Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can find us at Apple, Spotify, or on RSS.

In this conversation, we chat with David Shuttleworth, the managing director of token engineering at Binance. Prior to this, David was a Senior DeFi Economist at ConsenSys, where he focused on mechanism design, tokenomics, and protocol design. David’s experience is extensive and includes leading the development of the Medical Advanced Analytics team at GlaxoSmithKline and was a data scientist at various stage startups in FinTech and predictive analytics.

David also conducted research in behavioral economics and health outcomes at the University of Pennsylvania and has published his work in peer-reviewed scientific journals such as JAMA, the Annals of Internal Medicine, and the Lancet.

In Partnership

Fintech Meetup Ticket Prices increase Friday at Midnight! Don’t miss these ticket prices! Fintech Meetup is the big new fintech event that delivers measurable ROI. Make connections, see the latest tech, and hear from industry experts! Plus 200+ sponsors, 30,000+ double opt-in meetings, exhibit hall, and more! At the Aria, Las Vegas March 19-22.

👑See related coverage👑

[PREMIUM ANALYSIS]: Long Take: Generative AI creates the surreal search engine of our dreams

Digital Wealth: Arta's PFM acquisition echoes Personal Capital strategy

Timestamp

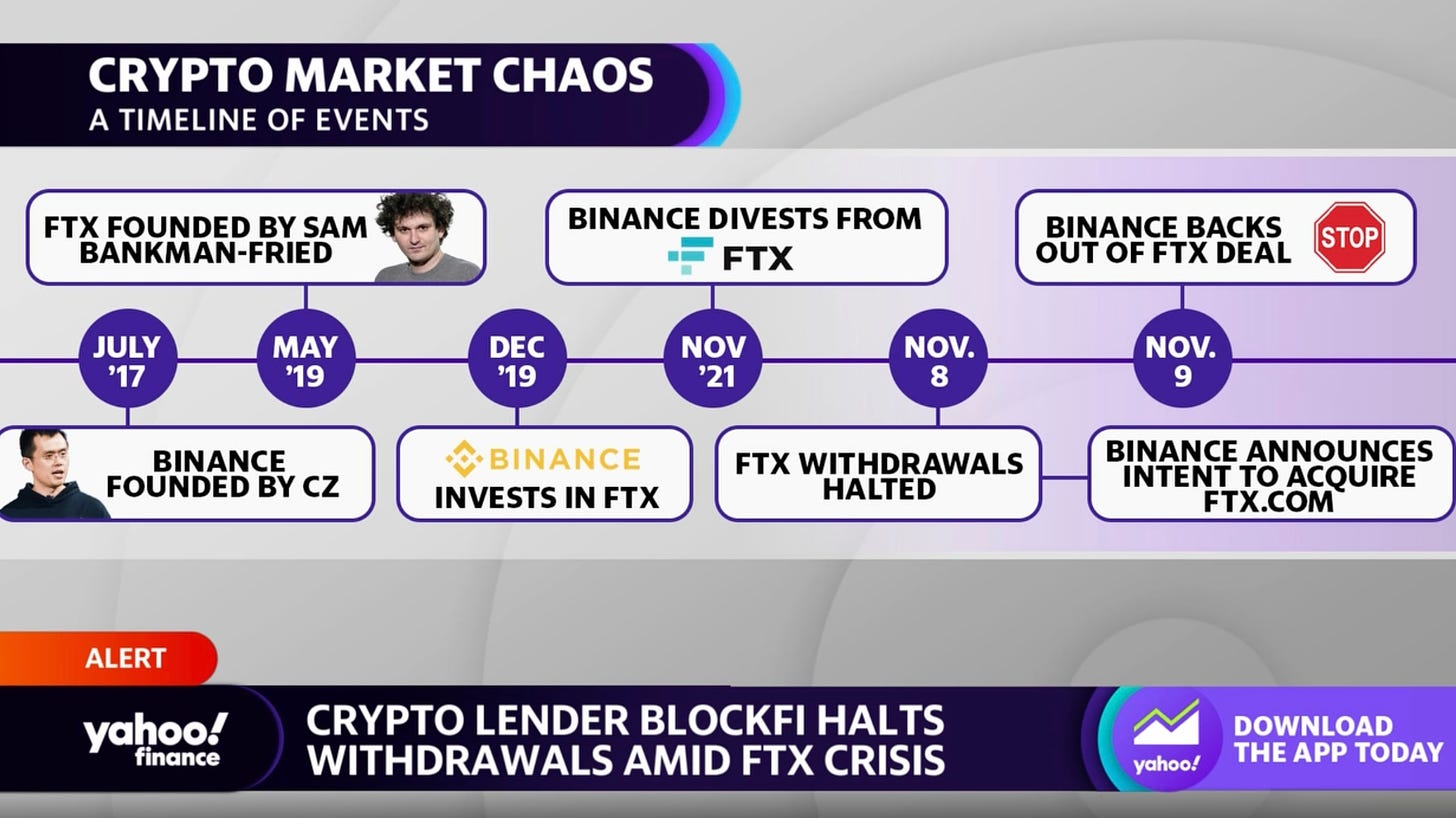

2’21”: A high level overview of what happened to FTX and the bizarre coverage of Sam Bankman-Fried

