Long Take: What's wrong with $12B Credit Suisse, but right with $8B Wise

We also look at SoFi as a check on Fintech narratives

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Credit Suisse has been in the news about its failing investment banking division and need to raise capital. We use that as a jumping off point to explore the scale of such a business, and the damage that can be done in bundling capital markets into wealth and private banking. As a comparison, we look at the result of Wise and SoFi. Wise has held value despite a bad fintech SPAC / IPO market and we explore the reasons why. Similarly, SoFi has struggled, and we show how its growth strategy is less in favor during a risk-off environment. Also, some GPT-3 prompts for your pleasure.

Topics: Banking, investment banks, asset management, capital markets, valuations, SPACs

Tags: Credit Suisse, Wise, SoFi, Galileo, MoneyLion, Lehman Brothers

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

Enter the Finance Contestants

You might think that the world has devolved into nothing but the horse-trading of stories, and that nothing but mass confusion fills the air.

If it is not said, if it is not heard, if it is not ingested into a GPT-3 chatbot to be duly regurgitated, did it even happen?

Done, scratched that one off the to-do list!

The interesting thing in finance is that we have some very different narratives, at a meta level about politics, innovation, and so on, generating pretty comparable business activity. Over time, we might be able to pull apart whether some spin about a company is true — i.e., Celcius is going to unbank the population with magic money — or just a trap to take the customer's money. But this works also for less obvious things.

Like, is $1 generated by Credit Suisse in its wealth management division worth the same as $1 generated by SoFi in its roboadvisor? Different words, different background stories, likely different behavioral and generational profiles, different growth rates and future trajectories. But the same $1. With that, we pick three different stories — Credit Suisse, SoFi, and TransferWise — and give it a reality check in.

Wise, aka Transferwise, is the best performer of the bunch YTD, worth about $6.7B GBP or about $8.1B USD, not too far off from the IPO during some pretty heady days. Credit Suisse, the venerable bank of stone columns, has sunk down 70% to $12.5B in marketcap. SoFi has performed worst of all, up from the $10 SPAC price to $25 ($24B marketcap), and then down to $4, also a 70% fall this year, with a current marketcap of $4B.

Each of these companies at one point was more valuable than each of the others.

And the trends that drive their performances are so interestingly different, despite what could be seen as similar underlying money machines.

Credit Suisse’s Capital Markets Errors

Credit Suisse is a large private bank, and like many financial institutions that win their local market and need to keep expanding, it has grown both geographically and across industry segment. The natural business model of a bank is to hold money, maybe lend it out, and make that money available to customers. Thereafter you might get pulled into the idea that you should be managing the money on behalf of customers, and attach an asset management business to double-dip into fees.

Or, if you’re like Lehman Brothers, you might see the economics of capital markets businesses and get jealous. You, dear reader, know capital markets businesses. Here’s one — Alameda Research. Here’s another — Voyager Financial. Or maybe some of these hedge funds — Three Arrows Capital, Long Term Capital Management, and so on. Asset management has that nice tempting combination of thinking you are prudently managing client money, and then maybe going down the risk spectrum, and taking some proprietary bets, or doing market making, and boom, next thing you know, everyone is talking about your leverage ratio.

Going down the risk spectrum likely means you are going to get paid more in the short term. You are underwriting financial activity with your own capital, because you think you’ve got the “better math”. Maybe even Nobel Prize winning math. But the more your financial business becomes a capital business, the less it becomes about “user experience” or “demand”, and the more it becomes “where else can we put all that capital”.

Credit Suisse lost $4.7 billion on its lending to Archegos Capital, which had lost $20B in highly levered trading. Archegos was the family office of Bill Hwang, who in turn was indicted on federal charges of fraud and racketeering, because he allegedly lied to get the loans and then market-manipulated stock prices. If this sounds like SBF and FTX, and the destruction to lending desks in the crypto industry, well yeah!

But Credit Suisse also lost $3B for clients in investments associated with Greensill Capital, a supply chain financing firm that failed in March 2021. The failure was a result of a web of loans not being repaid, and then being margin called by Credit Suisse. In other words — bad underwriting and risk management.

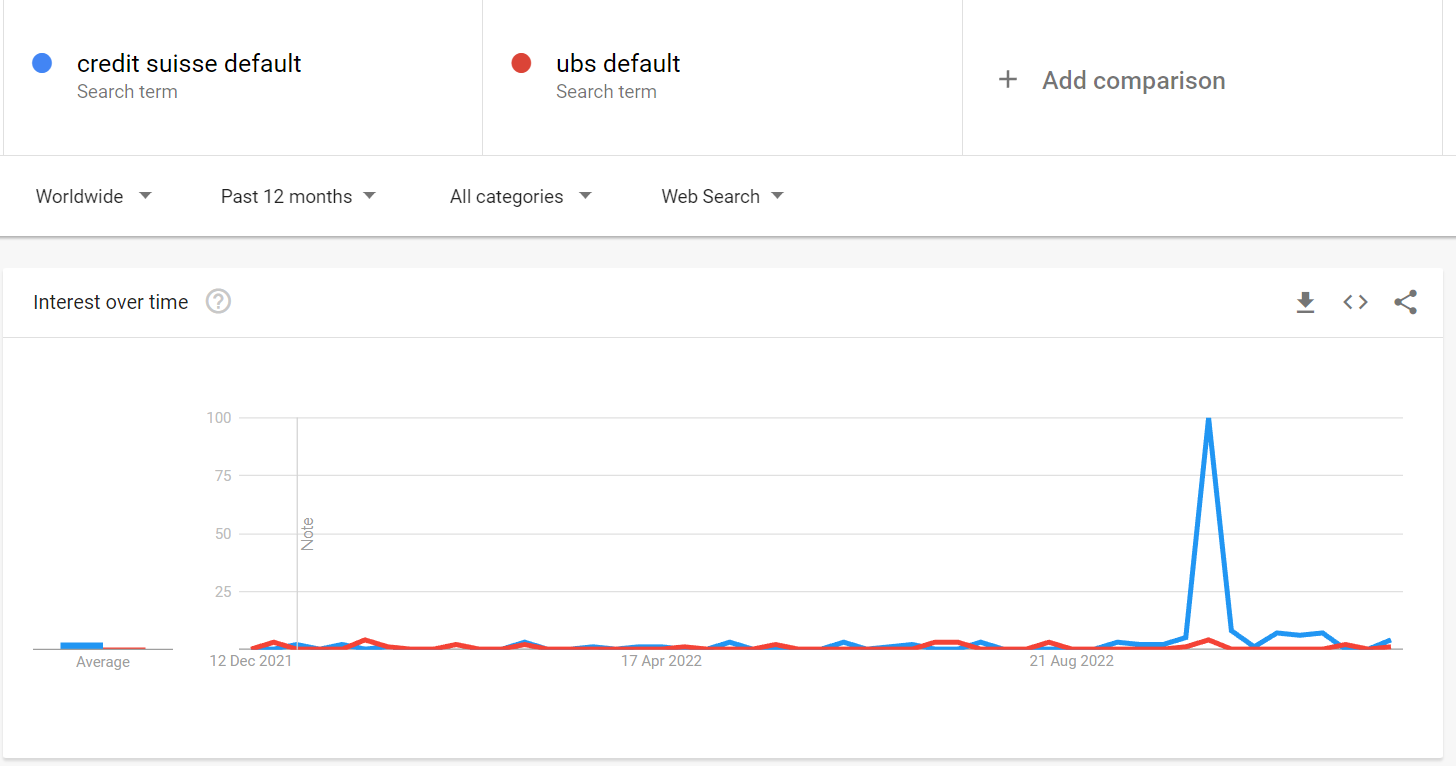

There is some other choice stuff the bank did, including paying fines for money laundering, various information leaks, geopolitical issues, and so on. We would just say that any financial business cannot deliver a clean record, it is structurally impossible. Some percentage of your relationships will turn out to be bad, and you will be sued, and you just need to build buffers to protect yourself. But Credit Suisse seems to be rolling bad rolls continuously, and that results in stories, such as the story that Credit Suisse is losing its reputation, that it is firing 9,000 people after its GBP 3.5B loss.

