Long Take: Wirecard's collapse hurts Fintech & Crypto start-ups, like Lehman and Enron burned the economy

Hi Fintech futurists --

This week, we consider the impact of financial infrastructure collapse and who really gets hurt through the lens of Wirecard, Enron, and Lehman Brothers. Yes, there are investors in the entity that will lose value. But there are also clients and counterparties of Wirecard, like Curve, Revolut, and Crypto.com. In the case of Lehman, there was a $40 trillion derivatives notional amount that took twenty years to wind down. We also consider the most recent $500,000 hacking in DeFi of an automated market maker to see if there are common threads to be drawn between the two worlds.

For exclusive analysis parsing over a dozen frontier technology developments every week, become a Blueprint member below.Long Take

Let's take a walk down memory lane.

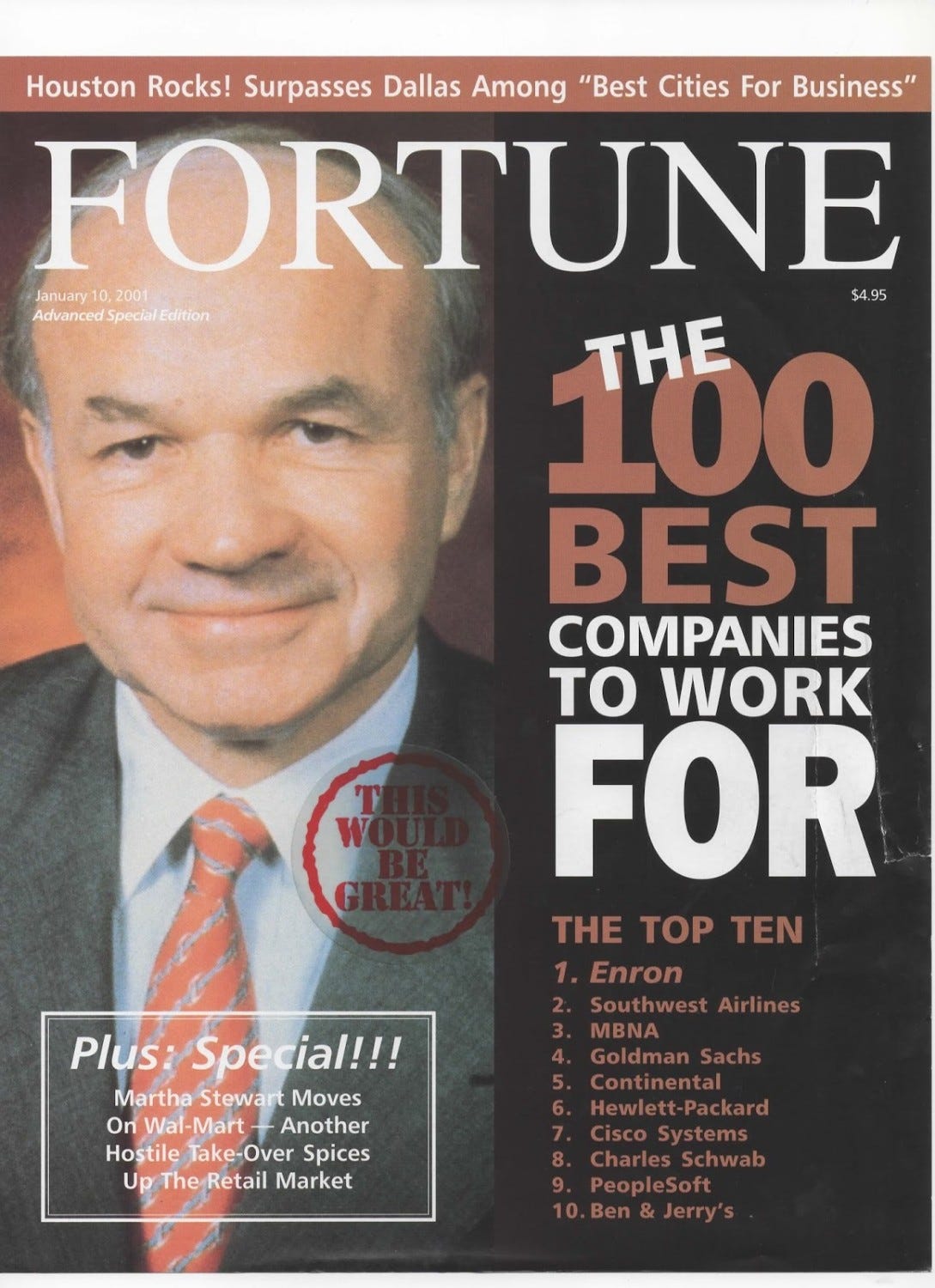

First Enron. Most innovative company to work for. Smartest guys in the room. Allegedly $100 billion of revenue in the year 2000.

What did these guys do wrong?

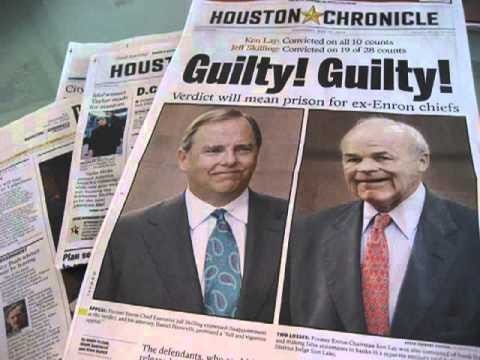

Well, they put billions of dollars of liabilities off the company's balance sheet, hid them while inflating profits, misled public investors, and traded on insider information. $70 million insider trading proceeds for the CEO, for example. The world's biggest accounting firm at the time, Arthur Andersen, gave this accounting treatment a hall pass. Once the fraud was uncovered and executives jailed, the accounting firm permanently lost its reputation, split into component parts, and rebranded as Accenture.

Lehman Brothers. I'd rather not put them in this bucket, or paint with the broad brush of malfeasance -- there was not fraud in the way of Enron. But there's still nothing like seeing Dick Fuld and the praise for Lehman's growing business on magazine covers.

Being hailed as an innovative hero about to give Goldman Sachs a run for its money isn't a credit rating. It's media spin. You don't really know what risks are being taken, by whom, and at what magnitude. Despite being public, you don't know if a firm is fixing LIBOR rates, marking up IPOs for early investors in a multi level marketing scheme, hiding assets to cook up your statements, or saying auction rate securities are cash equivalents. You don't know that everyone else in the industry is doing the same thing too.

Which of course brings us to today --

Wirecard.

What made Wirecard tick is that it -- reportedly -- made up fictional trustee counterparties across Asia that kept $2 billion of revenue proceeds on its behalf, due to the company's "innovative" structure. These trustees were supposedly "necessary" because Wirecard was doing payments processing in jurisdictions where it was not licensed, and partnered with third party financial institutions. Sounds like super valuable, innovative open-banking to me! The FT has tried to break this story repeatedly and investors tried to short-sell the company, only to be barred on occasion. Wirecard fought back with lawsuits and accounting support from Ernst & Young, which is now trying to swim out of the Arthur Andersen waters.

Now lets be clear. There are thousands of good people that worked at Wirecard, at Lehman Brothers, at Enron. I worked at Lehman, and you're reading this -- so at the least you are complicit now! Most if not all rank-and-file employees don't know about the shenanigans. They think they are working at the greatest company in the world. But leadership, leadership knows about the shenanigans because leadership creates, enables, and benefits from the shenanigans.

The Foundation

There is no point in finger wagging, and I have no deep insight into the fraud that you couldn't just pick up in the Financial Times or a Google search. This is broadly a tragedy, born from the recursive greed of human nature.

But we can still say something useful. What I regret is that many other companies relied on Wirecard, and are now left with a junk piece of core payments infrastructure in their stack. You might be excited about Curve powering Samsung Pay, wrapping multiple bank accounts into a proximity payment experience you can manage with an app. You might like that a Fintech application is competing with Apple Pay and Google Pay, creating a novel competitive threat to the tech monopolies.

But Curve is temporarily frozen as the FCA performs investigations into the Wirecard UK subsidiary. In addition to Curve, companies like Revolut, Pockit, U Account, McLear Ring, Crypto.com, Anna Money, CardOneMoney, Payoneer, Morses Club, Boon, and Holvi have been impacted.

With its higher risk tolerance, Wirecard was a path for crypto-native companies to build ramps into the banking world. While JP Morgan has announced that it will bank crypto companies, a faster moving payments firm is still needed to power up commerce on blockchain. Crypto.com is one such example client, which now has to refund all of its pre-paid card clients.

And if you were to do some finger-wagging, let's be clear that this is not the fault of a crypto-native economy trying to use large public third-party services. The fault for all these users being exposed to financial risk lies with Wirecard, and the audit process of EY, on whose representations everyone relied.

Implications for Open Banking

This Lehman thing is still not wound down.

The company had 1.2 million derivative contractions with a notional value of $40 trillion. Here is a 4 page excerpt of the long-dated liabilities and notes from the bankruptcy processt, of which there were 49 such pages. The lawyers and consultants pulling apart this mammoth beast have earned several billion dollars in fees.

I go on to highlight to you the meaning of counterparty risk.

When Wirecard falls, a few Fintechs might go down for several days. Commerce halts, shoppers cannot pay, stores close down, and some players along the value chain will go bankrupt. But when a significantly important financial institution, levered up 50x and high on financial engineering, fails or is forced to liquidate, there is an immense social cost.

In this light, financial product APIs and the open-banking movement is an unrecognized systemic risk to the financial industry. Our fintech and high tech champions have been paving the way for a financial system where the seller of the financial product is not the owner or the servicer. When Apple gives you a banking product, it is from Green Dot or from Goldman Sachs. When SoFi delivers a payment card, it asks banking-as-a-service provider Galileo to generate a virtual card, which in turn triggers the public company Bancorp to create an accounting entry.