6’56”: How BitMEX fits into the equation

11’34”: Addressing the relevance of the conspiracy theories surrounding FTX

16’19”: Tokenomics of FTT (FTX’s token) overview - explaining trading on the margin, how this differs from buying at spot rates, and liquidation machanics

20’24”: Crypto holding attacks and why this is profitable for the attacker

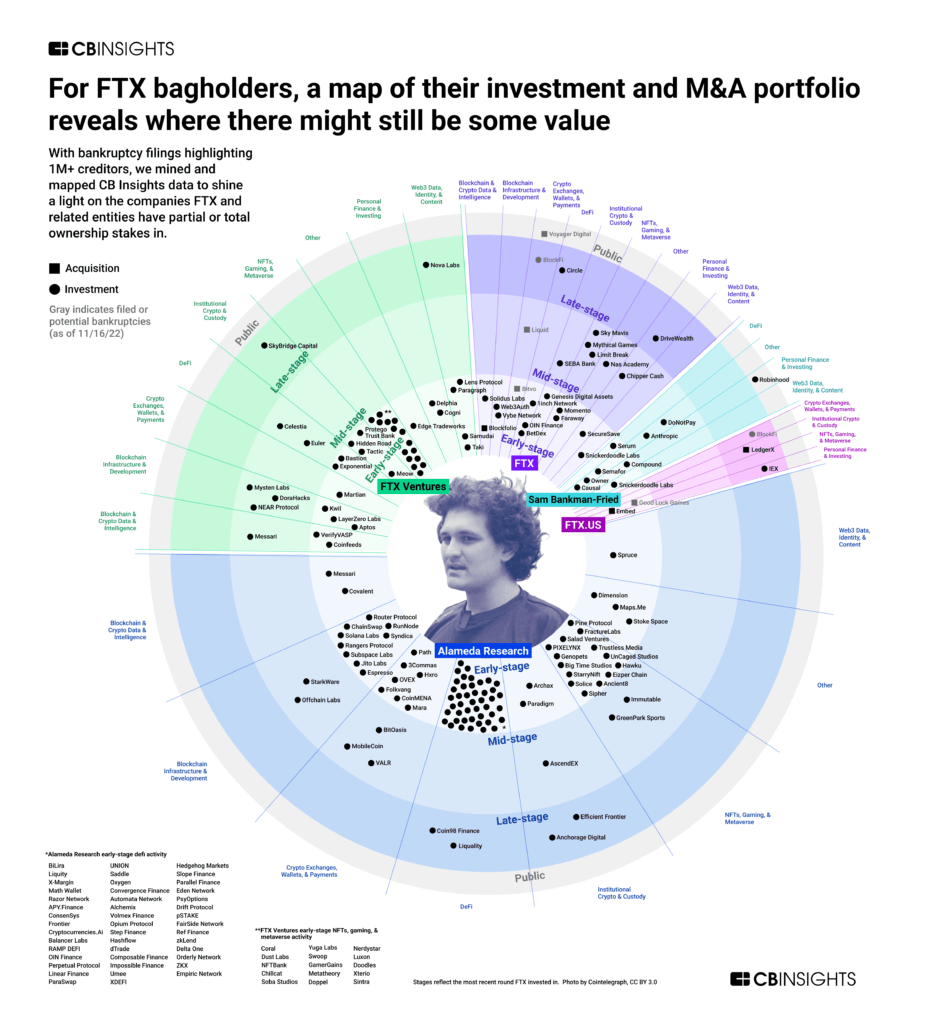

