bigger business lines, and are somewhat invisible. It is unclear if they had ever surpassed the materiality threshold, or are now simply one of many parts of the technology stack for presenting information.

Perhaps Kensho was just early, or perhaps it didn’t yet plug into the right marketplace or data set. Goldman and the S&P were Kensho’s first customers, but like most AI startups at the time, its engine relied on being fed data by its much bigger customers on their own terms. That’s certainly not the case of Goldman on AWS, and we are excited to see how it all plays out.

One of the major things to pay attention to is also whether these tools are money makers, or merely the catnip that brings institutional customers to market venues. Giving away software and trapping transaction volume is a well known, profitable game.

Embedding the Treasury

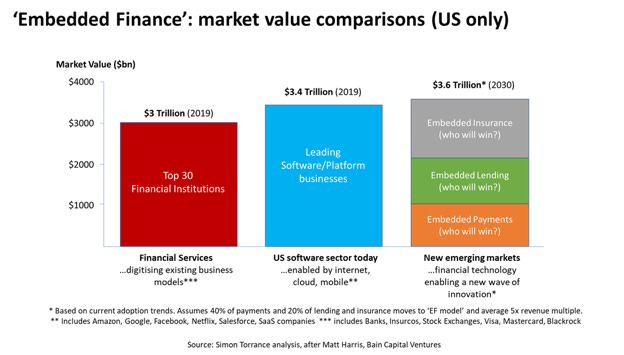

We’ve covered the trading side. But of course, that’s not the only financial API opportunity that’s available to large investment banks — embedded finance could be a $3 trillion market cap opportunity across the various asset classes and functions. You’ve surely seen this market size chart below. For a deeper dive, listen to our conversation with one of the leading industry experts on the topic Simon Torrance here.

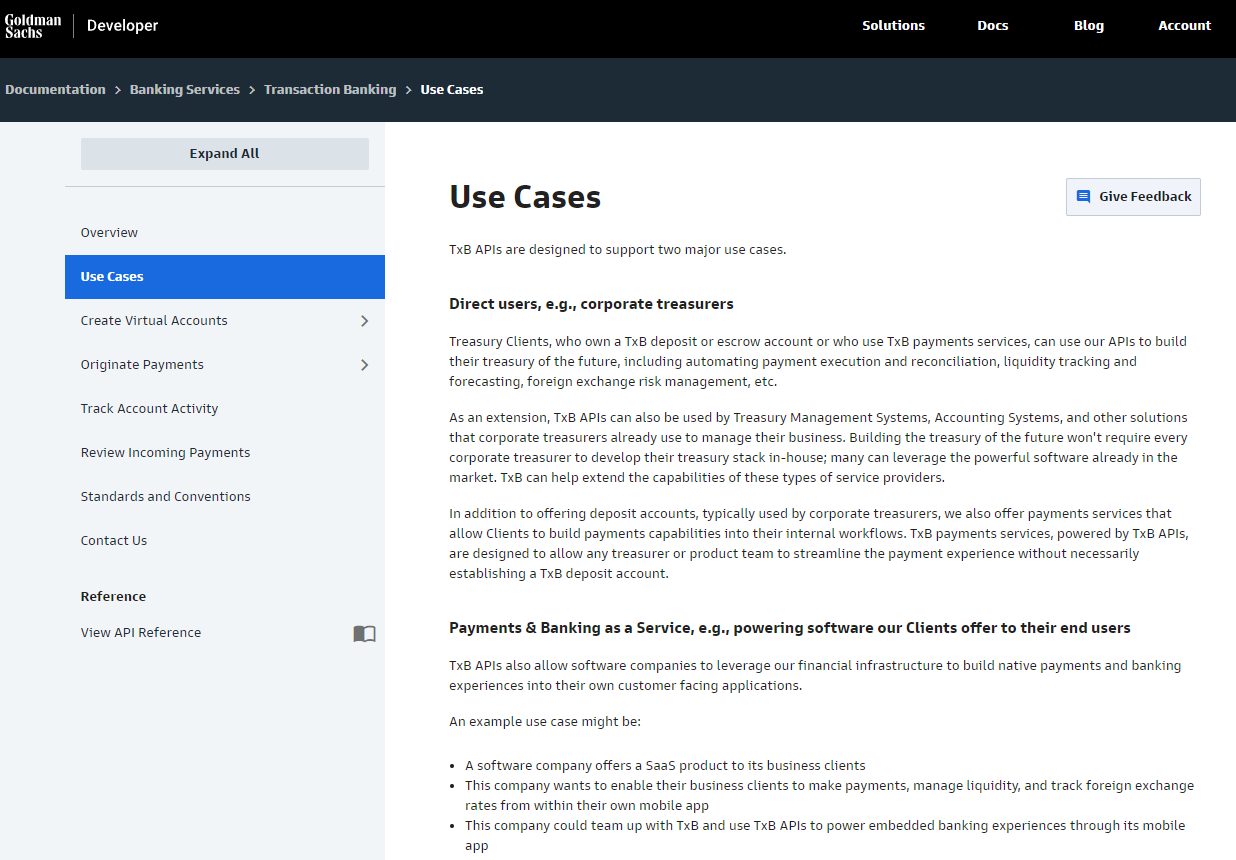

Goldman’s offering targeting this opportunity within the financial cloud is their (1) corporate treasury and (2) banking APIs.

