Long Take: What Ray Dalio's new research says about American Empire, the US dollar, Gold, and Bitcoin

Hi Fintech futurists --

This week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

These opinions are personal and do not reflect the views of any other parties. Thanks for reading and let me know your thoughts here!

You can get more content like this in your Inbox for $3 per week -- the humble price of a delicious Fintech coffee. For exclusive analysis parsing over a dozen frontier technology developments every week, become a Blueprint member below.

Long Take

The hard thing about abundance is making a choice. We live in a time of the broadest set of economic, social, and political thinking, available to all at any time. When the world's most important macroeconomic investor, Ray Dalio, publishes a deeply-researched description of the money markets and a forward view of the impact on American Empire, all we have to do is listen and learn. It is all available here, for free.

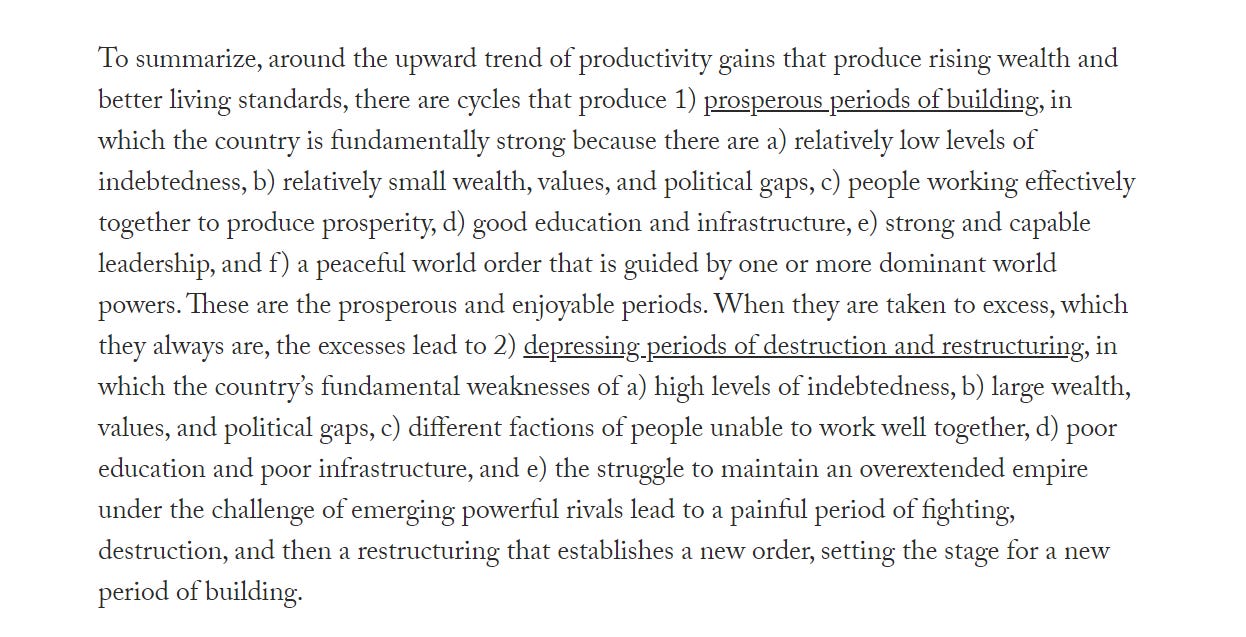

What makes empires according to Ray? And what breaks them?

The Bridgewater team looked across time to the East and the West. In Europe, they tracked the British, Dutch, and other colonial powers. In Asia, they analyzed the coming and going of Chinese dynasties. While the structure and organizing principles of the political super-organisms (i.e., the bee hive) has changed drastically over millenia, human nature and DNA has not.

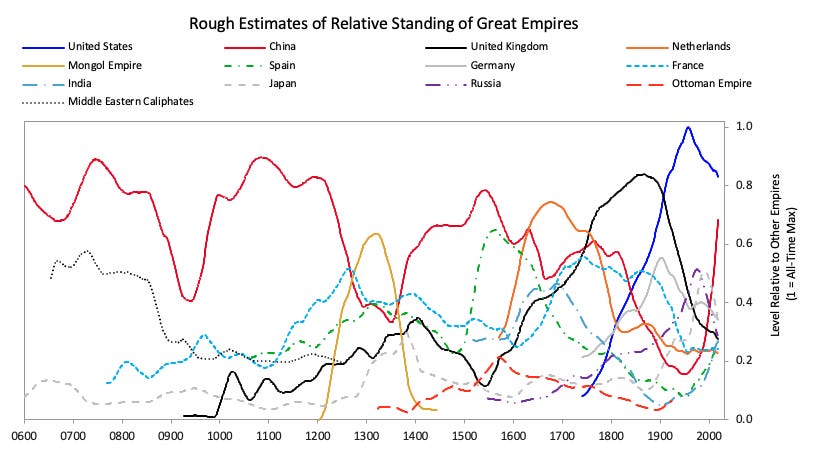

As you can see in the graphic above, which suggests that empires last about 200 years, it all starts with education, which leads to innovation and productive competitiveness. Growing military power, funded by growing wealth, protects trade and financial flows that attach to a dominant power. After a rise and time lag of almost 100 years, the incumbent is crowned with the gift of a reserve currency -- that financial superpower that allows it to print money. Yet when that superpower is over-exercised, and investments in education and innovation erode away, debt cycles accumulate and collapse the whole endeavor. The biome is effectively destroyed.