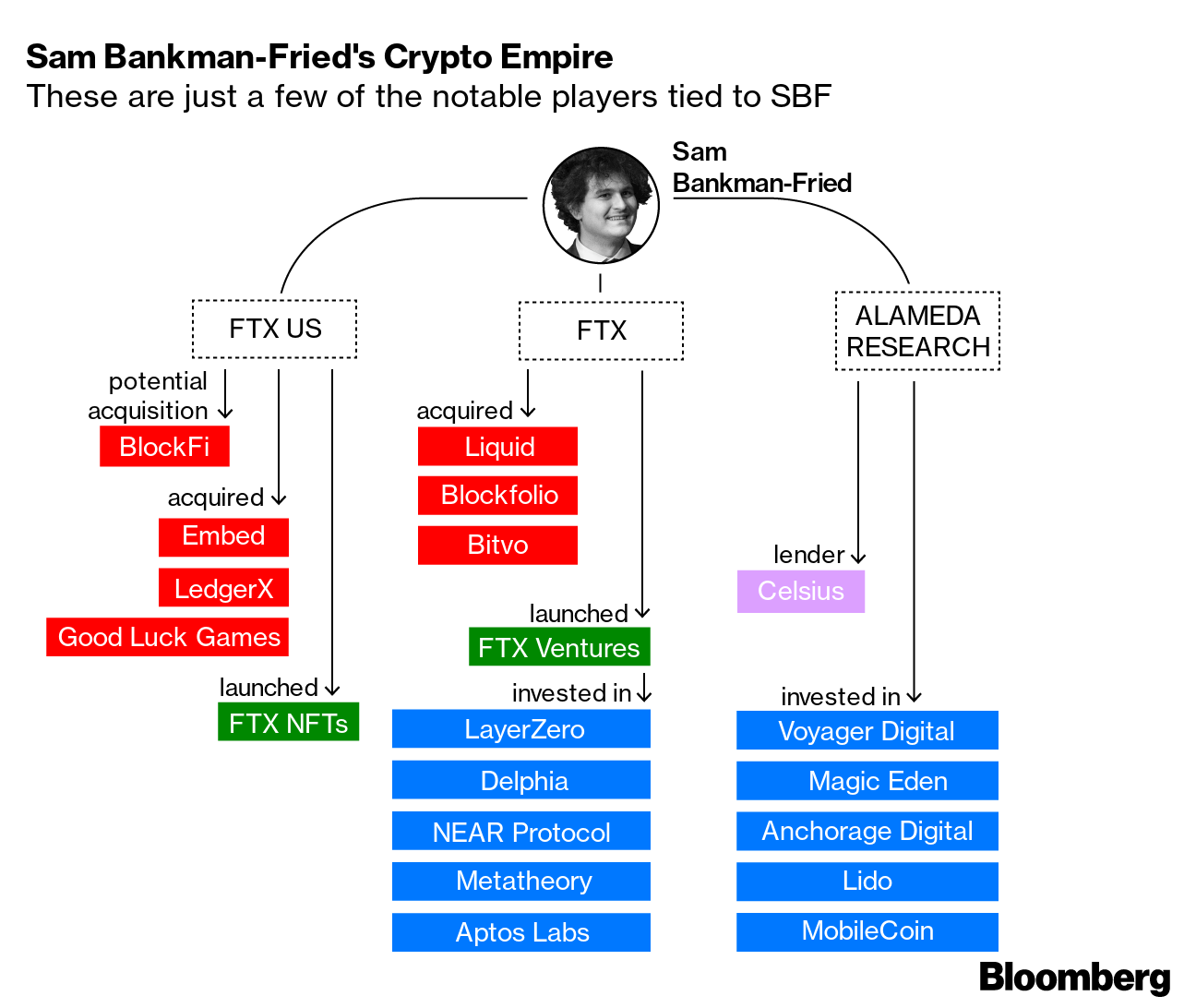

22’59”: FTX and Alameda Research’s Balance sheet - collateralization, strategy, and leverage

27’16”: The collapse of Terra LUNA and Three Arrows Capital, how this impacted FTX, and who is likely to fall next

35’02”: Remediation strategies: The Binance Billion Dollar Recovery Fund and Proof of Reserves

39’12”: Channels to use to connect with David

Sneak Peek:

David Shuttleworth:

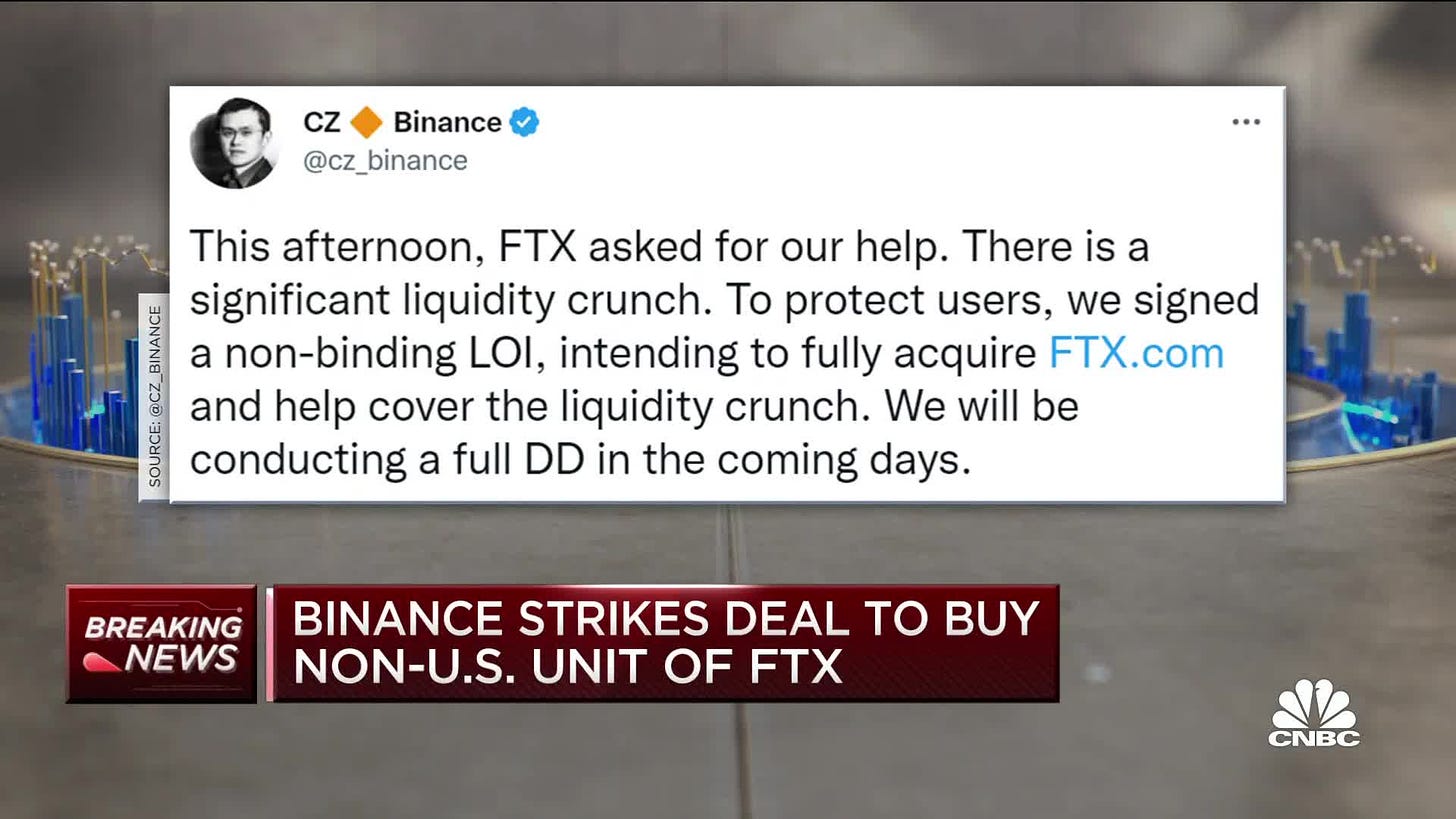

…You had SBF, probably for his effective altruism. He bailed them out and kept BlockFi afloat, but he did it for the people. But I think you're right. He was intertwined doing things that he shouldn't been doing and that if these things fell and more liquidations would've occurred, FTX probably would've been insolvent, and it probably would've imploded earlier on. It probably would've been over the summer, and they might not have lasted.I don't think we've seen the full extent of it. That's just my sense. At this point, I don't trust anything that any entity or any individual says on crypto Twitter. I don't trust any of it. I think we've seen in the past, even Alameda, like, "Hey, we don't trade customer assets, or we'll buy all." When CZ was saying he was going to sell FTT, he had Caroline from Alameda come out and say, "Hey, we'll buy all it at $22, no big deal." But do they even have that? No. So I really don't trust any entity right now.

I think that, again, it goes back to that a lot of the data is on-chain. I think that detective work and different sleuthing will help figure it out. In terms of some of the lenders we've seen or some of the different entities right now, we've seen BlockFi go under and file for Chapter 11. Even Kraken, I don't even know the extent to which they were involved, but they had to lay off 30% of their workforce, which is brutal. Then Silvergate's another one. I think their exposure, as they were saying they were maybe less than $20 million for their exposure to block buy. I hope they're right, but I don't know.

I think that you also have to look at other... Not to call out people by name, but just off the top of my mind, you have…

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions