Long Take: Why are PayPal, JPM Chase, and Nubank launching advertising & telecom businesses?

JP Morgan and PayPal are in advertising; Nubank and Revolut's offering eSIMs

Gm Fintech Architects —

I’m on the way to Austin for Consensus and writing this on a plane. The agenda will be full on Finance and Decentralized AI — multiple events over several days. It’s surprising how quickly this space has spun itself up into existence. If you are there, here are the events I am planning to attend.

And with that, let’s jump in.

Summary: In this article, we discuss the surprising expansion of traditional and fintech banking players into the media and telecommunications sectors in 2024. JP Morgan Chase and PayPal have launched advertising divisions, leveraging their financial data to offer targeted marketing, while Nubank and Revolut have entered the mobile network space, providing eSIM services. These moves illustrate the growing trend of financial companies capitalizing on their extensive networks to diversify revenue streams. We explore several explanations for this shift, including the potential development of financial SuperApps, the influence of global market dynamics, and the benefits of expanding user engagement. Ultimately, these initiatives reflect the banks' strategic focus on building multi-sided networks that enhance their core financial services.

Topics: JP Morgan Chase, PayPal, Nubank, Revolut, Chase Media Solutions, PayPal Ads, Figg, Venmo, Claro, Wise, 1Global, Gigs

Today’s Premium post is open to all. If you learned something new, consider supporting the Blueprint with a subscription.

In Partnership

Generative Ventures invests in the machine economy — the financial activity settled on blockchain protocols and accelerated by the machine labor of generative AI.

Long Take

Surprise!

Did you think that JP Morgan Chase is a bank and that PayPal is a payment company?

Surprise! Both are also in the advertising business.

Did you think that Nubank and Revolut are neobanks?

Surprise! Both are mobile network operators.

What?

This doesn’t make any sense to us either. But apparently, 2024 has seen a string of announcements from traditional and fintech banking players into the media and telecom businesses. How can this possibly be material to large financial companies, and what are they trying to accomplish?

Before we try to pull this apart, let’s refresh on a couple of mental models that might be able to help.

Mental Shortcuts

When you find a piece of evidence that doesn’t seem to map onto a prior view of the world — like, Chase is selling ads and not just bank accounts — it is important to pause on this exception. It is the exception that teaches us something about the world, and forces us to update our explanations of how things are.

So here are a few potential explanations.

Financial Superapps were meant to rule the world after the success of Ant Financial. In this case, the finance functionality is so large and monopolistic that it captures economic activity and subsumes it. Commerce becomes intermediated almost entirely by payments, and the place where people shop derives from the place where people pay. A super app contains not just the full list of finance products, from payments to investing, but also non-financial products as well. Perhaps the large banks are growing up?

Another approach is to revisit the source of financial product manufacturing. While in the US, banks and government hold the upper hand, but this is not always the case globally. In Asia, the tech firms outraced everyone else towards banking the unbanked. In India and Africa, the telecom providers ended up holding a disproportionate amount of power, issuing their own currency or intermediating identity.

There is a nexus between governments, big tech and media by extension, the finance industry, and telecoms — over time, power can shift between them. Perhaps finance is now so strong it commands the attention lost by the tech sector?

Or, perhaps banks have gotten so good at the attention economy that they are able to sell it downstream to others. In the past, most financial companies were able to only play in the manufacturing and distribution of their features, focusing on their own vertical. But as operating capabilities at the tech-forward banks grew — such as the ability to engage new communities through products and rewards — they could start to platform those capabilities into products.

We tried to put together some version of this idea forward in a discussion of Square acquiring Tidal, the music label, a few years back. Tidal’s cultural impact on customers of Cash App and musicians as small businesses sort of falls into the category of community.

In retrospect, we were probably over-thinking it. Maybe Jack Dorsey and Jay-Z were just friends.

An adjacent idea would be that banks are expanding their potential users by offering them mobile access in new geographies and helping marketers deepen consumer and merchant relationships. The expansion of the overall network, whether in the number of users or in the amount of time that users spend on the platform, creates more opportunities for financial activity. This in turn is profitable to the core business.

This is akin to Facebook giving away free Internet access so that more people could spend time on Facebook. If you can get Internet from Revolut in another country, maybe you will pay with Revolut.

There seems to be an intuitive truth in this. Commercial and financial networks are not always the same. You may want to align things that people want to do — like have Internet access to browse and shop, and capture their marketing intent with advertising — with your financial rails so that they end up increasing their usage of your infrastructure.

The Details

Taking this context into consideration, let’s describe some of what is happening.

Chase has launched Chase Media Solutions, a digital media business designed to connect brands with the bank’s customer base of 80 million. It will use Chase’s first-party financial data and insights into consumer spending habits, offering targeted marketing opportunities for advertisers. This follows Chase's acquisition of Figg, a card-linked marketing platform, in 2022.