If Bancorp were to succumb to some version of corporate *shenanigans*, all the dominos would fall. No Galileo, no SoFi, no Chime or MoneyLion. This in turn would put pressure on the venture investors who have been sloshing money into B2C consumer fintech, like Ribbit or Andreessen Horowitz, which in turn would wipe out endowment and pensioner assets, and make it harder for new entrepreneurs hoping to change the world to raise capital. All you have to do is look at SoftBank and its experience with WeWork, Uber, and the rest of the blitz-scaling portfolio.

The Way Out

We need good actors running our public financial infrastructure. One approach is principles-led regulation -- fiduciaries with the right incentives to protect users and encourage competition (the UK FCA gets this right). The world has never been so interconnected in the ways capital is invested and risks are pooled. We should not use technology integration to align all our correlations to one, and be surprised when everything fails together.

Some of my readers will say the answer is to put the financial industry on blockchain (+1 for meme!). This would create transparency about the underlying transactions -- a Wirecard would never be able to get away with a fake account balance in a fake trustee, because you could effortlessly verify in real time large and complex financial structures. Lehman's derivatives could be accounted and wound down more cheaply than $2 billion. But if you say this, then you have to be open to oversight and audit of public chain transactions, at least for companies that choose to be public (in the traditional sense), to issue financial products (in the traditional sense), and are therefore licensed and regulated.

Others will say that we should throw the whole incumbent financial industry out the window, with its propensity to have multi-billion accounting frauds, pervasive money laundering, and various political entanglements. Besides being unrealistic and unproductive, it is also flawed to have a blind spot for your own problems. The crypto sphere and decentralized finance are subject to these very same impulses. They are after all, populated by people governed by human nature and interested in financial engineering.

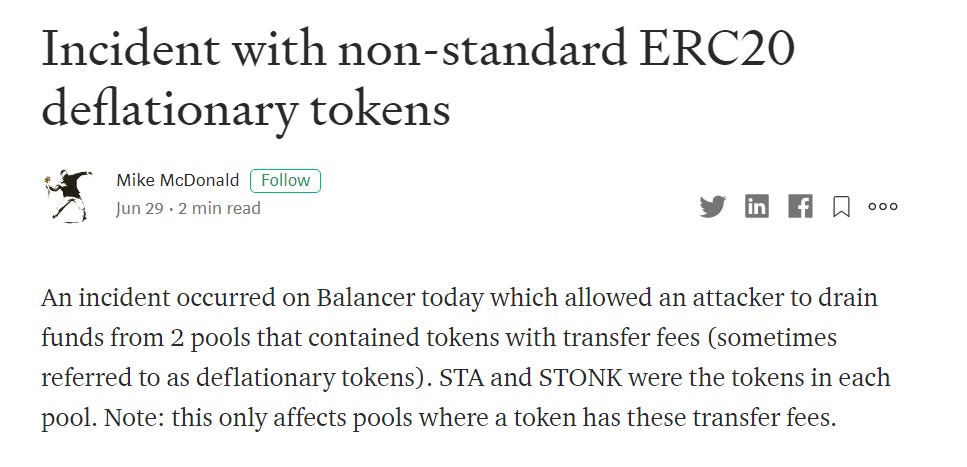

Just today, a hacker drained $500,000 from open automated market maker Balancer by taking on leverage (i.e., flash loans in crypto parlance), initiating repeated transactions into the capital pool, and using an exploit of a built-in 1% fee to run down the balance, until the whole thing became worthless.

The underlying protocol underwent 2 different security audits -- but the attack vector came from using a product (i.e., token) design that allowed this transfer fee, which was also audited. The token project is blaming the protocol and the protocol is blaming the token project. Granted, in the Wirecard case, Wirecard's fraudulent activity created a situation that led to Wirecard shutting down and thereby impacting the industry. In Balancer's case, it does not control who connects to the open protocol and how they do it. But they can still manage block-lists, reputational systems, and other systemic guard rails.

Should users be protected? Whose responsibility is it to protect the user? What responsibilities does a smart contract auditor have? What responsibilities did Arthur Andersen have? How does a protocol become systemically significant in a small system? How do responsibilities change when that system is large?

These are the types of questions entrepreneurs trying to create new financial constructs must integrate from the start. Or it will all have been a fevered dream.

You can get more content like this in your Inbox for $3 per week -- the humble price of a delicious Fintech coffee. For exclusive analysis parsing over a dozen frontier technology developments every week, become a Blueprint member below.

Your history is incorrect about Accenture. Andersen Consulting split from Arthur A several years before Enron. It became Accenture and a public company. Arthur A was actually competing against Accenture on some consulting mandates before it tanked.

Article is well done overall. Slicing and dicing of functions and services is confusing and will lead to numerous disputes in long run. Regulators are way behind the curve here. Worst is confusing consumers with too many options and setting stage for less savory firms to take advantage. I'm not advocating consolidation, but the lack of financial literacy in US is a big problem. Consumers are paying a price for it, witness travesty of Robinhood. Informed consumers wouldn't have chased it.

Really good article thought provoking thanks