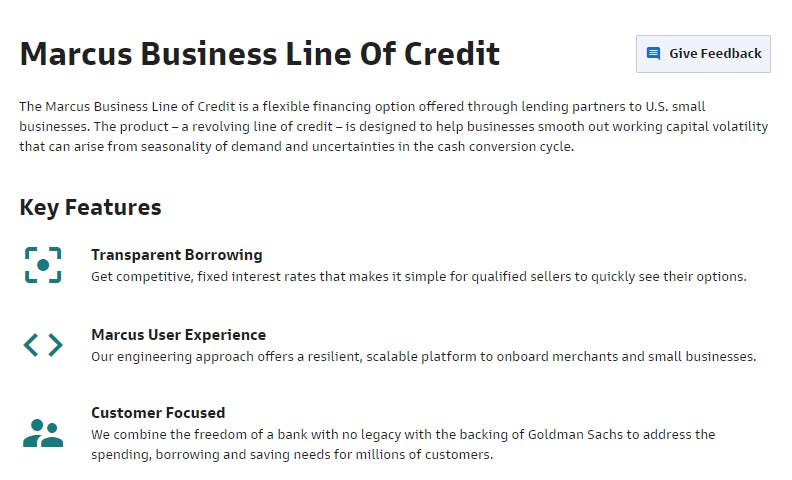

The former is not a market deeply served or well understood by fintechs, outside of perhaps a handful of companies like Treasury Prime (podcast here) or Standard Treasury. But it is a strong competence for wholesale banking, and now you can get the Goldman version! In exploring the developer website further, we are quite excited by the consumer finance features as well, like Marcus’ business credit underwriting, and the digital wealth and payments services.

In this line of products, we started off the discussion by mentioning Thought Machine, a core banking platform backed by JP Morgan and others.

Thought Machine is cloud *native*, optimized around scalability and automated account workflows. By leaning into modular micro-services and scalability, the platform is optimized for taking an offering from 0 to millions of users — a problem faced when blitzscaling or launching a new product within an existing distribution footprint. One radical headline suggests the tech will eliminate 10,000 jobs doing data reconciliation at Lloyds.

The company aims to unseat the Fiserv, FIS, and Jack Henry oligopoly that has dominated banking cores for decades, and its latest round prices it above $1 billion. For comparison, Jack Henry trades at $10B, FIS at $65B, and Fiserv at $70B. So it is still early days.

These are of course different things: (1) embedding Goldman’s modular services that integrate financial products into a major cloud infrastructure provider, and (2) launching a cloud-focused core banking system that essentially manufactures the banking product. But they point in a similar direction, which is the shape of financial workflows and delivery methods over the coming decades.

Battle of the Clouds — Web2 vs. Web3

This is a topic for a much longer deep dive. But we can sketch out the main fronts for the battle.

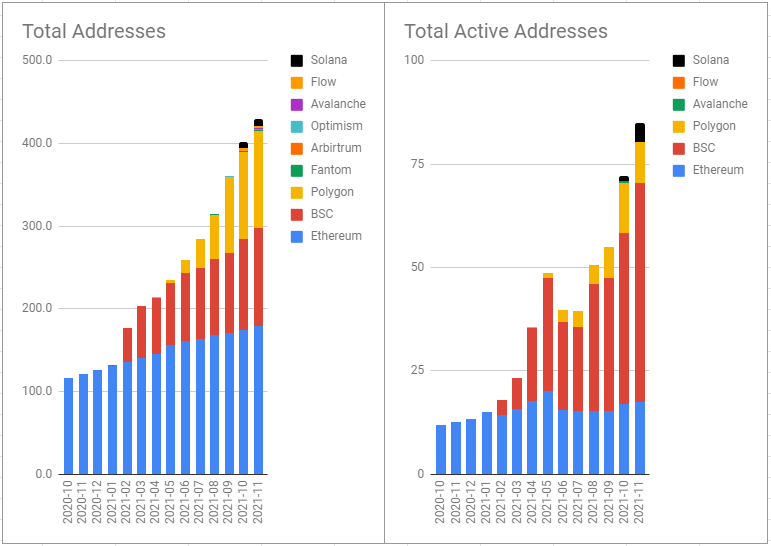

In Web2, the storefronts are the ones we described — AWS, Azure, and Google Cloud. The motion for those storefronts is to provide core infrastructure and expand into modular functional use cases, swallowing up the entire market functionally over time. A few very large companies are going to own the running of core infrastructure, and the long tail of apps comes there with the hope of capturing customer demand.

In Web3, the storefronts are essentially computational blockchains — Ethereum, Solana, Polygon, Polkadot, Avalanche, and so on. The market structure at the moment puts EVM-compatible chains in the lead, though it is still possible for other equilibria to emerge. Functional applications, including all the fintech and DeFi ones, are built on the chain where they hope to capture customer demand. So far, so good.

Yet one of the primary distinctions between the two paradigms is that even though computational blockchains may have high relative market share, they are essentially public goods run by thousands of independent, disconnected actors.

Those actors *may* self organize into DAOs, which resembles a much more lively and aligned version of shareholder governance. But even then, there is a very large difference between Amazon pursuing equity value maximization and code shepherded by a global open source community.

How could the Goldman/Amazon collaboration transition into a Web3 model? This one is a headscratcher. The first thing that would have to happen is the decentralization of Amazon’s cloud provision. All of us would need to be able to run highly performant cloud services, and likely be paid in tokens for the privilege. Or perhaps, AWS is simply in the business of validating Ethereum.

Next, Goldman’s code would be deployed like Uniswap’s smart contracts onchain, with data flowing through a provider like Chainlink and cash management features looking like some version of Curve, Compound, or Aave. We would be rewarded for the use of Goldman’s APIs through tokens as well, because it is clear that the liquidity we bring to their market venues is the real money maker. All this would be transparently deployed in an open environment and tracked via onchain data analysis.

We’d have tokens in that too.

More? More!

Another friendly reminder to share this post so that others can learn:

Want to discuss? Stop by our Discord or reach out here anytime.