This is the flipside of having a capital markets or investment banking business attached to a deposit base! Markets are bad now. You are collecting defaults on all your liabilities, seeing how well you did placing bets in the past. Capital is expensive. So maybe, maybe, don’t overcrank well organized private banks into being trading floors?

Here’s the totally busted investment bank, which just two years ago had almost 3x the revenue — down from $2.7B to $1.1B with a $2B cost base.

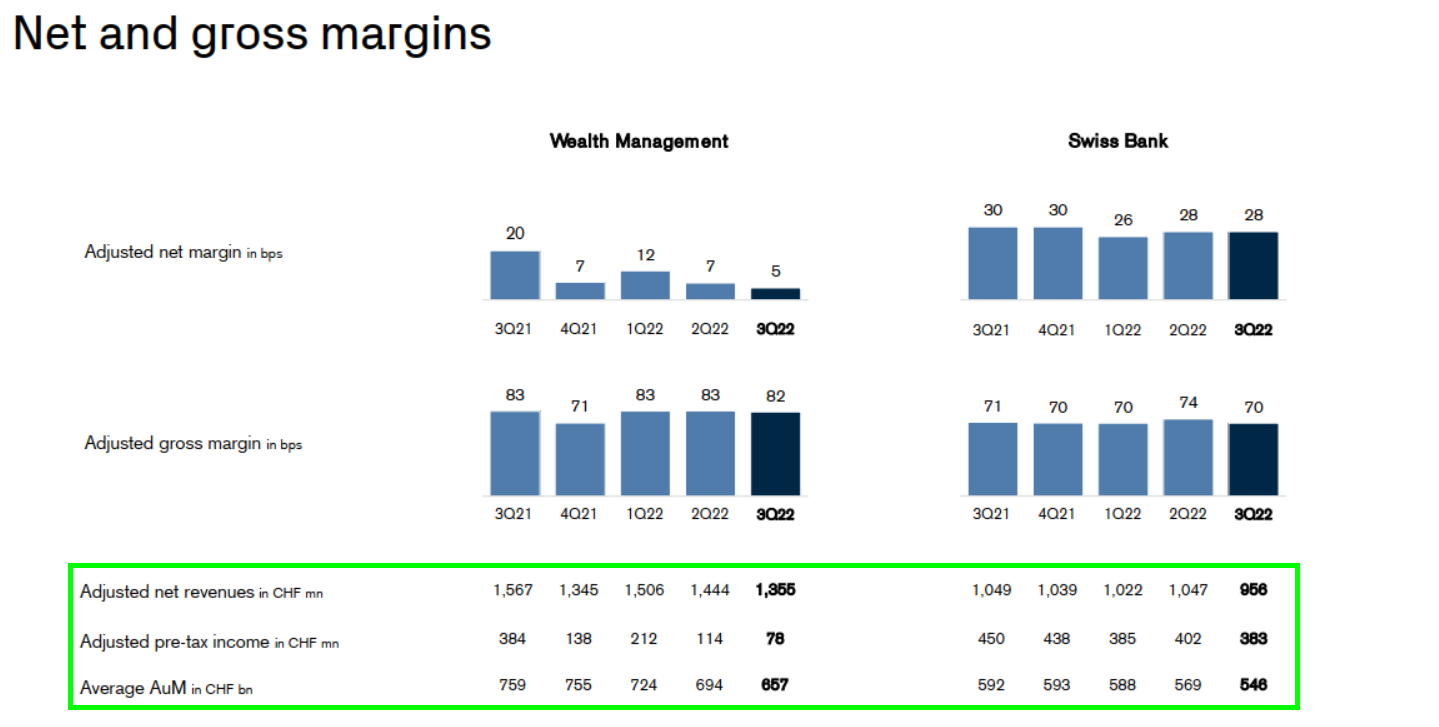

For comparison, check out the money at rest businesses:

Assets under management in the wealth management business are at $650B, generating $1.4B in quarterly revenue and $80MM of income. The bank has $550B in deposits, printing about $1B per quarter and $400MM of income. Can this steady and boring income stream sufficiently underwrite a variety of lending adventures?