An interesting deep dive on the topic is here, which is where we grabbed the screenshot above. We imagine that businesses relying on Chase to provide customer insights — derived from using its financial rails — may be interested in hunting for new customers across those rails.

Now PayPal is following suit. The company has launched a new advertising division, PayPal Ads, relying on its own user data — like user purchases and spending patterns on PayPal and Venmo — to help advertisers reach targeted audiences. Mark Grether, previously head of Uber's advertising business, will lead PayPal Ads, focusing on developing ad formats, sales, and team expansion. Grether has over 20 years in the advertising industry, growing Uber Advertising to a $1 billion business, as well as doing similar roles at Amazon.

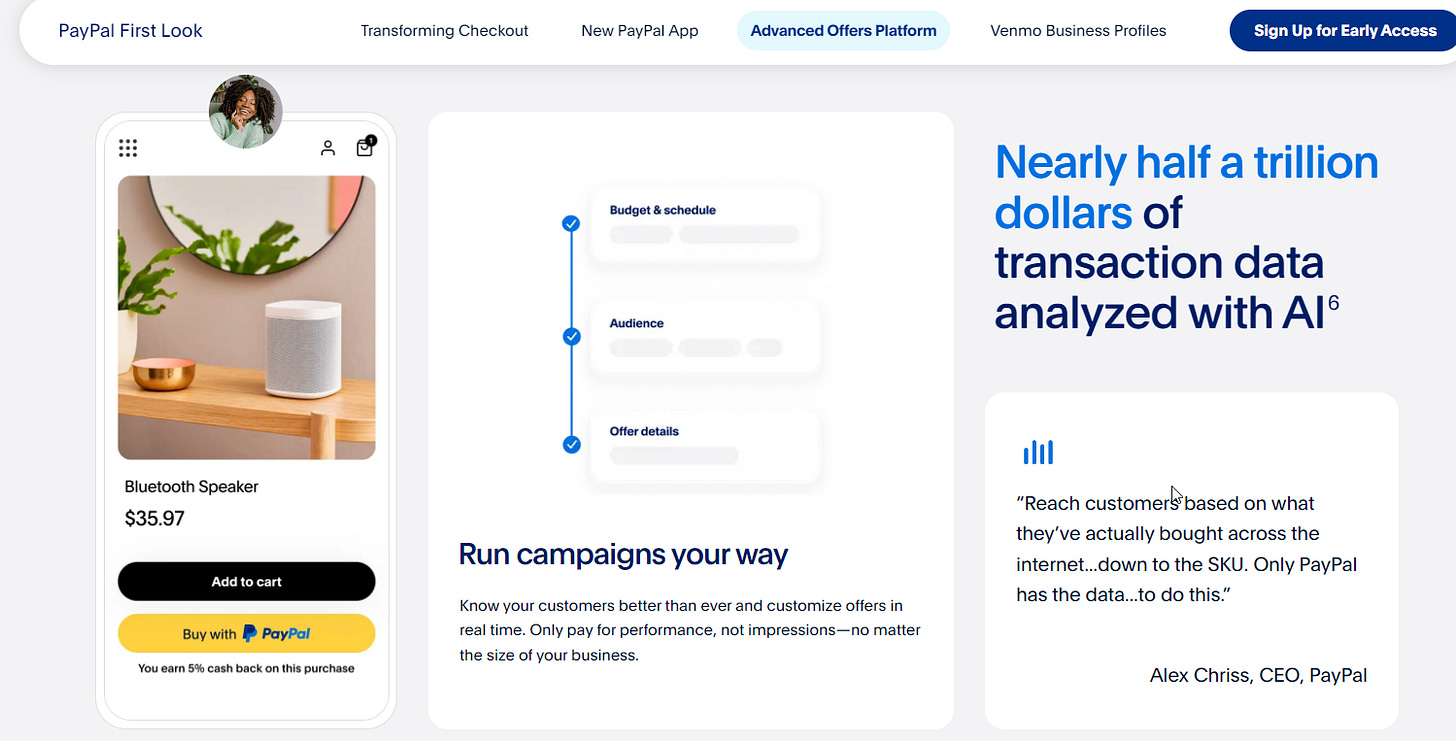

PayPal’s Advanced Offers Platform, which is a machine learning overlay on its commercial data, gives a glimpse of what PayPal Ads could look like. It’s possible that fintechs are finally able to leverage the enormous amount of financial information to which they have access.

Shame it’s powering more advertising. But that is the cost of the attention economy. Even Apple has shifted from a pure hardware player to one that makes increasingly more money from its advertising services.

Nubank just announced the launch of an eSIM service for travelers, providing 10GB of roaming Internet access in 40 countries. Brazil’s National Telecommunications Agency approved the Fintech to partner with Claro as a mobile virtual network operator (MVNO). The company is using an eSim-as-a-Service provider Gigs to handle the underlying provision and the regulatory complexities of being a Telecom.

The service is part of Nubank's broader push to offer diverse value-added products that enhance its premium subscription, Nubank Ultravioleta. It bundles the new eSIM service with features like a global account in partnership with Wise for international money transfers. The company has over 100 million customers and posted a profit of over $1 billion recently.

That sounds like a real digital bank!

Revolut had a similar announcement as well.

The integration comes from 1Global, a telecom infrastructure provider. From this perspective, it appears that the eSim feature targets a digital bank’s global customer base. Just as a user doesn’t want to pay FX fees while traveling, they would not want to figure out buying a local Sim plan either. To that end, these integrations look like an extension of customer demand.

Key Takeaways

If we were to create a grand unifying theory of what these companies are trying to do, the most appealing hypothesis is to focus on networks.

It doesn’t seem like advertising or telecom services are within the scope of the super app. Helping marketers comes closer to a small enterprise / business product line, deepening the economics extracted from that segment. Internet access is similarly upstream from financial consumption and is not a feature of it.

A more satisfying idea is that successful financial firms are successful because they have built out a large multi-sided network. For example, a trading venue has buyers and sellers. A payments rail has shoppers and merchants. Even a lender has providers of capital and borrowers. Therefore, once you get to the scale of JPM or PayPal or Revolut or Nubank, what you really have is a network willing to engage in economic activity.

This opens up access to other network-shaped business models, like advertising or telecommunications.

![revenueandprofit[1] revenueandprofit[1]](https://substackcdn.com/image/fetch/$s_!cLbw!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F93fa0d4f-60b8-4f80-b706-540b8aaea1aa_1200x584.png)

We love the chart above. Though quite old, it shows effectively the financial returns available to businesses that follow a platform approach, rather than a product-manufacturing one. Hard to know whether those numbers hold up in the NVIDIA era, but we don’t see banks manufacturing video cards any time soon.

On the other hand, maybe these moves are a lot more opportunistic, driven by demand, and nothing more fancy. Some merchants want to reach people using PayPal or Chase, and so they are willing to pay for it. Some of the customers of neobanks travel a lot, so maybe they are willing to pay for Internet as part of a premium subscription.

Surely we prefer to believe in a world of patterns and strategy. But equally important is action and experimentation.

Go forth. Think a little. Test. And then Do!

Postscript

Read our Disclaimer here — this newsletter does not provide investment advice

Want to discuss — reach out here anytime.

To support the Fintech Blueprint, subscribe below:

Fascinating! FB bought Whatsapp, instead of LendingClub over a decade ago... Not that Zuck isn't a genius billionaire.

Paypal bought Honey in fall of 2019, when Honey started creating/fascilitating Merchant discounts, rather than only scanning discount codes to lift cart closures (whether a code was found or not). Perhaps Chase is chasing Paypal, rather than the other way around. But of course Chase has their "ultimate rewards" loyalty ecosystem, they're leveraging and repositioning, not that they have a (global) stablecoin and digital-first ethos.

Sure, GDPR/privacy is a big advantage to fintech/payment-providers to capitalize on "secure/private" data and brand.

Hopeful that both players are anticipating payment transaction fees going toward 0% due to payments/walleting being as commoditized as things get. Ideally they'll shift to a much more aligned PMF/biz-model of precisely what they're saying - charging for a successful transaction solicitation (with facilitation embedded).

This is aligned with all-in-one marketing platforms and genAI squeezing all the artificial intermediaries and costs in marketing. All the fluff via SEO/search.

Only major player in the advertising/attention space quietly withering under a rock is the Brave Browser. Their bizdev person is aped out on NFTs, pretending like they don't owe their users a development of an ATTENTION economy, rather than puny advertising CPM utility. BAT comes with Brave's 25m MAU at a $350m market cap. Global early adopters in tech, crypto... with an embedded wallet. With the power of reordering ANY proprietary algorithm whether it is Amazon or Airbnb search results for example (clearly they're too afraid to go there to this day!). Honey browser extension was $3B in 2019 dollars.

Finally, the "scarcity" utility is an ok reason for corporations to hold bitcoin as part of the treasury. But most corporations have marketing budgets, why are they not holding part of that marketing budget in BAT, which comes with great CTR-based marketing utility...

Because Luke has absolutely no idea what he's doing and they do not have a product person working on BAT's ATTENTION utility. Listen to any of his calls - useless marketing tech NFT gibberish.

https://basicattentiontoken.org/team/