Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Chris Dean, who is the Founder & CEO at Treasury Prime. Previously, Chris was the CTO & VP of Engineering at Standard Treasury, which was acquired by Silicon Valley Bank for an undisclosed amount.

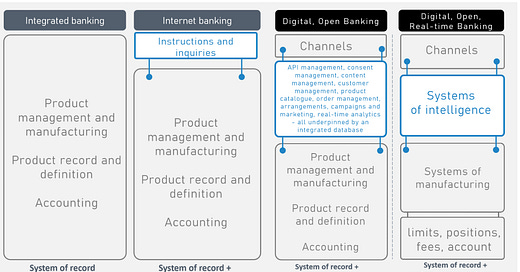

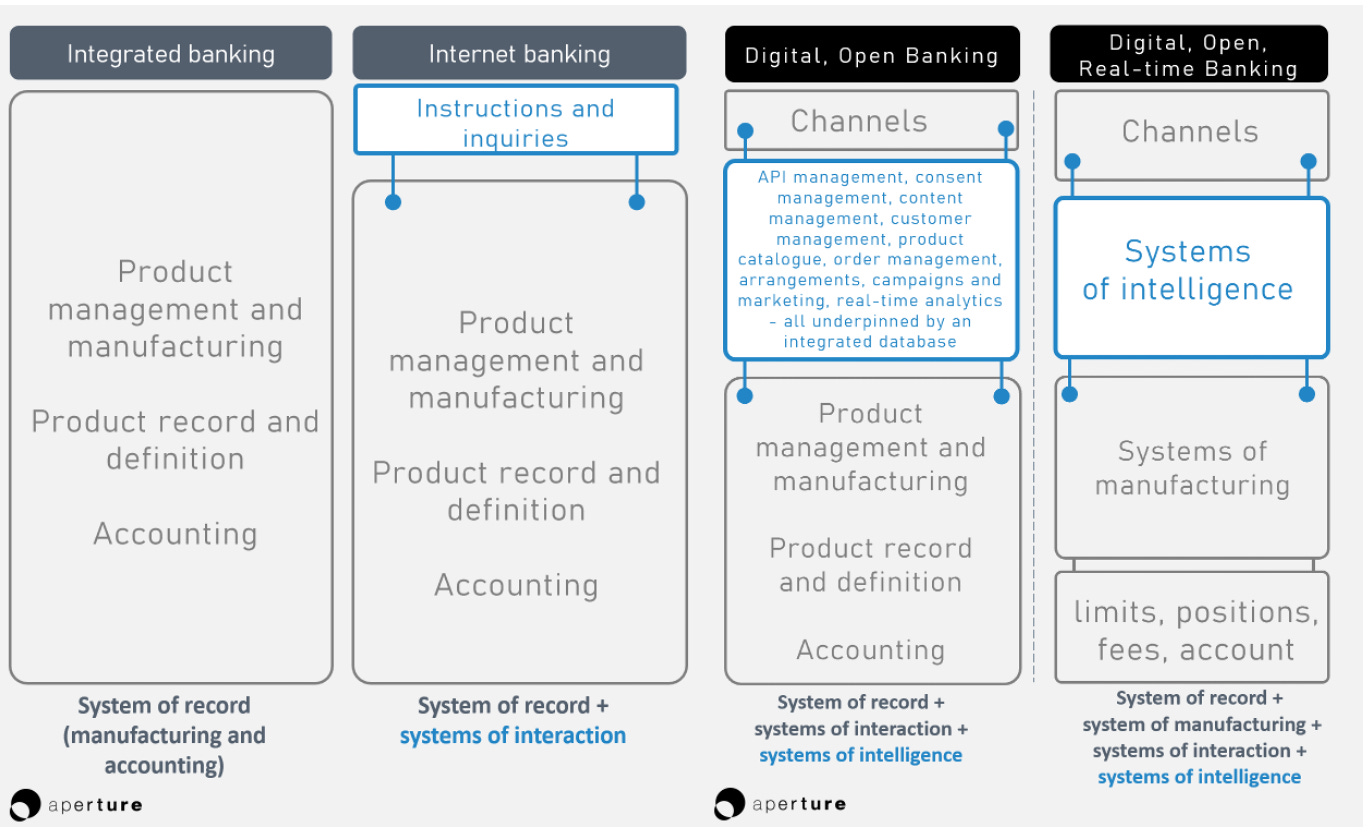

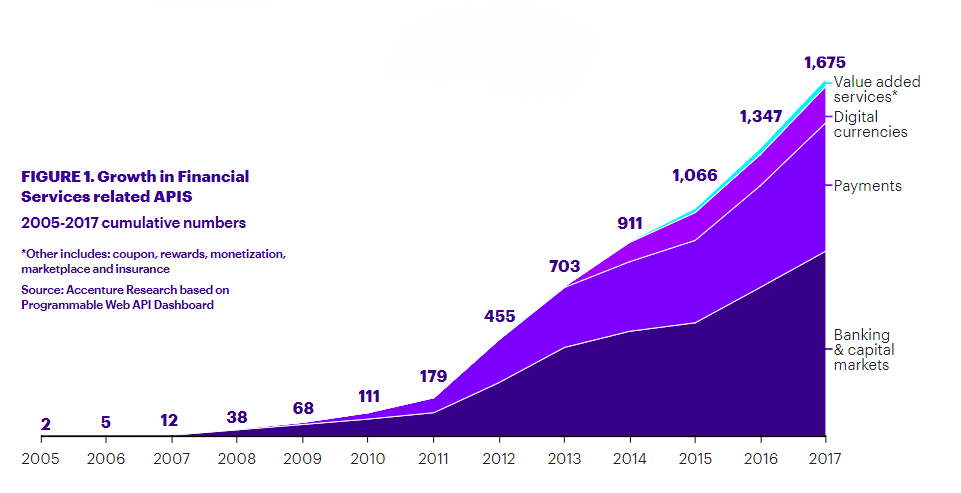

More specifically, we discuss all things banking-as-a-service, FinTech APIs, embedded finance, and the general evolution of the FinTech banking industry over the last decade.

For premium subscribers, a full transcript is provided along with the recording.

Hope you enjoy, and do not hesitate to reach out here!

Excerpt

Chris Dean:

…that was an aha moment for us where we're like, "Wait, we built one tool that both the fintechs and the bank itself want," and then shortly thereafter, some folks from the payment groups came to us and said, "Hey, we want to send some ACH or wires, and we hear you have an API for that." Of course, we have an API for that. We send all our stuff to you. You know we have an API. They say, "Well, we want to use the API to send our own stuff." Imagine it from my perspective, I'm sitting in a chair and someone's coming to me and says, "Who are you?" They're the ACH team. It's, I don't know, 20, 30 people. They're like, "Great. We've met before. I love you guys. What do you need?

"We want to use your API so you can send ACH's to us." I'm like, "No, no, no, no, no, no, no. You can skip the middleman here, buddy. Just send it to yourself." You're sitting right there. You don't need to send it out the door. Just use it. They said something that was like, I remember Jim coming to this afterwards, he was like, "What they just said was there's enough exception processing that they have to do manually that they want an automated system to do it." I said, "That's right." I said this the payment guys too, is that, we're just a small team of programmers, and programmers are well known to be super lazy. We're not going to do things manually. We're going to spend 100 hours writing a script and a workflow system to save ourselves all that time.

We did that, and that was another aha moment where the bank itself wanted to use our system to send payments itself. This was great. This was the Genesis of the idea for Treasury Prime, because Jim and I realized…

Help us grow and improve with your feedback

Tell us what you thought about today’s newsletter by clicking above or here.