Here is the tracking of empires in Dalio's study using a smoothed weighted average of the discussed attributes to create an index of power. Pay close attention to America in blue, Britain in black, and China in red.

This is a fantastic amount of work, condensed into a clear visualization. Now, as the US has to contend with the rise of China, it competes with a nation that has improving fundamental attributes (education, innovation), but not yet the reserve currency. The reserve currency allows its bearer to generate economic activity from thin air at the expense of the rest of the world. This brings us back on point to money, which is why you are reading this article.

The empire super-organism emerges as complexity out of the interaction of millions of individual human agents, and the other organisms that they form, like families, teams, companies, and states (for more on what complexity really looks like, see my thoughts on Wolfram's theory of the universe). I think it is hard to create a deterministic model that describes complex systems without overshooting the truth with convenient narrative. But we do what we must, and it is better to have a rough compass to the truth than none at all.

When looking at the money part of empire, Ray sees two attributes of the "machine". The first is the regular expansion/contraction business cycle, lasting 5 to 10 years on average, driven by the extension of credit and its default. Like the human body drawing breath in and out, money flows into our pockets and out like a wave.

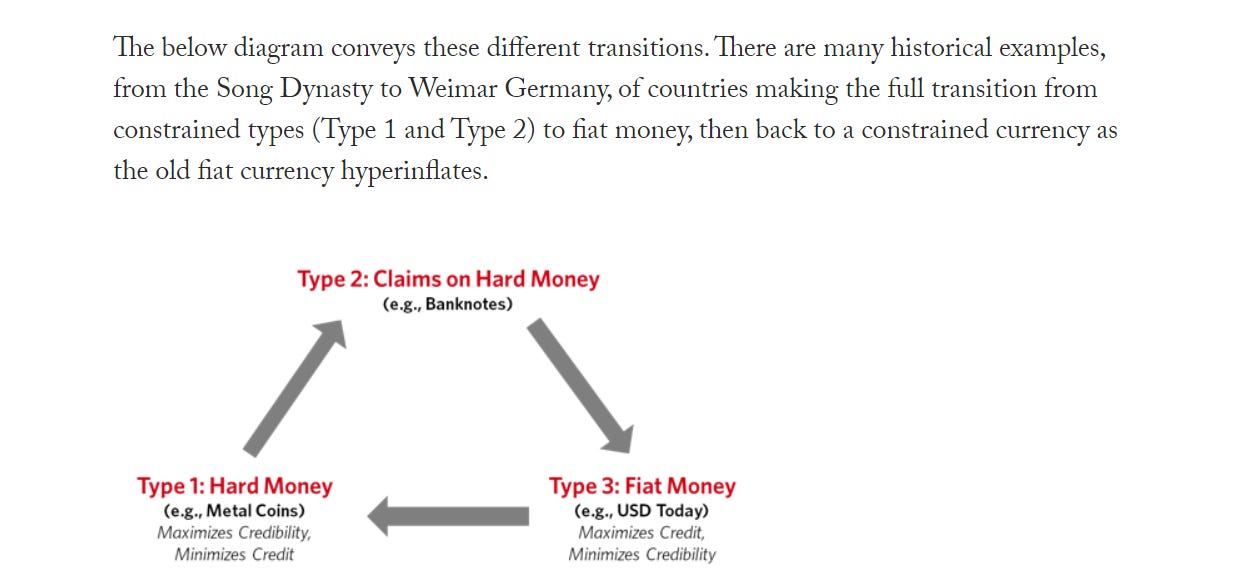

The second insight is to recognize a 50 to 100 year cycle of sovereign money. This is a cycle that switches between (1) hard money like Gold, which has intrinsic redeemable value and is trustless (i.e., can be used for transactions between enemies), (2) paper money built on credit tied to hard money, and (3) fiat money issued at will by sovereigns. Another way to describe the same concept is to say that money starts out physically scarce, then becomes digitally or contractually scarce, and then loses its scarcity entirely.

The entropy of the system, or alternately human nature, moves us from scarce money to credit because we want growth. I believe this is tied to how our brains are wired for loss aversion and dopamine rewards. We will cheat ourselves the future for just a hit of pleasure today. Credit is its own animal, and left unchecked unhinges from collateral to become mere imagination. Once that imagination runs wild and is spent for the enrichment of the few (e.g., corporate equity buy-backs) rather than the safety of the money (e.g., universal healthcare), you get some form of revolution or currency devaluation, which then leads to seeking scarcity again. Here's how Dalio illustrates it, followed by some hard data about the US monetary base.

If you're not going berserk looking at the above chart, which shows a peak of the Monetary Base as % of GDP in the 1930s and then in 2010-2020, then you are not paying attention. The USA is massively unmoored from scarcity by design, which puts us on the brink of a systemic paradigm shift. Last month, the government printed 20% of GDP in a single stroke, and will continue to do so for the foreseeable future. The Gold and Bitcoin bugs feel vindicated in their core philosophical premise, which is that the Central Banks will always "cheat" and generate more money whenever politically convenient.

Can you spot the difference between the two charts? The first one is denominated in USD, while the second one is in GBP. The sterling does not have reserve currency status anymore, and as such the demand shock of the COVID quarantine steadily has eroded its purchasing power. On the other hand, the USD is both local currency and global store of value -- and demand for it from the rest of the world will drive up its price (which I believe you see as an inverse relationship to the gold price as money flowed to dollars). Here's the academic paper explaining this effect.

Anyway, we were on the topic of the money printer. If we anchor back to Dalio's description of the money super-cycle machine, our economy is in 1930s territory -- as is the divided state of our polity, and the rising autocratic pressure across the world given wealth and income inequality. But let's table the latter and focus on the former. Roosevelt and the Keynesians drove the largest expansion of the American social welfare system and government employment in response to the Great Depression. The government gave itself new fiscal powers and silenced the judiciary (at the time a good thing) to spend, spend, spend in order to avoid unbearable crisis.

In my research for this piece, I encountered two growing ideas that are used to justify the current approach of the Central Banks. One is called Modern Monetary Theory ("MMT"), which goes one step further than the Keynesians, who thought that taxation and bond issuance should be the mechanism by which money is tied to government obligations, before it is spent by the government. MMT supporters think that money, especially when it is the reserve currency and is thereby protected from international FX pressure, is a phantom accounting and should be simply issued by the government to provide social services like universal basic income and healthcare. The target of policy is full employment.

While I am likely distorting the summary with personal bias, to me it seems the core goal here is for the government to use money for maintaining the standard of living inside a late-stage reserve-incumbent empire. Dalio's take is here, wherein he titles MMT as "Monetary Policy 3" or MP3.

The second idea is called Market Monetarism, advocated by economist Scott Sumner, my friend David Siegel, and even Eliezier Yudkowsky. If you have an hour to spare and want an eerily prescient imagined conversation between Yudkowsky and a central banker, read this piece from 2017 that predicts the future we live in. The core premise is that Central Banks should not target interest rates or unemployment, but instead choose a long term Nominal GDP growth target like 5%. If you have real GDP growth of 2%, you need inflation of 3%. If you have real GDP growth of -10%, you need inflation of 15%. Further, the effects of this should persist year over year, such that mistakes are corrected to the multi-year average (e.g., if you want to grow 50% over 10 years, you would need to go up 6% if you only did 4% last year, ignoring the actual compounding arithmetic).

The outcome is that economic actors in the NGDP targeted system can rely on what economic growth looks like -- at least on paper. To effect this in practice, the money machine has to print variable rates of inflation or disinflation. In this world, printing 20% of GDP or having negative interest rates is just fine, as long as it leads to that 5% growth expectation coming true. Everything else is just a math plug, since fiat money is just a construct in a database.

The year 2020 will see the above logic tested precisely. Whether it works or not in the long term will be experimentally observed. But I have strong doubts, and think Ray Dalio's piece provides the necessary bridges between Market Monetarism and Modern Monetary Theory to the long history of humankind.

We can play the confidence game in the late stages of American empire, sure. We can unmoor money from economy and stimulate employment in order to dampen social unrest, preventing societal collapse and another Constitutional crisis. But there's a cycle, and it is a cycle of trust.

Physical scarcity and utility is one aspect. You can trust the shiny gold you hold now, and the shiny gold in the shelf of the museum. There are thousands of years of precedent saying it is safe to own.

Digital scarcity and utility is another aspect. Blockchain-based systems have recreated such attributes in Bitcoin, Ethereum, and others. While many people are wary of these systems today, it is largely due to the tragedy of scammers and hackers undermining the public perception of sound long-term technology for short term gains. Yet digital value exchange systems are inevitable by Moore's Law (a joke for those of you still paying attention)!

Digital assets traveling on decentralized rails are one of the few alternatives to sovereign currencies and physical bullion. They will benefit not just from the collapse of the business cycle, but the broader ending of the macro super-cycle. Through this lens, China's quick movement to the blockchain-based yuan is a story of battle for global hegemony. It wants to park its reserve currency into the crypto ecosystem, despite currently being behind to the tune of $10 billion in cash equivalents. What we can also deduce by corollary is that once money truly flows into blockchain-anchored economies, blockchain-native software and businesses will bloom by the thousands. The latter is a reason to get up in the morning.

Now is not an incremental time. Now is not a time for mild cost savings or small improvements in user experience. Now is a time for building the future of the world.

Looking for more?

Want to send me a note? Reach out here anytime.

For just $3 per week, you can get the premium weekly summary and analysis by subscribing here.